Overview

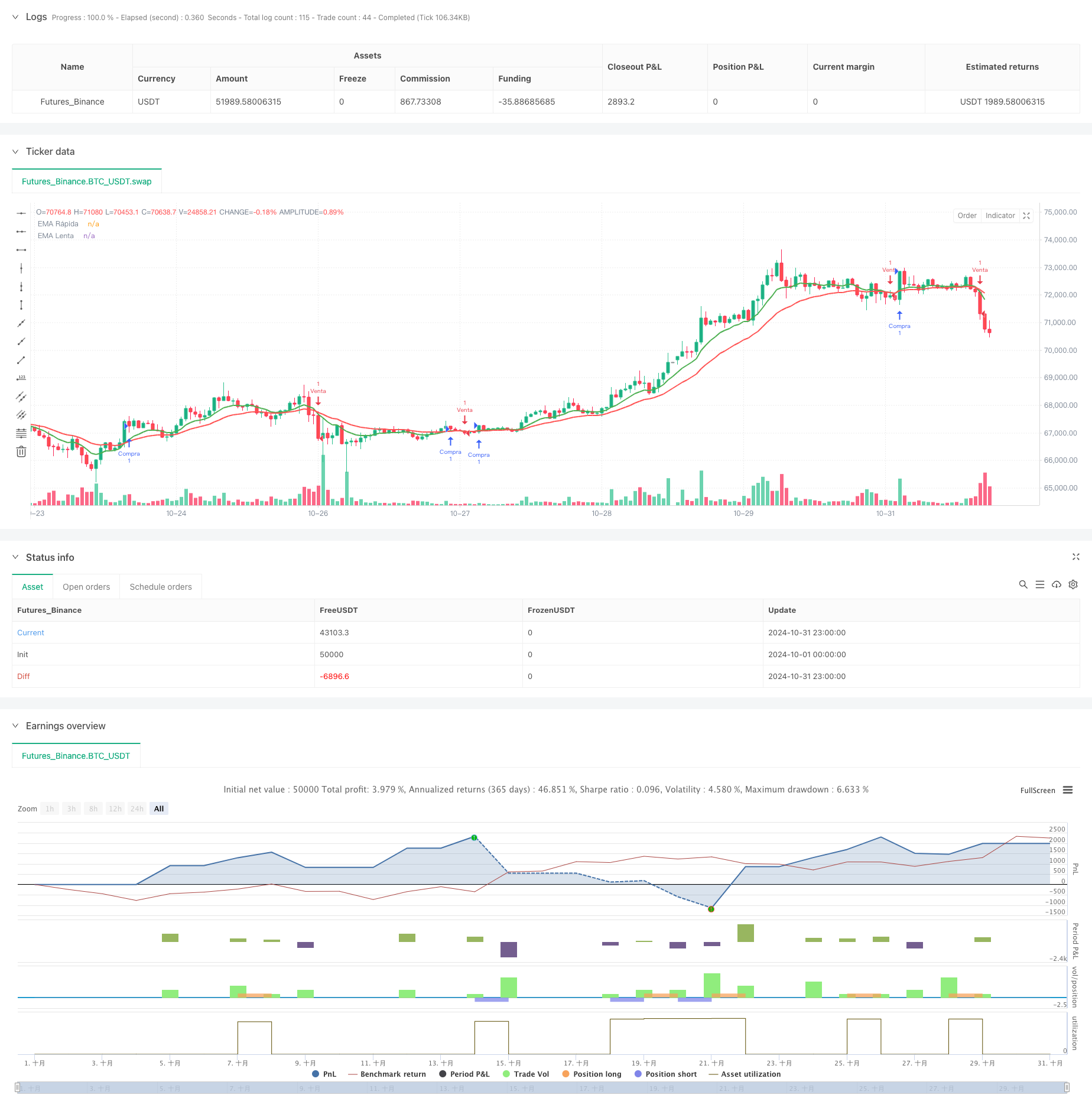

This is a quantitative trading strategy based on dual EMA crossover combined with RSI indicator, integrated with dynamic take-profit and stop-loss mechanisms. The strategy utilizes 9-period and 21-period Exponential Moving Averages (EMA) as primary trend indicators, coupled with the Relative Strength Index (RSI) as a filter condition, managing risk and profit through dynamic take-profit and stop-loss levels.

Strategy Principles

The strategy uses the crossover of fast EMA (9-period) and slow EMA (21-period) to capture trend changes. Long positions are opened when the fast line crosses above the slow line and RSI is below 70; short positions are opened when the fast line crosses below the slow line and RSI is above 30. Each trade is set with a 1.5% take-profit and 1% stop-loss, with this dynamic mechanism automatically adjusting based on entry prices.

Strategy Advantages

- Combination of trend following and oscillator indicators improves signal quality

- Dynamic take-profit/stop-loss mechanism effectively controls risk per trade

- Avoids entering in extreme overbought/oversold areas

- Simple and maintainable strategy logic

- Flexible parameter configuration for different market conditions

Strategy Risks

- False breakout signals may occur frequently in ranging markets

- Fixed percentage take-profit/stop-loss may not suit all market conditions

- Dual EMA system may be slow to react at trend reversal points

- RSI filter might miss important trend beginnings

- Lack of consideration for volume and other important market information

Optimization Directions

- Incorporate volume indicators to validate trend validity

- Dynamically adjust take-profit/stop-loss ratios based on volatility

- Add trend strength filters

- Optimize EMA periods, consider adaptive periods

- Include market environment assessment module for parameter adaptation

- Consider implementing periodic take-profit/stop-loss position adjustment mechanism

Summary

This is a well-structured and logically rigorous quantitative trading strategy. It captures trends through EMA crossovers, filters entry timing with RSI, and manages risk with dynamic take-profit/stop-loss levels. While it has certain limitations, the suggested optimization directions can further enhance strategy stability and profitability. The strategy serves as a solid foundation framework that can be optimized based on specific trading instruments and market conditions.

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia BTC/USDT - Ajustada", overlay=true)

// Definición de las EMAs

emaRapida = ta.ema(close, 9)

emaLenta = ta.ema(close, 21)

// Cálculo del RSI

rsi = ta.rsi(close, 14)

// Condiciones de compra y venta

longCondition = ta.crossover(emaRapida, emaLenta) and rsi < 70

shortCondition = ta.crossunder(emaRapida, emaLenta) and rsi > 30

// Ajustes de Take Profit y Stop Loss

takeProfitLong = close * 1.015 // Take Profit del 1.5% para Long

stopLossLong = close * 0.99 // Stop Loss del 1% para Long

takeProfitShort = close * 0.985 // Take Profit del 1.5% para Short

stopLossShort = close * 1.01 // Stop Loss del 1% para Short

// Ejecución de la estrategia

if (longCondition)

strategy.entry("Compra", strategy.long)

strategy.exit("Take Profit Long", "Compra", limit=takeProfitLong, stop=stopLossLong)

if (shortCondition)

strategy.entry("Venta", strategy.short)

strategy.exit("Take Profit Short", "Venta", limit=takeProfitShort, stop=stopLossShort)

// Visualización de las EMAs

plot(emaRapida, color=color.green, linewidth=2, title="EMA Rápida")

plot(emaLenta, color=color.red, linewidth=2, title="EMA Lenta")