Dual Donchian Channel Breakout Strategy

Author: ChaoZhang, Date: 2024-02-21 11:38:48Tags:

Overview

The Dual Donchian Channel Breakout Strategy is a breakout trading strategy based on Donchian Channels. It uses fast and slow Donchian Channels to construct long and short trading signals. When the price breaks through the slow channel, open long or short positions. When the price breaks back through the fast channel, close positions. The strategy also sets take profit and stop loss conditions.

Strategy Principle

The Dual Donchian Channel Breakout Strategy is based on two parameters: Slow Donchian Channel Period and Fast Donchian Channel Period. The strategy first calculates the upper and lower bands of the two Donchian Channels.

- The default slow Donchian channel period is 50 bars, reflecting longer term trends.

- The default fast Donchian channel period is 30 bars, reflecting shorter term trend changes.

The long entry signal is a breakout above the upper band with volatility greater than the threshold. The short entry signal is a breakdown below the lower band with volatility greater than the threshold.

The long stop loss exit signal is a breakdown below the lower band. The short stop loss exit signal is a breakout above the upper band.

The strategy also sets take profit exit conditions. The default take profit ratio is 2%, that is, take profit half position when price movement reaches 2%.

Advantage Analysis

The Dual Donchian Channel Breakout Strategy has the following advantages:

-

The dual channel design can capture trend signals from both longer and shorter timeframes, allowing more accurate entries.

-

The volatility condition avoids frequent trading in range-bound markets.

-

Comprehensive take profit and stop loss settings lock in partial profits and reduce losses.

-

Simple and clear strategy logic, easy to understand and implement.

-

Customizable parameters suit different products and trading preferences.

Risk Analysis

The Dual Donchian Channel Breakout Strategy also has some risks:

-

The dual channel design is sensitive and can generate false signals. Wider channels or adjusted volatility parameters may reduce false signals.

-

In volatile markets, stop loss may trigger too frequently. Consider setting a limit on number of trades or widening stop loss range.

-

Fixed percentage take profit fails to maximize profits. Consider dynamic or manual intervention for optimal take profit pricing.

-

Real trading performance may differ from backtest expectations. Requires thorough validation and parameter adjustments if needed.

Optimization Directions

The Dual Donchian Channel Breakout Strategy can be optimized in several aspects:

-

Test more period combinations to find optimal parameters.

-

Try different volatility measures like ATR to find the most stable metric.

-

Set a limit on number of entries to avoid losses at end of trends.

-

Try dynamic take profit for higher single trade profit.

-

Incorporate other indicators to filter entries and improve accuracy, e.g. volume.

-

Optimize money management models like fixed fractional position sizing for better risk control.

Conclusion

In conclusion, the Dual Donchian Channel Breakout Strategy is an excellent trend following strategy. It combines both trend identification and reversal protection capabilities. With parameter optimization and rule refinement, it can be profitable across most products and market conditions. The strategy is simple and practical, worth learning and applying for quantitative traders.

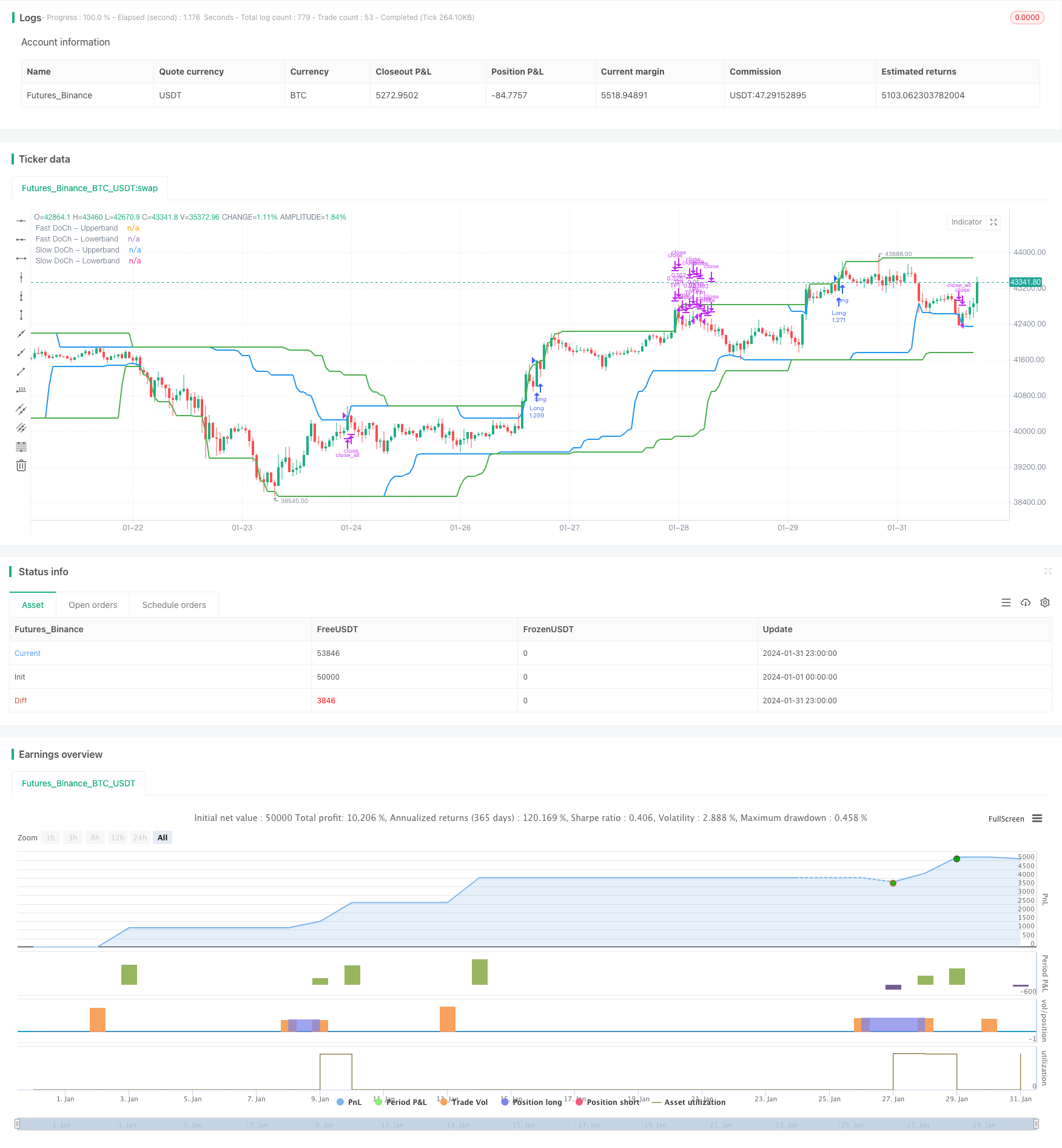

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © omererkan

//@version=5

strategy(title="Double Donchian Channel Breakout", overlay=true, initial_capital = 1000, commission_value = 0.05, default_qty_value = 100, default_qty_type = strategy.percent_of_equity)

// Donchian Channels

slowLen = input.int(50, title="Slow Donchian", group = "Conditions")

fastLen = input.int(30, title="Fast Donchian", group = "Conditions")

// Volatility Calculated as a percentage

volatility = input.int(3, title="Volatility (%)", group = "Conditions")

// Long positions

long = input.bool(true, "Long Position On/Off", group = "Strategy")

longProfitPerc = input.float(2, title="Long TP1 (%)", group = "Strategy", minval=0.0, step=0.1) * 0.01

// Short positions

short = input.bool(true, "Short Position On/Off", group = "Strategy")

shortProfitPerc = input.float(2, title="Short TP1 (%)", group = "Strategy", minval=0.0, step=0.1) * 0.01

// First take profit point for positions

TP1Yuzde =input.int(50, title = "TP1 Position Amount (%)", group = "Strategy")

// Slow Donchian Calculated

ubSlow = ta.highest(high, slowLen)[1]

lbSlow = ta.lowest(low, slowLen)[1]

// Fast Donchian Calculated

ubFast = ta.highest(high, fastLen)[1]

lbFast = ta.lowest(low, fastLen)[1]

// Plot Donchian Channel for entries

plot(ubSlow, color=color.green, linewidth=2, title="Slow DoCh - Upperband")

plot(lbSlow, color=color.green, linewidth=2, title="Slow DoCh - Lowerband")

plot(ubFast, color=color.blue, linewidth=2, title="Fast DoCh - Upperband")

plot(lbFast, color=color.blue, linewidth=2, title="Fast DoCh - Lowerband")

// This calculation, the strategy does not open position in the horizontal market.

fark = (ubSlow - lbSlow) / lbSlow * 100

// Take profit levels

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

// Code long trading conditions

longCondition = ta.crossover(close, ubSlow) and fark > volatility

if longCondition and long == true

strategy.entry("Long", strategy.long)

// Code short trading conditions

shortCondition = ta.crossunder(close, lbSlow) and fark > volatility

if shortCondition and short == true

strategy.entry("Short", strategy.short)

// Determine long trading conditions

if strategy.position_size > 0 and ta.crossunder(close, lbFast)

strategy.close_all("Close All")

// Determine short trading conditions

if strategy.position_size < 0 and ta.crossover(close, ubFast)

strategy.close_all("Close All")

// Take Profit Long

if strategy.position_size > 0

strategy.exit("TP1", "Long", qty_percent = TP1Yuzde, limit = longExitPrice)

// Take Profit Short

if strategy.position_size < 0

strategy.exit("TP1", "Short", qty_percent = TP1Yuzde, limit = shortExitPrice)

- Reversal Trading Strategy with Bollinger Bands, RSI, ADX and ATR

- DEMA Crossover Trend Following Strategy

- Extreme Reversal Setup Strategy

- OBV and CCI Indicators Based Trend Following Strategy

- Breakout Trading System

- Multi-timeframe Bollinger Bands Breakout Strategy Incorporating RSI

- Momentum Indicator Aggregation Trading Strategy

- Multi-indicator Quant Trading Strategy

- TradingVMA – Variable Moving Average Trading Strategy

- RSI Divergence Strategy

- Bollinger Bands Breakout Trading Strategy

- EMA Breakthrough Trap Strategy

- Golden Cross Dead Cross Trading Strategy

- Supertrend Based Multitimeframe Trend Tracking Strategy

- Manual Buy & Sell Alerts Strategy

- Quantitative Breakthrough Uptrend Reference Strategy

- Adaptive Grid Trading Strategy Based on Quantitative Trading Platform

- Quantitative Trading Strategy Based on Ichimoku Cloud and Moving Average

- Dual Moving Average Reversal Tracking Strategy

- Bollinger Bands Reversal Strategy