Multiple EMA Buy Strategy

Author: ChaoZhang, Date: 2024-02-20 15:38:08Tags:

Overview

This is a buy-only strategy based on price action and short-term trend. It uses multiple exponential moving averages (EMA) as technical indicators for entry and exit.

Strategy Logic

The strategy employs six EMAs - 5-day, 10-day, 20-day, 50-day, 100-day and 200-day EMA. The buy signal is triggered when:

- 5-day EMA crosses above 10-day EMA

- 10-day EMA crosses above 20-day EMA

- 20-day EMA crosses above 50-day EMA

- 50-day EMA crosses above 100-day EMA

- 100-day EMA crosses above 200-day EMA

- Close price crosses above 5-day EMA

When all six conditions are met, a long position is initiated.

The exit signal is when close price crosses below 200-day EMA.

Advantage Analysis

The advantages of this strategy include:

- Using multiple EMAs as filters to identify medium-short term trends effectively

- Strict crossover criteria on multiple EMAs help avoid false breakouts

- Incorporating close price avoids false breakout risks

- Buy-only, avoids shorting risks

- Conservative exit mechanism favorable for profit taking

Risk Analysis

There are also some risks:

- Low probability of consecutive EMA crossovers, tends to miss opportunities

- Buy-only, cannot profit from drops

- Prone to being trapped in ranging markets

- Exits prematurely, giving up some profits

- Static parameter settings not adaptive across products and markets

Solutions:

- Reduce number of EMAs based on market conditions

- Consider incorporating CCI etc. to introduce shorting opportunities

- Set trailing stop loss or manual oversight

- Adjust parameters based on trending products

- Manual oversight advised to adjust parameters

Enhancement Opportunities

Some ways to enhance the strategy:

- Incorporate volume to avoid false breakouts

- Utilize volatility measures to optimize parameters

- Introduce machine learning models to dynamically optimize parameters

- Add breakout validation mechanisms

- Incorporate deep learning models for trend forecast

- Introduce stop loss and take profit

Conclusion

In summary, this is a medium-short term trend following strategy based on price technical indicators. It identifies trends using multiple EMA filters and incorporates close price to avoid false breakouts. The logic is simple and easy to understand. The disadvantages are fewer opportunities and prone to being trapped. It is suggested to be used as a supplementary tool combined with manual oversight. Enhancements can be made in aspects like volume, parameter optimization and machine learning to make the strategy more robust.

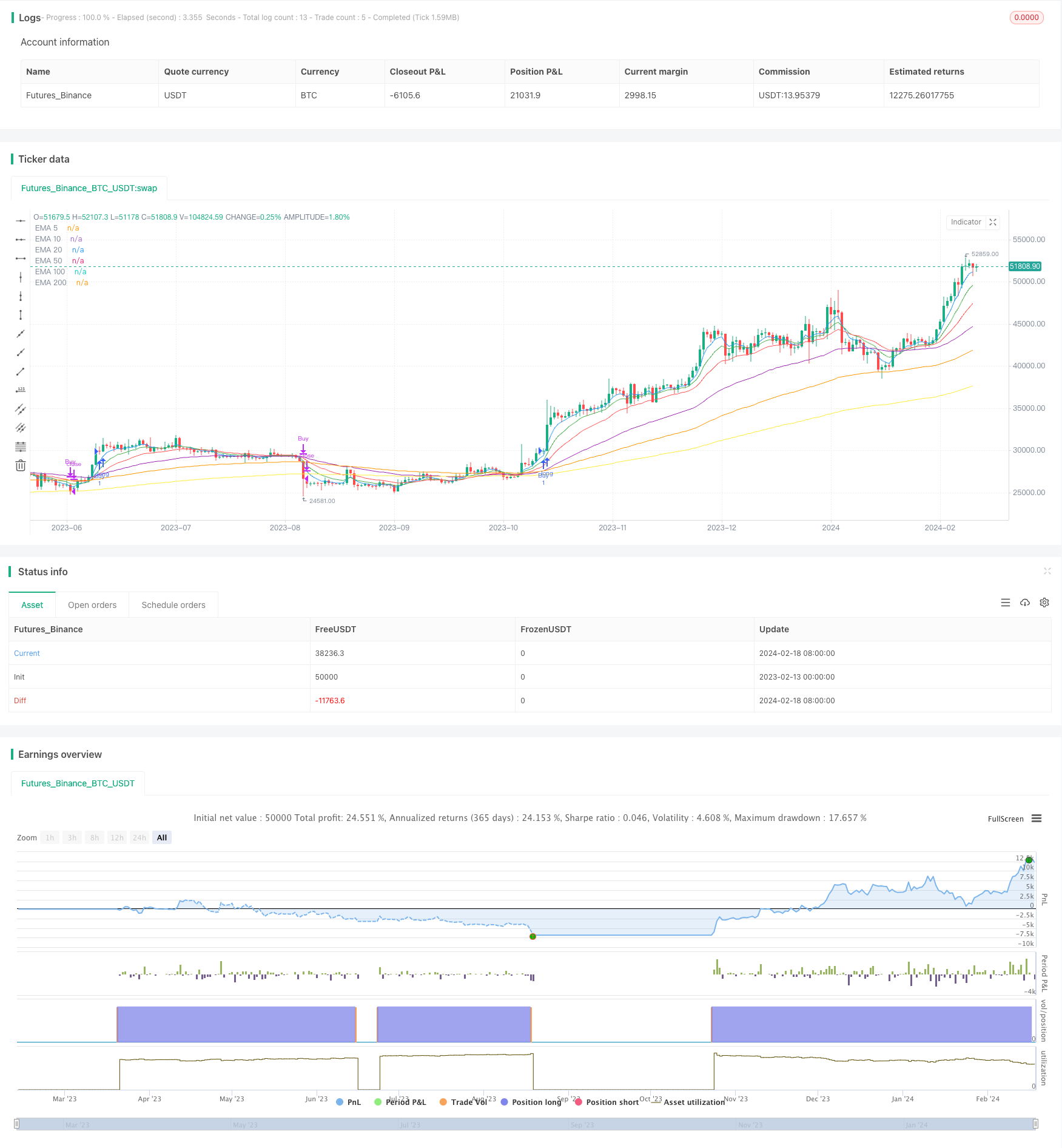

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multiple EMA Buy Strategy with Price Condition", overlay=true)

// Calculate EMAs

ema5 = ta.ema(close, 5)

ema10 = ta.ema(close, 10)

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// Plot EMAs

plot(ema5, color=color.blue, title="EMA 5")

plot(ema10, color=color.green, title="EMA 10")

plot(ema20, color=color.red, title="EMA 20")

plot(ema50, color=color.purple, title="EMA 50")

plot(ema100, color=color.orange, title="EMA 100")

plot(ema200, color=color.yellow, title="EMA 200")

// Entry conditions

buy_condition = ema5 > ema10 and ema10 > ema20 and ema20 > ema50 and ema50 > ema100 and ema100 > ema200 and close > ema5

// Exit conditions

exit_condition = close < ema200

// Strategy entry and exit conditions

strategy.entry("Buy", strategy.long, when = buy_condition)

strategy.close("Buy", when = exit_condition)

- Quantitative Trading Strategy Based on Ichimoku Cloud and Moving Average

- Dual Moving Average Reversal Tracking Strategy

- Bollinger Bands Reversal Strategy

- Ichimoku Kinko Hyo Cloud + QQE Quantitative Strategy

- All About Momentum Trading Strategy with Stop Loss for Gold

- Parabola Oscillator Seeking Highs and Lows Strategy

- Bollinger Bands Breakout Strategy

- Breakthrough Fair Value Gap Strategy

- Adaptive Moving Average Crossover System with Momentum Breakout

- Peak-to-Peak Pattern Based Trading Strategy

- OBV EMA Crossover Trend Following Strategy

- RSI and MA Crossover Trend Tracking Strategy

- Reversal Momentum Strategy with Double Confirmation

- EMA Crossover for Long Line Quant Strategy

- Extremum Reversion Tracking Strategy

- Bollinger Band Mean Reversion Strategy with Intraday Intensity Index

- B-Xtrender Exponential Moving Average Crossover Strategy

- Moving Average Trend Tracking Strategy

- A Combined RSI Strategy with Moving Average and MACD

- EMA, RSI and MACD Based Multi Timeframe Trading Strategy