Estrategia de divergencia de precios v1.0

El autor:¿ Qué pasa?, Fecha: 31 de mayo de 2022 18:31:45Las etiquetas:El MACDIndicador de riesgo

Creado por solicitud: Esta es una estrategia de negociación de tendencia que utiliza señales de detección de divergencia de precios que son confirmadas por el oscilador matemático de Murray (basado en el canal Donchanin).

Código de estrategia basado en:

Detector de divergencia de precios V2 por RicardoSantos

UCS_Murrey

Prueba posterior

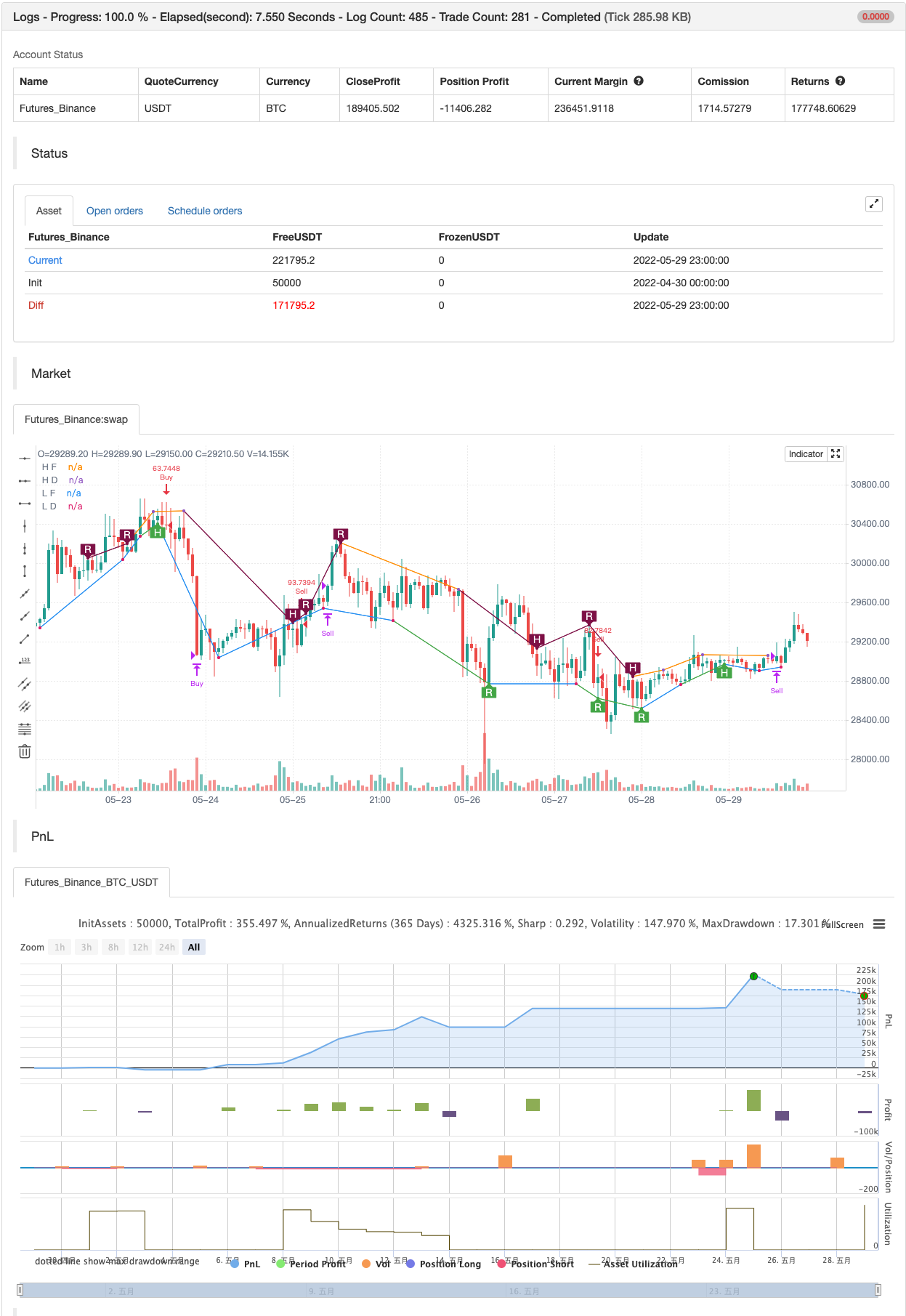

/*backtest

start: 2022-04-30 00:00:00

end: 2022-05-29 23:59:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// Title: [STRATEGY][UL]Price Divergence Strategy V1.1

// Author: JustUncleL

// Date: 23-Oct-2016

// Version: v1.1

//

// Description:

// A trend trading strategy the uses Price Divergence detection signals, that

// are confirmed by the "Murrey's Math Oscillator" (Donchanin Channel based).

//

// *** USE AT YOUR OWN RISK ***

//

// Mofidifications:

// 1.0 - original

// 1.1 - Pinescript V4 update 21-Aug-2021

//

// References:

// Strategy Based on:

// - [RS]Price Divergence Detector V2 by RicardoSantos

// - UCS_Murrey's Math Oscillator by Ucsgears

// Some Code borrowed from:

// - "Strategy Code Example by JayRogers"

// Information on Divergence Trading:

// - http://www.babypips.com/school/high-school/trading-divergences

//

strategy(title='[STRATEGY][UL]Price Divergence Strategy v1.1', pyramiding=0, overlay=true, initial_capital=10000, calc_on_every_tick=false, currency=currency.USD,

default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// || General Input:

method = input(title='Method (0=rsi, 1=macd, 2=stoch, 3=volume, 4=acc/dist, 5=fisher, 6=cci):', type=input.integer, defval=1, minval=0, maxval=6)

SHOW_LABEL = input(title='Show Labels', type=input.bool, defval=true)

SHOW_CHANNEL = input(title='Show Channel', type=input.bool, defval=false)

uHid = input(true, title="Use Hidden Divergence in Strategy")

uReg = input(true, title="Use Regular Divergence in Strategy")

// || RSI / STOCH / VOLUME / ACC/DIST Input:

rsi_smooth = input(title='RSI/STOCH/Volume/ACC-DIST/Fisher/cci Smooth:', type=input.integer, defval=5)

// || MACD Input:

macd_src = input(title='MACD Source:', type=input.source, defval=close)

macd_fast = input(title='MACD Fast:', type=input.integer, defval=12)

macd_slow = input(title='MACD Slow:', type=input.integer, defval=26)

macd_smooth = input(title='MACD Smooth Signal:', type=input.integer, defval=9)

// || Functions:

f_top_fractal(_src) =>

_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and

_src[2] > _src[0]

f_bot_fractal(_src) =>

_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and

_src[2] < _src[0]

f_fractalize(_src) =>

f_bot_fractal__1 = f_bot_fractal(_src)

f_top_fractal(_src) ? 1 : f_bot_fractal__1 ? -1 : 0

// ||••> START MACD FUNCTION

f_macd(_src, _fast, _slow, _smooth) =>

_fast_ma = sma(_src, _fast)

_slow_ma = sma(_src, _slow)

_macd = _fast_ma - _slow_ma

_signal = ema(_macd, _smooth)

_hist = _macd - _signal

_hist

// ||<•• END MACD FUNCTION

// ||••> START ACC/DIST FUNCTION

f_accdist(_smooth) =>

_return = sma(cum(close == high and close == low or high == low ? 0 : (2 * close - low - high) / (high - low) * volume), _smooth)

_return

// ||<•• END ACC/DIST FUNCTION

// ||••> START FISHER FUNCTION

f_fisher(_src, _window) =>

_h = highest(_src, _window)

_l = lowest(_src, _window)

_value0 = 0.0

_fisher = 0.0

_value0 := .66 * ((_src - _l) / max(_h - _l, .001) - .5) + .67 * nz(_value0[1])

_value1 = _value0 > .99 ? .999 : _value0 < -.99 ? -.999 : _value0

_fisher := .5 * log((1 + _value1) / max(1 - _value1, .001)) + .5 * nz(_fisher[1])

_fisher

// ||<•• END FISHER FUNCTION

rsi_1 = rsi(high, rsi_smooth)

f_macd__1 = f_macd(macd_src, macd_fast, macd_slow, macd_smooth)

stoch_1 = stoch(close, high, low, rsi_smooth)

sma_1 = sma(volume, rsi_smooth)

f_accdist__1 = f_accdist(rsi_smooth)

f_fisher__1 = f_fisher(high, rsi_smooth)

cci_1 = cci(high, rsi_smooth)

method_high = method == 0 ? rsi_1 : method == 1 ? f_macd__1 :

method == 2 ? stoch_1 : method == 3 ? sma_1 : method == 4 ? f_accdist__1 :

method == 5 ? f_fisher__1 : method == 6 ? cci_1 : na

rsi_2 = rsi(low, rsi_smooth)

f_macd__2 = f_macd(macd_src, macd_fast, macd_slow, macd_smooth)

stoch_2 = stoch(close, high, low, rsi_smooth)

sma_2 = sma(volume, rsi_smooth)

f_accdist__2 = f_accdist(rsi_smooth)

f_fisher__2 = f_fisher(low, rsi_smooth)

cci_2 = cci(low, rsi_smooth)

method_low = method == 0 ? rsi_2 : method == 1 ? f_macd__2 :

method == 2 ? stoch_2 : method == 3 ? sma_2 : method == 4 ? f_accdist__2 :

method == 5 ? f_fisher__2 : method == 6 ? cci_2 : na

fractal_top = f_fractalize(method_high) > 0 ? method_high[2] : na

fractal_bot = f_fractalize(method_low) < 0 ? method_low[2] : na

high_prev = valuewhen(fractal_top, method_high[2], 1)

high_price = valuewhen(fractal_top, high[2], 1)

low_prev = valuewhen(fractal_bot, method_low[2], 1)

low_price = valuewhen(fractal_bot, low[2], 1)

regular_bearish_div = fractal_top and high[2] > high_price and method_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and method_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and method_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and method_low[2] < low_prev

plot(title='H F', series=fractal_top ? high[2] : na, color=regular_bearish_div or hidden_bearish_div ? color.maroon : not SHOW_CHANNEL ? na : color.silver, offset=-2)

plot(title='L F', series=fractal_bot ? low[2] : na, color=regular_bullish_div or hidden_bullish_div ? color.green : not SHOW_CHANNEL ? na : color.silver, offset=-2)

plot(title='H D', series=fractal_top ? high[2] : na, style=plot.style_circles, color=regular_bearish_div or hidden_bearish_div ? color.maroon : not SHOW_CHANNEL ? na : color.silver, linewidth=3, offset=-2)

plot(title='L D', series=fractal_bot ? low[2] : na, style=plot.style_circles, color=regular_bullish_div or hidden_bullish_div ? color.green : not SHOW_CHANNEL ? na : color.silver, linewidth=3, offset=-2)

plotshape(title='+RBD', series=not SHOW_LABEL ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=color.maroon, textcolor=color.white, offset=-2)

plotshape(title='+HBD', series=not SHOW_LABEL ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=color.maroon, textcolor=color.white, offset=-2)

plotshape(title='-RBD', series=not SHOW_LABEL ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, offset=-2)

plotshape(title='-HBD', series=not SHOW_LABEL ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, offset=-2)

// Code borrowed from UCS_Murrey's Math Oscillator by Ucsgears

// - UCS_MMLO

// Inputs

length = input(100, minval=10, title="MMLO Look back Length")

quad = input(2, minval=1, maxval=4, step=1, title="Mininum Quadrant for MMLO Support")

mult = 0.125

// Donchanin Channel

hi = highest(high, length)

lo = lowest(low, length)

range = hi - lo

multiplier = range * mult

midline = lo + multiplier * 4

oscillator = (close - midline) / (range / 2)

a = oscillator > 0

b = oscillator > 0 and oscillator > mult * 2

c = oscillator > 0 and oscillator > mult * 4

d = oscillator > 0 and oscillator > mult * 6

z = oscillator < 0

y = oscillator < 0 and oscillator < -mult * 2

x = oscillator < 0 and oscillator < -mult * 4

w = oscillator < 0 and oscillator < -mult * 6

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval=0, title="Take Profit Points", minval=0)

inpStopLoss = input(defval=0, title="Stop Loss Points", minval=0)

inpTrailStop = input(defval=100, title="Trailing Stop Loss Points", minval=0)

inpTrailOffset = input(defval=0, title="Trailing Stop Loss Offset Points", minval=0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => // functions can be used to wrap up and work out complex conditions

(uReg and regular_bullish_div or uHid and hidden_bullish_div) and

(quad == 1 ? a[1] :

quad == 2 ? b[1] : quad == 3 ? c[1] : quad == 4 ? d[1] : false)

exitLong() =>

oscillator <= 0

strategy.entry(id="Buy", long=true, when=enterLong()) // use function or simple condition to decide when to get in

strategy.close(id="Buy", when=exitLong()) // ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() =>

(uReg and regular_bearish_div or uHid and hidden_bearish_div) and

(quad == 1 ? z[1] :

quad == 2 ? y[1] : quad == 3 ? x[1] : quad == 4 ? w[1] : false)

exitShort() =>

oscillator >= 0

strategy.entry(id="Sell", long=false, when=enterShort())

strategy.close(id="Sell", when=exitShort())

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry="Buy", profit=useTakeProfit, loss=useStopLoss, trail_points=useTrailStop, trail_offset=useTrailOffset)

strategy.exit("Exit Sell", from_entry="Sell", profit=useTakeProfit, loss=useStopLoss, trail_points=useTrailStop, trail_offset=useTrailOffset)

//EOF

Contenido relacionado

- Estrategias de optimización de la dinámica de tendencias en combinación con indicadores de canal G

- Estudio de versión optimizada de estrategias de entrada flexibles basadas en RSI y MACD en cinco días

- El RSI-MACD es un sistema de negociación de múltiples señales combinado con una estrategia de stop loss dinámica.

- Los indicadores múltiples se alejan de las estrategias de compra y venta y de la adaptación a la contención de pérdidas.

- Estrategias de trading de línea larga combinadas con el MACD y el RSI

- Estrategias de espacio múltiple combinadas con RSI y MACD

- Darvas, la estrategia de gestión de riesgos y el despliegue de la caja

- Estrategias de desviación de la dinámica de la nube de seguimiento de tendencias

- La estrategia de la pirámide inteligente de múltiples indicadores

- Estrategias de trading de alta frecuencia de criptomonedas de bajo riesgo y estabilidad basadas en RSI y MACD

Más contenido

- Tendencia lineal

- Patrón de tiempo de Fibonacci

- Caja Darvas Comprar Vender

- Indicador de configuración de demarque

- Las bandas de Bollinger RSI estocástico extremo

- Indicador MACD BB V 1,00

- SAR parabólico

- Indicador de divergencia de los índices de rentabilidad

- Indicador MACD del OBV

- Tendencia pivotal

- La ruptura de soporte-resistencia

- Promedio móvil adaptativo de pendiente

- Estrategia del oscilador Delta-RSI

- Estrategia de escáner bajo cripto

- [blackcat] L2 estrategia de reversión de las etiquetas

- SuperB

- Alto SAR bajo

- SuperTREX

- Detector de picos

- Buscador bajo