The Dual Reversal Strategy

Author: ChaoZhang, Date: 2024-02-26 12:07:32Tags:

Overview

The dual reversal strategy is a quantitative strategy that combines the 123 reversal and three-bar reversal pattern to improve signal quality and reduce risk. It adopts a trading approach using a combination of price differential indicators and candlestick pattern indicators, opening positions only when both indicate a signal, thereby increasing signal accuracy.

Strategy Principle

The dual reversal strategy brings together two different types of trading strategies. First is the 123 reversal strategy, which employs price differential indicators and triggers when prices reverse over two consecutive days and stochastic indicators cross threshold values. The second is the three-bar reversal pattern strategy, which looks at a three-day candlestick chart and triggers when the middle day posts the lowest low and the last day closes above the prior day’s high. The strategy enters a long or short position when both strategies concurrently issue a signal in the same direction.

Specifically, the 123 reversal strategy uses a 9-day stochastic oscillator to identify overbought and oversold conditions. It generates a buy signal when prices fall for two straight days and the stochastic readings dip below 50, and a sell signal when prices rise for two straight days and stochastic tops 50. The three-bar reversal pattern strategy detects if prices have formed a high-low-high pattern over three days, indicating a short-term oversold reversed by momentum.

The dual reversal strategy requires concordant signals from both strategies before taking any positions. This greatly reduces false signals, ensuring the system only trades at high-probability opportunities.

Advantage Analysis

Compared to single-strategy systems, the dual reversal strategy has the following advantages:

- Improved signal quality, fewer false signals

- Dual indicator confirmation, lower drawdown risk

- Captures both short-term and medium-term reversal opportunities

- Simple to understand and implement

Risks and Solutions

The main risk of the dual reversal strategy is missing some profitable opportunities. Due to its strict signal requirements, some trading opportunities identified by individual indicators will be skipped. This can be mitigated by adjusting parameters to relax the conditions of one indicator and increase trade frequency.

Another risk is both indicators concurrently failing in extreme market conditions, yielding a higher rate of false signals. For such cases, stop-loss mechanisms can be added to quickly unwind positions and limit losses. Alternatively, disable trade signals during historically proven unfavorable extreme market conditions to avoid taking positions.

Optimization Suggestions

Further optimizations for the dual reversal strategy include:

- Adjust stochastic indicator parameters to improve overbought/oversold assessment accuracy

- Test effectiveness across different trading instruments to find best asset fit

- Incorporate machine learning models to aid signal validation and improve accuracy

- Combine more market statistics like volume changes, intraday volatility to determine optimal entry timing.

Conclusion

The dual reversal strategy successfully combines mean-reversion principles with candlestick pattern analysis, fully capturing the cyclicality in prices. Compared to simple trend-following methods, it strikes a balance between risk and reward. With continual enhancements, the strategy’s value will be validated over time.

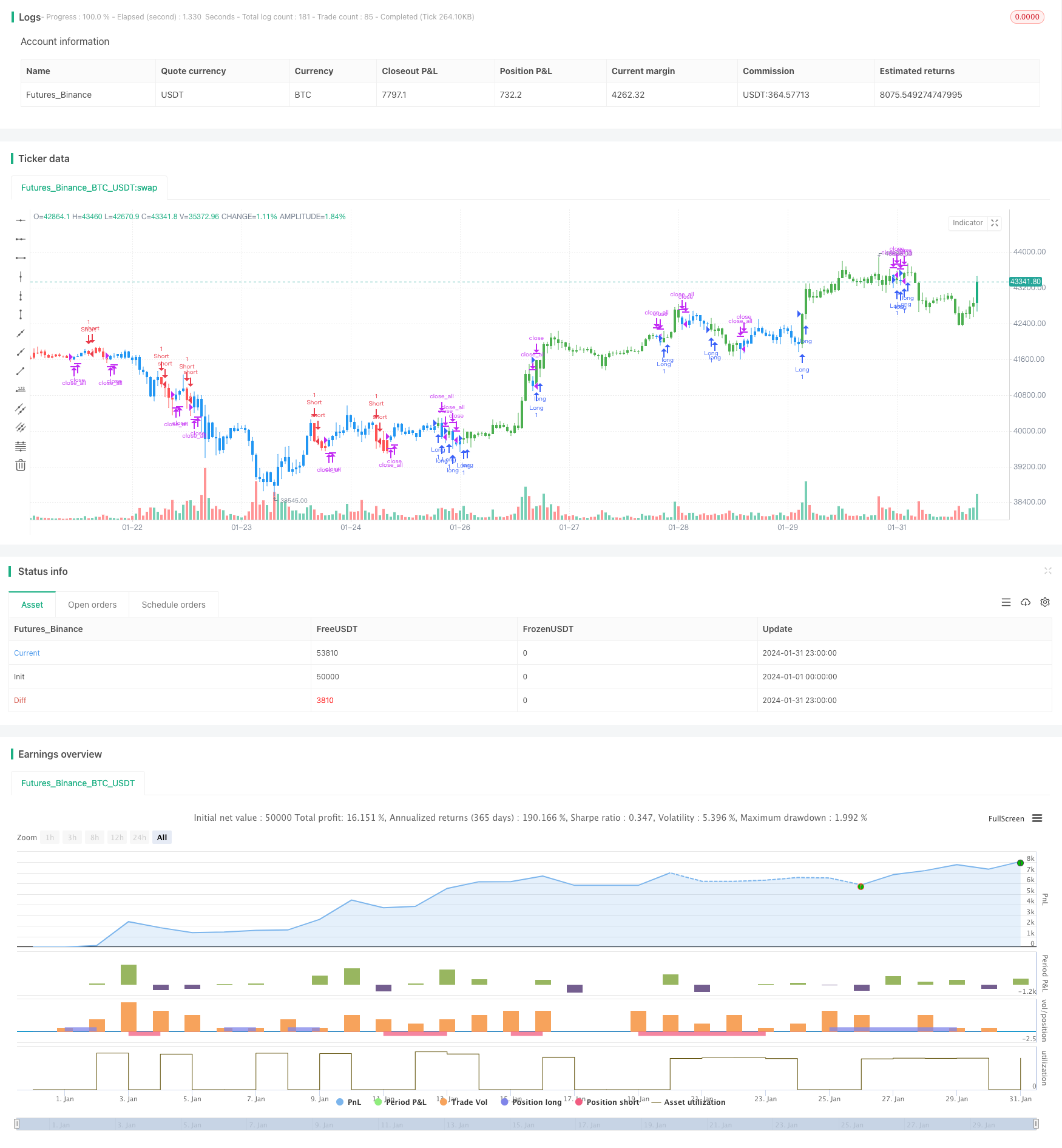

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 17/04/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Secon strategy

// This startegy based on 3-day pattern reversal described in "Are Three-Bar

// Patterns Reliable For Stocks" article by Thomas Bulkowski, presented in

// January,2000 issue of Stocks&Commodities magazine.

// That pattern conforms to the following rules:

// - It uses daily prices, not intraday or weekly prices;

// - The middle day of the three-day pattern has the lowest low of the three days, with no ties allowed;

// - The last day must have a close above the prior day's high, with no ties allowed;

// - Each day must have a nonzero trading range.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

BarReversalPattern() =>

pos = 0.0

pos := iff(open[2] > close[2] and high[1] < high[2] and low[1] < low[2] and low[0] > low[1] and high[0] > high[1], 1,

iff(open[2] < close[2] and high[1] > high[2] and low[1] > low[2] and high[0] < high[1] and low[0] < low[1], -1, nz(pos[1], 0)))

pos

strategy(title="Combo Strategies 123 Reversal and 3-Bar-Reversal-Pattern", shorttitle="Combo Backtest", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

pos3BarReversalPattern = BarReversalPattern()

pos = iff(posReversal123 == 1 and pos3BarReversalPattern == 1 , 1,

iff(posReversal123 == -1 and pos3BarReversalPattern == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

- The Dual Quant Trading System

- StochRSI Reversal Trading Strategy

- Four DEMA Multi Timeframe Trend Strategy

- Follow The Bear Strategy

- Intelligent Accumulator Buy Strategy

- The Dual EMA Price Swing Strategy

- RSI Indicator Long Short Separation Trading Strategy

- Trend Following Quant Trading Strategy Based on Moving Average

- Inside Bar Breakout Strategy

- Gold Standard Quantitative Trading Strategy

- The Order Block Momentum Breakout Strategy

- Dual EMA Intelligent Tracking Strategy

- Moving Average Trading Strategy

- Dual Moving Average HullMA Crossover Trend Strategy

- Dynamic Dual Moving Average Trailing Stop Strategy

- Moving Average Indicator Strategy

- Pivot Point SuperTrend Strategy

- Elliott Wave Strategy with 200 Day Moving Average

- Supertrend and CCI Scalping Strategy

- Supertrend and CCI Scalping Strategy