The Double EMA Strategy Analysis

Author: ChaoZhang, Date: 2024-02-28 18:07:59Tags:

Overview

The double EMA strategy is a trend following strategy that identifies the trend direction of prices by calculating EMAs of different cycles and uses that to determine entries and exits. This simple and practical strategy works well in trending markets.

Strategy Logic

The strategy is mainly based on two EMA indicators, a short-term 9-day EMA and a longer 21-day EMA. Their crossovers generate entry and exit signals.

When the short EMA crosses above the long EMA, it is viewed as prices entering an uptrend. The strategy will go long to follow the rising trend. When the short EMA crosses below the long EMA, it is viewed as prices entering a downtrend. The strategy will go short to follow the falling trend.

The EMA indicators can effectively filter out noise from price data and identify the main direction of the trend. Therefore, the strategy uses dual EMAs as the basis for entries and exits in order to capture longer price trends.

Advantages

The strategy has the following advantages:

- The strategy idea is simple and easy to understand and implement.

- It can effectively identify price trends and timely enter positions to follow trends.

- Using EMAs filters noise and avoids interference from short-term price fluctuations.

- The EMA parameters can be configured to adjust the sensitivity of the strategy.

Risks

There are also some risks with this strategy:

- The lagging characteristic of EMAs may increase losses when trends reverse.

- Improper EMA parameter settings increase false signal rates.

- The strategy is more suitable for strong trending markets and vulnerable in range-bound periods.

Enhancement

The strategy can be optimized in the following aspects:

- Incorporate other indicators to identify trend reversals and reduce losses, e.g. MACD, KDJ, etc.

- Add stop loss logic. Good stop loss strategies can greatly reduce maximum drawdown.

- Optimize the EMA parameters to make them fit better with the price characteristics of different products.

- Use machine learning algorithms to automate EMA parameter optimization.

Summary

In summary, the double EMA strategy is a very useful trend following strategy. It is easy to operate, understand, and performs excellently in strong trending markets. The strategy also has some risks that can be mitigated through various enhancements to improve its stability. Overall, double EMAs serve as an important reference template for quantitative trading.

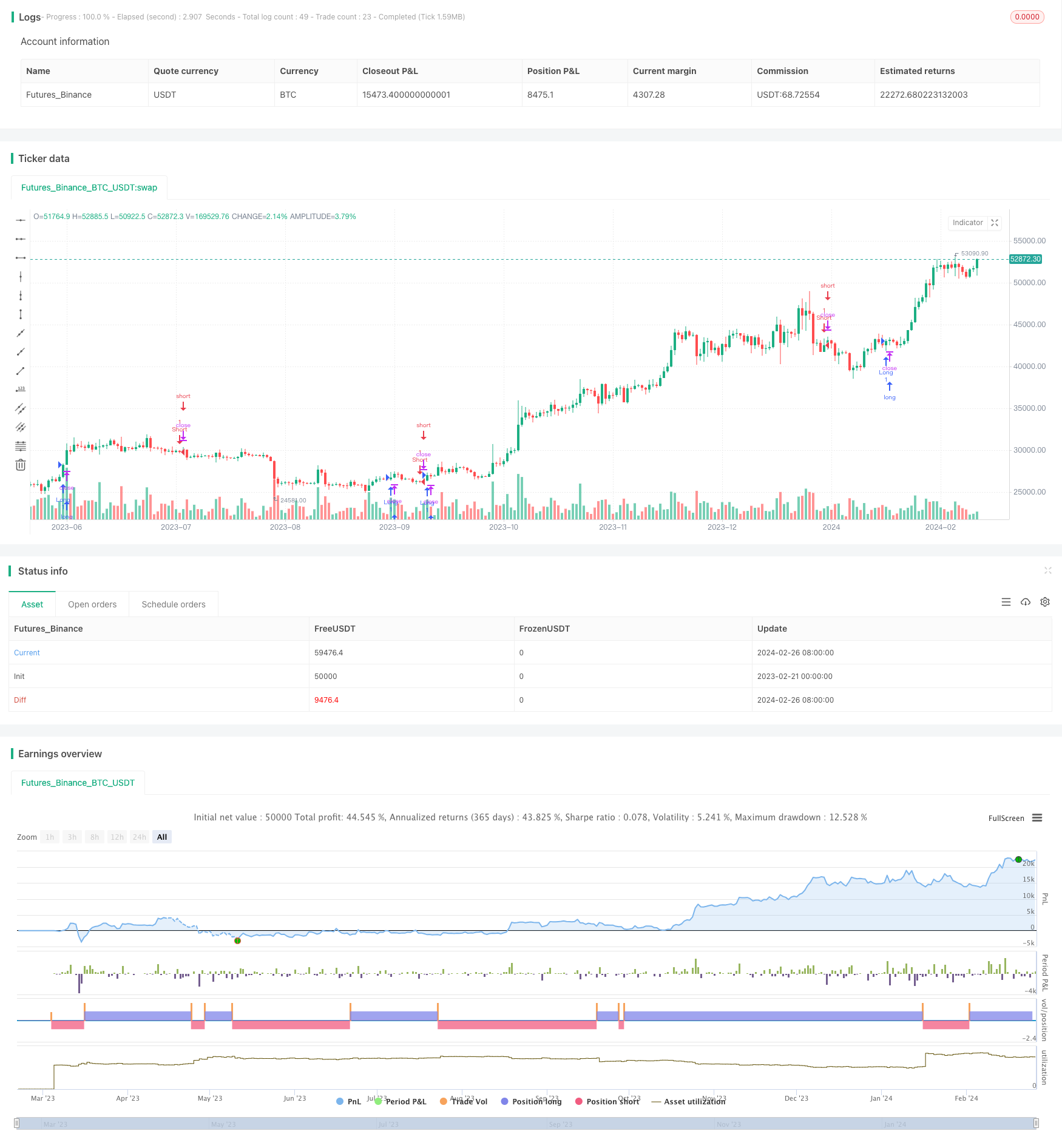

/*backtest

start: 2023-02-21 00:00:00

end: 2024-02-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This can only draw so many lines. Use bar replay to go back further

strategy("Strategy Lines", shorttitle="Strategy Lines", overlay=true, max_lines_count=500)

//###########################################################################################################################################

// Replace your strategy here

//###########################################################################################################################################

shortEMA = ta.ema(close, input(9, title="Short EMA Length"))

longEMA = ta.ema(close, input(21, title="Long EMA Length"))

// Entry conditions for long and short positions

longCondition = ta.crossover(shortEMA, longEMA)

shortCondition = ta.crossunder(shortEMA, longEMA)

//###########################################################################################################################################

// Strategy Lines

//###########################################################################################################################################

var timeLow = bar_index

var line li = na

var openLPrice = 0.0000

var openSPrice = 0.0000

LongWColor = input.color(color.rgb(0,255,0,0),"Long Win Color", group="Strategy Lines")

LongLColor = input.color(color.rgb(0,0,255,0),"Long Loss Color", group="Strategy Lines")

ShortWColor = input.color(color.rgb(255,255,0,0),"Short Win Color", group="Strategy Lines")

ShortLColor = input.color(color.rgb(255,0,0,0),"Short Loss Color", group="Strategy Lines")

WinFontColor = input.color(color.rgb(0,0,0,0),"Win Font Color", group="Strategy Lines")

LossFontColor = input.color(color.rgb(255,255,255,0),"Loss Font Color", group="Strategy Lines")

LinesShowLabel = input(false,"Show Labels?",group = "Strategy Lines")

// // Start new line when we go long

// if strategy.position_size >0

// line.delete(li)

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close>openLPrice?LongWColor:LongLColor)

// // Start new line when we go short

// if strategy.position_size <0

// line.delete(li)

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close<openSPrice?ShortWColor:ShortLColor)

// //Delete Lines if we don't have a position open

// if strategy.position_size ==0

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=color.rgb(0,0,0,100))

// line.delete(li)

if LinesShowLabel

// Short Label

if strategy.position_size>=0 and strategy.position_size[1] <0

label.new(

timeLow, na,

text=str.tostring((openSPrice-close[1])/(syminfo.mintick*10)),

color=close[1]<openSPrice?ShortWColor:ShortLColor,

textcolor=close[1]<openSPrice?WinFontColor:LossFontColor,

size=size.small,

style=label.style_label_down, yloc=yloc.abovebar)

// Long Label

if strategy.position_size<=0 and strategy.position_size[1] >0

label.new(

timeLow, na,

text=str.tostring((close[1]-openLPrice)/(syminfo.mintick*10)),

color=close[1]>openLPrice?LongWColor:LongLColor,

textcolor=close[1]>openLPrice?WinFontColor:LossFontColor,

size=size.small,

style=label.style_label_down, yloc=yloc.abovebar)

// Open long position and draw line

if (longCondition)

//strategy.entry("Long", strategy.long)

// timeLow := bar_index

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close>openLPrice?LongWColor:LongLColor)

openLPrice := close

// Open short position and draw line

if (shortCondition)

//strategy.entry("Short", strategy.short)

// timeLow := bar_index

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close<openSPrice?ShortWColor:ShortLColor)

openSPrice := close

//###########################################################################################################################################

// Strategy Execution (Replace this as well)

//###########################################################################################################################################

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

- Double Moving Average and MACD Combination Trading Strategy

- Dynamic Engulfing Trend Strategy

- Multi Timeframe Moving Average Pullback Trading Strategy

- Dual Moving Average Volatility Tracking Strategy

- Short-term Trading Strategy Based on Bollinger Bands

- Trend Riding Strategy Based on MOST and KAMA

- Dual Timeframe Trend Following Strategy

- Bitlinc MARSI Trading Strategy

- The Bollinger Bands Tracking Strategy

- SuperTrend Breakout Strategy

- The Breakthrough Callback Trading Strategy

- The Moving Average Crossover Trend Strategy

- Price Channel Robot White Box Strategy

- Simple Moving Average Trend Price Quantitative Strategy

- Time-based ATR Stop Loss Buy Strategy

- Binomial Momentum Breakout Reversal Strategy

- Gap Opening Strategy

- ATR Trailing Stop Strategy with Fibonacci Retracement Targets

- Bollinger Bands Breakout Trend Trading Strategy

- Based on the Moving Average Reversion Strategy