Momentum Reversal Trading Strategy

Author: ChaoZhang, Date: 2024-01-26 15:51:20Tags:

Overview

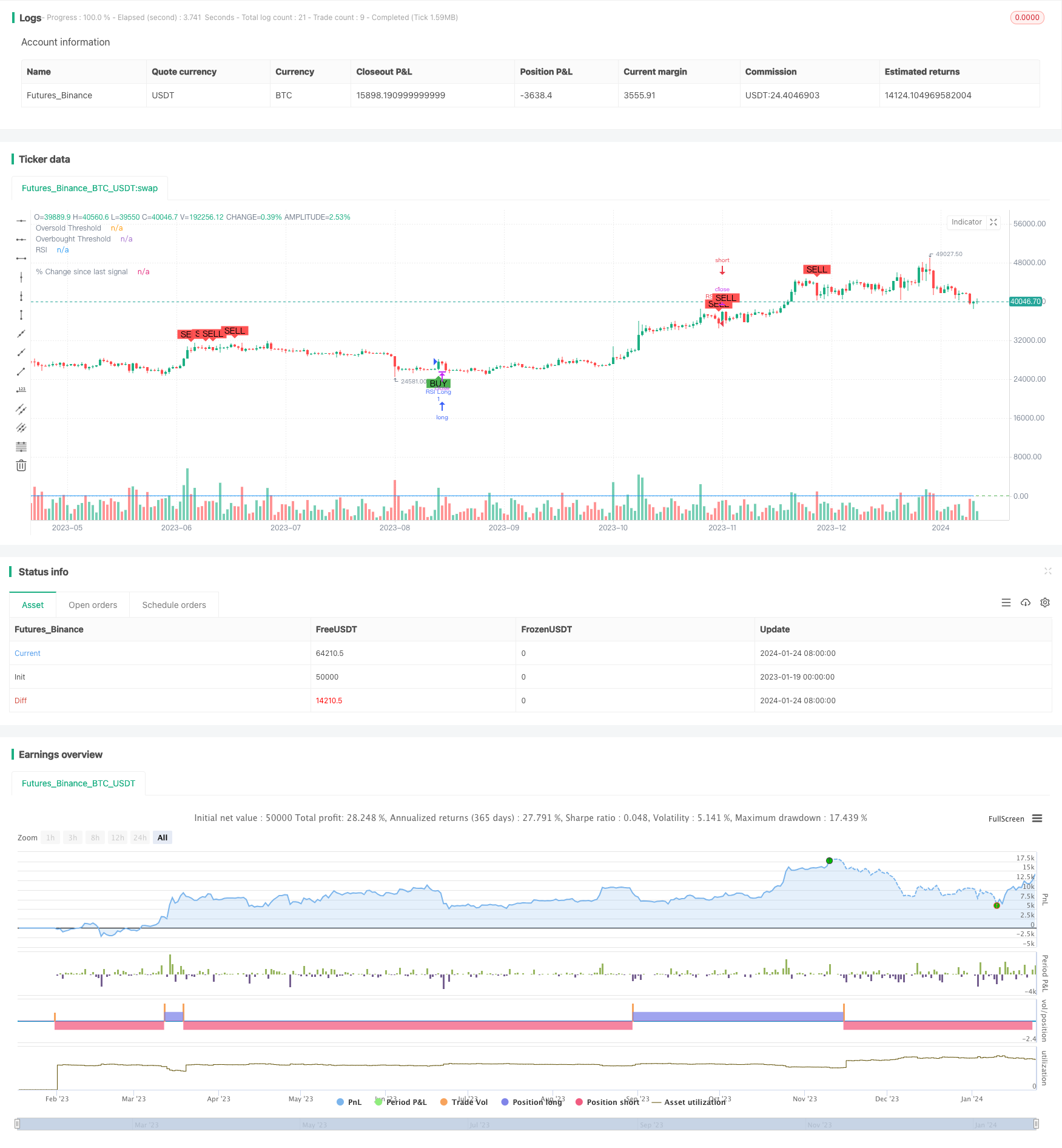

This strategy identifies potential buy and sell opportunities in the market by calculating the Relative Strength Index (RSI). It utilizes the RSI indicator to spot points where price may reverse from a trend to a counter-trend, in order to capture reversal opportunities. Trading signals are generated when the RSI reverses from overbought or oversold territories.

Strategy Logic

The core indicator of this strategy is RSI. It shows the ratio of upward price closes to downward price closes over a period of time, used to judge if an asset is overvalued or undervalued. RSI fluctuates between 0 to 100, with high values indicating a strong upward market and low values indicating a strong downward market.

The strategy first sets the parameters for RSI, including period length (default 14) and threshold values for overbought/oversold territories (default 70/30). It then calculates the RSI value based on closing prices. Buy signals are generated when RSI crosses above the oversold threshold, and sell signals when RSI crosses below the overbought threshold.

The strategy also plots the RSI line, as well as the threshold lines. Buy and sell signals are marked on the price chart with text and shapes. Additionally, the percentage change since the last signal is calculated and plotted to give traders an intuitive view of post-signal price moves.

Advantage Analysis

- Utilizes RSI’s ability to judge overbought/oversold to effectively identify reversals

- Clear visualization of entry points with trading signals

- Displays percentage change since last signal to judge effectiveness of reversals

- Customizable RSI parameters suit different periods and assets

- Can be used alone or combined with other indicators to improve strategy

Risk Analysis

- Possibilities of fake signals where no actual reversal is triggered

- Insufficient trend continuation after reversal, could be short-term corrections

- Higher probability of RSI failure in high volatility periods

- Recommend combining with volume/price indicators to ensure signal reliability

- Threshold zones should be adjusted properly to reduce fake signals

Optimization Directions

- Add stop loss to control single trade loss

- Combine with Moving Averages etc. to avoid false breakouts

- Test RSI periods of different lengths

- Optimize overbought/oversold threshold values based on market conditions

- Add position management for exponential growth of profitable positions

Summary

This strategy is designed based on the reversal trading logic of RSI, mainly judging if assets are significantly overbought or oversold in the short-term, in order to capture subsequent reversals. The percentage change calculation and visual trading prompts can aid in trading decisions. RSI parameters can be customized based on user preferences. Combining with other indicators to improve signal reliability and proper optimizations to reduce fake signals are future enhancement directions for this strategy.

/*backtest

start: 2023-01-19 00:00:00

end: 2024-01-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved RSI Strategy", overlay=true)

// Define RSI parameters

rsiLength = input(14, title="RSI Length")

rsiOversold = input(30, title="Oversold Threshold")

rsiOverbought = input(70, title="Overbought Threshold")

// Calculate RSI

rsiValue = ta.rsi(close, rsiLength)

// Define entry conditions

longCondition = ta.crossover(rsiValue, rsiOversold)

shortCondition = ta.crossunder(rsiValue, rsiOverbought)

// Plot RSI and thresholds

plot(rsiValue, title="RSI", color=color.blue)

hline(rsiOversold, title="Oversold Threshold", color=color.red)

hline(rsiOverbought, title="Overbought Threshold", color=color.green)

// Calculate percentage change since last signal

var float percentageChange = na

lastCloseValue = ta.valuewhen(longCondition or shortCondition, close, 1)

if longCondition or shortCondition

percentageChange := (close - lastCloseValue) / lastCloseValue * 100

plot(percentageChange, color=color.blue, style=plot.style_histogram, linewidth=1, title="% Change since last signal")

// Execute strategy

if longCondition

strategy.entry("RSI Long", strategy.long)

if shortCondition

strategy.entry("RSI Short", strategy.short)

// Plot shapes and text for buy/sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

- Dual Moving Average and Williams Average Combination Strategy

- Adaptive Triple Supertrend Strategy

- Moving Average Crossover Strategy

- Multiple Indicator Quantitative Trading Strategy

- Market Cypher Wave B Automated Trading Strategy

- Key Reversal Backtest Strategy

- Three EMA Stochastic RSI Crossover Golden Cross Strategy

- Reversal Candlestick Backtesting Strategy

- Ehlers-Smoothed Stochastic RSI Strategy

- Swing High Low Price Channel Strategy V.1

- Adaptive Linear Regression Channel Strategy

- Moving Average Difference Zero Cross Strategy

- Multiple Indicators Follow Strategy

- Solid Trend Following Strategy

- Price Crossing Moving Average Trend Following Strategy

- Dual EMA Golden Cross Breakout Strategy

- Gradual BB KC Trend Strategy

- Triple SMA Auto-Tracking Strategy

- Bitcoin Futures Position Trading Strategy

- Price EMA with stochastic optimization based on machine learning