Intelligent Accumulator Buy Strategy

Author: ChaoZhang, Date: 2024-02-26 13:59:57Tags:

Overview

The Intelligent Accumulator Buy Strategy is a proof of concept strategy. It combines recurring buy-in with technical analysis-based entries and exits.

The strategy will allocate a portion of the funds and continue to increase positions as long as the technical analysis condition is valid. Use the exit technical analysis condition to define your exit strategy.

You can add to losing positions to average down, or choose a more aggressive approach that allows adding to winning positions.

You can choose to take full profit or distribute your exits into multiple take profits of the same size.

You can also decide whether to allow your exit conditions to close your position at a loss or require a minimum take profit percentage.

The strategy contains default technical analysis entry and exit conditions just to showcase the idea, but the final intent of this script is to delegate entries and exits to external sources.

The internal conditions use RSI length 7 crossing below the 1 standard deviation Bollinger Bands for entries and above for exits.

To control the number of orders, adjust the parameters in Settings: - Adjust pyramiding - Adjust percentage of equity - Make sure pyramiding *% equity equals 100 to prevent overuse of equity (unless using leverage)

The script is designed as an alternative to daily or weekly recurring purchases, but depending on the accuracy of your technical analysis conditions, it may also prove profitable at lower timeframes.

The reason the script is called Intelligent is because the most common recurring buy does not involve any decision making: buy no matter what with a certain frequency. This strategy still performs recurring purchases but filters out some potential bad entries that can unnecessarily delay seeing the position profitable. The second reason is also having an exit strategy in place from the start, which no recurring buy option offers out of the box.

Strategy Principles

The strategy determines entries and exits based on the crossover of the RSI indicator with the Bollinger Bands. Specifically, when the RSI is below the lower rail, look for short entries, and when the RSI is above the upper rail, look for long exits.

In addition, the strategy provides settings for pyramiding and batched exits. The sum of the number of pyramiding and the percentage of equity used each time should equal 100 to prevent overuse of funds. You can choose to allow continued pyramiding on winning positions or only pyramiding on losing positions to achieve average down.

When exiting, you can choose to take full profit or exit in batches according to the set percentage. In addition, the minimum profit percentage can be set to avoid exits if the profit is lower than that percentage.

Overall, the strategy combines recurring purchases and technical analysis indicators to achieve more stable pyramiding by filtering out some wrong signals, while setting up flexible exit mechanisms that can be adjusted according to one’s own risk appetite.

Advantage Analysis

Compared with traditional recurring purchase strategies, the biggest advantage of this strategy is that both entries and exits have technical indicators as references, which can filter out some wrong signals, in contrast to the daily and weekly purchases without any decision making. The specific advantages are:

- Use RSI and Bollinger Bands to determine entry timing to avoid chasing highs

- Clear exit conditions with profit taking and stop loss standards instead of holding positions indefinitely

- Pyramiding parameters can be adjusted as needed for more flexible position sizing

- Option to only add to losing positions or pyramid winners as well

- Take full profit or scale out in batches

- Minimum profit percent avoids premature exits

In summary, the strategy realizes the periodic pyramiding effect of recurring purchases while increasing the technical indicator judgment for entries and exits, allows parameters adjustment according to one’s own preferences, reduces the risk of blind entries, and improves profit efficiency.

Risk Analysis

Although the strategy sets technical indicators filtering and flexible pyramiding/exit mechanisms to reduce risks, there are still inevitable risks for any strategy. The main risks include:

- Probability of wrong signals from the indicators, which may cause missing the best entry or exit timing

- Inappropriate setting of pyramiding times and capital allocation leading to oversized position risks

- Market fluctuates violently in the short term while indicators fail to respond in time

- Premature or belated profit-taking exits impacting profitability

The corresponding solutions are:

- Use multiple indicators combination to reduce errors

- Carefully test and evaluate parameters to avoid over leveraging

- Incorporate real-time signals from shorter-period indicators as auxiliary judgment

- Test and optimize profit-taking parameters to improve steady profitability

Optimization Directions

The strategy can be further optimized in the following aspects:

- Optimize or replace technical indicators to improve entry/exit accuracy. Different parameters or combinations can be tested to choose more reliable signals.

- Add stop loss strategy. Currently no stop loss is configured. Loss standards can be set based on drawdown or other metrics to control maximum loss.

- Dynamically adjust pyramiding magnitude. The funds added on each pyramid can be adjusted in real time based on the number of positions or market volatility. Reduce pyramiding in high volatility environments.

- Integrate algorithmic trading. The current strategy consists of simple indicators. Machine learning models can potentially be incorporated for higher level decision making.

- Optimize parameter settings. Continuously optimize parameters like pyramiding percentages, profit taking percentages etc. with the goal to pursue higher returns while controlling risks.

Conclusion

The Intelligent Accumulator Buy Strategy retains the periodic pyramiding advantage of recurring purchases while filtering entries and exits with technical indicators and setting clear profit taking/stop loss exit mechanisms, avoiding the disadvantages of blind entries and indefinite holdings. The strategy allows high customization of pyramiding and exit parameters based on personal risk preference, thus very advantageous for long-term holders.

Of course, there are still risks of signal errors and inappropriate parameters, which needs to be addressed through continued optimization of indicators and parameters as well as auxiliary stop loss means. Overall, the strategy forms an important evolution from recurring purchases to intelligent accumulators, providing investors a relatively comprehensive and controllable long-term holding solution.

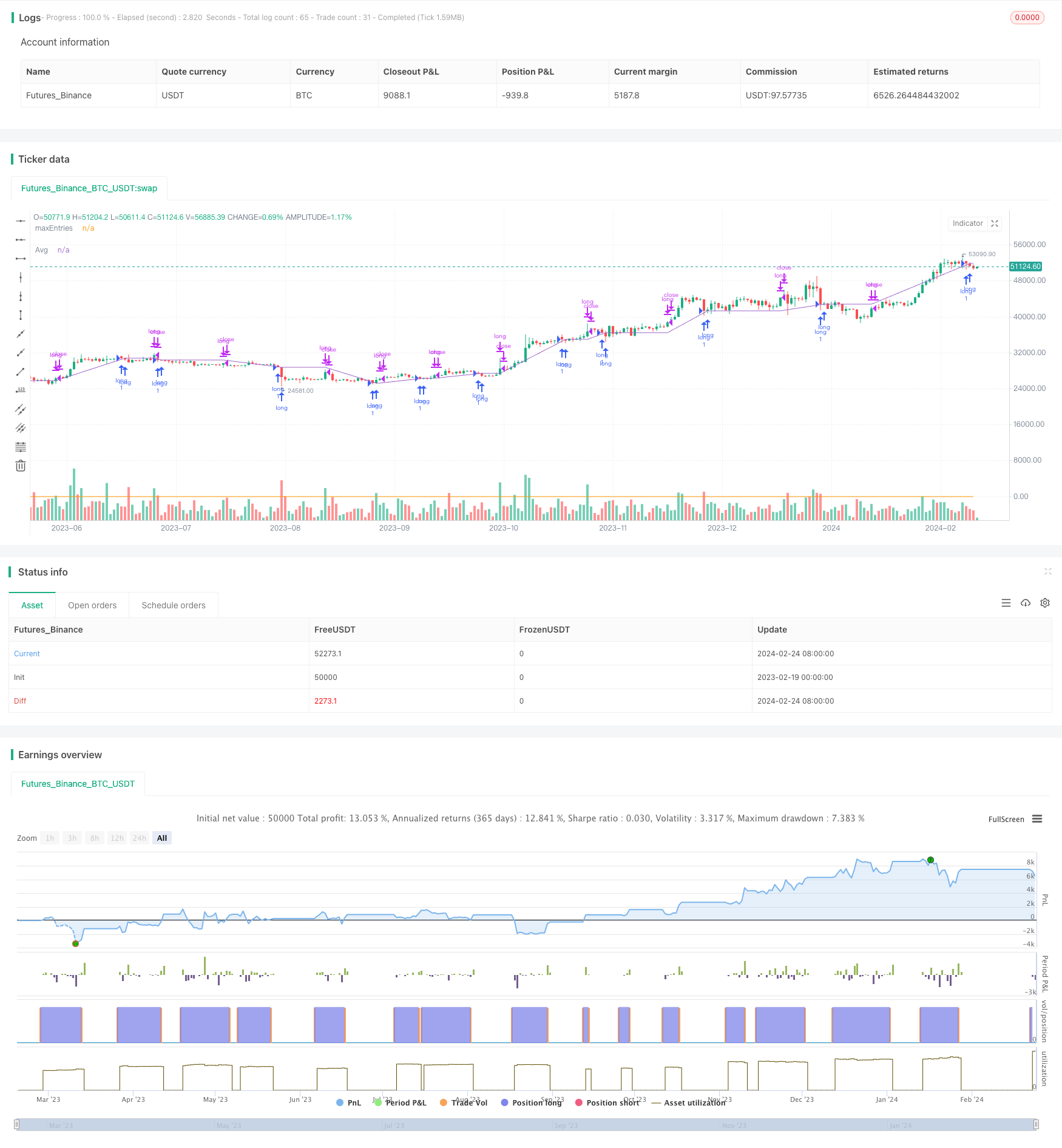

/*backtest

start: 2023-02-19 00:00:00

end: 2024-02-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TheTradingParrot

//@version=5

strategy("TTP Intelligent Accumulator", overlay=true)

maxEntries = 0.0

if not na(maxEntries[1])

maxEntries := maxEntries[1]

rsi = ta.rsi(close, 7)

rsima = ta.sma(rsi, 14)

bbstd = ta.stdev(rsi, 14)

// plot(rsi)

// plot(rsima)

// plot(rsima - bbstd)

// plot(rsima + bbstd)

intEntry = rsi < rsima - bbstd

intExit = rsi > rsima + bbstd

maxEntries := math.max(strategy.opentrades, maxEntries)

plot(maxEntries, "maxEntries")

addWhileInProfit = input.bool(false, "Add while in profit")

extLong = input.bool(false, "", inline = "long")

entry = input.source(close,"entry", inline = "long") == 1

if not extLong

entry := intEntry

longCondition = entry and (strategy.opentrades == 0 or (not addWhileInProfit or close < strategy.position_avg_price))

if (longCondition)

strategy.entry("long", strategy.long)

minProfit = input.float(0.0, "Required profit % to exit")

exitPxcandle = input.float(100.0,"% exit per candle")

extShort = input.bool(false, "", inline = "exit")

exit = input.source(close,"exit", inline = "exit") == 1

if not extShort

exit := intExit

shortCondition = exit

if (shortCondition and strategy.opentrades > 0)

strategy.close("long", qty_percent = exitPxcandle)

plot(strategy.position_avg_price, "Avg")

- Three Factors Model for Price Oscillation Detection

- Momentum Breakthrough EMA 34 Crossover Strategy

- Average True Range Breakout Strategy with Golden Ratio

- Adaptive Exponential Moving Average Range Strategy

- Donchian Channel Breakout Strategy

- Turtle Trading Strategy Based on Donchian Channels

- The Dual Quant Trading System

- StochRSI Reversal Trading Strategy

- Four DEMA Multi Timeframe Trend Strategy

- Follow The Bear Strategy

- The Dual EMA Price Swing Strategy

- RSI Indicator Long Short Separation Trading Strategy

- Trend Following Quant Trading Strategy Based on Moving Average

- Inside Bar Breakout Strategy

- Gold Standard Quantitative Trading Strategy

- The Dual Reversal Strategy

- The Order Block Momentum Breakout Strategy

- Dual EMA Intelligent Tracking Strategy

- Moving Average Trading Strategy

- Dual Moving Average HullMA Crossover Trend Strategy