Moving Average Crossover Trading Strategy

Author: ChaoZhang, Date: 2024-01-24 11:48:29Tags:

Overview

The moving average crossover trading strategy generates buy and sell signals by calculating the crossover of the fast EMA (fastLength) and slow EMA (slowLength) lines. When the fast line crosses above the slow line, a buy signal is generated. When the fast line crosses below the slow line, a sell signal is generated. This strategy is simple and practical, suitable for medium and short term trading.

Strategy Principle

The strategy uses two moving average lines, fast line and slow line. The fast line parameter EMAfastLength defaults to 9-day line, and the slow line parameter EMAslowLength defaults to 26-day line. Calculate the crossover of the two EMA lines to determine market buy and sell signals:

- When the fast line breaks upward through the slow line, a buy signal enterLong() is generated.

- When the fast line breaks downward through the slow line, a sell signal enterShort() is generated.

The specific trading signals and strategy rules are as follows:

- When the fast line crosses above the slow line, go long; when the fast line crosses below the slow line, close position.

- The take profit for long is Targetpercentage (default 0.15%) of the price, which is to close position when the profit reaches 15%.

- The stop loss for long is StopLosspercentage (default 0.20%) of the price, which is to close position when the loss reaches 20%.

- Short position works the same way.

So this strategy trades based on the golden cross and dead cross of the two moving average lines.

Advantage Analysis

- The strategy is simple and easy to understand.

- The application of moving average filters out some market noise and makes trading signals more precise.

- Trading rules are clear with definite profit taking and stop loss.

- Test parameters can be adjusted flexibly to adapt to different market conditions.

Risk Analysis

- Moving averages themselves have lagging, which may miss short-term price changes, leading to inaccurate buy and sell points.

- Different cycle moving average parameters may generate false signals and bring losses.

- Relying solely on a few parameters, this strategy has high hyperparameter optimization requirements to find the best parameter combination.

- In some particular major trends, this strategy is prone to fail.

To address the risks, parameters that can be optimized include moving average cycle, trading variety, profit taking and stop loss ratio, etc. Extensive testing is required to reduce risks.

Optimization Directions

The moving average crossover idea of this strategy is simple and practical. It can be optimized in the following ways:

- Change moving average type: In addition to EMA, also test SMA, LWMA, HMA and other types.

- Add other indicators: Combine with RSI, MACD and other indicators.

- Parameter optimization: Auto optimize the two cycle parameters of EMA to find the best parameter combination.

- Trend filtering: Trade selectively based on major trend situations.

- Profit taking and stop loss optimization: Improve the fixed percentage profit taking and stop loss to make it more practical.

Through these optimization tests, the strategy’s practical effect and stability can be greatly improved.

Summary

The moving average crossover strategy idea is simple, but practical application requires continuous optimization. This strategy gives the logic of generating trading signals and basic trading rules. On this basis, it can be greatly optimized to become a usable quantitative strategy. The application of moving average also provides us with ideas for strategies, based on which we can innovate and improve.

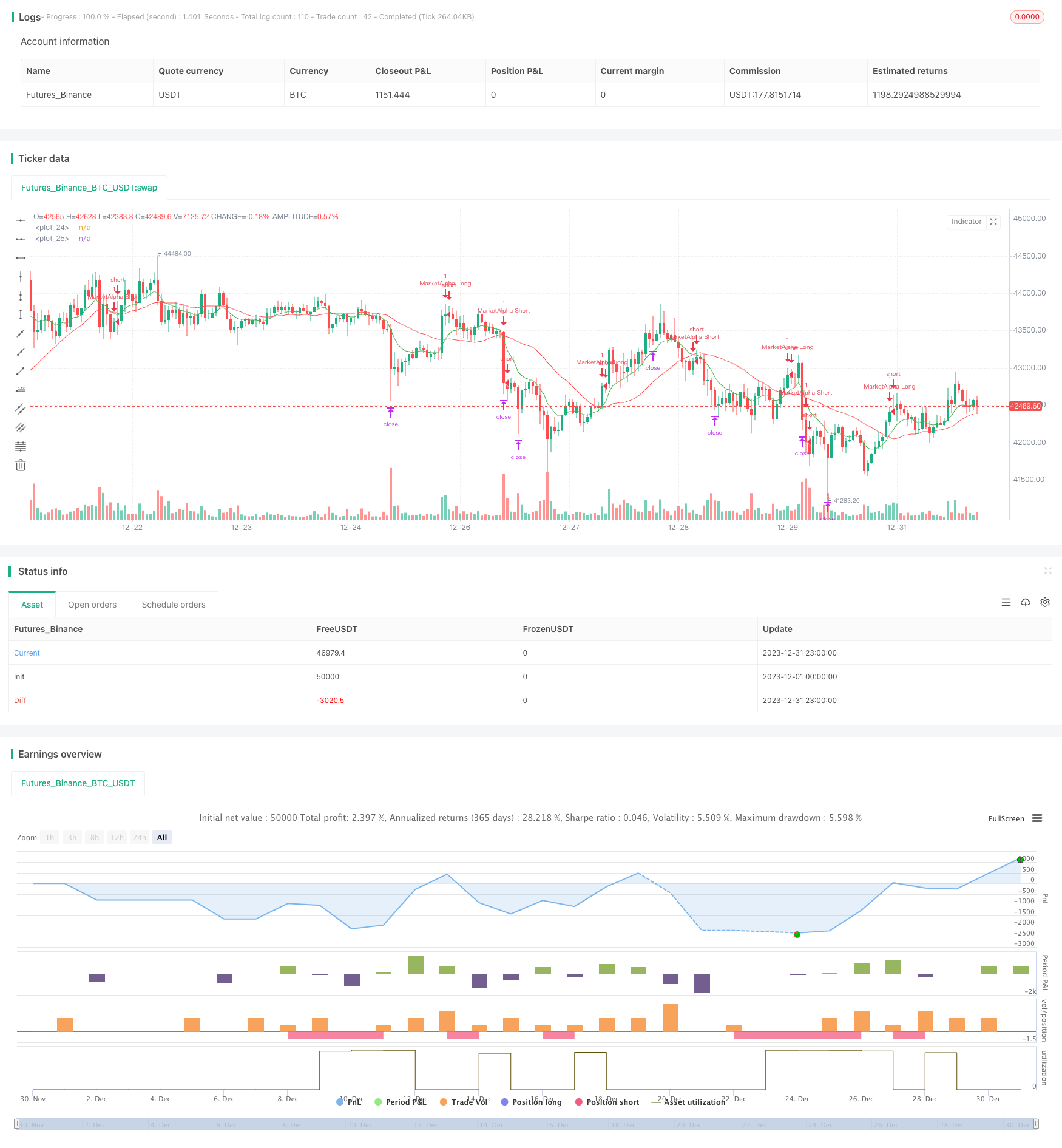

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA Cross by MarketAlpha", overlay=true)

EMAfastLength = input(defval = 9, minval = 2)

EMAslowLength = input(defval = 26, minval = 2)

Targetpercentage = input(defval = 0.15, title = "Profit Target in percentage", minval = 0.05)

StopLosspercentage = input(defval = 0.20, title = "Stop Loss in percentage", minval = 0.05)

profitpoints = close*Targetpercentage

stoplosspoints = close*StopLosspercentage

price = close

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2000)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

emafast = ema(price, EMAfastLength)

emaslow = sma(price, EMAslowLength)

plot(emafast,color=green)

plot(emaslow,color=red)

enterLong() => crossover(emafast, emaslow)

strategy.entry(id = "MarketAlpha Long", long = true, when = window() and enterLong())

strategy.exit("Exit Long", from_entry = "MarketAlpha Long", profit = profitpoints,loss = stoplosspoints)

enterShort() => crossunder(emafast, emaslow)

strategy.entry(id = "MarketAlpha Short", long = false, when = window() and enterShort())

strategy.exit("Exit Short", from_entry = "MarketAlpha Short", profit = profitpoints,loss = stoplosspoints)

- Moving Average Crossover Trading Strategy

- RSI Bollinger Bands Trading Strategy

- Trend Following Strategy Based on Dual EMA

- Dual Moving Average Breakout Strategy

- RSI and Moving Average Breakout Strategy

- EMA Tracking Strategy

- Trend Following Strategy Based on Moving Average

- SMA Crossover Ichimoku Market Depth Volume Based Quantitative Trading Strategy

- Trend Tracking Stop Loss Take Profit Strategy

- Bi-directional Crossing Zero Axis Qstick Indicator Backtest Strategy

- Moving Average Divergence Strategy

- Reversal High Frequency Trading Strategy Based on Shadow Line

- Quantitative Trading Strategy Based on Linear Regression RSI

- This strategy is a bidirectional adaptive range filtering momentum tracking strategy

- Dual Moving Average Trend Tracking Strategy

- Force Breakthrough Strategy

- RSI CCI Williams%R Quantitative Trading Strategy

- Dynmaic Risk Adjusted Momentum Trading Strategy

- Momentum Moving Average Crossover Trading Strategy

- Bollinger Band Limit Market Maker Strategy