Peanut 123 Reversal and Breakout Range Short-term Trading Strategy

Author: ChaoZhang, Date: 2024-01-29 16:31:04Tags:

Overview

The Peanut 123 Reversal and Breakout Range Short-term Trading Strategy is a combination strategy that incorporates the signals from a reversal strategy and a breakout strategy sub-strategies to generate more powerful trading signals.

Strategy Logic

The strategy consists of two sub-strategies:

-

Peanut 123 Reversal Strategy

It is an adapted reversal strategy based on the system introduced on P183 of Ulf Jensen’s book. It goes long when the close price rises for 2 consecutive days and the 9-day Stochastic Slow line is below 50; It goes short when the close price falls for 2 consecutive days and the 9-day Stochastic Fast line is above 50.

-

Breakout Range Short Strategy

It is a short-term strategy that uses the breakout of the lowest price in a certain look_bak period as the signal. It goes short when the price breaks below the lowest low in the look_bak period.

The combination strategy takes into account the signals from both sub-strategies. It generates actual trading signals only when the two sub-strategies give signals in the same direction. No trading signals will be generated if the two sub-strategies give opposite signals.

Advantage Analysis

The strategy combines the advantages of both reversal and breakout sub-strategies and considers more factors. It can filter out some noise trades and improve win rate.

-

The reversal strategy captures short-term reversal opportunities and makes profit during fluctuations.

-

The breakout strategy catches the short-term trend after the breakout.

-

By combining the signals of two sub-strategies, more effective trading signals can be generated and noise can be filtered out.

Risk Analysis

The strategy also has the following risks:

-

Reversals may not happen, there are risks of failed reversals.

-

Breakouts can also be false breakouts, there are risks of chasing highs and lows.

-

Neither of the sub-strategies can ensure effectiveness when used alone, combining them may also fail.

To address these risks, methods like optimizing parameters, adjusting the weighting of sub-strategies, choosing different products for arbitrage can be used to reduce risks.

Optimization Directions

There is room for further optimization of the strategy:

-

Optimize the parameters of the two sub-strategies to better adapt to different cycles and different products.

-

Increase other types of sub-strategies, such as machine learning prediction strategies, to incorporate more factors.

-

Dynamically adjust the weighting of the two sub-strategies to give more weight to the better-performed one in different market environments.

-

Conduct combination arbitrage by selecting products with little correlation but certain commonality.

Summary

The Peanut 123 Reversal and Breakout Range Short-term Trading Strategy integrates the reversal and breakout sub-strategies at the strategy level. To some extent, it combines the advantages of the two sub-strategies while having space for further optimization. It provides new ideas for strategy design - conducting integration and combination at the strategy level while preserving the independence of sub-strategies, in order to discover more effective trading opportunities.

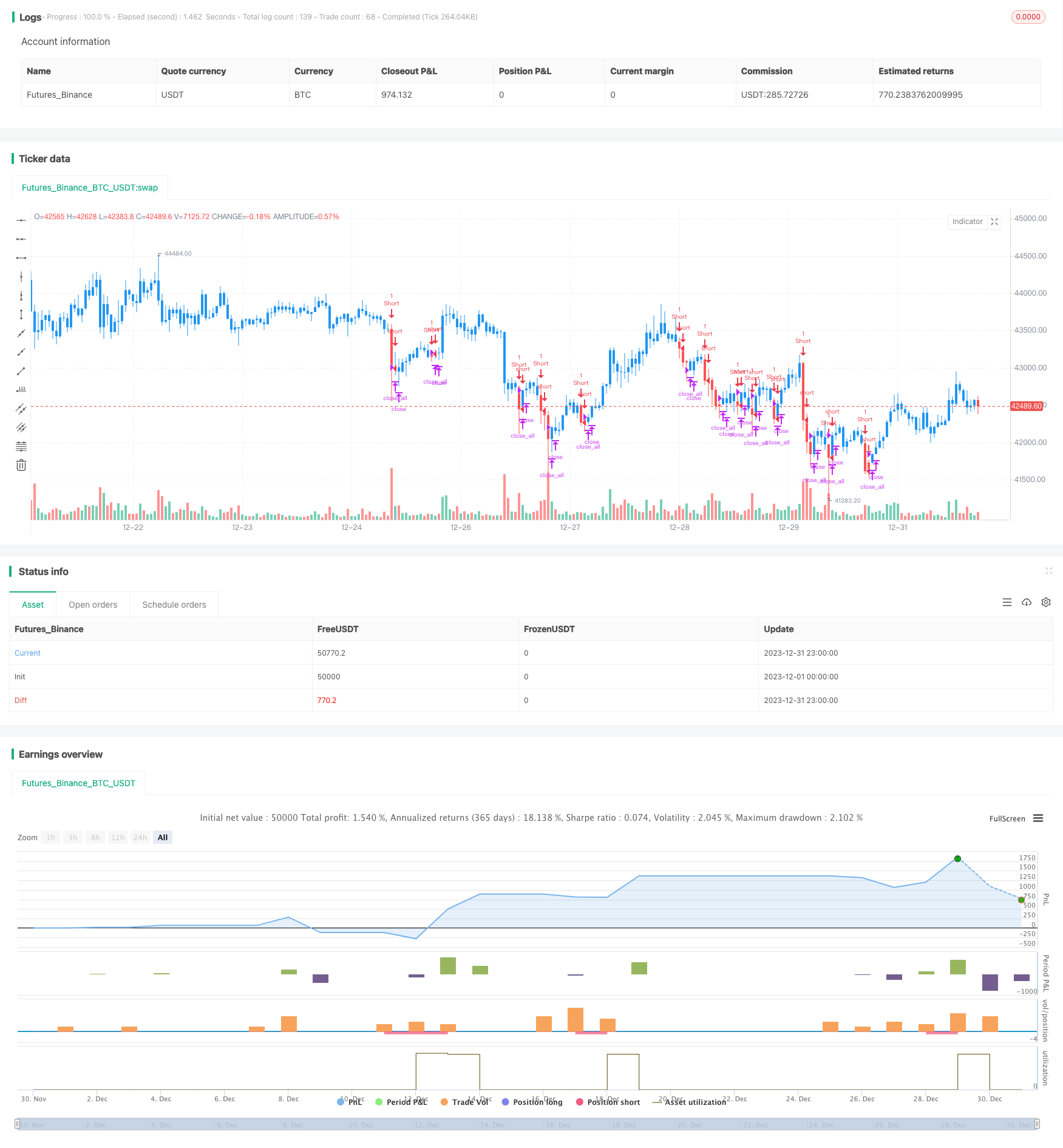

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 01/07/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Breakout Range Short Strategy

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

BreakoutRangeShort(look_bak) =>

pos = 0

xLowest = lowest(low, look_bak)

pos := iff(low < xLowest[1], -1, 0)

pos

strategy(title="Combo Backtest 123 Reversal & Breakout Range Short", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

look_bak = input(4, minval=1, title="Look Bak")

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBreakoutRangeShort = BreakoutRangeShort(look_bak)

pos = iff(posReversal123 == 1 and posBreakoutRangeShort == 1 , 1,

iff(posReversal123 == -1 and posBreakoutRangeShort == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? color.red: possig == 1 ? color.green : color.blue )

- RSI Indicator Based Stock Trading Pyramiding Strategy

- All about EMA Channel Trading Strategy

- Double Decker RSI Trading Strategy

- Bollinger Bands and RSI Combination Strategy

- Double Inside Bar & Trend Strategy

- Amazing Price Breakout Strategy

- Robust Trend Continuation Strategy

- Trend Tracking Moving Average Crossover Strategy

- Breakout Reversal Model Based on Turtle Trading Strategy

- Momentum Trend Strategy

- Smoothed RSI Based Stock Trading Strategy

- Smooth Volatility Band Strategy

- Commodity Channel Index Reversal Trading Strategy

- Time-based Strategy with ATR Take Profit

- Momentum Trend Tracker Strategy

- EMA Candle Close Strategy

- EMA Crossover Quantitative Trading Strategy

- Dynamic Stop-Loss Moving Average Strategy

- Mean Reversion with Incremental Entry Strategy

- Dynamic Average Price Tracking Strategy