Robust Trend Continuation Strategy

Author: ChaoZhang, Date: 2024-01-29 16:57:01Tags:

Overview

This strategy is based on moving averages. It goes long after a short-term correction in an upward trend. It belongs to the trend following strategy.

Strategy Principle

This strategy uses 3 EMA lines with different periods. The EMA1 line with shorter period is used to judge the short-term trend. The EMA2 and EMA3 lines with longer periods are used to determine the mid-long term trend, where EMA3 has the longest period. When the short-term EMA1 line goes up, it indicates that it is in a short-term upward trend. If EMA2 is above EMA3, it means the mid-long term is also in upward trend, so this is a good timing for long entry. Specifically, the trading signal is generated when the price crosses above the EMA1 line. To further verify the stability of the trend, it requires that EMA2 and EMA3 are pointing up and the last bar is also rising in the signal generation bar, which helps filter out wrong signals from short-term corrections.

The stop loss line and take profit line are set to lock in profits and losses. Specifically, the stop loss line moves according to the ATR value, and the take profit line also moves based on the ATR value.

Advantage Analysis

The biggest advantage of this strategy is that it can effectively capture the mid-long term upward trend, while also taking into account the short-term correction, which makes its holding time and profit space considerable.

In addition, the setting of stop loss and take profit also makes its risk controllable.

Risk Analysis

The biggest risk of this strategy is that it cannot determine the trend reversal point. If the mid-long term trend reverses while the short term is still rising, it will generate a wrong long signal to enter the market, which may cause greater loss.

In addition, unnecessary trading losses may also occur in range-bound markets.

Optimization Directions

Consider adjusting the cycle parameters of EMA based on the characteristics of specific trading varieties to better match the mid-long cycle of the variety.

Combining with other indicators to determine the end of short-term adjustments can avoid wrong entry.

Consider adjusting the stop loss coefficient based on the ATR value, appropriately relaxing the stop loss distance when ATR is large.

Conclusion

In general, this strategy is a mid-long term trend following strategy that performs well. It determines the trend direction through moving averages, entry timing through pullback signals, and locks in profits and losses through stop loss and take profit settings. But there is also a certain risk of blind trend following. Traders need to make their own judgment on the market to decide whether to enter.

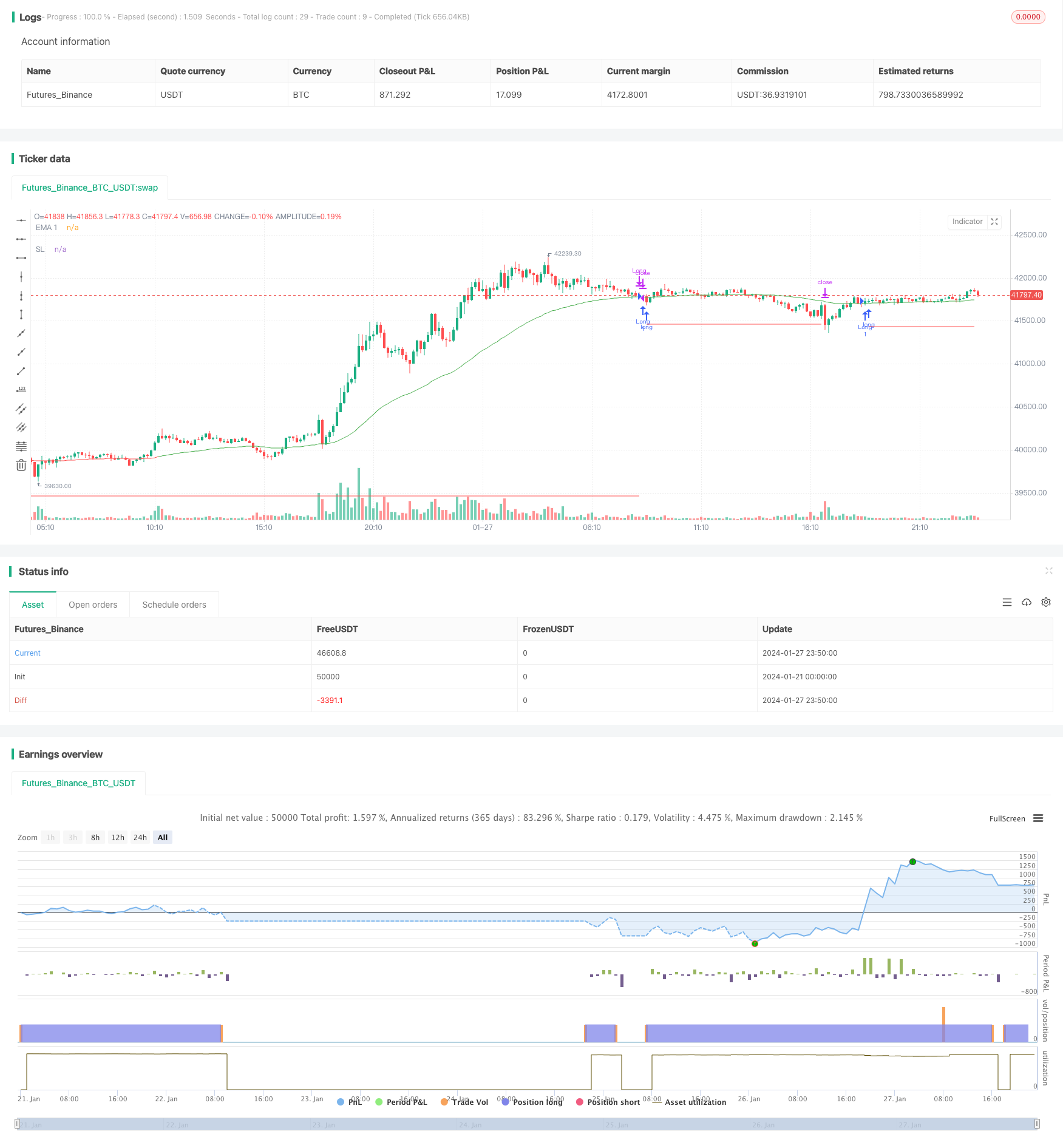

/*backtest

start: 2024-01-21 00:00:00

end: 2024-01-28 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Trend Continuation', shorttitle='Trend_Continuation', overlay=true)

// Input

price = input(close)

MA1_Length = input.int(50, step=1, title='EMA 1 Length')

MA2_Length = input.int(80, step=1, title='EMA 2 Length')

MA3_Length = input.int(200, step=1, title='EMA 3 Length')

numberOfCandles = input(1)

slATRFactor = input(3.5)

tpATRFactor = input(3.5)

ATRLength = input(14)

// switch1=input(true, title="Show Bar Color?")

// switch2=input(true, title="Show Moving Averages?")

// Calculation

MA1 = ta.ema(price, MA1_Length)

MA2 = ta.ema(price, MA2_Length)

MA3 = ta.ema(price, MA3_Length)

prev_price = close[numberOfCandles]

// Strategy

allPositive = true

for i = 0 to numberOfCandles - 1 by 1

if close[i] < close[i + 1] or close[i] < MA1

allPositive := false

break

long = MA2 > MA3 and price > MA1 and ta.crossunder(prev_price, MA1) and allPositive

// short = crossover(price, MA3) or ( change(price)>0 and change(MA1)>0 and crossover(price,MA1) and change(MA2)<0 )

if long

strategy.entry('Long', strategy.long, comment='Long')

bought = strategy.position_size[0] > strategy.position_size[1]

atrAtLong = ta.valuewhen(bought, ta.atr(ATRLength), 0)

// Stop loss and take profit

slPrice = strategy.position_avg_price - slATRFactor * atrAtLong

tpPrice = strategy.position_avg_price + tpATRFactor * atrAtLong

SL = plot(slPrice, title='SL', style=plot.style_linebr, linewidth=1, color=color.new(color.red, 0))

if price >= tpPrice and price < MA1

strategy.close('Long')

if price < strategy.position_avg_price

strategy.exit('Stop Loss', 'Long', stop=slPrice)

// Strategy Alert

alertcondition(long, title='Long Alert', message='Go Long!')

// alertcondition(short, title='EMA Slope + EMA Cross Strategy, Short Alert', message='Go Short!')

// MA trend bar color

// up = change(MA2)>0 and change(MA3)>0

// dn = change(MA2)<0 and change(MA3)<0

// bar_color = up?green:dn?red:blue

// barcolor(switch1?bar_color:na)

// MA trend output color

change_1 = ta.change(MA2)

MA2_color = ta.change(MA2) > 0 ? color.lime : change_1 < 0 ? color.red : color.blue

change_2 = ta.change(MA3)

MA3_color = ta.change(MA3) > 0 ? color.lime : change_2 < 0 ? color.red : color.blue

// MA output

// EMA2 = plot(switch2?MA2:na, title="EMA 2", style=linebr, linewidth=2, color=MA2_color)

// EMA3 = plot(switch2?MA3:na, title="EMA 3", style=linebr, linewidth=4, color=MA3_color)

// fill(EMA2, EMA3, color=silver, transp=50)

color_1 = MA2 > MA3 ? color.green : color.red

EMA1 = plot(MA1, title='EMA 1', style=plot.style_linebr, linewidth=1, color=color_1)

// EMA2 = plot(MA2, title="EMA 2", style=linebr, linewidth=2, color=blue)

// EMA3 = plot(MA3, title="EMA 3", style=linebr, linewidth=3, color=red)

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

- Double Exponential Moving Average RSI Trading Strategy

- Simple Moving Average Crossover Strategy

- Scalping Strategy Based on Market Liquidity and Trend

- Cross-Border Short-Term Breakthrough Reversal 5EMA Strategy

- RSI Indicator Based Stock Trading Pyramiding Strategy

- All about EMA Channel Trading Strategy

- Double Decker RSI Trading Strategy

- Bollinger Bands and RSI Combination Strategy

- Double Inside Bar & Trend Strategy

- Amazing Price Breakout Strategy

- Trend Tracking Moving Average Crossover Strategy

- Breakout Reversal Model Based on Turtle Trading Strategy

- Momentum Trend Strategy

- Peanut 123 Reversal and Breakout Range Short-term Trading Strategy

- Smoothed RSI Based Stock Trading Strategy

- Smooth Volatility Band Strategy

- Commodity Channel Index Reversal Trading Strategy

- Time-based Strategy with ATR Take Profit

- Momentum Trend Tracker Strategy

- EMA Candle Close Strategy