Dynamic PSAR Stock Fluctuation Tracking Strategy

Author: ChaoZhang, Date: 2024-02-05 10:40:12Tags:

Overview

This strategy implements a simple and efficient stock fluctuation tracking and automatic take profit/stop loss strategy based on the Parabolic SAR indicator. It can dynamically track the uptrend and downtrend of stock prices and automatically set take profit/stop loss points at the reversal points without manual intervention, realizing automated trading.

Strategy Principle

This strategy uses the Parabolic SAR indicator to determine the trend direction of stock price fluctuations. When the PSAR indicator is below the K-line, it indicates an upward trend; when the PSAR indicator is above the K-line, it indicates a downward trend. The strategy tracks changes in PSAR values in real time to determine changes in trends.

When an upward trend is confirmed, the strategy will set a stop loss point at the PSAR point of the next BAR; when a downward trend is confirmed, the strategy will set a take profit point at the PSAR point of the next BAR. This achieves the automatic take profit/stop loss function when stock prices reverse.

At the same time, the strategy has built-in parameters such as starting value, step value and maximum value to adjust the sensitivity of the PSAR indicator, thereby optimizing the effect of take profit/stop loss.

Advantage Analysis

The biggest advantage of this strategy is that it realizes full automation of stock fluctuation tracking and automatic take profit/stop loss. Profits can be realized without manual judgment of market trends, which greatly reduces the time and energy costs of manual trading.

Compared with traditional stop loss/take profit strategies, the take profit/stop loss points of this strategy are variable, which can capture price changes and opportunities more quickly. It also reduces the probability of misjudgment and increases profit potential.

After parameter optimization, this strategy can continuously profit in major trends, while automatically stop loss to protect the principal when reversal comes.

Risk Analysis

The biggest risk of this strategy is the probability that the PSAR indicator misjudges the trend direction. When the stock price has a short-term adjustment and fluctuation, the PSAR indicator may give a wrong signal. At this time, it is necessary to reasonably optimize the parameters of PSAR to improve the accuracy of judgment.

Another risk point is that the take profit/stop loss point is too close to the current price. This may increase the probability that the stop loss point is broken, bringing greater impact to the principal. At this time, appropriately relax the take profit/stop loss range to ensure sufficient buffer space.

Strategy Optimization

The optimization potential of this strategy mainly focuses on adjusting the parameters of the PSAR indicator itself. By testing different stocks and optimizing the settings of starting value, step value and maximum value, the PSAR indicator can be more sensitive to price fluctuations, while ensuring judgment accuracy. This requires a lot of backtesting and analysis work.

Another optimization direction is to set the range of take profit/stop loss. It is necessary to study the intraday fluctuation range of different stocks, and set reasonable profit/loss ratio requirements based on this. This can further reduce the probability of principal loss.

Summary

This strategy utilizes the Parabolic SAR indicator to realize a fully automated stock tracking and automatic take profit/stop loss trading strategy. Its biggest advantage is that no manual intervention is required, which can reduce time and energy costs. The main risks come from misjudgments of indicators, which can be reduced through parameter optimization. In general, this strategy provides an efficient and reliable solution for quantitative trading of stocks.

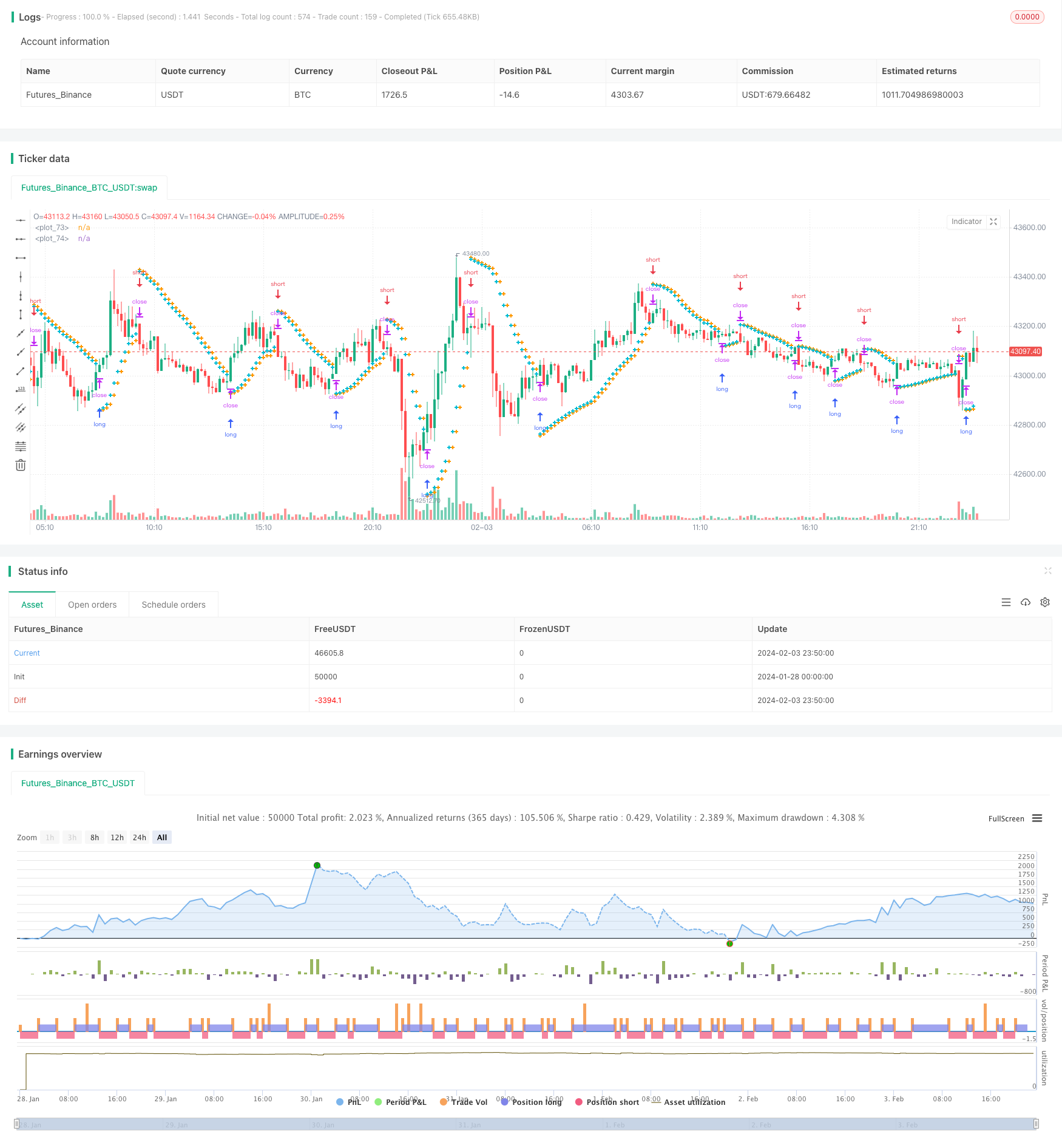

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Swing Parabolic SAR Strategy", overlay=true)

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := min(AF + increment, maximum)

else

if low < EP

EP := low

AF := min(AF + increment, maximum)

if uptrend

SAR := min(SAR, low[1])

if bar_index > 1

SAR := min(SAR, low[2])

else

SAR := max(SAR, high[1])

if bar_index > 1

SAR := max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

if barstate.isconfirmed

if uptrend

strategy.entry("short", strategy.short, stop=nextBarSAR, comment="short")

strategy.cancel("long")

else

strategy.entry("long", strategy.long, stop=nextBarSAR, comment="long")

strategy.cancel("short")

plot(SAR, style=plot.style_cross, linewidth=3, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

- Moving Average and RSI Crossover Strategy

- Dual Range Filter Trend Tracking Strategy

- Super Trend Following Strategy Based on Moving Averages

- Engulfing Candle RSI Trading Strategy

- A Bollinger Band and Trend Tracking Strategy Based on RSI

- Robust Dual Moving Average Trading Strategy

- Bollinger Band Momentum Breakout Trading Strategy

- Quantitative Trading Strategy Based on 5-day Moving Average Band and GBS Buy/Sell Signals

- Dual Moving Average Oscillator Stock Strategy

- Momentum Swing Trading Strategy

- Closing Price Comparison Dual Moving Average Crossover Strategy

- Ichimoku Cloud, MACD and Stochastic Based Multi-Timeframe Trend Tracking Strategy

- MACD Volume Reversal Trading Strategy

- Dynamic Moving Average Crossover Combo Strategy

- Willy Wonka Breakout Strategy

- Exponential Moving Average and Relative Strength Index Combination Trend Following Strategy

- Reversal Trend Catching and Dynamic Stop Loss Combo Strategy

- Golden Parabola Breakout Strategy

- SAR Momentum Reversal Tracking Strategy

- Dynamic RSI Trading Strategy