Dual ATR Trailing Stop Strategy

Author: ChaoZhang, Date: 2024-01-31 17:10:32Tags:

Overview

The Dual ATR Trailing Stop strategy is a short-term trading strategy based on the Average True Range (ATR) indicator. The strategy sets two stop loss lines, fast ATR line and slow ATR line, at the same time, and determines entry and exit based on the crossover of the two lines. The strategy is simple, responsive, and suitable for high volatility markets.

Strategy Principle

The core of this strategy is using two ATR stop loss lines. One is the fast ATR line with short period and small multiplier for fast reaction. The other is the slow ATR line with longer period and bigger multiplier for filtration. When fast ATR line crosses above slow ATR line, it generates buy signal. When fast ATR line crosses below slow ATR line, it generates sell signal. So the strategy uses the crossover of two ATR lines to determine entry and exit, which can effectively control the stop loss.

The specific logic is: calculate fast ATR line and slow ATR line. When price is above slow line, use fast line to trail stop loss. Otherwise, use slow line to trail stop loss. The color of Kline represents current stop loss line. Green and blue means using fast line. Red and yellow means using slow line. Exit when market price touches the stop loss lines.

Advantage Analysis

The advantages of this strategy are:

- Simple and clear logic, easy to understand and implement.

- Fast response to market change, suitable for high volatility market.

- Dual ATR stop loss controls risk effectively.

- ATR indicator is parametric for adjusting stop loss range.

- Visual Kline color indicates stop loss situation clearly.

Risk Analysis

There are also some risks:

- Prone to over-trading.

- ATR has poor curve fitting, may amplify losses.

- Cannot effectively filter sideways and trending markets.

We can reduce risks by optimizing ATR period, adjusting ATR multiplier, combining other indicators for filtration etc.

Optimization Direction

The optimization directions are:

- Optimize ATR parameters for better stop loss range.

- Add filter indicators to avoid invalid trades, like MA.

- Add open conditions to avoid mistrades. For example, add volume indicators.

- Add exits for holding period to avoid over-trading.

Conclusion

The Dual ATR Trailing Stop Strategy is easy to understand and implement, especially suitable for high volatility scenarios, and can effectively control risks. There is also large room for optimization. It is a recommended short-term strategy worth trying.

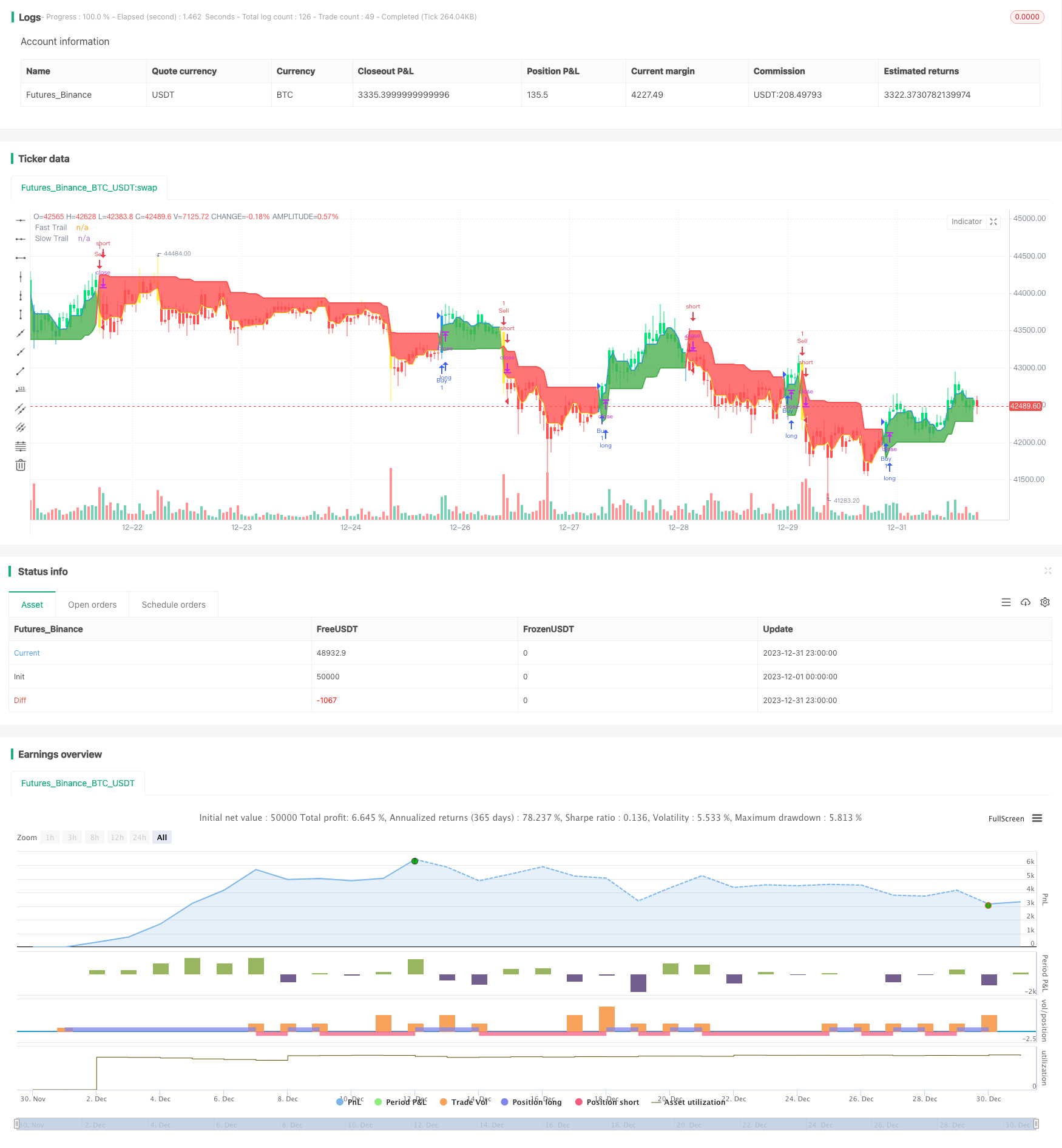

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ceyhun

//@version=4

strategy("ATR Trailing Stop Strategy by ceyhun", overlay=true)

/////////notes////////////////////////////////////////

// This is based on the ATR trailing stop indicator //

// width addition of two levels of stops and //

// different interpretation. //

// This is a fast-reacting system and is better //

// suited for higher volatility markets //

//////////////////////////////////////////////////////

SC = input(close, "Source", input.source)

// Fast Trail //

AP1 = input(5, "Fast ATR period", input.integer) // ATR Period

AF1 = input(0.5, "Fast ATR multiplier", input.float) // ATR Factor

SL1 = AF1 * atr(AP1) // Stop Loss

Trail1 = 0.0

Trail1 := iff(SC > nz(Trail1[1], 0) and SC[1] > nz(Trail1[1], 0), max(nz(Trail1[1], 0), SC - SL1), iff(SC < nz(Trail1[1], 0) and SC[1] < nz(Trail1[1], 0), min(nz(Trail1[1], 0), SC + SL1), iff(SC > nz(Trail1[1], 0), SC - SL1, SC + SL1)))

// Slow Trail //

AP2 = input(10, "Slow ATR perod", input.integer) // ATR Period

AF2 = input(2, "Slow ATR multiplier", input.float) // ATR Factor

SL2 = AF2 * atr(AP2) // Stop Loss

Trail2 = 0.0

Trail2 := iff(SC > nz(Trail2[1], 0) and SC[1] > nz(Trail2[1], 0), max(nz(Trail2[1], 0), SC - SL2), iff(SC < nz(Trail2[1], 0) and SC[1] < nz(Trail2[1], 0), min(nz(Trail2[1], 0), SC + SL2), iff(SC > nz(Trail2[1], 0), SC - SL2, SC + SL2)))

// Bar color for trade signal //

Green = Trail1 > Trail2 and close > Trail2 and low > Trail2

Blue = Trail1 > Trail2 and close > Trail2 and low < Trail2

Red = Trail2 > Trail1 and close < Trail2 and high < Trail2

Yellow = Trail2 > Trail1 and close < Trail2 and high > Trail2

// Signals //

Bull = barssince(Green) < barssince(Red)

Bear = barssince(Red) < barssince(Green)

Buy = crossover(Trail1, Trail2)

Sell = crossunder(Trail1, Trail2)

TS1 = plot(Trail1, "Fast Trail", style=plot.style_line,color=Trail1 > Trail2 ? color.blue : color.yellow, linewidth=2)

TS2 = plot(Trail2, "Slow Trail", style=plot.style_line,color=Trail1 > Trail2 ? color.green : color.red, linewidth=2)

fill(TS1, TS2, Bull ? color.green : color.red, transp=90)

plotcolor = input(true, "Paint color on chart", input.bool)

bcl = iff(plotcolor == 1, Blue ? color.blue : Green ? color.lime : Yellow ? color.yellow : Red ? color.red : color.white, na)

barcolor(bcl)

if Buy

strategy.entry("Buy", strategy.long, comment="Buy")

if Sell

strategy.entry("Sell", strategy.short, comment="Sell")

- Short-Term Trading Strategy Based on RSI and SMA

- Momentum Breakout Intraday Trading Strategy

- KDJ Golden Cross Long Entry Strategy

- Breakback Storm Strategy in Hidden Opportunities

- Cross-Timeframe Momentum Tracking Strategy

- Moving Average Trend Following Strategy

- Pivot SuperTrend Strategy Across Multiple Timeframes

- Quantitative Candlestick Pattern and Trend Following Strategy

- Supertrend Combined with RSI Quantitative Trading Strategy

- Cape Town 15-min Candle Breakout Strategy

- Qullamaggie Breakout Tracking Strategy

- Extreme version of Noro's Trend Moving Averages Strategy

- Recursive Momentum Trading Strategy

- Donchian Trend Following Strategy

- SuperTrend RSI EMA Crossover Strategy

- Bilateral Three-Point Moving Average Quantitative Trading Strategy

- Trading Strategy Based on RSI and MACD Indicators

- CCI and EMA Based Scalping Strategy

- Improved Wave Trend Tracking Strategy

- Ichimoku Entries Strategy