Intraday Dual Moving Average Trading Strategy

Author: ChaoZhang, Date: 2024-02-27 16:36:31Tags:

Overview

This is a simple intraday trading strategy based on dual moving averages. It uses two simple moving averages with different periods and takes long or short positions when the moving averages cross over. The position is reversed using double quantity when signal changes. All open positions are squared off when the intraday session ends.

Strategy Logic

The strategy uses a 10-day and a 40-day simple moving average. It goes long when the short period moving average crosses above the long period one and goes short when the reverse crossover happens. When signal changes, the position is closed out using double quantity and a reverse position is initiated. Trading only happens following the moving average signals during a defined intraday session. Any open positions left are squared off when the session ends.

The strategy mainly utilizes the faster price change capturing capability of the shorter period moving average. When the short SMA crosses above the long SMA, it indicates an uptrend in prices in the short term hence going long can capture this. The reverse indicates a short term downtrend. The double quantity reverse entry expands profit potential.

Advantages

- Simple and clear strategy logic, easy to understand and implement.

- Effectively catches short term price trends using dual MA crossover.

- Avoids overnight risk by restricting to an intraday session.

- Expands profit potential using double quantity reverse trading.

Risk Analysis

- Prone to noise trading errors as a short term strategy.

- Double quantity may amplify losses.

- Forced square off risks missing longer profitable trends.

Risk Mitigation:

- Optimize MA parameters to reduce false signals.

- Add filters using other indicators.

- Optimize quantity parameters.

- Relax intraday session duration.

Enhancement Opportunities

Optimize MA parameters by testing more combinations for best fit.

Add filters like MACD confirmation to reduce false signals.

Optimize reverse entry quantity multiplier through parameter tuning.

Test extending intraday session duration for better returns.

Conclusion

The strategy catches short term trends formed from MA crossover signals, expands profits using double quantity reverse trading and restricts overnight risks by trading only in an intraday session. Further optimizations on parameters and adding filters can improve strategy performance. On the whole, it is an effective strategy suitable for intraday trading.

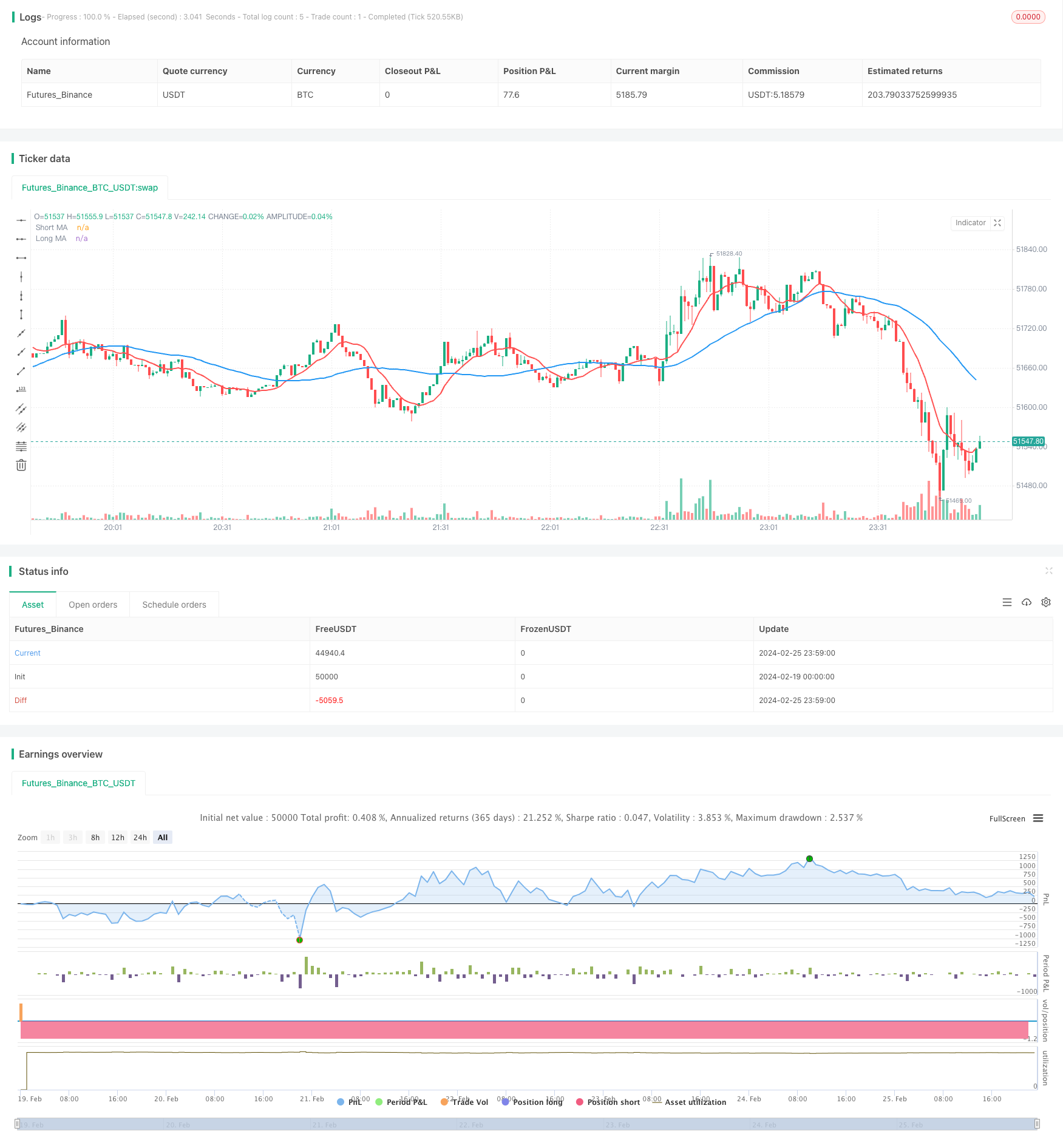

/*backtest

start: 2024-02-19 00:00:00

end: 2024-02-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pritesh-StocksDeveloper

//@version=4

strategy("Moving Average - Intraday", shorttitle = "MA - Intraday",

overlay=true, calc_on_every_tick = true)

// Used for intraday handling

// Session value should be from market start to the time you want to square-off

// your intraday strategy

var i_marketSession = input(title="Market session", type=input.session,

defval="0915-1455", confirm=true)

// Short & Long moving avg. period

var int i_shortPeriod = input(title = "Short MA Period", type = input.integer,

defval = 10, minval = 2, maxval = 20, confirm=true)

var int i_longPeriod = input(title = "Long MA Period", type = input.integer,

defval = 40, minval = 3, maxval = 120, confirm=true)

// A function to check whether the bar is in intraday session

barInSession(sess) => time(timeframe.period, sess) != 0

// Calculate moving averages

shortAvg = sma(close, i_shortPeriod)

longAvg = sma(close, i_longPeriod)

// Plot moving averages

plot(series = shortAvg, color = color.red, title = "Short MA",

linewidth = 2)

plot(series = longAvg, color = color.blue, title = "Long MA",

linewidth = 2)

// Long/short condition

longCondition = crossover(shortAvg, longAvg)

shortCondition = crossunder(shortAvg, longAvg)

// See if intraday session is active

bool intradaySession = barInSession(i_marketSession)

// Trade only if intraday session is active

// Long position

strategy.entry(id = "Long", long = strategy.long,

when = longCondition and intradaySession)

// Short position

strategy.entry(id = "Short", long = strategy.short,

when = shortCondition and intradaySession)

// Square-off position (when session is over and position is open)

squareOff = (not intradaySession) and (strategy.position_size != 0)

strategy.close_all(when = squareOff, comment = "Square-off")

- Binomial Momentum Breakout Reversal Strategy

- Gap Opening Strategy

- ATR Trailing Stop Strategy with Fibonacci Retracement Targets

- Bollinger Bands Breakout Trend Trading Strategy

- Based on the Moving Average Reversion Strategy

- Short-term Breakthrough Strategy Based on Golden Crossover

- Multi-Timeframe Trend Trading Strategy Based on Compressed Indicators

- Momentum Line Crossover EMA Nine Stock MACD Strategy

- Quantitative Oscillation Indicator Combination Strategy

- Ichimoku Cloud Trend Following Strategy

- Mayan Treasure Hunting Guide

- Trend Tracking Strategy Based on Moving Average

- EMA Cross Trend Following Strategy

- Dual Moving Average Crossover Strategy

- Bollinger Band Tracking Strategy

- Fast and Slow Moving Averages Crossover Strategy

- An Advanced Dual Timeframe Trend Tracking Strategy for a Hot Stock

- Combo Quantitative Trend Tracking Strategy

- Awesome Oscillator Double Stochastic Filtered Divergence Trading Strategy

- Trend Filter Quantitative Strategy Based on Keltner Channels and CCI Indicator