Buy Low Volatility VS Buy High Volatility Strategy

Author: ChaoZhang, Date: 2024-01-08 11:33:58Tags:

Overview

This strategy aims to study the difference between buying assets when volatility is low and when it is high. It allows the user to choose whether to buy during low or high volatility periods by changing the mode input variable.

Strategy Logic

This strategy determines volatility by calculating the ATR and its SMA. Specifically, it calculates the SMA of ATR, and then computes the ratio between the ATR and its SMA. If this ratio is higher than the user-defined threshold volatilityTargetRatio, the volatility is considered high. If lower than the threshold, the volatility is considered low.

Depending on the mode chosen by the user, the strategy generates buy signals when volatility is high or low. Once bought, the strategy will hold for a number of bars defined by sellAfterNBarsLength, and then close the position.

Advantage Analysis

The main advantages of this strategy are:

- Can intuitively compare the performance of buying strategies during low and high volatility periods.

- Using SMA to smooth ATR can filter false breakouts.

- Can test different volatility levels by tuning parameters.

Risk Analysis

The main risks of this strategy are:

- May miss price uptrend opportunities if only buying low volatility.

- May increase system risk if only buying high volatility.

- Inappropriate parameter settings may lead to missing buy opportunities or closing positions too early.

The above risks can be mitigated by adjusting parameters and combining buys from different volatility levels.

Optimization Directions

This strategy can be further optimized by:

- Testing different ATR length parameters.

- Adding stop loss strategies.

- Combining other indicators to filter false breakouts.

- Optimizing entry and exit criteria.

Conclusion

This strategy can effectively compare the performance of low volatility buy and high volatility buy strategies. It uses SMA to smooth ATR and generates trading signals based on volatility levels. The strategy can be improved through parameter tuning and optimizing conditions. Overall, this strategy provides an effective tool for researching volatility-based strategies.

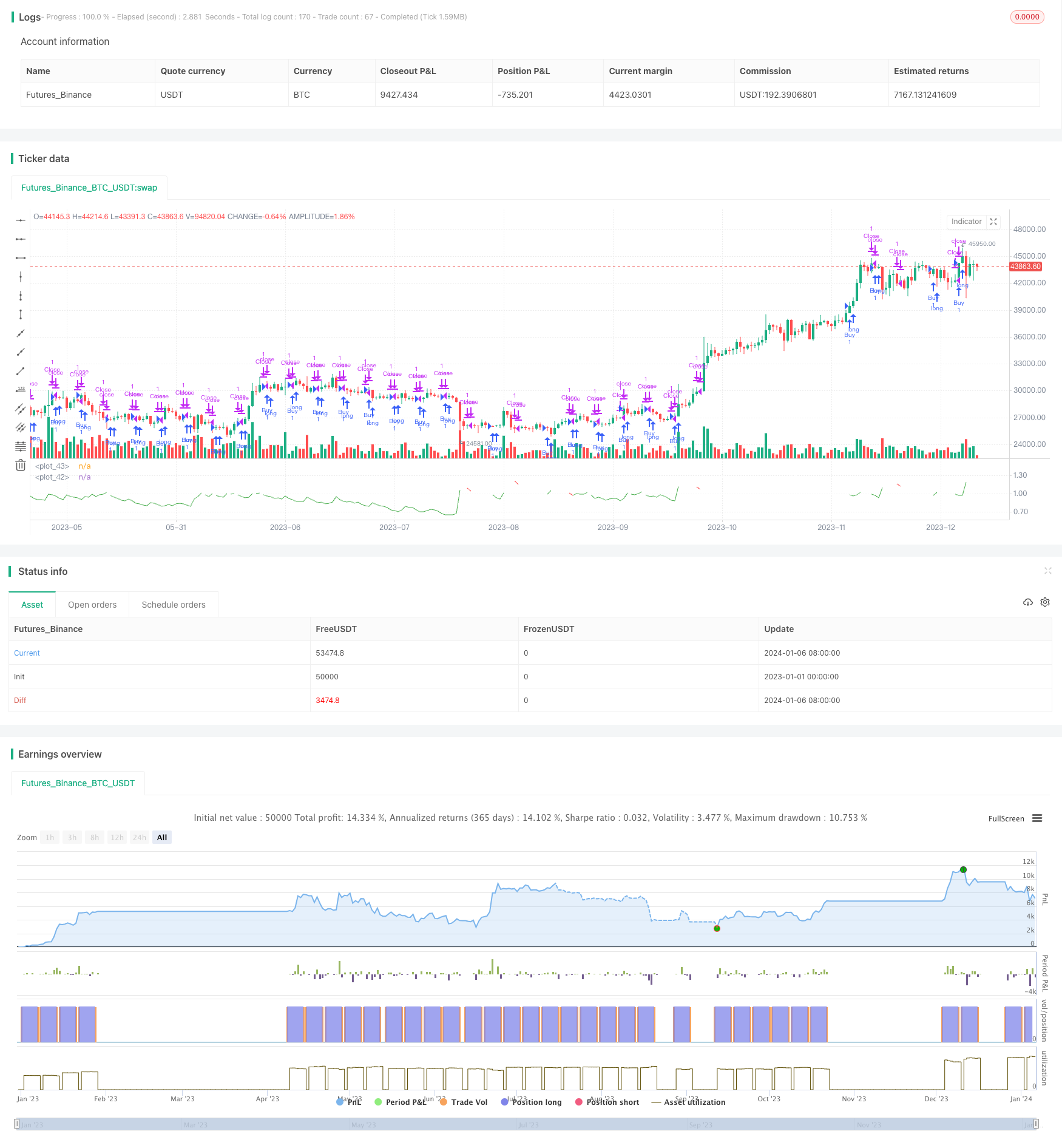

/*backtest

start: 2023-01-01 00:00:00

end: 2024-01-07 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © I11L

//@version=5

strategy("I11L - Better Buy Low Volatility or High Volatility?", overlay=false)

mode = input.string("Buy low Volatility",options = ["Buy low Volatility","Buy high Volatility"])

volatilityTargetRatio = input.float(1,minval = 0, maxval = 100,step=0.1, tooltip="1 equals the average atr for the security, a lower value means that the volatility is lower")

atrLength = input.int(14)

atr = ta.atr(atrLength) / close

avg_atr = ta.sma(atr,atrLength*5)

ratio = atr / avg_atr

sellAfterNBarsLength = input.int(5, step=5, minval=0)

var holdingBarsCounter = 0

if(strategy.opentrades > 0)

holdingBarsCounter := holdingBarsCounter + 1

isBuy = false

if(mode == "Buy low Volatility")

isBuy := ratio < volatilityTargetRatio

else

isBuy := ratio > volatilityTargetRatio

isClose = holdingBarsCounter > sellAfterNBarsLength

if(isBuy)

strategy.entry("Buy",strategy.long)

if(isClose)

holdingBarsCounter := 0

strategy.exit("Close",limit=close)

plot(ratio, color=isBuy[1] ? color.green : isClose[1] ? color.red : color.white)

plot(1, color=color.white)

- Dual Moving Average Oscillation Breakout Strategy

- Adaptive Volatility Breakout Strategy

- SuperTrend Strategy for Ethereum Trading

- EMA Crossover and MACD Signals Trend Following Strategy

- Multiple Crossovers Turtle and Weighted Moving Average and MACD and TSI Combination Strategy

- Momentum Strategy Based on DEMA and EMA Crossover with ATR Volatility Filter

- Consecutive Up/Down Strategy with Reverse and SL/TP Extension

- Prime Number Bands Backtest Strategy

- Fast Oscillating RSI Trading Strategy

- Single Exponential Smoothed Moving Average with Trailing Stop Loss Trend Following Strategy

- Exponential Moving Average Crossover Strategy

- Multi-Timeframe Trailing Stop Loss Strategy

- Momentum Dual Moving Window TSI Indicator

- RSI and Bollinger Bands Profitable Strategy

- Buy/Sell on Candle Close Strategy

- Supertrend Take Profit Strategy

- Price Channel Trend Following Strategy

- Dual Moving Average Counter Trend Strategy

- Positive Bars Percentage Breakout Strategy

- RSI Dual-track Breakthrough Strategy