Pivot Point and Fibonacci Retracement Based Automatic Trend Following Strategy

Author: ChaoZhang, Date: 2024-01-05 11:34:17Tags:

Overview

This strategy automatically identifies ABC patterns in stock prices based on pivot points and Fibonacci retracement ratios, and generates long/short signals. It uses pivot points to determine price waves and calculates Fibonacci retracement ratios between ABC waves. If the ratios meet certain criteria, trading signals are generated.

Strategy Logic

- Calculate the stock’s pivot high and low points

- Judge if the price has fallen from the previous high point or risen from the previous low point

- Calculate the Fibonacci retracement ratio between the current wave and previous wave

- If the retracement ratios of both up and down waves are within proper ranges, determine a potential ABC pattern

- After ABC pattern confirmation, set stop loss at Point C for long, and Point A for short. Set take profit at 1.5 times the price wave range.

Advantage Analysis

- Pivot points identify key support/resistance levels to improve signal accuracy

- Fibonacci retracements catch trend turning points by identifying ABC patterns

- Clear profit/loss rules avoid huge losses

Risk Analysis

- Pivot points and Fibonacci retracements cannot ensure perfect identification of every trend turning point. Misjudgements may occur.

- Point C and Point A stops can be broken through, leading to larger losses

- Parameters like Fibonacci retracement ratio ranges need further optimization

Optimization Directions

- Incorporate more technical indicators to assist ABC pattern confirmation, improving signal accuracy

- Optimize Fibonacci retracement ratio ranges to suit more market conditions

- Utilize machine learning methods to train ABC pattern recognition models

Conclusion

This strategy identifies ABC patterns for generating long/short signals at trend turning points, based on pivot point confirmation of key support/resistance levels, and Fibonacci retracement ratio calculations. The logic is simple and clean, with sensible profit/loss rules that effectively control risks. However, certain misjudgement risks remain, requiring further optimizations and improvements to suit more market conditions.

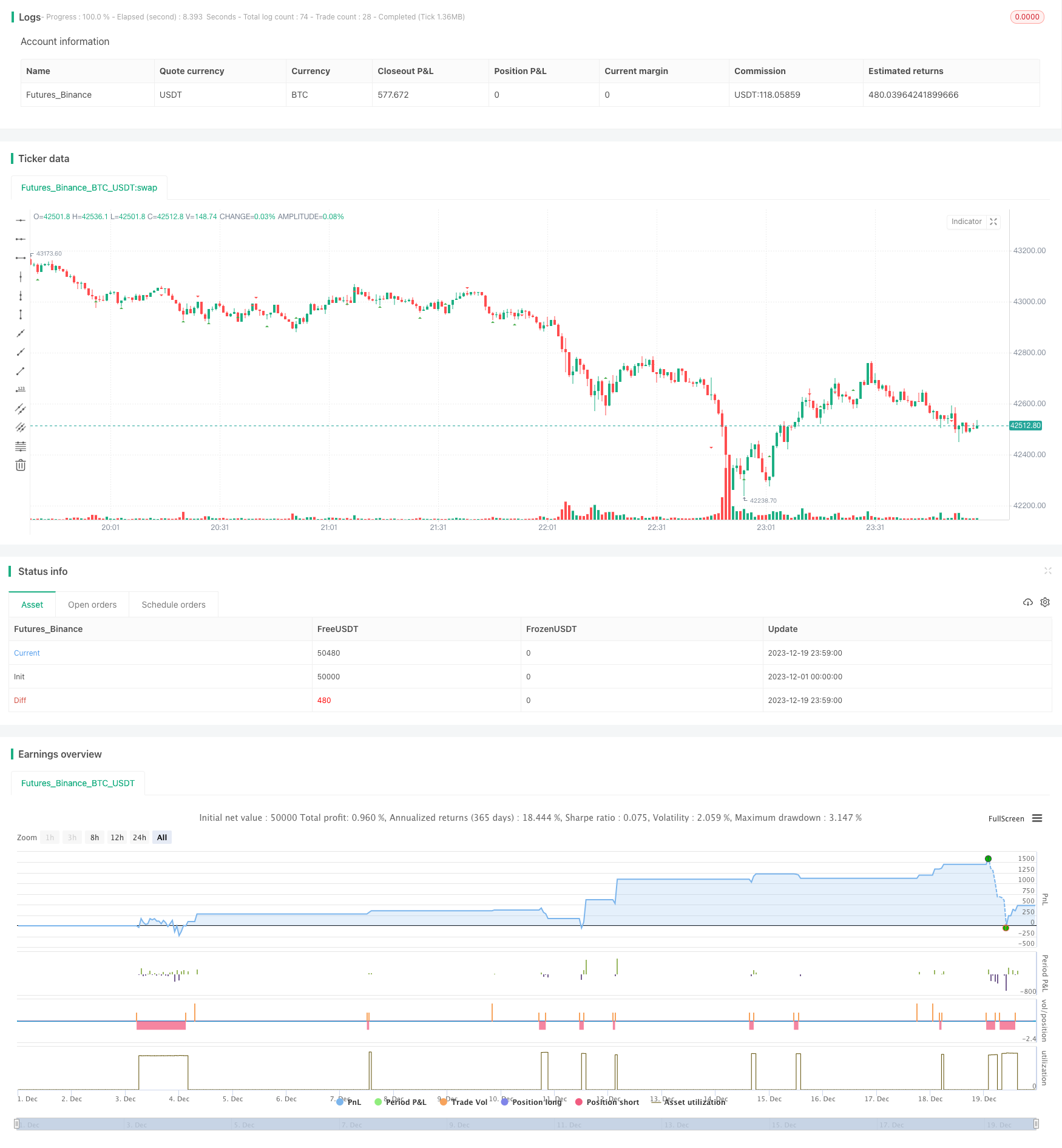

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-19 23:59:59

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kerok3g

//@version=5

strategy("ABCD Strategy", shorttitle="ABCDS", overlay=true, commission_value=0.04)

calcdev(fprice, lprice, fbars, lbars) =>

rise = lprice - fprice

run = lbars - fbars

avg = rise/run

((bar_index - lbars) * avg) + lprice

len = input(5)

ph = ta.pivothigh(len, len)

pl = ta.pivotlow(len, len)

var bool ishigh = false

ishigh := ishigh[1]

var float currph = 0.0

var int currphb = 0

currph := nz(currph)

currphb := nz(currphb)

var float oldph = 0.0

var int oldphb = 0

oldph := nz(oldph)

oldphb := nz(oldphb)

var float currpl = 0.0

var int currplb = 0

currpl := nz(currpl)

currplb := nz(currplb)

var float oldpl = 0.0

var int oldplb = 0

oldpl := nz(oldpl)

oldplb := nz(oldplb)

if (not na(ph))

ishigh := true

oldph := currph

oldphb := currphb

currph := ph

currphb := bar_index[len]

else

if (not na(pl))

ishigh := false

oldpl := currpl

oldplb := currplb

currpl := pl

currplb := bar_index[len]

endHighPoint = calcdev(oldph, currph, oldphb, currphb)

endLowPoint = calcdev(oldpl, currpl, oldplb, currplb)

plotshape(ph, style=shape.triangledown, color=color.red, location=location.abovebar, offset=-len)

plotshape(pl, style=shape.triangleup, color=color.green, location=location.belowbar, offset=-len)

// var line lnhigher = na

// var line lnlower = na

// lnhigher := line.new(oldphb, oldph, bar_index, endHighPoint)

// lnlower := line.new(oldplb, oldpl, bar_index, endLowPoint)

// line.delete(lnhigher[1])

// line.delete(lnlower[1])

formlong = oldphb < oldplb and oldpl < currphb and currphb < currplb

longratio1 = (currph - oldpl) / (oldph - oldpl)

longratio2 = (currph - currpl) / (currph - oldpl)

formshort = oldplb < oldphb and oldphb < currplb and currplb < currphb

shortratio1 = (oldph - currpl) / (oldph - oldpl)

shortratio2 = (currph - currpl) / (oldph - currpl)

// prevent multiple entry for one pattern

var int signalid = 0

signalid := nz(signalid[1])

longCond = formlong and

longratio1 < 0.7 and

longratio1 > 0.5 and

longratio2 > 1.1 and

longratio2 < 1.35 and

close < oldph and

close > currpl and

signalid != oldplb

if (longCond)

signalid := oldplb

longsl = currpl - ta.tr

longtp = ((close - longsl) * 1.5) + close

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", limit=math.min(longtp, oldph), stop=longsl)

shortCond = formshort and

shortratio1 < 0.7 and

shortratio1 > 0.5 and

shortratio2 > 1.1 and

shortratio2 < 1.35 and

close > oldpl and

close < currph and

signalid != oldphb

if (shortCond)

signalid := oldphb

shortsl = currph + ta.tr

shorttp = close - ((shortsl - close) * 1.5)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", limit=math.max(shorttp, oldpl), stop=shortsl)

- Trend Following Moving Average Trading Strategy

- Trend Following Momentum Breakout Strategy

- Breakout and Intelligent Bollinger Bands Price Channel Strategy

- Simple Trend Following Strategy

- Long Breakthrough Strategy Based on K-Line Construction

- Momentum Oscillating Moving Average Trading Strategy Based on Buffered Bollinger Bands

- Adaptive Backtest Date Range Selection Strategy Based on Double MA

- Multi-Timeframe Moving Average Crossover Optimization Strategy

- Breakthrough Tracking Strategy

- Adaptive Trading Strategy Based on Momentum Indicators

- Trend Following Strategy Based on EMA and MACD across Timeframes

- Multi-indicator Collision Reversal Strategy

- Trend Reversal Strategy Based on EMA and SMA Crossover

- DMI DPO Guard Strategy

- Trend Tracking Short-term Trading Strategy

- RSI Trend Following Bull Strategy

- RSIndex and Moving Average Combination Strategy

- Multi-timeframe MA Trend Following Strategy

- Dual Indicators Bottom Buying Strategy

- Bearish Engulfing Reversal Strategy