RSI Indicator Grid Trading Strategy

Author: ChaoZhang, Date: 2024-01-29 11:42:46Tags:

Overview

The RSI Indicator Grid Trading Strategy integrates the RSI and CCI technical indicators with a fixed grid trading approach. It uses the values of RSI and CCI indicators to determine entry signals, and sets take profit orders and additional grid orders based on a fixed profit ratio and number of grids. The strategy also incorporates a hedging mechanism against volatile price movements.

Strategy Logic

Entry Conditions

Long signals are generated when the 5-minute and 30-minute RSI are below threshold values, and the 1-hour CCI is below the threshold. The current close price is recorded as the entry price, and the size of the first order is calculated based on account equity and the number of grids.

Take Profit Conditions

The take profit price level is calculated using the entry price and the target profit ratio. Profit take orders are placed at this price level.

Grid Entry Conditions

After the first order, remaining fixed-size grid orders are placed one by one until the specified number of grids is reached.

Hedging Mechanism

If price increases beyond the set hedging threshold percentage from entry, all open positions are hedged by closing them.

Reversal Mechanism

If price drops beyond the set reversal threshold percentage from entry, all pending orders are cancelled to await new entry opportunities.

Advantage Analysis

- Combines RSI and CCI indicators to improve profitability

- Fixed grid targets profit locking to increase certainty

- Integrated hedging guards against volatile price swings

- Reversal mechanism cuts losses

Risk Analysis

- False signals from indicators

- Price spikes penetrate hedging thresholds

- Failure to re-enter on reversals

These can be mitigated by adjusting indicator parameters, expanding hedging range, reducing reversal range.

Enhancement Areas

- Test more indicator combinations

- Research adaptive profit taking

- Optimize grid logic

Conclusion

The RSI Grid Strategy determines entries with indicators, and locks in stable profits using fixed grid take profits and entries. It also incorporates volatility hedging and re-entry after reversals. The integration of multiple mechanisms helps reduce trading risks and increase profitability rates. Further optimizations of indicators and settings can improve live performance.

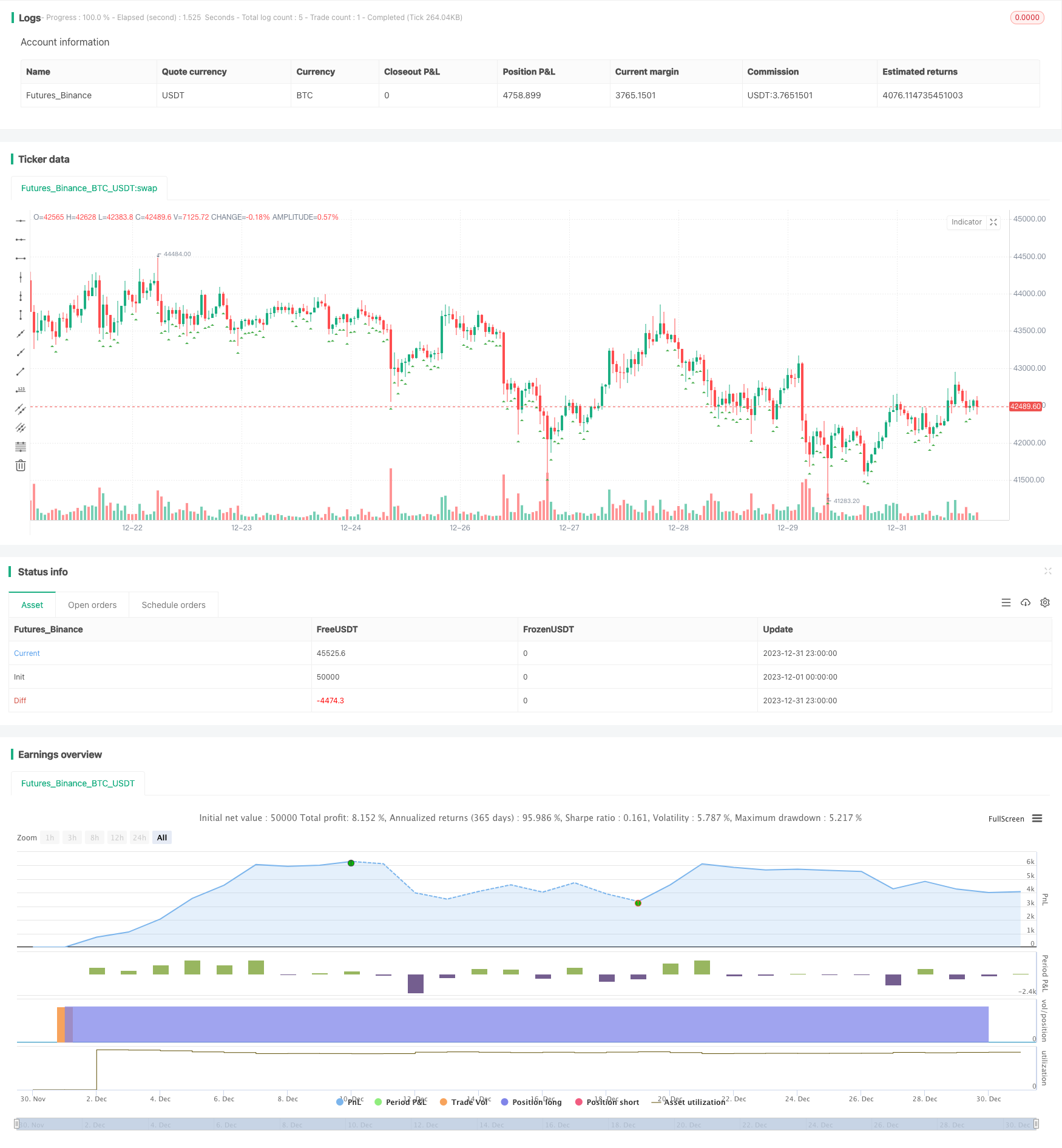

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Custom RSI/CCI Strategy with Fixed Grid", shorttitle="INVESTCOIN_RSI_CCI_Fixed_Grid", overlay=true)

// Input parameters

input_rsi_5min_value = 55

input_rsi_30min_value = 65

input_cci_1hr_value = 85

input_profit_target_percent = 0.6 // Target profit in percentage

input_grid_size = 15 // Number of orders in grid

input_hedging_percent = 20 // Percentage price change for hedging

input_first_order_offset = 0.2 // Offset for the first order in percentage

input_reversal_percent = 0.4 // Percentage price change for reversal

// Calculating the RSI and CCI values

rsi_5min = ta.rsi(close, 5)

rsi_30min = ta.rsi(close, 30)

cci_1hr = ta.cci(close, 60)

// Define strategy conditions based on the provided screenshot

long_condition = (rsi_5min < input_rsi_5min_value) and (rsi_30min < input_rsi_30min_value) and (cci_1hr < input_cci_1hr_value)

// Plot signals

plotshape(series=long_condition, title="Long Entry Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

// Initialize a variable to store the entry price

var float entry_price = na

// Initialize a variable to store the profit target

var float profit_target = na

// Hedge condition based on price change percentage

var float hedge_price = na

// Initialize a variable to count the total number of orders

var int total_orders = 0

// Calculate the initial order size based on account equity and grid size

var float initial_order_size = 1 / input_grid_size / 100

// Entry orders with fixed size

if (long_condition and total_orders < 9000)

// Place first order with an offset

if total_orders == 0

strategy.order("First Long", strategy.long, qty=initial_order_size, limit=close * (1 - input_first_order_offset / 100))

total_orders := total_orders + 1

// Place remaining grid orders

for i = 1 to input_grid_size - 1

if (total_orders >= 9000)

break // Stop if max orders reached

strategy.entry("Long_" + str.tostring(i), strategy.long, qty=initial_order_size)

total_orders := total_orders + 1

// Calculate the profit target in currency

if (long_condition)

entry_price := close // Store the entry price when the condition is true

if (not na(entry_price))

profit_target := entry_price * input_profit_target_percent / 100 // Calculate the profit target

// Setting up the profit target

if (not na(profit_target))

strategy.exit("Take Profit", "Long", limit=entry_price + profit_target)

// Hedge by closing all positions if the price increases by the hedging percentage

if (strategy.position_size > 0)

hedge_price := close * (1 + input_hedging_percent / 100)

if (not na(hedge_price) and close >= hedge_price)

strategy.close_all(comment="Hedging")

// Reversal condition based on the price change percentage

var float reversal_price = na

if (strategy.position_size > 0 and total_orders > 1) // Check if at least one grid order has been placed

reversal_price := entry_price * (1 - input_reversal_percent / 100)

// Cancel trades and wait for a new entry point if the price reverses by the specified percentage

if (not na(reversal_price) and close <= reversal_price)

strategy.cancel_all()

total_orders := 0 // Reset the total orders count after cancellation

- Significant Pivot Points Reversal Strategy

- FNGU Quantitative Trading Strategy Based on Bollinger Bands and RSI

- Bollinger Bands RSI OBV Strategy

- P-Signal Reversal Strategy

- RSI Alligator Trend Strategy

- Daily FX Strategy Based on Moving Average and Williams Indicator

- Moving Average Channel Breakout Trading Strategy

- Dual Moving Average Stochastic Strategy

- Donchian Channel Breakout Strategy

- Moving Average Trend Tracking Strategy

- PPO Price Sensitivity Momentum Double Bottom Directional Trading Strategy

- Scalping Strategy with Volume and VWAP Confirmation

- ADX, MA and EMA Long Only Trend Tracking Strategy

- Momentum Breakthrough Golden Cross Strategy

- Triple Indicator Collision Strategy

- Out-of-the-box Machine Learning Trading Strategy

- Moving Average Turning Point Crossover Trading Strategy

- Cross-Cycle Arbitrage Strategy Based on Multiple Indicators

- The Bollinger Band breakout strategy is a long-only momentum chasing strategy

- Flawless Victory Quantitative Trading Strategy Based on Double BB Indicators and RSI