Overview

This strategy combines the strengths of double mechanism indicators by using 123 pattern to determine reversal signals, and aided by Price Volume Index to determine momentum signals, in order to capture short-term reversal trends.

Strategy Logic

123 pattern for reversal signal

Constructed with 9-day Stoch fast line and slow line

When close price falls for 2 consecutive days and rises on the 3rd day, and Stoch fast line is below 50, a buy signal is generated

When close price rises for 2 consecutive days and falls on the 3rd day, and Stoch fast line is above 50, a sell signal is generated

Price Volume Index for momentum signal

PVI judges momentum by comparing volume change between previous and current day

When PVI crosses above its N-day moving average, momentum amplifies and a buy signal is generated

When PVI crosses below its N-day moving average, momentum declines and a sell signal is generated

Dual signal combination

- Trading signals are only generated when 123 reversal and PVI momentum signals agree

In summary, this strategy leverages the advantage of dual mechanism indicators to effectively identify short-term price-volume reversal opportunities.

Advantage Analysis

123 pattern catches key short-term reversal spots

PVI momentum judges coordinated price-volume action to avoid false breakouts

Parameter optimized Stoch filters out most noise signals in turbulent zones

Dual signal reliability higher than single signals

Intraday design avoids overnight risks suitable for short-term trading

Risk Analysis

Failed reversal risk

- 123 pattern reversal signals do not always succeed with pattern failure risks

Indicator failure risks

- Stoch, PVI and other indicators can fail in certain anomalous markets

Dual signal miss risk

- Relatively stringent dual signal criteria may miss some single signal opportunities

- Relatively stringent dual signal criteria may miss some single signal opportunities

High trading frequency risks

- Close monitoring of position sizing and risk control is needed for the high frequency strategy

Optimization Direction

Large parameter optimization space

- Windows, cycles of Stoch, PVI etc. have optimization space

Can incorporate stop loss strategies

- Mobile stop loss can ensure win rate

- Mobile stop loss can ensure win rate

Consider adding filter conditions

- Tests can add moving average, volatility filters etc.

- Tests can add moving average, volatility filters etc.

Optimize dual signal portfolio

- Test combinations of more dual indicator strategies

Summary

This strategy forms a high-reliability short-term price-volume reversal system through the combination of Stoch and PVI indicators. Compared to single indicators, it has higher win rate and positive expectancy. Sharpe ratio can be further improved via optimization and risk control. In conclusion, this strategy leverages the strengths of dual mechanism indicators to effectively capture short-term reversal opportunities in the market, and is worth live testing and optimization.

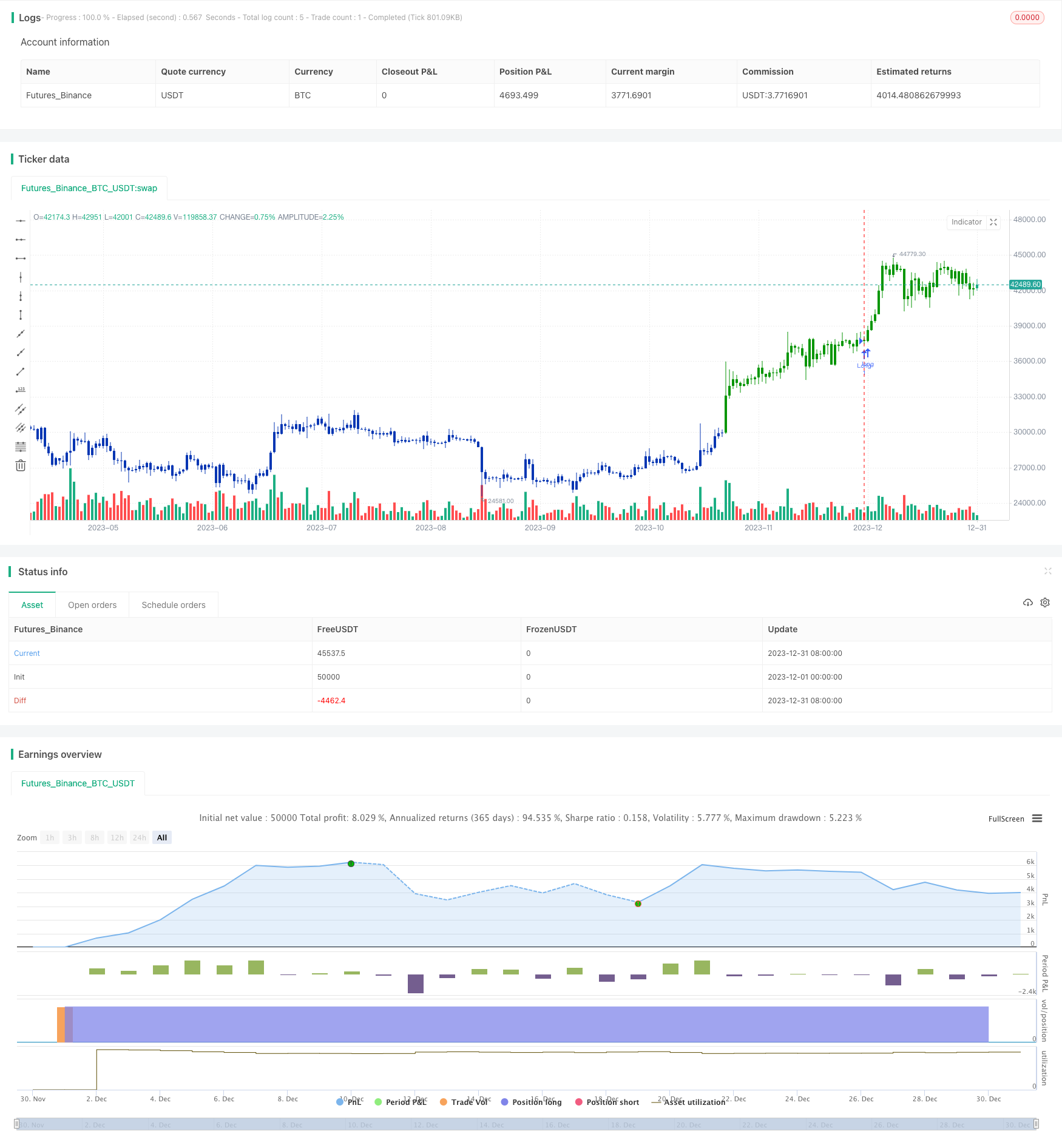

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 22/04/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The theory behind the indexes is as follows: On days of increasing volume,

// you can expect prices to increase, and on days of decreasing volume, you can

// expect prices to decrease. This goes with the idea of the market being in-gear

// and out-of-gear. Both PVI and NVI work in similar fashions: Both are a running

// cumulative of values, which means you either keep adding or subtracting price

// rate of change each day to the previous day`s sum. In the case of PVI, if today`s

// volume is less than yesterday`s, don`t add anything; if today`s volume is greater,

// then add today`s price rate of change. For NVI, add today`s price rate of change

// only if today`s volume is less than yesterday`s.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

PVI(EMA_Len) =>

pos = 0.0

xROC = roc(close, 1)

nRes = 0.0

nResEMA = 0.0

nRes := iff(volume > volume[1], nz(nRes[1], 0) + xROC, nz(nRes[1], 0))

nResEMA := ema(nRes, EMA_Len)

pos := iff(nRes > nResEMA, 1,

iff(nRes < nResEMA, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Positive Volume Index", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Positive Volume Index ----")

EMA_Len = input(255, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posPVI = PVI(EMA_Len)

pos = iff(posReversal123 == 1 and posPVI == 1 , 1,

iff(posReversal123 == -1 and posPVI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )