MACD与EMA结合的SMC策略

Author: ChaoZhang, Date: 2024-03-19 17:37:45Tags:

策略概述

该策略主要利用MACD指标和EMA指标来判断市场趋势,结合Lux Algo SMC指标的买卖信号,在趋势向上且价格在EMA之上时买入,在趋势向下且价格在EMA之下时卖出。通过这种方式,该策略能够在趋势行情中获利,同时避免在震荡行情中频繁交易。

策略原理

该策略的核心是MACD指标和EMA指标。MACD指标由两条线组成:MACD线和信号线。当MACD线从下向上突破信号线时,表明趋势可能向上,当MACD线从上向下突破信号线时,表明趋势可能向下。EMA指标则是用来判断价格是否在均线之上,从而确定当前的趋势方向。

具体来说,该策略的逻辑如下:

- 计算MACD指标的三个变量:macdLine、signalLine和hist。

- 计算EMA指标的值:emaValue。

- 获取Lux Algo SMC指标的买卖信号:buySignal和sellSignal。

- 当buySignal为true,且macdLine大于signalLine,且收盘价大于emaValue时,开多仓。

- 当sellSignal为true,且macdLine小于signalLine,且收盘价小于emaValue时,开空仓。

通过这种方式,该策略能够在趋势行情中及时入场,同时避免在震荡行情中频繁交易,从而提高策略的稳定性和盈利能力。

策略优势

- 趋势跟踪能力强:通过结合MACD和EMA指标,该策略能够及时判断市场趋势,在趋势行情中获利。

- 避免频繁交易:通过引入EMA指标,该策略能够避免在震荡行情中频繁交易,从而减少交易成本和回撤。

- 参数可调:该策略的各个参数都可以根据市场情况进行调整,从而提高策略的适应性。

- 代码简洁:该策略的代码逻辑清晰,易于理解和修改。

策略风险

- 参数敏感性:该策略的表现对参数设置较为敏感,不同的参数组合可能导致策略表现差异较大。因此,在实际应用中需要对参数进行优化和测试。

- 趋势判断错误:该策略主要依赖于MACD和EMA指标来判断趋势,但这两个指标都有可能发出错误信号,导致策略出现亏损。因此,需要结合其他指标或方法来验证趋势的可靠性。

- 突发事件风险:该策略无法应对一些突发事件,如重大利空消息、黑天鹅事件等,这些事件可能导致策略出现大幅回撤。因此,需要设置适当的止损措施来控制风险。

策略优化方向

- 引入更多指标:可以考虑引入其他趋势类指标,如ADX、DMI等,来验证MACD和EMA指标的可靠性,提高趋势判断的准确性。

- 优化参数:可以通过遗传算法、网格搜索等方法来优化策略的各个参数,找到最优的参数组合,提高策略的表现。

- 加入止损措施:可以加入一些止损措施,如固定止损、移动止损等,来控制策略的回撤风险。

- 多时间框架结合:可以考虑在不同时间框架下运行该策略,通过高级别时间框架来判断大趋势,低级别时间框架来判断入场点,提高策略的稳定性和盈利能力。

总结

该策略通过结合MACD指标和EMA指标来判断市场趋势,同时利用Lux Algo SMC指标的买卖信号来确定入场点,在趋势行情中获利,避免在震荡行情中频繁交易。该策略优势明显,代码简洁,参数可调,但同时也存在一些风险,如参数敏感性、趋势判断错误、突发事件风险等。为了进一步提高策略的表现,可以考虑引入更多指标、优化参数、加入止损措施、多时间框架结合等方法。总的来说,该策略是一个有潜力的量化交易策略,值得进一步研究和优化。

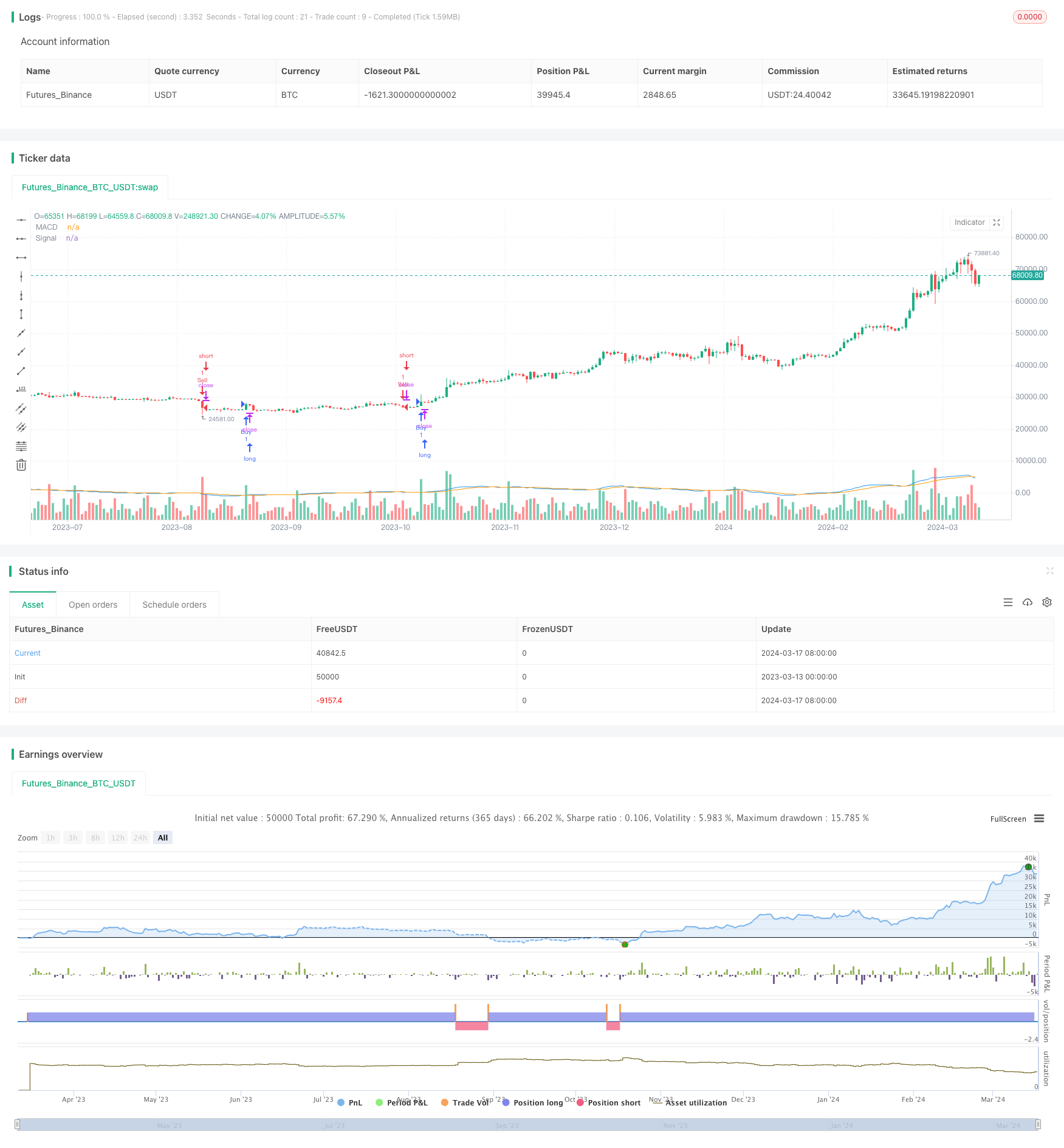

/*backtest

start: 2023-03-13 00:00:00

end: 2024-03-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SMC with MACD and EMA", overlay=true)

// 1. MACD Settings

fastLength = input(12, title="MACD Fast Length")

slowLength = input(26, title="MACD Slow Length")

signalLength = input(9, title="MACD Signal Length")

// 2. EMA Settings

emaLength = input(200, title="EMA Length")

// 3. Calculating MACD and assigning variables correctly

[macdLine, signalLine, hist] = ta.macd(close, fastLength, slowLength, signalLength)

// 4. EMA Calculation

emaValue = ta.ema(close, emaLength)

// 5. Get Buy/Sell Signals from Lux Algo SMC Indicator (Modify as needed)

buySignal = input.bool(true, title="Buy Signal from Lux Algo SMC")

sellSignal = input.bool(true, title="Sell Signal from Lux Algo SMC")

// 6. Strategy Logic (Using the corrected variables)

if buySignal and macdLine > signalLine and close > emaValue

strategy.entry("Buy", strategy.long)

if sellSignal and macdLine < signalLine and close < emaValue

strategy.entry("Sell", strategy.short)

// 7. Optional: Plot MACD for visualization

plot(macdLine, color=color.blue, title="MACD")

plot(signalLine, color=color.orange, title="Signal")

更多内容

- 基于技术分析和资金管理的量化交易策略

- Kuberan策略:市场掌控的交汇策略

- 烛台形态趋势过滤策略

- 双均线趋势跟踪策略

- 基于ATR双重跟踪止损的动态止盈止损策略

- MACD+EMA多时间尺度突破策略

- Flawless Victory DCA 动量与波动率策略

- 基于MACD、ADX和EMA200的多时间框架趋势交易策略

- RSI双向交易策略与初始止损

- 基于9:15高低点自动预测的多空目标止损策略

- 基于动态多均线与MACD指标的XAUUSD交易策略

- 基于双移动平均线交叉的量化交易策略

- EMA 200 交叉量价趋势策略

- RSI动态止损止盈策略

- 一文中局部震荡趋势识别策略

- 基于9EMA动态仓位的5分钟双收盘价强势突破策略

- 基于多空自适应动态网格策略

- 基于平均真实波幅和相对强弱指数的钱德勒出场策略

- 高低点自动预测与交易策略

- 日内锤子反转形态多头策略