Multi-Frequency Momentum Reversal Quantitative Strategy System

Author: ChaoZhang, Date: 2024-11-29 14:47:54Tags:

Overview

This strategy is a quantitative trading system based on market continuous movement characteristics, capturing market reversal opportunities by analyzing the frequency of consecutive price rises or falls. The core of the strategy is to take reverse actions when reaching preset thresholds for consecutive movements, combining multiple dimensions such as holding periods and candlestick patterns for trading decisions.

Strategy Principles

The core logic includes several key elements:

- Streak Counting: The system continuously tracks consecutive price increases and decreases, comparing them with preset thresholds.

- Trade Direction Selection: Users can choose between long or short positions, focusing on losing streaks for long positions and winning streaks for short positions.

- Holding Period Management: Fixed holding periods are set with automatic position closure to avoid over-holding.

- Doji Filtering: Incorporates Doji candlestick analysis to filter false signals during market fluctuations.

- Position Control: Utilizes single position trading without scaling or partial position building.

Strategy Advantages

- Clear Logic: Trading logic is intuitive and easy to understand and execute.

- Controlled Risk: Risk is managed through fixed holding periods and single position control.

- High Adaptability: Parameters can be adjusted according to different market characteristics.

- High Automation: Fully system-executed, reducing human intervention.

- Multi-dimensional Analysis: Combines price trends, candlestick patterns, and other dimensions.

Strategy Risks

- Trend Continuation Risk: Potential misjudgments in strong trend markets.

- Parameter Sensitivity: Strategy performance directly affected by threshold and holding period settings.

- Market Environment Dependency: Performs well in oscillating markets but may frequently lose in unidirectional markets.

- Slippage Impact: High-frequency trading may be affected by slippage.

- Cost Pressure: Frequent trading generates high transaction costs.

Strategy Optimization Directions

- Incorporate Volatility Indicators: Adjust thresholds using indicators like ATR.

- Add Trend Filtering: Improve win rate by incorporating long-term trend analysis.

- Dynamic Holding Periods: Adapt holding times based on market characteristics.

- Position Management Optimization: Introduce dynamic position management mechanisms.

- Multi-timeframe Analysis: Add multi-period signal confirmation mechanisms.

Conclusion

This strategy is a quantitative trading system based on market reversal characteristics, capturing reversal opportunities through analysis of continuous price movements. The strategy design is reasonable with controlled risks but requires parameter adjustment according to market conditions. Through continuous optimization and improvement, this strategy has the potential to achieve stable returns in actual trading. It is recommended to conduct thorough historical data backtesting and verify strategy effectiveness in demo trading before live implementation.

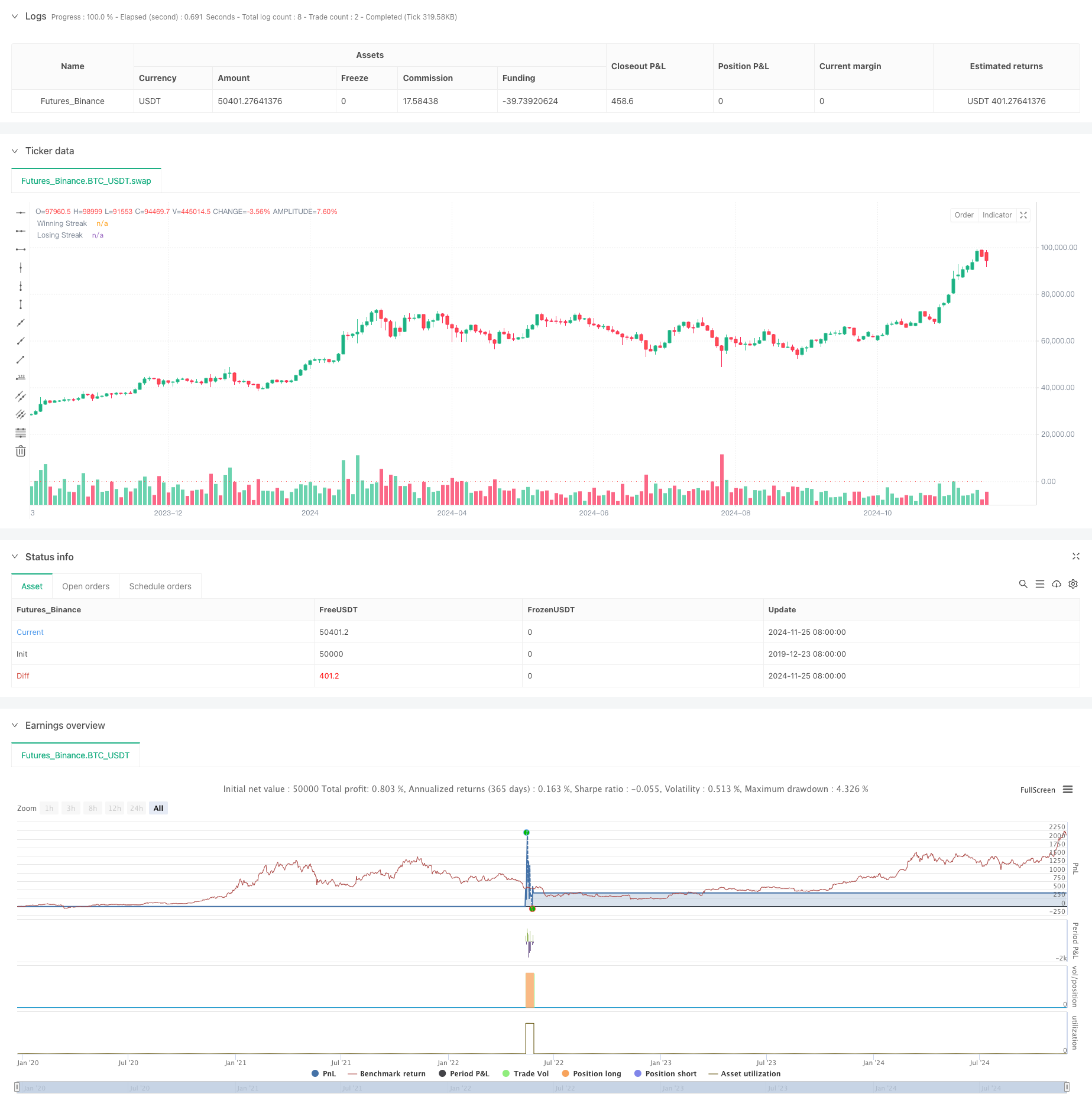

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Streak-Based Trading Strategy", overlay=true)

// User Inputs

trade_direction = input.string(title="Trade Direction", defval="Long", options=["Long", "Short"]) // Option to choose Long or Short

streak_threshold = input.int(title="Streak Threshold", defval=8, minval=1) // Input for number of streaks before trade

hold_duration = input.int(title="Hold Duration (in periods)", defval=7, minval=1) // Input for holding the position

doji_threshold = input.float(0.01, title="Doji Threshold (%)", minval=0.001) / 100 // Doji sensitivity

// Calculate win or loss streak

is_doji = math.abs(close - open) / (high - low) < doji_threshold

win = close > close[1] and not is_doji

loss = close < close[1] and not is_doji

// Initialize variables for streak counting

var int win_streak = 0

var int loss_streak = 0

var bool in_position = false

var int hold_counter = 0

// Track streaks (only when not in a position)

if not in_position

if win

win_streak += 1

loss_streak := 0

else if loss

loss_streak += 1

win_streak := 0

else

win_streak := 0

loss_streak := 0

// Logic for closing the position after the holding duration

if in_position

hold_counter -= 1

if hold_counter <= 0

strategy.close_all() // Close all positions

in_position := false // Reset position flag

win_streak := 0 // Reset streaks after position is closed

loss_streak := 0

// Trade condition (only when no position is open and streak is reached)

if not in_position

if trade_direction == "Long" and loss_streak >= streak_threshold

strategy.entry("Long", strategy.long) // Open a long position

in_position := true

hold_counter := hold_duration // Set holding period

if trade_direction == "Short" and win_streak >= streak_threshold

strategy.entry("Short", strategy.short) // Open a short position

in_position := true

hold_counter := hold_duration // Set holding period

// Plotting streaks for visualization

plot(win_streak, color=color.green, title="Winning Streak", style=plot.style_histogram, linewidth=2)

plot(loss_streak, color=color.red, title="Losing Streak", style=plot.style_histogram, linewidth=2)

- Multi-MA Trend Following with RSI Momentum Strategy

- Multi-Level Fibonacci EMA Trend Following Strategy

- Trend-Following Gap Breakout Trading System with SMA Filter

- Dual EMA Crossover Trend Following Strategy with Risk Management and Time Filtering System

- Double Smoothed Moving Average Trend Following Strategy - Based on Modified Heikin-Ashi

- MACD Multi-Interval Dynamic Stop-Loss and Take-Profit Trading System

- Dynamic Trading System with Stochastic RSI and Candlestick Confirmation

- Dual Moving Average Trend Following Strategy with ATR-Based Risk Management System

- Multi-Technical Indicator Dynamic Adaptive Trading Strategy (MTDAT)

- Adaptive FVG Detection and MA Trend Trading Strategy with Dynamic Resistance

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Dynamic Dual-SMA Trend Following Strategy with Smart Risk Management

- KNN-Based Adaptive Parametric Trend Following Strategy

- Multi-Period Trend Following Trading System Based on EMA Volatility Bands

- Random bidding generator for the retesting system

- Multi-Timeframe EMA Cross High-Win Rate Trend Following Strategy (Advanced)

- Adaptive Range Volatility Trend Following Trading Strategy

- Dual Moving Average Trend Following Trading System with Risk-Reward Ratio Optimization Strategy

- Moving Average Crossover and Candlestick Pattern Smart Timing Strategy

- Dynamic Dual Moving Average Crossover Quantitative Trading Strategy