Momentum Price Climbing Crypto Currency Strategy

Author: ChaoZhang, Date: 2024-02-04 15:38:17Tags:

Overview

This strategy is a simple and efficient short-term trading climb strategy suitable for cryptocurrencies, and can also be used for medium and long-term trend trading. Its main components include price fluctuation index, vortex indicator and risk management mechanism of stop loss and take profit.

Strategy Principle

The entry conditions for this strategy are:

The price fluctuation index is positive, indicating that the price is climbing;

The VIP of the vortex indicator crosses above the VIM, indicating an upward trend;

The closing price of the current K line is higher than the highest price of the previous two K lines, which also means the price is breaking upwards.

When the above three conditions are met at the same time, go long to enter the market.

The exit conditions for this strategy are:

The price fluctuation index is negative, indicating that the price is falling back, exit long positions;

The VIP of the vortex indicator crosses below the VIM, indicating a downward trend, exit long positions;

Reaching the stop loss or take profit condition.

Advantages of the Strategy

This strategy combines the price fluctuation index and vortex indicator to judge price trends and breakthrough signals, and can effectively capture the upside price movement, with the following advantages:

Using the price fluctuation index to determine if the price is climbing, avoids wrong trading during consolidation;

Vortex indicator to judge the trend direction, helps identify overall market trends;

Closing price breakthrough judges the momentum that could reduce fake breakouts;

Risk management mechanisms set stop loss and take profit points to effectively control the risk per trade;

Flexibility to adjust parameters suitable for different cycles and trading products.

Risks of the Strategy

Although the strategy is generally stable, there are still some risks to note:

Missing major trend: using an overly short-term cycle may miss bigger market opportunities;

Fake breakout risk: prices may have misleading moves during sharp fluctuations, tending to trigger false signals;

Excessive trading risk: improper parameter settings can lead to overly frequent trading, increasing transaction costs and slippage losses.

These risks could be prevented and resolved by adjusting holding cycle, combining more indicators to filter signals, optimizing parameter settings etc.

Directions for Strategy Optimization

The strategy can also be optimized in the following aspects:

Add more technical indicators for judgement, such as volatility, volume indicators etc. to improve signal quality;

Optimize parameter settings to better suit different products and cycles;

Increase machine learning models to generalize price movement predictions based on big data;

Add auto stop loss, trailing stop profit functions on advanced platforms for increased automation.

Through the above optimizations, the win rate, profit level and stability of the strategy can be further improved.

Summary

The strategy is relatively simple and efficient overall, able to capture upside price climbing phases with decent profit potential for crypto currencies. Although there is room for further optimization, it already works well as an introductory quantitative trading strategy. In summary, this strategy suits crypto currency traders looking for high frequency short and medium-term profits.

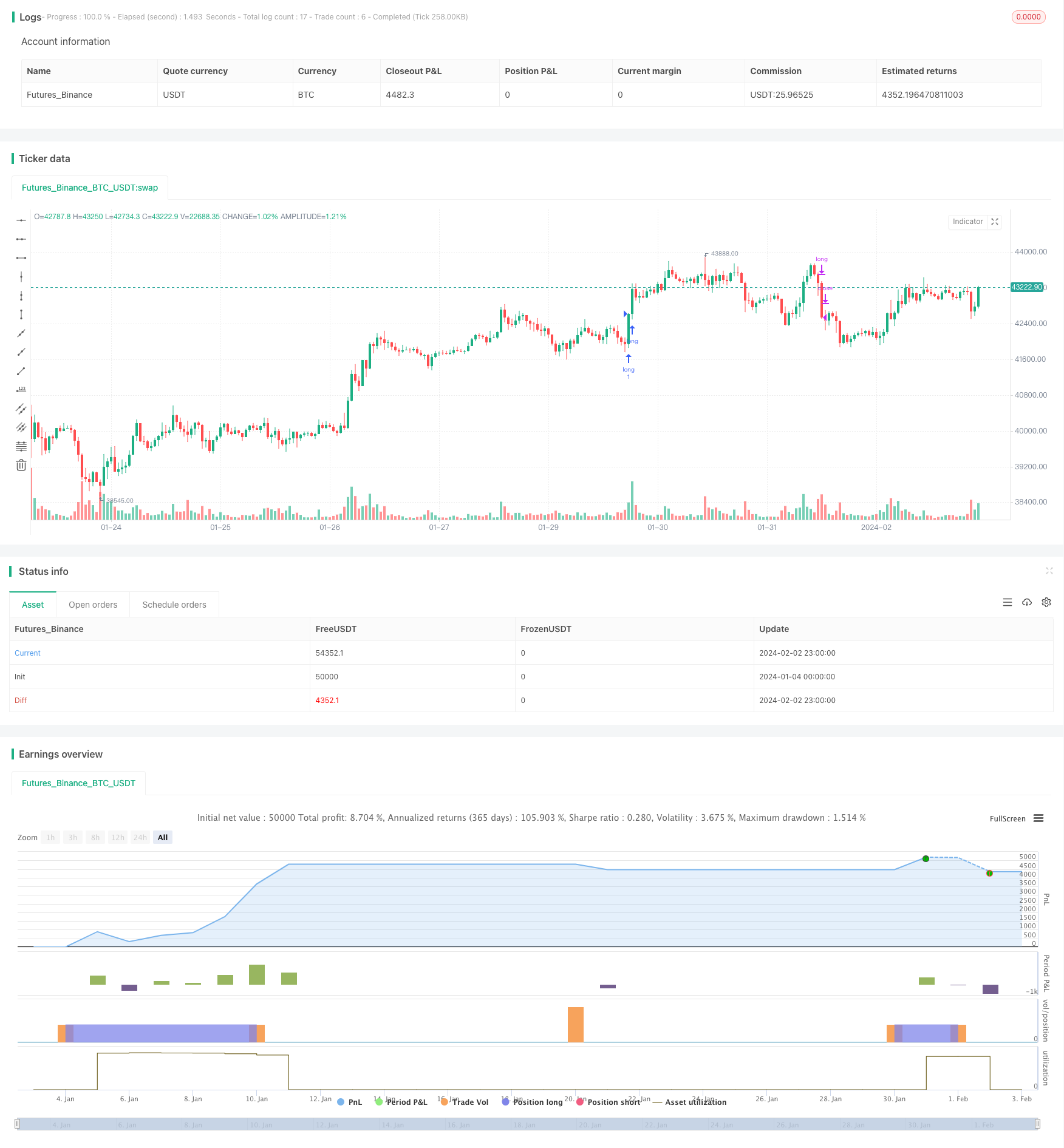

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy(title="Crypto Price Scalper", shorttitle="Scalper Crypto", overlay=true)

inputcc = input(60, title="Number of candles")

low9=lowest(low,inputcc)

high9=highest(high,inputcc)

plotlow = ((close - low9) / low9) * 100

plothigh = ((close - high9) / high9) * 100

plotg = (plotlow +plothigh)/2

center=0.0

period_ = input(14, title="Length VORTEX", minval=2)

VMP = sum( abs( high - low[1]), period_ )

VMM = sum( abs( low - high[1]), period_ )

STR = sum( atr(1), period_ )

VIP = VMP / STR

VIM = VMM / STR

long= crossover(plotg,center) and close > high[2] and crossover(VIP,VIM)

short= crossunder(plotg,center) and crossunder(VIP,VIM)

tplong=input(0.1, title="TP Long", step=0.01)

sllong=input(0.1, title="SL Long", step=0.01)

strategy.entry("long",1,when=long)

strategy.exit("closelong", "long" , profit = close * tplong / syminfo.mintick, loss = close * sllong / syminfo.mintick, alert_message = "closelong")

strategy.close("long",when=short)

- SAR Momentum Reversal Tracking Strategy

- Dynamic RSI Trading Strategy

- Crossover Strategy between Multiple Moving Averages

- Dual Moving Average Breakout Strategy

- Moving Average Crossover Strategy

- Dual Moving Average Trend Tracking Strategy

- Quadratic Momentum Double Indicators Timing Strategy

- Renko and Relative Vigor Index Trend Following Strategy

- Swing Trend Moving Average Strategy

- Bollinger Band, Moving Average and MACD Combined Trading Strategy

- Momentum Trading Strategy Based on Multi-factor Model

- Adaptive Bollinger Bands Trend Tracking Strategy

- Improved RSI Breakout Strategy with Stop Loss and Take Profit

- Quantitative Trading Strategy Based on RSI and Bollinger Bands

- Quantitative Trading Strategy Based on SMA and Rolling Trendline

- Stochastic Weekly Options Trading Strategy

- Powerful EMA and RSI Quantitative Trading Strategy

- Bollinger Bands and RSI Combination Trading Strategy

- Demigod Candlestick MACD Divergence Trend Following Strategy

- Dual Moving Average Cross Timeframe Trading Strategy