Moving Average and Stochastic RSI Strategy

Author: ChaoZhang, Date: 2024-02-01 11:37:40Tags:

Overview

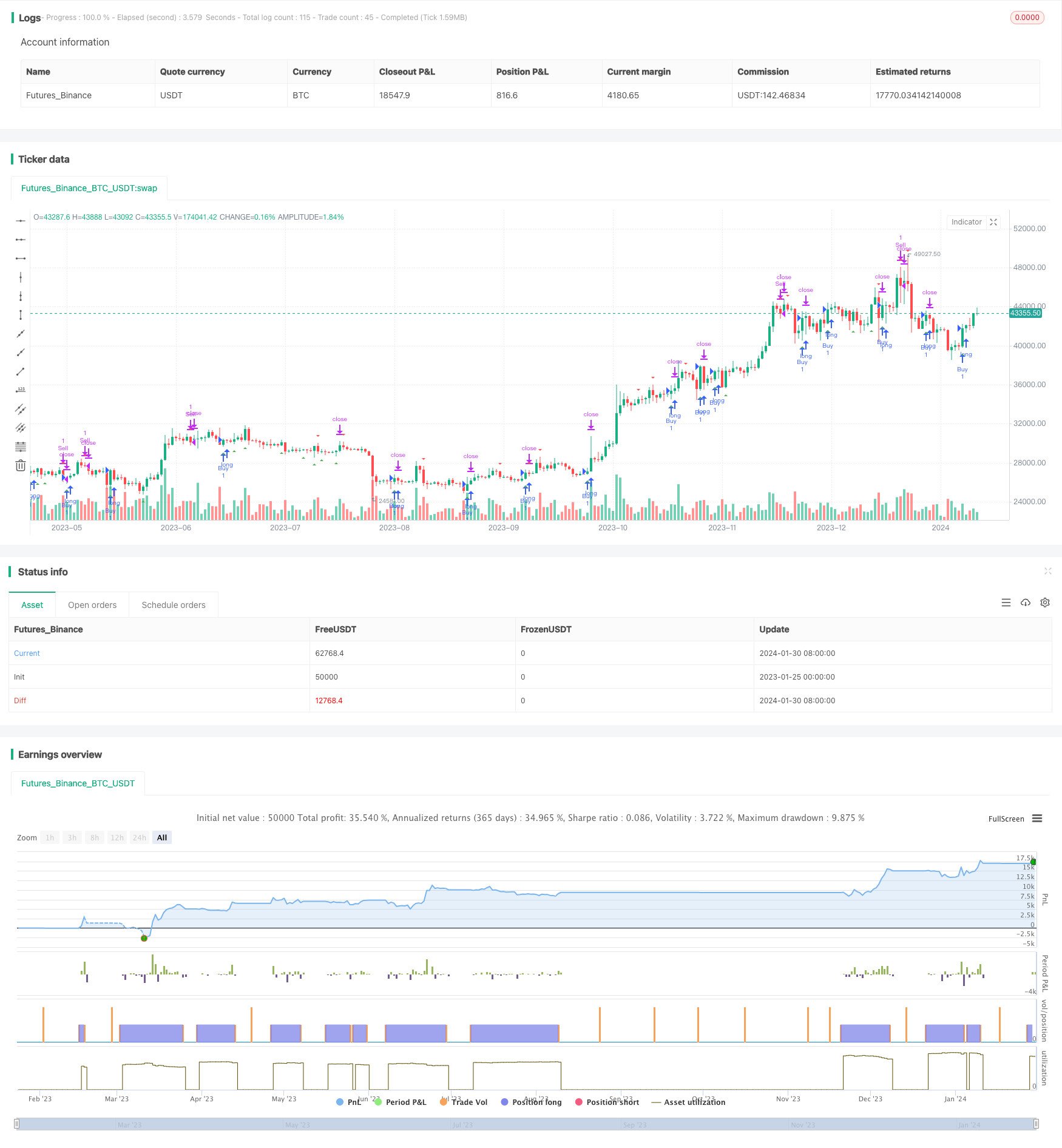

This strategy was tested on the BTC/USDT trading pair on the 3-minute timeframe and gave wonderful results. It combines the use of moving averages and the Stochastic RSI indicator to identify trading signals.

Strategy Principle

The strategy uses two simple moving averages with different time periods, 20 periods and 50 periods respectively. These two averages are used to judge the price trend. When the short-term moving average crosses above the long-term moving average, it is a bullish signal, and when it crosses below, it is a bearish signal.

The calculation formula of Stochastic RSI indicator is: (RSI - Lowest RSI) / (Highest RSI - Lowest RSI) * 100. This indicator reflects the current level of the RSI indicator relative to the highest and lowest RSI over a recent period of time. When Stochastic RSI crosses above 20, it is an oversold signal, and when it crosses below 80, it is an overbought signal.

This strategy combines the use of moving averages to judge the trend direction and Stochastic RSI to locate potential reversal points as entry opportunities.

Advantage Analysis

Compared with using moving averages or Stochastic RSI alone, this strategy combines the advantages of both to better identify trends while locating potential reversal points, thus improving the probability of profit.

Compared with a single indicator, this strategy integrates multiple indicators and sets strict entry rules, which can effectively filter out false signals and avoid unnecessary trading.

This strategy also controls risks very well by using only 2% of capital for margin trading each time, which can effectively limit the impact of a single loss.

Risk Analysis

This strategy mainly relies on technical indicators to determine trading signals. If the indicators fail, it may generate wrong signals and cause losses. In addition, improper parameter settings will also affect strategy performance.

In times of violent market fluctuations, stop-loss settings may be broken through, leading to the risk of expanding losses.

Optimization Directions

Test more moving average combinations and parameters to find the optimal parameter combination. Other potential indicators such as KD and RSI can also be combined with moving averages.

Choose the best stop-loss modes according to the characteristics of different cryptocurrencies to further control risks.

Introduce machine learning algorithms to automatically optimize parameter settings and signal judgment rules to make the strategy more robust and adaptive.

Conclusion

This strategy successfully combines moving averages and Stochastic RSI indicator to determine trading signals. Compared with a single technical indicator, this strategy can provide more reliable trading signals. With strict risk control and parameter optimization, this strategy has the potential to achieve stable profits.

/*backtest

start: 2023-01-25 00:00:00

end: 2024-01-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average and Stochastic RSI Strategy", shorttitle="MA+Stoch RSI", overlay=true)

// Input variables

ma1_length = input.int(20, title="MA1 Length")

ma2_length = input.int(50, title="MA2 Length")

stoch_length = input.int(14, title="Stochastic RSI Length")

overbought = input.int(80, title="Overbought Level")

oversold = input.int(20, title="Oversold Level")

risk_percentage = input.float(2.0, title="Risk Percentage")

// Calculate moving averages

ma1 = ta.sma(close, ma1_length)

ma2 = ta.sma(close, ma2_length)

// Calculate Stochastic RSI

rsi1 = ta.rsi(close, stoch_length)

rsiH = ta.highest(rsi1, stoch_length)

rsiL = ta.lowest(rsi1, stoch_length)

stoch = (rsi1 - rsiL) / (rsiH - rsiL) * 100

// Determine buy and sell signals based on Stochastic RSI

buySignal = ta.crossover(stoch, oversold)

sellSignal = ta.crossunder(stoch, overbought)

// Plot signals on the chart

plotshape(buySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(sellSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Calculate position size based on equity and risk percentage

equity = strategy.equity

riskAmount = equity * risk_percentage / 100

positionSize = riskAmount / ta.atr(14)

// Entry and exit conditions

var float stopLoss = na

var float takeProfit = na

if buySignal

stopLoss := low

takeProfit := high

strategy.entry("Buy", strategy.long)

else if sellSignal

strategy.exit("Sell", from_entry="Buy", stop=stopLoss, limit=takeProfit)

- Grid Trading Strategy Based on Real-time K-line Tracking

- Breakout Pullback Strategy

- Multi-cycle Adaptive Trend Forecast Strategy

- Renko ATR Trend Reversal Strategy

- Ichimoku Clouds Quant Strategy

- Dual-directional Trend Tracking Strategy Based on Range Breakout

- Cryptocurrency Trading Strategy Based on MACD and Stochastic Indicators

- Swing Dual Moving Average and RSI Crossover Strategy

- Golden Bollinger Band Gap Reversion System

- Quantitative Trend Tracking Strategy

- Ichimoku Cloud Trend Following Strategy

- Long-Term Trading Strategy Based on Bollinger Bands %B Indicator

- The Triple Moving Average Channel Strategy for Patiently Mining Valuable Information from Candlestick Lines

- Yin Yang Hanging Man Strategy

- Trailing Stop Loss Percent Strategy

- Triple Moving Average Trend Following Strategy

- Tracking Stop Loss Moving Average Trading Strategy

- Dual Indicator Mean Reversion Trend Following Strategy

- Dynamic Price Channel with Stop Loss Tracking Strategy

- Dynamic Stop Loss Bollinger Bands Strategy