Modelo de reversión de la ruptura basado en la estrategia de negociación de tortugas

El autor:¿ Qué pasa?, Fecha: 2024-01-29 16:48:00Las etiquetas:

Resumen general

Esta estrategia se basa en la famosa

Cabe señalar que la estrategia combina dos sistemas que trabajan juntos (S1 y S2).

Estrategia lógica

El tamaño de posición es muy importante para los operadores de tortugas para gestionar adecuadamente el riesgo. Esta estrategia de tamaño de posición se adapta a la volatilidad del mercado y la cuenta (ganancias y pérdidas). Se basa en ATR (Rango Verdadero Medio), que también se puede llamar

El número de unidades a comprar es:

unit = (percentage_to_risk/100)*account/atr*syminfo.pointvalue

Dependiendo de su apetito por el riesgo, puede aumentar el porcentaje de su cuenta, pero los comerciantes de tortugas no cumplen con el 1%.

También existe una regla adicional para reducir el riesgo si el valor de la cuenta cae por debajo del capital inicial: en este caso y sólo en este caso, en la fórmula de unidad se debe sustituir por:

account := (strategy.equity-strategy.openprofit)*(strategy.equity-strategy.openprofit)/strategy.initial_capital

2 sistemas trabajan juntos:

Si es un nuevo máximo, abrimos una posición larga y viceversa si es un nuevo mínimo entramos en una posición corta.

Añadimos una regla adicional:

Esta regla adicional permite al operador estar en tendencias principales si se ha omitido la señal del sistema 1. Si se ha omitido una señal para el sistema 1, y la siguiente vela también es una nueva ruptura de 20 días, S1 no da una señal.

Análisis de ventajas

La estrategia de la tortuga nos permite añadir unidades adicionales a la posición si el precio se mueve a nuestro favor. He configurado la estrategia para permitir que hasta 5 órdenes se agreguen en la misma dirección.

Hemos establecido un SL máximo del 10% para el primer pedido, lo que significa que no perderá más del 10% del valor de su primer pedido. Sin embargo, es posible perder más en sus órdenes piramidal, ya que el SL se incrementa/disminuye en 0.5*ATR(20), lo que no asegura una pérdida de más del 10% en sus órdenes piramidal.

Análisis de riesgos

El mayor riesgo de esta estrategia son las posiciones de gran tamaño. Dado que las órdenes de mercado se utilizan para la colocación de órdenes, la colocación de múltiples órdenes de mercado enormes al mismo tiempo tendrá un gran impacto en la cotización, causando un gran deslizamiento. Esto llevará a enormes pérdidas de capital.

Otro riesgo es la configuración inadecuada de la gestión de capital. Por ejemplo, la configuración incorrecta de stop loss o las proporciones de gran tamaño pueden conducir a pérdidas enormes. Esto debe configurarse con precaución de acuerdo con el propio apetito de riesgo.

Optimización

La estrategia se puede optimizar en los siguientes aspectos:

-

Prueba el impacto de diferentes parámetros como el período ATR, el multiplicador ATR para la pérdida de parada, etc. en la relación de retorno y de puntería.

-

Prueba diferentes reglas de entrada y salida. Por ejemplo, usa patrones de velas como filtros adicionales.

-

Pruebe otros tipos de stop loss, como stop loss móvil, stop loss dinámico. Esto puede reducir la probabilidad de que se alcance el stop loss.

-

Prueba el número de pedidos de la pirámide, cuanto más pedidos, mayor es el apalancamiento y el riesgo.

-

Trate de dejar de operar durante períodos de tiempo específicos (como antes de la publicación de los datos de las nóminas no agrícolas de EE.UU.) para evitar el impacto de eventos importantes.

Resumen de las actividades

En general, esta estrategia alcanza un buen equilibrio entre riesgo y recompensa, adecuada para el comercio de tendencias a mediano y largo plazo. Tiene las ventajas de la sistematización del comercio, riesgos controlables. La estrategia puede mejorarse aún más mediante la optimización para aumentar la estabilidad y el rendimiento.

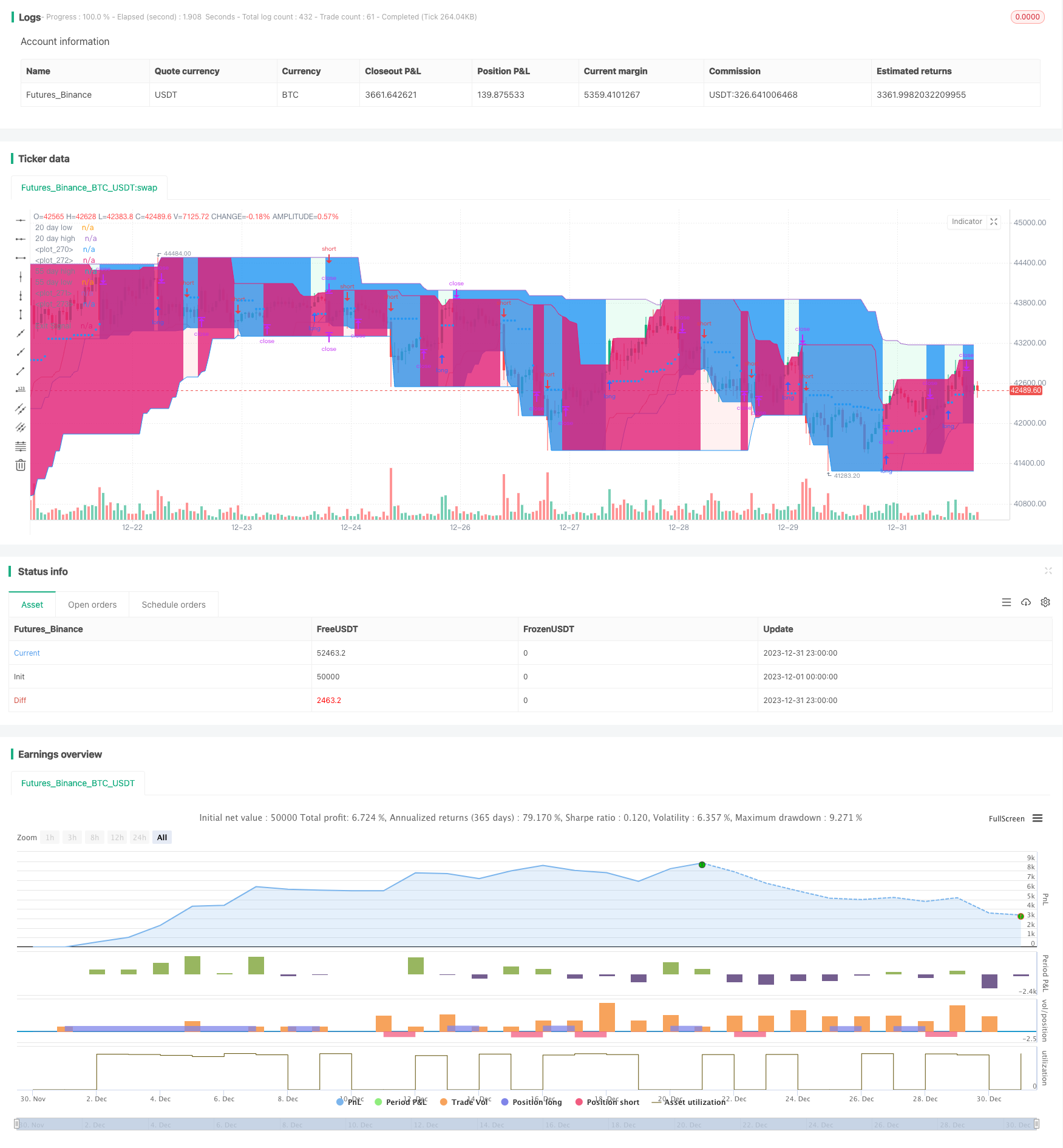

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gsanson66

//This strategy is based on the famous "Turtle Strategy"

//A well-known strategy which proved its performance during past years

//@version=5

strategy("TURTLE STRATEGY", overlay=true)

//------------------------------TOOL TIPS--------------------------------//

t1 = "Percentage of the account the trader is willing to lose. This percentage is used to define the position size based on previous gains or losses. Turtle traders default to 1%."

t2 = "ATR Length"

t3 = "ATR Multiplier to fix the Stop Loss"

t4 = "Pyramiding : ATR Multiplier to set a profit target to increase position size"

t5 = "System 1 enter long if there is a new high after this selected period of time"

t6 = "System 2 enter long if there is a new high after this selected period of time"

t7 = "Exit Long from system 1 if there is a new low after this selected period of time"

t8 = "Exit Long from system 2 if there is a new low after this selected period of time"

t9 = "System 1 enter short if there is a new low after this selected period of time"

t10 = "System 2 enter short if there is a new low after this selected period of time"

t11 = "Exit short from system 1 if there is a new high after this selected period of time"

t12 = "Exit short from system 2 if there is a new high after this selected period of time"

//----------------------------------------FUNCTIONS---------------------------------------//

//@function Displays text passed to `txt` when called.

debugLabel(txt, color) =>

label.new(bar_index, high, text=txt, color=color, style=label.style_label_lower_right, textcolor=color.black, size=size.small)

//@function which looks if the close date of the current bar falls inside the date range

inBacktestPeriod(start, end) => true

//---------------------------------------USER INPUTS--------------------------------------//

//Risk Management and turtle system input

percentage_to_risk = input.float(1, "Risk % of capital", maxval=100, minval=0, group="Turtle Parameters", tooltip=t1)

atr_period = input.int(20, "ATR period", minval=1, group="Turtle Parameters", tooltip=t2)

stop_N_multiplier = input.float(1.5, "Stop ATR", minval=0.1, group="Turtle Parameters", tooltip=t3)

pyramid_profit = input.float(0.5, "Pyramid Profit", minval=0.01, group="Turtle Parameters", tooltip=t4)

S1_long = input.int(20, "S1 Long", minval=1, group="Turtle Parameters", tooltip=t5)

S2_long = input.int(55, "S2 Long", minval=1, group="Turtle Parameters", tooltip=t6)

S1_long_exit = input.int(10, "S1 Long Exit", minval=1, group="Turtle Parameters", tooltip=t7)

S2_long_exit = input.int(20, "S2 Long Exit", minval=1, group="Turtle Parameters", tooltip=t8)

S1_short = input.int(15, "S1 Short", minval=1, group="Turtle Parameters", tooltip=t9)

S2_short = input.int(55, "S2 Short", minval=1, group="Turtle Parameters", tooltip=t10)

S1_short_exit = input.int(7, "S1 Short Exit", minval=1, group="Turtle Parameters", tooltip=t11)

S2_short_exit = input.int(20, "S2 Short Exit", minval=1, group="Turtle Parameters", tooltip=t12)

//Backtesting period

startDate = input(title="Start Date", defval=timestamp("1 Jan 2020 00:00:00"), group="Backtesting Period")

endDate = input(title="End Date", defval=timestamp("1 July 2034 00:00:00"), group="Backtesting Period")

//----------------------------------VARIABLES INITIALISATION-----------------------------//

//Turtle variables

atr = ta.atr(atr_period)

var float buy_price_long = na

var float buy_price_short = na

var float stop_loss_long = na

var float stop_loss_short = na

float account = na

//Entry variables

day_high_syst1 = ta.highest(high, S1_long)

day_low_syst1 = ta.lowest(low, S1_short)

day_high_syst2 = ta.highest(high, S2_long)

day_low_syst2 = ta.lowest(low, S2_short)

var bool skip = false

var bool unskip_buffer_long = false

var bool unskip_buffer_short = false

//Exit variables

exit_long_syst1 = ta.lowest(low, S1_long_exit)

exit_short_syst1 = ta.highest(high, S1_short_exit)

exit_long_syst2 = ta.lowest(low, S2_long_exit)

exit_short_syst2 = ta.highest(high, S2_short_exit)

float exit_signal = na

//Backtesting period

bool inRange = na

//------------------------------CHECKING SOME CONDITIONS ON EACH SCRIPT EXECUTION-------------------------------//

strategy.initial_capital = 50000

//Checking if the date belong to the range

inRange := inBacktestPeriod(startDate, endDate)

//Checking if the current equity is higher or lower than the initial capital to adjusted position size

if strategy.equity - strategy.openprofit < strategy.initial_capital

account := (strategy.equity-strategy.openprofit)*(strategy.equity-strategy.openprofit)/strategy.initial_capital

else

account := strategy.equity - strategy.openprofit

//Checking if we close all trades in case where we exit the backtesting period

if strategy.position_size!=0 and not inRange

strategy.close_all()

debugLabel("END OF BACKTESTING PERIOD : we close the trade", color=color.rgb(116, 116, 116))

//--------------------------------------SKIP MANAGEMENT------------------------------------//

//Checking if a long signal has been skiped and system2 is not triggered

if skip and high>day_high_syst1[1] and high<day_high_syst2[1]

unskip_buffer_long := true

//Checking if a short signal has been skiped and system2 is not triggered

if skip and low<day_low_syst1[1] and low>day_low_syst2[1]

unskip_buffer_short := true

//Checking if current high is lower than previous 20_day_high after a skiped long signal to set skip to false

if unskip_buffer_long

if high<day_high_syst1[1]

skip := false

unskip_buffer_long := false

//Checking if current low is higher than previous 20_day_low after a skiped short signal to set skip to false

if unskip_buffer_short

if low>day_low_syst1[1]

skip := false

unskip_buffer_short := false

//Checking if we have an open position to reset skip and unskip buffers

if strategy.position_size!=0 and skip

skip := false

unskip_buffer_long := false

unskip_buffer_short := false

//--------------------------------------------ENTRY CONDITIONS--------------------------------------------------//

//We calculate the position size based on turtle calculation

unit = (percentage_to_risk/100)*account/atr*syminfo.pointvalue

//Long order for system 1

if not skip and not (strategy.position_size>0) and inRange

strategy.cancel("Long Syst 2")

//We check that position size doesn't exceed available equity

if unit*day_high_syst1>account

unit := account/day_high_syst1

stop_loss_long := day_high_syst1 - stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_long < day_high_syst1*0.9

stop_loss_long := day_high_syst1*0.9

strategy.order("Long Syst 1", strategy.long, unit, stop=day_high_syst1)

buy_price_long := day_high_syst1

//Long order for system 2

if skip and not (strategy.position_size>0) and inRange

//We check that position size doesn't exceed available equity

if unit*day_high_syst2>account

unit := account/day_high_syst2

stop_loss_long := day_high_syst2 - stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_long < day_high_syst2*0.9

stop_loss_long := day_high_syst2*0.9

strategy.order("Long Syst 2", strategy.long, unit, stop=day_high_syst2)

buy_price_long := day_high_syst2

//Short order for system 1

if not skip and not (strategy.position_size<0) and inRange

strategy.cancel("Short Syst 2")

//We check that position size doesn't exceed available equity

if unit*day_low_syst1>account

unit := account/day_low_syst1

stop_loss_short := day_low_syst1 + stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_short > day_low_syst1*1.1

stop_loss_short := day_low_syst1*1.1

strategy.order("Short Syst 1", strategy.short, unit, stop=day_low_syst1)

buy_price_short := day_low_syst1

//Short order for system 2

if skip and not (strategy.position_size<0) and inRange

//We check that position size doesn't exceed available equity

if unit*day_low_syst2>account

unit := account/day_low_syst2

stop_loss_short := day_low_syst2 + stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_short > day_low_syst2*1.1

stop_loss_short := day_low_syst2*1.1

strategy.order("Short Syst 2", strategy.short, unit, stop=day_low_syst2)

buy_price_short := day_low_syst2

//-------------------------------PYRAMIDAL------------------------------------//

//Pyramid for long orders

if close > buy_price_long + (pyramid_profit*atr) and strategy.position_size>0

//We calculate the remaining capital

remaining_capital = account - strategy.position_size*strategy.position_avg_price*(1-0.0018)

//We calculate units to add to the long position

units_to_add = (percentage_to_risk/100)*remaining_capital/atr*syminfo.pointvalue

if remaining_capital > units_to_add

//We set the new Stop loss

stop_loss_long := stop_loss_long + pyramid_profit*atr

strategy.entry("Pyramid Long", strategy.long, units_to_add)

buy_price_long := close

//Pyramid for short orders

if close < buy_price_short - (pyramid_profit*atr) and strategy.position_size<0

//We calculate the remaining capital

remaining_capital = account + strategy.position_size*strategy.position_avg_price*(1-0.0018)

//We calculate units to add to the short position

units_to_add = (percentage_to_risk/100)*remaining_capital/atr*syminfo.pointvalue

if remaining_capital > units_to_add

//We set the new Stop loss

stop_loss_short := stop_loss_short - pyramid_profit*atr

strategy.entry("Pyramid Short", strategy.short, units_to_add)

buy_price_short := close

//----------------------------EXIT ORDERS-------------------------------//

//Checking if exit_long_syst1 is higher than stop_loss_long

if strategy.opentrades.entry_id(0)=="Long Syst 1"

if exit_long_syst1[1] > stop_loss_long

exit_signal := exit_long_syst1[1]

else

exit_signal := stop_loss_long

//Checking if exit_long_syst2 is higher than stop_loss_long

if strategy.opentrades.entry_id(0)=="Long Syst 2"

if exit_long_syst2[1] > stop_loss_long

exit_signal := exit_long_syst2[1]

else

exit_signal := stop_loss_long

//Checking if exit_short_syst1 is lower than stop_loss_short

if strategy.opentrades.entry_id(0)=="Short Syst 1"

if exit_short_syst1[1] < stop_loss_short

exit_signal := exit_short_syst1[1]

else

exit_signal := stop_loss_short

//Checking if exit_short_syst2 is lower than stop_loss_short

if strategy.opentrades.entry_id(0)=="Short Syst 2"

if exit_short_syst2[1] < stop_loss_short

exit_signal := exit_short_syst2[1]

else

exit_signal := stop_loss_short

//If the exit order is configured to close the position at a profit, we set 'skip' to true (we substract commission)

if strategy.position_size*exit_signal>strategy.position_size*strategy.position_avg_price*(1-0.0018)

strategy.cancel("Long Syst 1")

strategy.cancel("Short Syst 1")

skip := true

if strategy.position_size*exit_signal<=strategy.position_size*strategy.position_avg_price*(1-0.0018)

skip := false

//We place stop exit orders

if strategy.position_size > 0

strategy.exit("Exit Long", stop=exit_signal)

if strategy.position_size < 0

strategy.exit("Exit Short", stop=exit_signal)

//------------------------------PLOTTING ELEMENTS-------------------------------//

plotchar(atr, "ATR", "", location.top, color.rgb(131, 5, 83))

//Plotting enter threshold

plot(day_high_syst1[1], "20 day high", color.rgb(118, 217, 159))

plot(day_high_syst2[1], "55 day high", color.rgb(4, 92, 53))

plot(day_low_syst1[1], "20 day low", color.rgb(234, 108, 108))

plot(day_low_syst2[1], "55 day low", color.rgb(149, 17, 17))

//Plotting Exit Signal

plot(exit_signal, "Exit Signal", color.blue, style=plot.style_circles)

//Plotting our position

exit_long_syst2_plot = plot(exit_long_syst2[1], color=na)

day_high_syst2_plot = plot(day_high_syst2[1], color=na)

exit_short_syst2_plot = plot(exit_short_syst2[1], color=na)

day_low_syst2_plot = plot(day_low_syst2[1], color=na)

fill(exit_long_syst2_plot, day_high_syst2_plot, color=strategy.position_size>0 ? color.new(color.lime, 90) : na)

fill(exit_short_syst2_plot, day_low_syst2_plot, color=strategy.position_size<0 ? color.new(color.red, 90) : na)

- Estrategia de scalping basada en la liquidez y la tendencia del mercado

- Estrategia 5EMA para la reversión de los avances transfronterizos a corto plazo

- Estrategia de pirámide de negociación de acciones basada en indicadores RSI

- Todo acerca de la estrategia de negociación del canal EMA

- Estrategia de negociación del RSI de doble piso

- Las bandas de Bollinger y la estrategia de combinación del RSI

- Estrategia de doble barra interior y tendencia

- Es una estrategia increíble de ruptura de precios

- Estrategia de continuación de una tendencia sólida

- Estrategia de seguimiento de tendencias de media móvil cruzada

- Estrategia de tendencia de impulso

- Se trata de la suma de los valores de las acciones de la entidad en el mercado de valores de la entidad.

- Estrategia de negociación de acciones suavizada basada en el índice de rentabilidad

- Estrategia de banda de volatilidad suave

- Estrategia de negociación de inversión del índice de canal de materias primas

- Estrategia basada en el tiempo con ATR Take Profit

- Estrategia de seguimiento de tendencias de impulso

- Estrategia de cierre de la vela de EMA

- Estrategia de negociación cuantitativa cruzada de la EMA

- Estrategia dinámica de media móvil de stop-loss