Improved RSI Breakout Strategy with Stop Loss and Take Profit

Author: ChaoZhang, Date: 2024-02-04 15:27:50Tags:

Overview

The Improved RSI Breakout Strategy is a trend following strategy that uses the Relative Strength Index (RSI) indicator to determine entry and exit points. It builds upon a basic RSI strategy by adding stop loss and take profit orders to manage risk.

When RSI crosses above 70 (overbought level), the strategy goes long. When RSI crosses below 30 (oversold level), the strategy goes short. This allows it to ride strong trends up and down. Stop loss and take profit orders are then used to lock in profits and limit losses on existing positions.

How it Works

The core mechanism relies on the RSI indicator crossing its overbought level (default 70) or oversold level (default 30) to trigger entries.

When RSI crosses above 70, it indicates the asset is overbought and may reverse, so the strategy opens a long position.

When RSI crosses below 30, it indicates the asset is oversold and may bounce, so the strategy opens a short position.

This allows the strategy to capitalize on mean reversion tendencies coming off extreme RSI levels.

The key enhancement is the added risk management through stop loss and take profit orders.

After entering a position, stop loss and take profit orders are placed at fixed percentages away from the entry price (default 2% stop loss, 10% take profit). This locks in a fixed reward to risk ratio on every trade.

If a position moves favorably, the take profit limit order will close it for a gain. If it moves adversely, the stop loss order will close it for a small loss. This maximizes profits in winning trades and minimizes losses from losing trades.

Advantages

- Rides strong trends by buying dips and selling rallies

- Take profit targets larger than stop loss targets allow asymmetric risk-reward

- Stop losses minimize losses on trades going the wrong direction

- Simple concept easy to understand and implement

- Added risk management gives it edge over basic RSI strategies

Risks

- Whipsaws possible if RSI crosses levels multiple times

- Stop loss placement can be optimized

- Take profit levels need fine tuning for better performance

- Works best in trending markets, range-bound performance weaker

Enhancements

Some ways the strategy can be improved further:

- Add additional filters before entry trigger, such as a price breakout

- Trail stop loss levels to lock in more profits in winning trades

- Expand take profit targets for bigger reward potential

- Optimize RSI levels, stop loss %, take profit % for each market

- Adapt to volatility conditions by using ATR for stop loss size

Conclusion

The Improved RSI Breakout Strategy brings together several positive elements - using RSI to identify potential turning points, trend following entries in direction of momentum, asymmetric risk-reward from take profits > stop loss, and risk mitigation from exit orders.

By combining these aspects it aims to maximize reward while minimizing risk on each trade. Proper optimization and robust position sizing can turn this into a stable system across various market environments. The built-in risk controls give it an edge over basic RSI strategies.

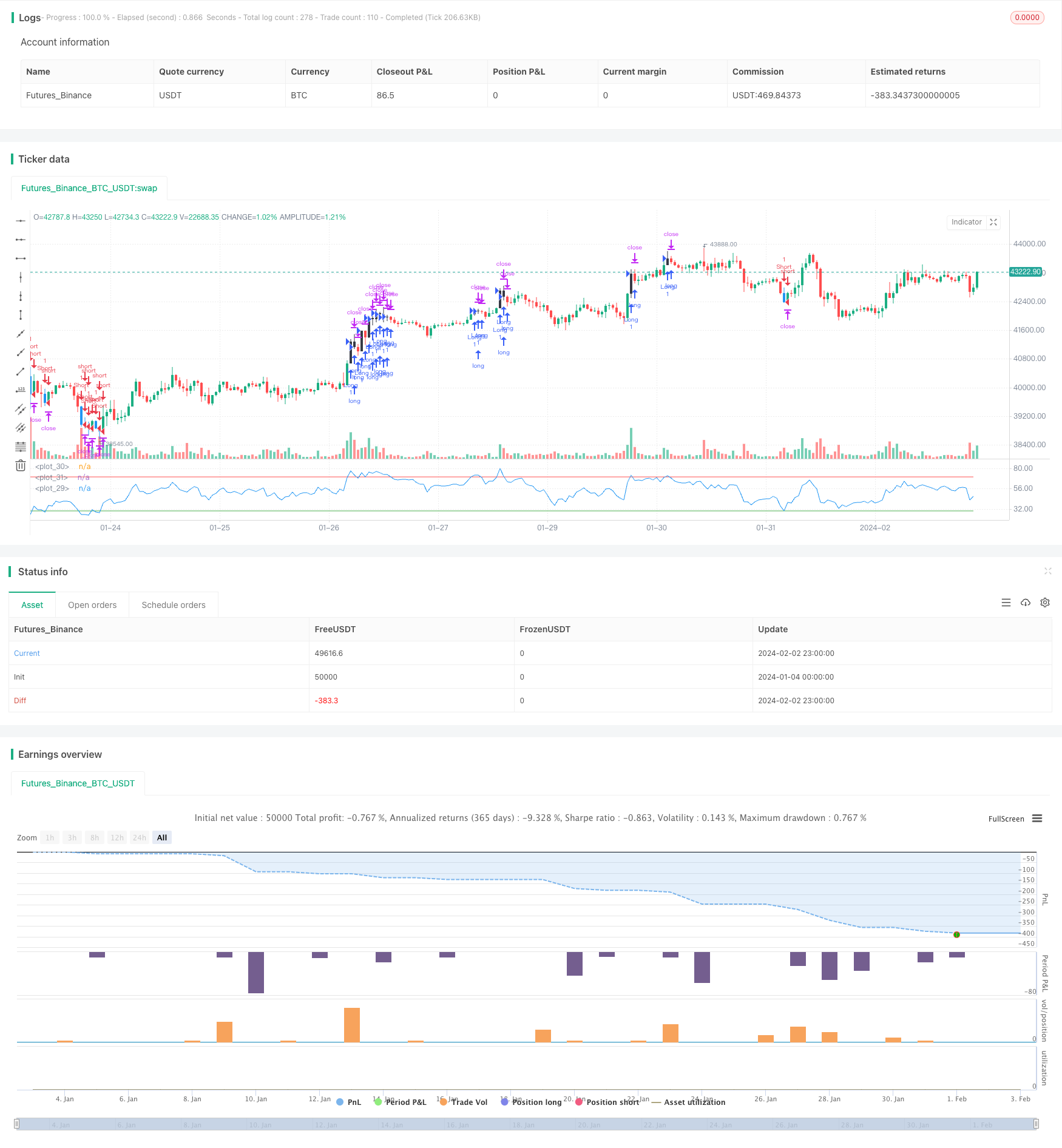

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// Improved RSI Simple Strategy

// Added Risk Management System: SL & TP

// © Bitduke

// All scripts: https://www.tradingview.com/u/Bitduke/#published-scripts

strategy("Simple RSI Buy/Sell at a level", shorttitle="Simple RSI Strategy (SL/TP)", overlay=false )

overbought = input(70, title="overbought value")

oversold = input(30, title="oversold value")

lenght = 14

rsi = rsi(close, lenght)

myrsi = rsi > overbought

myrsi2 = rsi < oversold

barcolor(myrsi ? color.black : na)

barcolor(myrsi2 ? color.blue : na)

// Risk Management Sysyem

convert_percent_to_points(percent) =>

strategy.position_size != 0 ? round(percent / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

setup_percent(percent) =>

convert_percent_to_points(percent)

STOP_LOSS = 2

TAKE_PROFIT = 10

plot(rsi)

plot(overbought, color = color.red)

plot(oversold, color = color.green)

//STRATEGY

if (myrsi)

strategy.entry("Long", strategy.long)

if (myrsi2)

strategy.entry("Short", strategy.short)

strategy.exit("Exit", qty_percent = 100, profit = setup_percent(STOP_LOSS), loss = setup_percent(TAKE_PROFIT))

- Dual Moving Average Breakout Strategy

- Moving Average Crossover Strategy

- Dual Moving Average Trend Tracking Strategy

- Quadratic Momentum Double Indicators Timing Strategy

- Renko and Relative Vigor Index Trend Following Strategy

- Swing Trend Moving Average Strategy

- Bollinger Band, Moving Average and MACD Combined Trading Strategy

- Momentum Price Climbing Crypto Currency Strategy

- Momentum Trading Strategy Based on Multi-factor Model

- Adaptive Bollinger Bands Trend Tracking Strategy

- Quantitative Trading Strategy Based on RSI and Bollinger Bands

- Quantitative Trading Strategy Based on SMA and Rolling Trendline

- Stochastic Weekly Options Trading Strategy

- Powerful EMA and RSI Quantitative Trading Strategy

- Bollinger Bands and RSI Combination Trading Strategy

- Demigod Candlestick MACD Divergence Trend Following Strategy

- Dual Moving Average Cross Timeframe Trading Strategy

- Dual Indicator Stochastic RSI and EMA Trading Strategy

- SMA Crossover Bullish Trend Following Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy