Exponential Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-01-08 11:30:21Tags:

Overview

The exponential moving average crossover strategy is a simple quantitative trading strategy that tracks price trends. It uses crosses of two exponential moving averages with different parameter settings as buy and sell signals. When the short-term EMA crosses above the long-term EMA, a buy signal is generated. When the short-term EMA crosses below the long-term EMA, a sell signal is generated.

Strategy Logic

The core logic of this strategy is based on the EMA theory. Exponential moving averages can effectively smooth price fluctuations and determine the direction of the price trend. The fast EMA responds quickly to price changes while the slow EMA provides a reference for the price trend direction. When the fast EMA crosses above the slow EMA, it indicates that prices have started to rise and a buy signal is generated. When the fast EMA crosses below the slow EMA, it indicates that prices have started to fall and a sell signal is generated.

Specifically, this strategy first defines two exponential moving averages: fib_level and fib_price. fib_level is set by user input, and fib_price is calculated based on the highest and lowest prices of the most recent 100 bars. When the close price crosses above or below fib_price, buy and sell signals are generated, respectively. At the same time, the stop loss is set to the highest and lowest prices of the most recent 10 bars.

Advantage Analysis

- Utilize dual EMA system to determine price trend direction and avoid wrong signals

- Customizable strategy with user-defined parameters

- Setting stop loss is beneficial for risk control

Risk Analysis

- EMA lag may miss price reversal points

- Frequent EMA crosses increase transaction costs and slippage losses

- Improper stop loss setting may cause premature stop loss or excessive losses

Risks can be reduced by optimizing EMA parameters, using triple EMA system, or combining with other indicators for signal confirmation. Also loosen the stop loss appropriately to prevent excessive early stop outs.

Optimization Directions

This strategy can be optimized from the following aspects:

-

Optimize EMA period parameters. Test different period combinations to find the best parameters.

-

Add Volume and other filters. Generate buy signals when Volume rises and sell signals when Volume falls to avoid wrong signals during sharp price spikes.

-

Utilize machine learning algorithms to automatically optimize parameters based on historical data.

-

Add trailing stop mechanism to stop loss placement. Move up stop loss line with increased profits to prevent premature stop out.

Summary

The exponential moving average crossover strategy is an easy-to-use quantitative trading strategy overall. It leverages the strengths of EMAs to determine price trends and sets stops to control risks. The strategy is easy to understand, flexible in parameters, and applicable for quantitative trading across different products. Further optimizations in parameter tuning, additional filters, and trailing stops can lead to even better strategy performance.

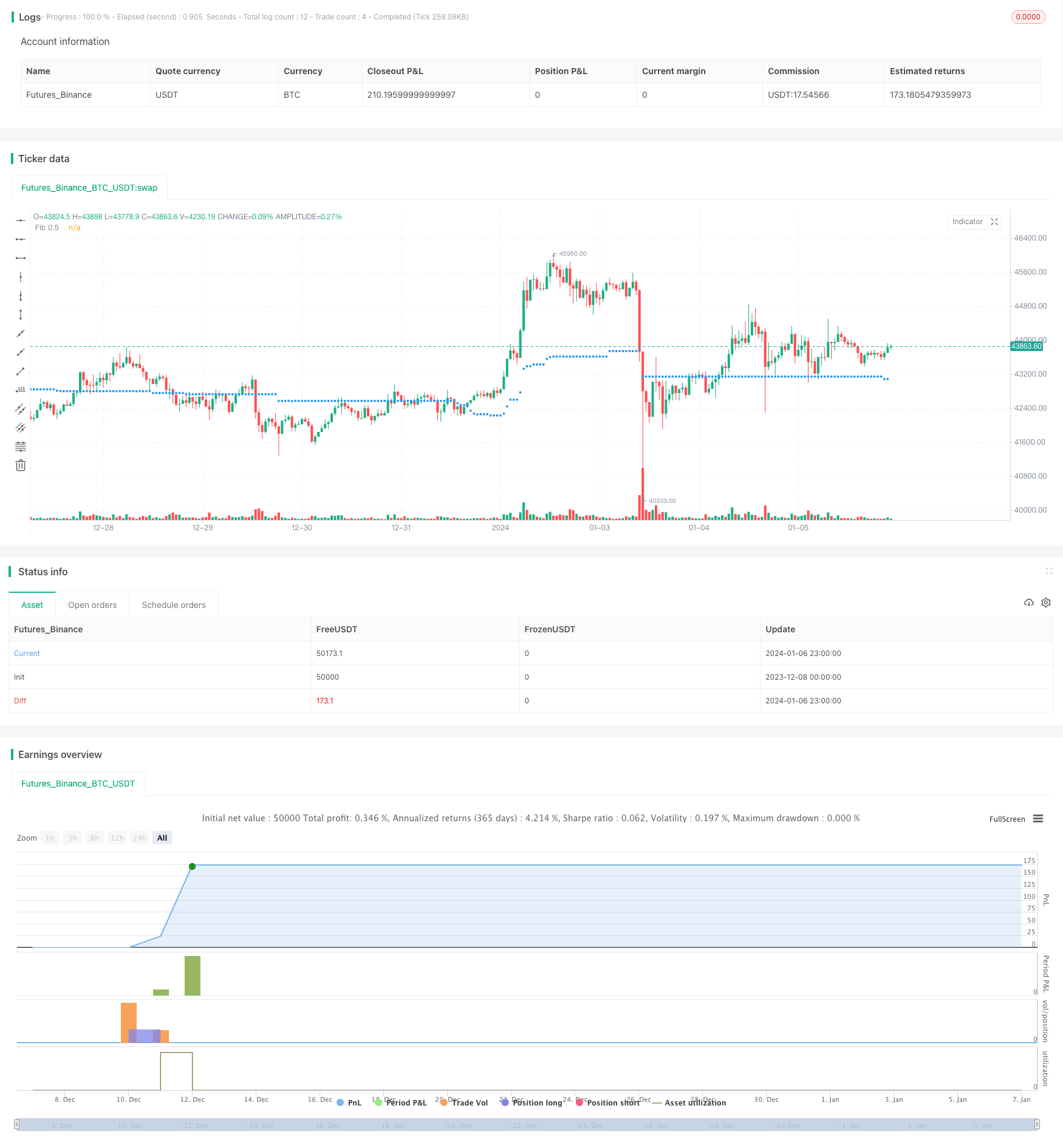

/*backtest

start: 2023-12-08 00:00:00

end: 2024-01-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fibonacci Strategy", overlay=true)

// Define Fibonacci 0.5 level

fib_level = input(0.5, title="Fibonacci Level")

// Calculate Fibonacci 0.5 level price

fib_price = ta.lowest(low, 100) + (ta.highest(high, 100) - ta.lowest(low, 100)) * fib_level

// Define entry and exit conditions

long_condition = ta.crossover(close, fib_price)

short_condition = ta.crossunder(close, fib_price)

// Set exit points (using previous high or low)

long_exit = ta.highest(high, 10)

short_exit = ta.lowest(low, 10)

// Plot Fibonacci 0.5 level

plot(fib_price, "Fib 0.5", color=color.blue, linewidth=1, style=plot.style_circles)

// Initialize variables

var inLong = false

var inShort = false

// Set trading signals

if (long_condition)

if not inLong

strategy.entry("Buy", strategy.long)

inLong := true

strategy.exit("Exit", "Buy", limit=long_exit)

if (short_condition)

if not inShort

strategy.entry("Sell", strategy.short)

inShort := true

strategy.exit("Exit", "Sell", limit=short_exit)

if (ta.crossover(close, long_exit) or ta.crossunder(close, short_exit))

inLong := false

inShort := false

- Adaptive Volatility Breakout Strategy

- SuperTrend Strategy for Ethereum Trading

- EMA Crossover and MACD Signals Trend Following Strategy

- Multiple Crossovers Turtle and Weighted Moving Average and MACD and TSI Combination Strategy

- Momentum Strategy Based on DEMA and EMA Crossover with ATR Volatility Filter

- Consecutive Up/Down Strategy with Reverse and SL/TP Extension

- Prime Number Bands Backtest Strategy

- Fast Oscillating RSI Trading Strategy

- Single Exponential Smoothed Moving Average with Trailing Stop Loss Trend Following Strategy

- Buy Low Volatility VS Buy High Volatility Strategy

- Multi-Timeframe Trailing Stop Loss Strategy

- Momentum Dual Moving Window TSI Indicator

- RSI and Bollinger Bands Profitable Strategy

- Buy/Sell on Candle Close Strategy

- Supertrend Take Profit Strategy

- Price Channel Trend Following Strategy

- Dual Moving Average Counter Trend Strategy

- Positive Bars Percentage Breakout Strategy

- RSI Dual-track Breakthrough Strategy

- Crude Oil Moving Average Crossover Strategy