RSI Dual Directional Trading Strategy with Initial Stop Loss

Author: ChaoZhang, Date: 2024-03-22 10:44:47Tags:

Overview

The RSI Dual Directional Trading Strategy with Initial Stop Loss is a quantitative trading strategy based on the Relative Strength Index (RSI) technical indicator. The strategy utilizes the reversal characteristics of the RSI indicator in overbought and oversold zones, entering long or short trades when the RSI indicator breaks through specific thresholds and setting an initial stop loss to manage risk, aiming to obtain stable trading profits. The strategy is suitable for trading on hourly charts of stocks with clear trends.

Strategy Principle

The core of this strategy is the RSI indicator, which is a momentum indicator that measures the trend of market price changes. It reflects the overbought and oversold state of the market by comparing the average gain on upward price days and the average loss on downward price days over a period of time. Generally, when the RSI indicator is above 70, it indicates that the market is overbought and prices may face pullback pressure; when the RSI indicator is below 30, it suggests that the market is oversold and prices may have a chance to rebound.

The trading logic of this strategy is as follows:

- Calculate the RSI indicator for a specified period (default is 14).

- When the RSI indicator of the previous hour is less than 60 and the current hour’s RSI indicator is greater than or equal to 60, open a long position; when the RSI indicator of the previous hour is greater than 60 and the current hour’s RSI indicator is less than or equal to 60, close the long position.

- When the RSI indicator of the previous hour is greater than 40 and the current hour’s RSI indicator is less than or equal to 40, open a short position; when the RSI indicator of the previous hour is less than 40 and the current hour’s RSI indicator is greater than or equal to 40, close the short position.

- When opening a position, simultaneously set an initial stop loss price, which defaults to 6% of the opening price, to control the maximum risk of a single trade.

Through the above trading logic, this strategy can promptly open positions when the RSI indicator breaks through key thresholds and timely close positions when the RSI indicator returns within the key thresholds, aiming to capture market trends and obtain trading profits. At the same time, setting an initial stop loss can effectively control the maximum loss of a single trade and improve the risk control capability of the strategy.

Advantage Analysis

The RSI Dual Directional Trading Strategy with Initial Stop Loss has the following advantages:

- Strong trend tracking capability: The RSI indicator is an effective trend tracking indicator. Through the breakthrough and regression of the RSI indicator, this strategy can better capture the main trends of the market and adapt to different market conditions.

- Dual-directional trading opportunities: By shorting in overbought zones and going long in oversold zones, this strategy can obtain trading opportunities in both long and short directions, improving the adaptability and profitability of the strategy.

- Risk control mechanism: By setting an initial stop loss, this strategy can effectively control the maximum loss of a single trade and reduce the overall risk of the strategy.

- Flexible parameter adjustment: The key parameters of this strategy, such as the RSI indicator period, overbought and oversold thresholds, and initial stop loss percentage, can be flexibly adjusted according to market characteristics and personal preferences, enhancing the adaptability of the strategy.

- Clear and simple logic: The trading logic of this strategy is clear and simple, easy to understand and implement, suitable for novice quantitative traders to learn and use.

Risk Analysis

Despite the advantages of the RSI Dual Directional Trading Strategy with Initial Stop Loss, it also has the following potential risks:

- Trend recognition risk: Although the RSI indicator is an effective trend tracking indicator, in some market conditions, such as sideways markets or early stages of trend reversal, the RSI indicator may generate false signals, leading to losses in the strategy.

- Parameter optimization risk: The key parameters of this strategy, such as the RSI indicator period and overbought/oversold thresholds, have a significant impact on the performance of the strategy. The optimization and selection of parameters require a large amount of historical data and backtesting verification. Improper parameter settings may result in poor strategy performance.

- Initial stop loss risk: Although setting an initial stop loss can control the maximum loss of a single trade, if the initial stop loss is set improperly, it may cause the strategy to frequently stop out and miss potential profit opportunities, reducing the strategy’s returns.

- Market risk: This strategy performs well in markets with clear trends, but in situations of large market fluctuations or major event shocks, the strategy may face greater drawdown risks.

- Arbitrage risk: When opening positions, this strategy may face slippage, transaction costs, and other arbitrage risks, affecting the actual returns of the strategy.

To address the above risks, the following measures can be taken:

- Combine with other technical indicators such as moving averages and MACD to perform secondary confirmation of RSI indicator signals, improving the accuracy of trend recognition.

- Conduct extensive backtesting on historical data, optimize key parameters, and regularly review and adjust parameter settings to adapt to market changes.

- Optimize the initial stop loss setting, such as using dynamic stop loss methods like ATR, to improve the flexibility and effectiveness of stop loss.

- Closely monitor market risk events and take risk control measures such as reducing positions or suspending trading when necessary.

- Choose targets with low transaction costs and good liquidity, and reasonably control the amount of funds for each trade to reduce the impact of arbitrage risks.

Optimization Direction

The RSI Dual Directional Trading Strategy with Initial Stop Loss can be further optimized and improved in the following aspects:

- Introduce a long-short position management module: On the basis of the existing strategy, the proportion of long and short positions can be dynamically adjusted according to indicators such as market trend strength and volatility. Increase positions when the trend is strong, and decrease positions when the trend weakens or reverses, improving the flexibility and profitability of the strategy.

- Optimize stop loss and take profit mechanisms: In addition to the existing initial stop loss, dynamic stop loss and take profit mechanisms such as trailing stop loss and sliding take profit can be introduced. Adjust stop loss and take profit levels dynamically according to market volatility characteristics and personal risk preferences, improving the strategy’s risk-reward ratio and risk control capability.

- Combine multi-timeframe analysis: In addition to the existing hourly chart, introduce RSI indicator analysis on other timeframes such as daily and 5-minute. Improve the accuracy and reliability of trend judgment through the resonance and divergence of multi-timeframe RSI indicators.

- Introduce market sentiment analysis: The RSI indicator itself is a sentiment indicator. Other market sentiment indicators such as the VIX fear index and bull-bear index can be introduced into the strategy. Quantify market sentiment to filter and confirm RSI indicator signals, enhancing the robustness of the strategy.

- Add a money management module: Money management methods such as the Kelly Criterion and fixed proportion money management can be introduced into the strategy. Reasonably allocate the fund proportion of each trade based on the historical performance and backtesting results of the strategy, improving the long-term stability and sustainability of the strategy.

Through the above optimization and improvement measures, the performance and robustness of the RSI Dual Directional Trading Strategy with Initial Stop Loss can be further enhanced to better adapt to different market conditions and trading needs.

Summary

The RSI Dual Directional Trading Strategy with Initial Stop Loss is a quantitative trading strategy based on the trend characteristics of the RSI indicator. By setting entry and exit signals in the overbought and oversold zones of the RSI indicator and setting an initial stop loss to control risk, it aims to obtain stable trading profits. The strategy has a clear and simple logic, and advantages such as strong trend tracking capability, multiple dual-directional trading opportunities, and a sound risk control mechanism, suitable for novice quantitative traders to learn and use.

However, this strategy also has potential problems such as trend recognition risk, parameter optimization risk, initial stop loss risk, market risk, and arbitrage risk. It needs to be addressed and improved by combining other technical indicators, optimizing key parameters, dynamically adjusting stop loss and take profit, paying attention to market risk events, controlling transaction costs, and other measures.

Moreover, this strategy can be further optimized and enhanced by introducing modules such as long-short position management, dynamic stop loss and take profit, multi-timeframe analysis, market sentiment analysis, and money management, to better adapt to different market conditions and trading needs, and improve the profitability, robustness, and sustainability of the strategy.

In summary, the RSI Dual Directional Trading Strategy with Initial Stop Loss is a simple and practical quantitative trading strategy. With reasonable optimization and improvement, it can become a powerful tool for quantitative traders, helping them obtain long-term stable returns in the financial market. However, every strategy has its limitations and risks. Quantitative traders need to prudently choose and apply strategies based on their own risk preferences, trading experience, and market environment, and always maintain caution and risk awareness in order to go further and more steadily on the path of quantitative trading.

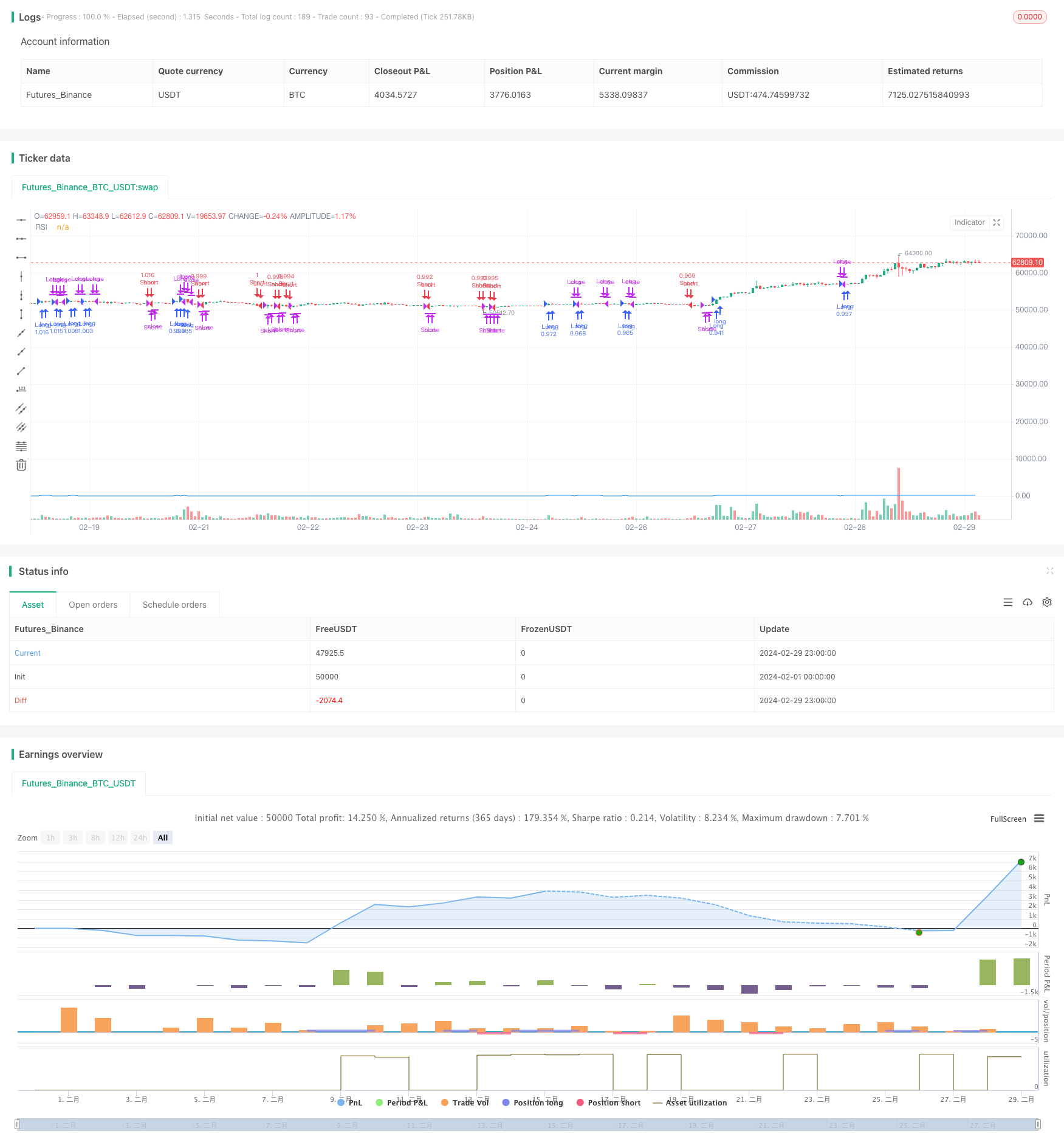

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI Long and Short Strategy with Initial Stop Loss", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input parameters

rsi_length = input(14, title="RSI Length")

initial_stop_loss_percentage = input(6, title="Initial Stop Loss Percentage")

// Calculate RSI

rsi_1hour = request.security(syminfo.tickerid, "60", ta.rsi(close, rsi_length))

// Entry condition for Long trades

long_entry = rsi_1hour[1] < 60 and rsi_1hour >= 60

// Exit condition for Long trades

long_exit = rsi_1hour[1] > 60 and rsi_1hour <= 60

// Entry condition for Short trades

short_entry = rsi_1hour[1] > 40 and rsi_1hour <= 40

// Exit condition for Short trades

short_exit = rsi_1hour[1] < 40 and rsi_1hour >= 40

// Initial Stop Loss calculation

initial_stop_loss_long = close * (1 - initial_stop_loss_percentage / 100)

initial_stop_loss_short = close * (1 + initial_stop_loss_percentage / 100)

// Strategy logic for Long trades

if (long_entry)

strategy.entry("Long", strategy.long)

if (long_exit)

strategy.close("Long")

// Strategy logic for Short trades

if (short_entry)

strategy.entry("Short", strategy.short)

if (short_exit)

strategy.close("Short")

// Set initial stop loss for Long trades

strategy.exit("Initial Stop Loss Long", "Long", stop=initial_stop_loss_long)

// Set initial stop loss for Short trades

strategy.exit("Initial Stop Loss Short", "Short", stop=initial_stop_loss_short)

// Plot RSI

plot(rsi_1hour, title="RSI", color=color.blue)

- Bollinger Bands + EMA Trend Following Strategy

- Trend Following Strategy Based on Dual Moving Average Crossover and Multi-Timeframe DMI Indicator

- The Support/Resistance-Psychology-Candlestick Feedback-Money Management strategy

- Kuberan Strategy: The Confluence Approach for Market Mastery

- Candlestick Pattern Trend Filter Strategy

- Double Moving Average Trend Following Strategy

- Dynamic Stop Loss and Take Profit Strategy Based on Dual ATR Trailing Stop

- MACD+EMA Multi-Timeframe Breakout Strategy

- Flawless Victory DCA Momentum and Volatility Strategy

- Multi-Timeframe Trend Trading Strategy Based on MACD, ADX, and EMA200

- Automatic Forecasting Long/Short Target Stop Loss Strategy Based on 9:15 High/Low

- SMC Strategy Combining MACD and EMA

- Dynamic Multi-SMA and MACD-based XAUUSD Trading Strategy

- Dual Moving Average Crossover Quantitative Trading Strategy

- EMA 200 Crossover with Volume and Trend Strategy

- RSI Dynamic Stop Loss and Take Profit Strategy

- Ichimoku Cloud Local Trend Identification Strategy

- 9EMA Dynamic Position Sizing Strategy with Two 5-Minute Close Breakouts

- A Long-Short Adaptive Dynamic Grid Strategy Based

- ATR Chandelier Exit Strategy with Relative Strength Index