Dual EMA Crossover Trend Following Strategy with Risk Management and Time Filtering System

Author: ChaoZhang, Date: 2024-11-29 15:05:45Tags: EMASLTPALGO

Overview

This strategy is a complete trading system that combines dual EMA crossover signals, stop-loss/take-profit management, and time filtering. The core strategy is based on the crossover of fast and slow exponential moving averages (EMA) to capture market trends, with risk control through Take Profit and Stop Loss settings. Additionally, the strategy includes time filtering functionality that allows traders to execute trades within specific time ranges.

Strategy Principles

The strategy operates based on the following core mechanisms:

- Uses two EMAs with different periods (default 5 and 21)

- Generates long signals when fast EMA crosses above slow EMA

- Generates short signals when fast EMA crosses below slow EMA

- Each trade has percentage-based stop-loss and take-profit levels

- Trading direction can be configured for: long-only, short-only, or both

- Includes time filtering to execute trades only within specified timeframes

- System generates alerts at key moments (entry, stop-loss/take-profit hits)

Strategy Advantages

- Systematic risk management: Clear risk control through preset stop-loss and take-profit levels

- Flexible parameter configuration: Traders can adjust EMA periods and risk levels

- Directional freedom: Options for unidirectional or bidirectional trading

- Time management capability: Avoids trading during unfavorable periods

- Real-time alert system: Helps traders receive timely signals and risk notifications

- Complete position management: Automated entry and exit without manual intervention

Strategy Risks

- Choppy market risk: May generate frequent false signals in ranging markets

- Slippage risk: Actual stop-loss/take-profit prices may deviate during high volatility

- Parameter sensitivity: Strategy performance heavily depends on EMA period selection

- Trend dependency: May underperform in non-trending markets

- Money management risk: Fixed percentage stops may not be flexible enough in certain conditions

Optimization Directions

- Add market environment filtering:

- Incorporate volatility indicators for different market states

- Implement trend strength filters to avoid false breakouts

- Dynamic parameter adjustment:

- Adjust stop-loss/take-profit levels based on market volatility

- Modify EMA periods according to trend strength

- Enhanced risk management:

- Add trailing stop functionality to protect profits

- Implement scaling in/out mechanisms

- Improve entry precision:

- Incorporate volume indicators to confirm signal validity

- Add supplementary technical indicators for confirmation

Summary

This is a well-designed trend-following strategy that combines a moving average system, risk management, and time filtering to provide a comprehensive trading solution. The strategy offers high configurability, suitable for traders with different risk preferences. Through the suggested optimization directions, there is room for further improvement. The key is to adjust parameters based on actual market conditions and personal trading objectives while maintaining strict risk control.

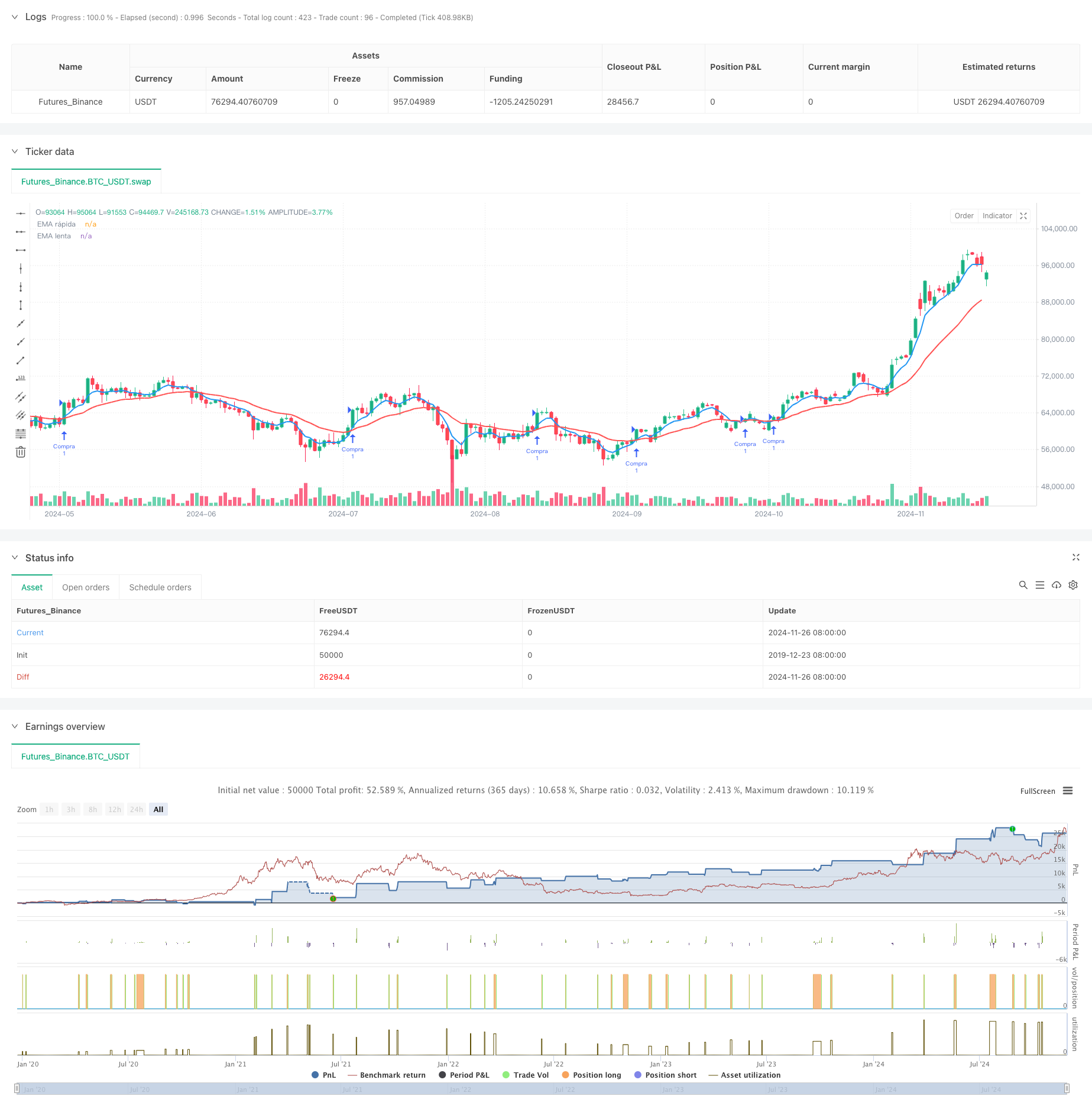

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia Cruce de EMAs con: Stop Loss, Take Profit, Días de Operación y Alertas (Modificables)", overlay=true, commission_value = 0.2, process_orders_on_close = true, initial_capital = 1000)

// Parámetros de las EMAs

emaRapidaLen = input.int(5, title="Periodo EMA rápida")

emaLentaLen = input.int(21, title="Periodo EMA lenta")

// Parámetros de Stop Loss y Take Profit

stopLoss = input.float(3.0, title="Stop Loss (%)", step=0.1) / 100

takeProfit = input.float(6.0, title="Take Profit (%)", step=0.1) / 100

// Tipo de operación: Largo, Corto o Ambos

operacion = input.string(title="Tipo de operación", defval="Largo", options=["Largo", "Corto", "Ambos"])

// Parámetros de la duración de la estrategia (días)

diasInicio = input(timestamp("2009-01-03 00:00"), title="Fecha de inicio (YYYY-MM-DD HH:MM)")

diasFin = input(timestamp("2024-09-11 00:00"), title="Fecha de fin (YYYY-MM-DD HH:MM)")

// Comprobar si estamos dentro del rango de días definido

dentroDeRango = true

// Cálculo de las EMAs

emaRapida = ta.ema(close, emaRapidaLen)

emaLenta = ta.ema(close, emaLentaLen)

// Condiciones para cruce de EMAs

cruceAlcista = ta.crossover(emaRapida, emaLenta)

cruceBajista = ta.crossunder(emaRapida, emaLenta)

// Operaciones en Largo (solo si estamos en el rango de días definido)

if dentroDeRango and (operacion == "Largo" or operacion == "Ambos") and cruceAlcista

strategy.entry("Compra", strategy.long)

alert("Posición larga abierta: Cruce alcista de EMAs", alert.freq_once_per_bar_close)

// Operaciones en Corto (solo si estamos en el rango de días definido)

if dentroDeRango and (operacion == "Corto" or operacion == "Ambos") and cruceBajista

strategy.entry("Venta", strategy.short)

alert("Posición corta abierta: Cruce bajista de EMAs", alert.freq_once_per_bar_close)

// Cálculo del Stop Loss y Take Profit para largos

if (strategy.position_size > 0 and strategy.opentrades.entry_id(strategy.opentrades - 1) == "Compra")

strategy.exit("Cerrar Compra", "Compra", stop=strategy.position_avg_price * (1 - stopLoss), limit=strategy.position_avg_price * (1 + takeProfit))

alert("Posición larga cerrada: Alcanzado Stop Loss o Take Profit", alert.freq_once_per_bar_close)

// Cálculo del Stop Loss y Take Profit para cortos

if (strategy.position_size < 0 and strategy.opentrades.entry_id(strategy.opentrades - 1) == "Venta")

strategy.exit("Cerrar Venta", "Venta", stop=strategy.position_avg_price * (1 + stopLoss), limit=strategy.position_avg_price * (1 - takeProfit))

alert("Posición corta cerrada: Alcanzado Stop Loss o Take Profit", alert.freq_once_per_bar_close)

// Plot de las EMAs

plot(emaRapida, color=color.blue, title="EMA rápida", linewidth = 2)

plot(emaLenta, color=color.red, title="EMA lenta", linewidth = 2)

- EMA Crossover with Dual Take Profit and Stop Loss Strategy

- Adaptive Trend-Following Trading Strategy: 200 EMA Breakout with Dynamic Risk Management System

- EMA Crossover Trading Strategy with Dynamic Take Profit and Stop Loss

- Williams %R Dynamic TP/SL Adjustment Strategy

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Advanced EMA Crossover Strategy: Adaptive Trading System with Dynamic Stop-Loss and Take-Profit Targets

- Multi-Timeframe Exponential Moving Average Crossover Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- Multi-Zone SMC Theory Based Intelligent Trend Following Strategy

- Dynamic Multi-Period Quantitative Trading Strategy Combining RSI and EMA

- Multi-Dimensional Technical Indicator Trend Following Quantitative Strategy

- Dual Moving Average Crossover Adaptive Parameter Trading Strategy

- Multi-Trend Following and Structure Breakout Strategy

- TRAMA Dual Moving Average Crossover Intelligent Quantitative Trading Strategy

- Multi-Timeframe RSI-EMA Momentum Trading Strategy with Position Scaling

- Multi-MA Trend Following with RSI Momentum Strategy

- Multi-Level Fibonacci EMA Trend Following Strategy

- Trend-Following Gap Breakout Trading System with SMA Filter

- Double Smoothed Moving Average Trend Following Strategy - Based on Modified Heikin-Ashi

- MACD Multi-Interval Dynamic Stop-Loss and Take-Profit Trading System

- Dynamic Trading System with Stochastic RSI and Candlestick Confirmation

- Dual Moving Average Trend Following Strategy with ATR-Based Risk Management System

- Multi-Technical Indicator Dynamic Adaptive Trading Strategy (MTDAT)

- Adaptive FVG Detection and MA Trend Trading Strategy with Dynamic Resistance

- Multi-Frequency Momentum Reversal Quantitative Strategy System

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Dynamic Dual-SMA Trend Following Strategy with Smart Risk Management

- KNN-Based Adaptive Parametric Trend Following Strategy