Open High Close Low Breakout Trading Strategy

Author: ChaoZhang, Date: 2024-02-02 12:03:45Tags:

Overview

The Open High Close Low breakout trading strategy is a trend-following strategy. It identifies the short-term trend direction by checking the relationship between the open and close prices on candlestick charts. When a trend starts, it enters long or short positions to catch the momentum quickly.

Strategy Logic

The core logic is to check if the open price equals the lowest or highest price of the candlestick. A long signal is triggered when the open price equals the low. A short signal is triggered when the open price equals the high. This aims to catch breakouts that suggest a short-term trend.

Once a signal is triggered, a fixed size position will be opened immediately. The stop loss is set based on the ATR indicator to trail the market volatility. The take profit level is a fixed RR multiple of the stop loss distance from the entry price. When the price hits either the stop loss or take profit, the position will be closed accordingly.

The strategy also flattens all positions at a user-defined daily cutoff time, such as 30 minutes before the US market close. This avoids overnight gap risk.

Advantage Analysis

The main advantages are:

Using open/close prices to identify breakout signals fast.

Clear entry signals that are easy to implement.

Timely stop loss and take profit to lock in profits and limit losses.

Flatten positions at the daily cutoff to avoid overnight gap risk.

Market-neutral, applies to forex, stocks, crypto etc.

Risk Analysis

Some risks to consider:

Frequent stop loss with ATR in choppy markets.

Overfit to specific instruments and sessions without additional filters.

Fixed take profit level may underperform in strong trends.

Bad timing on flattening positions could miss trends or cause unnecessary losses.

Improvement Areas

Some ways to further optimize it:

Experiment with various stop loss techniques for different market conditions.

Add filters using momentum indicators etc to avoid false signals.

Dynamically adjust take profit levels based on market volatility.

Optimize the daily cutoff time for various trading instruments and sessions.

Conclusion

The Open High Close Low breakout strategy offers a simple way to trade momentum. Clear entry and exit rules make it easy to implement and manage. But further optimizations on parameters like stop loss, take profit, filters would improve its robustness across more market conditions. Fine-tuned over time via rigorous testing, it has the potential to achieve strong risk-adjusted returns.

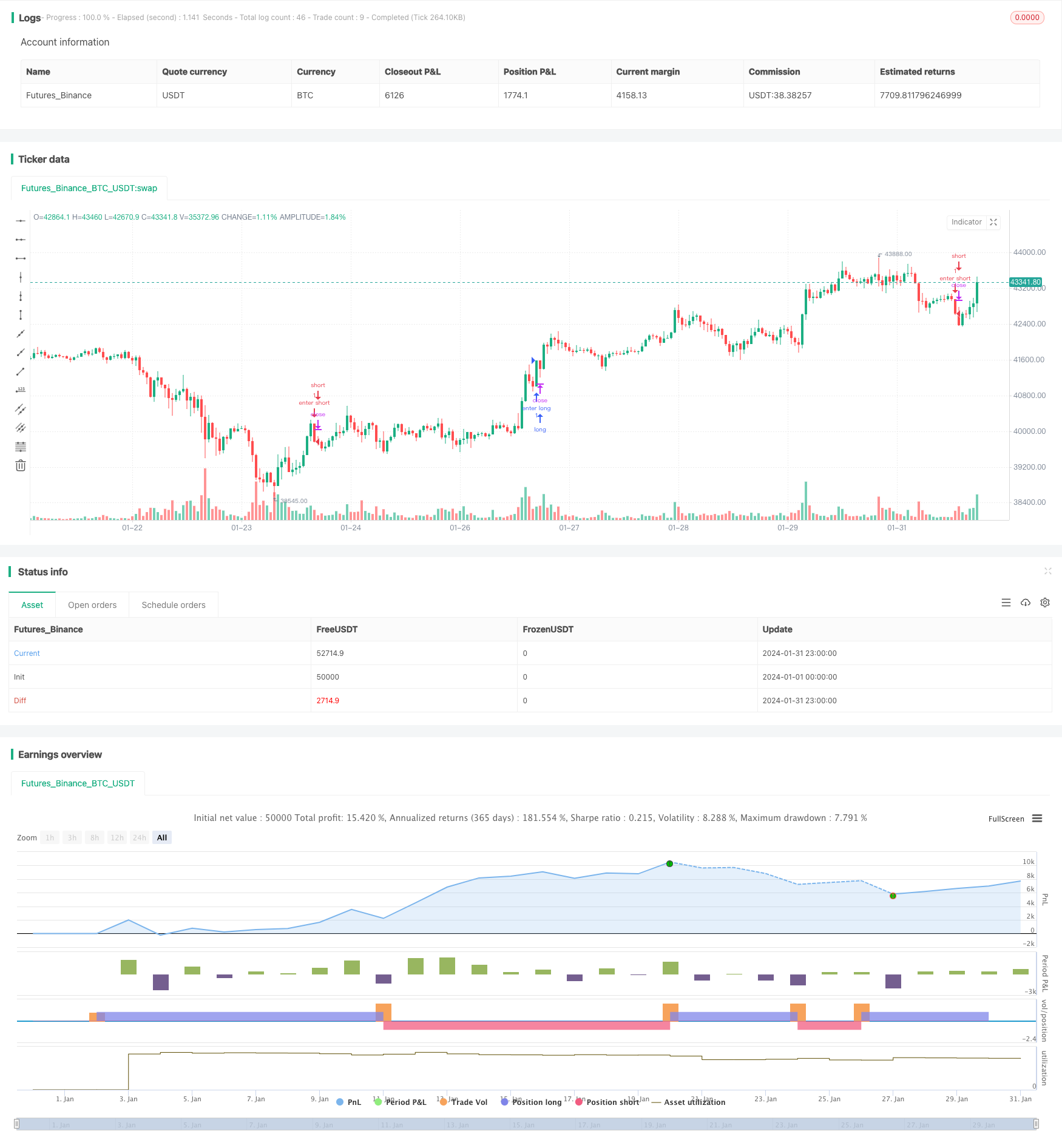

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Open-High-Low strategy

strategy('Strategy: OLH', shorttitle="OLH", overlay=true)

// Inputs

slAtrLen = input.int(defval=14, title="ATR Period for placing SL", group="StopLoss settings")

showSLLines = input.bool(defval=false, title="Show SL lines in chart", tooltip="Show SL lines also as dotted lines in chart. Note: chart may look untidy.", group="Stolploss settings")

// Trade related

rrRatio = input.float(title='Risk:Reward', step=0.1, defval=2.0, group="Trade settings")

endOfDay = input.int(defval=1500, title="Close all trades, default is 3:00 PM, 1500 hours (integer)", group="Trade settings")

mktAlwaysOn = input.bool(defval=true, title="Markets that never closed (Crypto, Forex, Commodity)", tooltip="Some markers never closes. For those cases, make this checked.", group="Trade settings")

lotSize = input.int(title='Lot Size', step=1, defval=1, group="Trade settings")

// Utils

green(open, close) => close > open ? true : false

red(open, close) => close < open ? true : false

body(open, close) => math.abs(open - close)

lowerwick = green(open, close) ? open - low : close - low

upperwick = green(open, close) ? high - close : high - open

crange = high - low

crangep = high[1] - low[1] // previous candle's candle-range

bullish = close > open ? true : false

bearish = close < open ? true : false

// Trade signals

longCond = barstate.isconfirmed and (open == low)

shortCond = barstate.isconfirmed and (open == high)

// For SL calculation

atr = ta.atr(slAtrLen)

highestHigh = ta.highest(high, 7)

lowestLow = ta.lowest(low, 7)

longStop = showSLLines ? lowestLow - (atr * 1) : na

shortStop = showSLLines ? highestHigh + (atr * 1) : na

plot(longStop, title="Buy SL", color=color.green, style=plot.style_cross)

plot(shortStop, title="Sell SL", color=color.red, style=plot.style_cross)

// Trade execute

h = hour(time('1'), syminfo.timezone)

m = minute(time('1'), syminfo.timezone)

hourVal = h * 100 + m

totalTrades = strategy.opentrades + strategy.closedtrades

if (mktAlwaysOn or (hourVal < endOfDay))

// Entry

var float sl = na

var float target = na

if (longCond)

strategy.entry("enter long", strategy.long, lotSize, limit=na, stop=na, comment="Enter Long")

sl := longStop

target := close + ((close - longStop) * rrRatio)

alert('Buy:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

if (shortCond)

strategy.entry("enter short", strategy.short, lotSize, limit=na, stop=na, comment="Enter Short")

sl := shortStop

target := close - ((shortStop - close) * rrRatio)

alert('Sell:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

// Exit: target or SL

if ((close >= target) or (close <= sl))

strategy.close("enter long", comment=close < sl ? "Long SL hit" : "Long target hit")

if ((close <= target) or (close >= sl))

strategy.close("enter short", comment=close > sl ? "Short SL hit" : "Short target hit")

else if (not mktAlwaysOn)

// Close all open position at the end if Day

strategy.close_all(comment = "Close all entries at end of day.")

- Moving Average Displaced Envelope Strategy

- Market Potential Ichimoku Bullish Cloud Strategy

- EMA RSI Hidden Divergence Trend Following Strategy

- Advanced Trend Tracking Strategy Based on Engulfing Pattern and Quantitative Indicators

- AlphaTrend Dual Tracking Strategy

- Fisher Yurik Trailing Stop Strategy

- Trend Following RSI Scalping Strategy

- Spiral Cross Strategy with Moving Average Confirmation

- Gold Cross Dead Cross Quantitative Trading Strategy

- Dual Moving Average Strategy 360°

- Double Exponential Moving Average Quant Trading Strategy

- Dynamic SMMA and SMA Crossover Strategy

- Trend Following Strategy Based on Bollinger Bands, RSI and Moving Average

- Trend Trading Strategy Based on MACD Indicator

- Stochastic & Moving Average Strategy with Double Filters

- Stoch RSI Based Trend Following Strategy

- Single Point Moving Average Breakout Strategy

- Moving Average Crossover Strategy

- SuperTrend Strategy

- Parabolic Period and Bollinger Band Combined Moving Stop Loss Strategy