概述

本策略是一个结合了相对强弱指数(RSI)和移动平均线趋同/发散指标(MACD)的量化交易策略。策略的核心在于通过观察RSI超买超卖区域,结合MACD指标在近5个交易周期内的交叉信号来确定市场趋势方向,并设置了止盈止损来控制风险。这种方法不仅能够提供更准确的交易信号,还能有效降低虚假信号带来的风险。

策略原理

策略主要基于以下几个核心组件: 1. RSI指标使用14周期作为参数设置,通过判断资产是否处于超买(>70)或超卖(<30)状态来识别潜在的反转机会。 2. MACD指标采用经典的12-26-9参数组合,通过在5个交易周期内寻找MACD线与信号线的交叉来确认趋势变化。 3. 入场逻辑包括两个条件: - 做多条件:RSI在5个周期内的最低值低于30,同时MACD线在近5个周期内出现与信号线的向上交叉。 - 做空条件:RSI在5个周期内的最高值高于70,同时MACD线在近5个周期内出现与信号线的向下交叉。 4. 风险控制采用对称的2%止损和2%止盈设置。

策略优势

- 多指标交叉验证提高了信号可靠性,通过RSI和MACD的配合使用,能够有效过滤单一指标可能产生的虚假信号。

- 灵活的5日周期观察窗口可以捕捉更多交易机会,同时避免错过重要的市场转折点。

- 对称的止盈止损设置有利于资金管理,可以有效控制单笔交易的风险。

- 策略逻辑简单明确,易于理解和执行,适合作为基础策略进行进一步优化。

策略风险

- RSI和MACD都属于滞后指标,在剧烈波动的市场中可能会产生延迟。

- 固定的止盈止损比例可能不适合所有市场环境,在波动率变化时需要及时调整。

- 5日观察周期可能在某些市场条件下过短,导致过度交易。

- 没有考虑成交量因素,可能在低流动性环境下产生不准确的信号。

策略优化方向

- 引入波动率自适应机制,根据市场波动情况动态调整止盈止损比例。

- 增加成交量指标作为辅助确认,提高信号的可靠性。

- 开发动态周期选择机制,根据市场状态自动调整观察窗口大小。

- 添加趋势过滤器,在强趋势市场中避免逆势交易。

- 考虑引入时间过滤器,避免在市场开盘和收盘等波动较大的时段交易。

总结

该策略通过结合RSI和MACD指标,配合灵活的入场条件和风险控制机制,构建了一个相对完整的交易系统。虽然存在一些需要优化的地方,但基本框架具有良好的可扩展性,通过进一步的优化和完善,有望发展成为一个更加稳健的交易策略。

策略源码

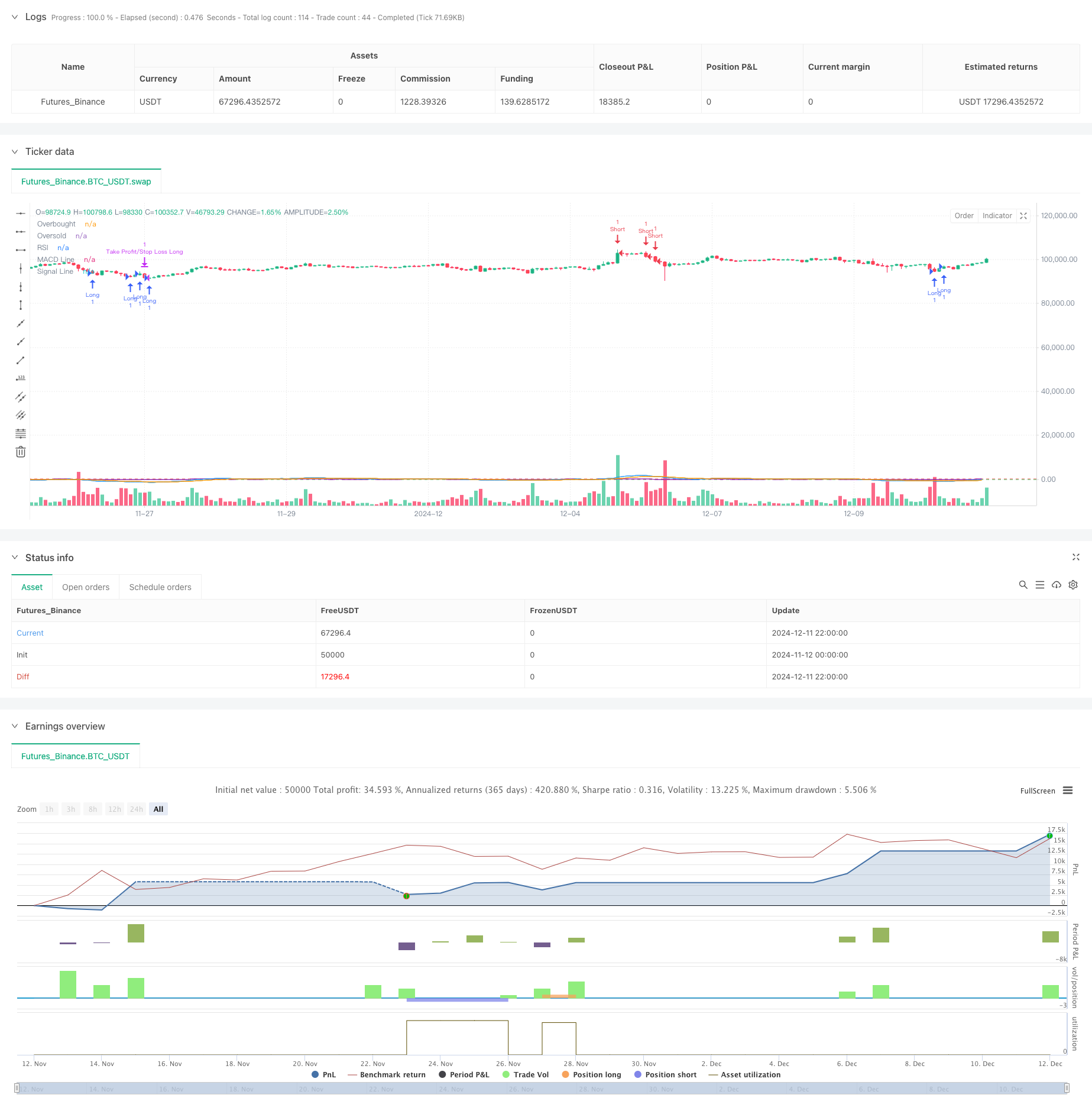

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-12 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MACD & RSI Strategy with SL/TP and Flexible Entry (5 bars)", overlay=true)

// Параметры для RSI и MACD

rsiLength = 14

overbought = 70

oversold = 30

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Рассчитаем RSI

rsi = ta.rsi(close, rsiLength)

// Проверка пересечения MACD

macdCrossOver = ta.crossover(macdLine, signalLine)

macdCrossUnder = ta.crossunder(macdLine, signalLine)

// Логика для проверки пересечения MACD за последние 5 баров

var bool macdCrossOverRecent = false

var bool macdCrossUnderRecent = false

// Проверяем пересечения за последние 5 баров

for i = 0 to 4

if macdCrossOver[i]

macdCrossOverRecent := true

if macdCrossUnder[i]

macdCrossUnderRecent := true

// Условия для шортовой сделки: RSI выше 70 (перекупленность) + пересечение MACD за последние 5 баров

shortCondition = ta.highest(rsi, 5) > overbought and macdCrossOverRecent

// Условия для лонговой сделки: RSI ниже 30 (перепроданность) + пересечение MACD за последние 5 баров

longCondition = ta.lowest(rsi, 5) < oversold and macdCrossUnderRecent

// Процент для стоп-лосса и тейк-профита

takeProfitPercent = 0.02

stopLossPercent = 0.02

// Открытие шортовой позиции

if (shortCondition)

strategy.entry("Short", strategy.short)

// Открытие лонговой позиции

if (longCondition)

strategy.entry("Long", strategy.long)

// Рассчитываем стоп-лосс и тейк-профит для шорта

shortStopLoss = strategy.position_avg_price * (1 + stopLossPercent)

shortTakeProfit = strategy.position_avg_price * (1 - takeProfitPercent)

// Рассчитываем стоп-лосс и тейк-профит для лонга

longStopLoss = strategy.position_avg_price * (1 - stopLossPercent)

longTakeProfit = strategy.position_avg_price * (1 + takeProfitPercent)

// Устанавливаем выход по стоп-лоссу и тейк-профиту для шортов

if (strategy.position_size < 0) // Проверяем, что открыта шортовая позиция

strategy.exit("Take Profit/Stop Loss Short", "Short", stop=shortStopLoss, limit=shortTakeProfit)

// Устанавливаем выход по стоп-лоссу и тейк-профиту для лонгов

if (strategy.position_size > 0) // Проверяем, что открыта лонговая позиция

strategy.exit("Take Profit/Stop Loss Long", "Long", stop=longStopLoss, limit=longTakeProfit)

// Графики для отображения RSI и MACD

plot(rsi, "RSI", color=color.purple)

hline(overbought, "Overbought", color=color.red)

hline(oversold, "Oversold", color=color.green)

plot(macdLine, "MACD Line", color=color.blue)

plot(signalLine, "Signal Line", color=color.orange)

相关推荐