Estrategia de ruptura de momentum basada en bloques de órdenes

Descripción general

La estrategia busca un rango de precios con un gran impulso identificando bloques de pedidos en el precio y entran en el mercado cuando se produce una señal de compra y venta. Los bloques de pedidos marcan las áreas en las que las instituciones participan, lo que refleja una mayor fuerza del mercado. Por lo tanto, cuando se produce una señal de bloques de pedidos, hay una mayor probabilidad de que se produzca un cambio de precio tendencial.

Principio de estrategia

Identificación de las órdenes

Los bloques de orden se dividen en bloques de orden múltiple y bloques de orden en blanco. Los bloques de orden múltiple se definen como una línea K hacia abajo (la línea K roja) seguida de una línea K hacia arriba (la línea K verde). Los bloques de orden en blanco se definen como una línea K hacia arriba (la línea K verde) seguida de una línea K hacia abajo (la línea K roja).

Para identificar un bloque de pedidos, se requiere que se cumplan las siguientes condiciones:

El color de la línea K cambia: el color de la línea K cambia de color de la línea K anterior a la línea K actual (por ejemplo, de rojo a verde, o de verde a rojo). Esto indica que puede haber una tendencia antes de que la institución termine y esté lista para iniciar una nueva tendencia.

La dirección de color de las líneas K sucesivas es uniforme: después de alcanzar la raíz especificada en el parámetro periodos, las líneas K sucesivas mantienen la misma dirección de color (por ejemplo, todos los bloques de pedidos de múltiples cabezas están detrás de líneas K verdes). Esto indica que la nueva tendencia se refuerza y confirma.

El alza y la caída superan el umbral: desde el precio de apertura de la pieza de pedido hasta el precio de cierre de la línea K posterior, el alza y la caída superan el umbral establecido en el parámetro ((default0) ̳ que asegura que la nueva tendencia tenga suficiente fuerza e influencia ̳.

Cuando se cumplen las tres condiciones anteriores, se puede reconocer una señal de bloque de orden.

La generación de señales de negociación

Cuando se identifican bloques de órdenes múltiples, se genera una señal de compra; cuando se identifican bloques de órdenes vacíos, se genera una señal de venta.

Teniendo en cuenta la incertidumbre de las señales de bloque de pedidos y la posibilidad de volver a probarlas, la estrategia no entra directamente en el mercado cuando aparece la señal de bloque de pedidos, sino que alerta al comerciante mediante líneas de dibujo, alarmas, etc. El comerciante puede optar por implementar un precio de límite apropiado cerca de la zona de precios de los bloques de pedidos y esperar a que los precios se activen para entrar en la tendencia.

Ventajas estratégicas

Dinámica de la información de flujo de pedidos

Los bloques de pedidos marcan la participación de los fondos de la institución y el gran volumen de transacciones que representan la conversión de las fuerzas del mercado. Por lo tanto, las señales de los bloques de pedidos tienen cierta previsibilidad y precisión, y se puede capturar de antemano la dirección de las posibles rupturas. Esto proporciona una posición y un momento favorables para abordar la tendencia.

Parámetros de la política ajustables

Los parámetros de la estrategia, incluidos el número de líneas K históricas, la amplitud del movimiento de ruptura, etc., se pueden ajustar a través de los parámetros para optimizar y mejorar la adaptabilidad de la estrategia para diferentes entornos de mercado y estilos de comerciantes.

El riesgo está bajo control

La estrategia no entra en el mercado cuando aparece la señal de bloque de pedidos, sino que establece una alarma y construye posiciones a través de una lista de precios límite fuera del campo. De esta manera, el comerciante puede controlar el punto de entrada y el riesgo específicos. Incluso si la señal de bloque de pedidos se equivoca, solo puede provocar que la lista de precios límite no se active, y el riesgo puede controlarse.

Riesgo estratégico

Las señales de bloque de pedidos tienen una mayor probabilidad de ser probadas de nuevo

Dado que el bloque de órdenes marca un intervalo, hay una mayor probabilidad de que el precio posterior vuelva a resonar en ese intervalo. Por lo tanto, la señal de bloque de órdenes no se utiliza como una señal de entrada estándar, sino como una información de alerta, que requiere que el comerciante juzgue el momento de la entrada por sí mismo.

Los parámetros mal configurados pueden generar señales erróneas

La configuración de los parámetros del bloque de pedidos (número de líneas K históricas, valores de amplitud, etc.) puede generar falsas señales en el intervalo de Sideways normal si no es apropiada. Esto requiere que el comerciante tenga cierta sensibilidad y juicio al mercado para evitar la optimización ciega de los parámetros.

Se requiere una evaluación manual de la calidad de cada señal.

Debido a que las señales de bloque de pedidos no son 100% fiables, el comerciante necesita un análisis adicional al obtener la señal para determinar la credibilidad de la señal actual, lo que aumenta un cierto volumen de trabajo manual. Diferentes juicios sobre la calidad de la señal también pueden causar diferencias en el rendimiento de las operaciones.

Dirección de optimización de la estrategia

Combinación de otros indicadores para filtrar falsas señales

Se puede combinar con otros indicadores para juzgar la dirección y la intensidad de la tendencia cuando aparece la señal de bloque de pedidos, por ejemplo, en combinación con MACD, RSI, etc., para filtrar las señales erróneas causadas por la configuración de los parámetros y mejorar la precisión de la señal.

Ajuste de los parámetros de optimización

Los parámetros, como el número de líneas K, el umbral de alza y caída, pueden ser probados y optimizados para adaptarse mejor al entorno de mercado actual en diferentes mercados y diferentes variedades de operaciones. También se puede configurar la función de adaptación de los parámetros, que se ajustan automáticamente según la volatilidad del mercado y las preferencias de riesgo.

Desarrollo de mecanismos automatizados de entrada y salida

En la actualidad, la estrategia es solo una herramienta de indicación de señales, y el comerciante debe decidir por sí mismo cuándo entrar. Podemos desarrollar un mecanismo de pedido automático para el rango de precios de los bloques de órdenes, que entra automáticamente cuando se cumplen ciertas condiciones; y combinar métodos como el stop loss para establecer la lógica de salida, reducir el requisito de juicio manual y aumentar el grado de automatización de la estrategia.

Resumir

La estrategia de bloque de pedidos tiene una cierta capacidad de identificación de cabeza y la iniciativa en comparación con los métodos de seguimiento de tendencias simple. Cuando se utiliza en combinación con la optimización de parámetros, métodos de control de viento, puede ser una estrategia de tendencias eficaz. Pero los comerciantes necesitan estar alerta a la generación de señales erróneas, y para cada juicio de la calidad de la señal.

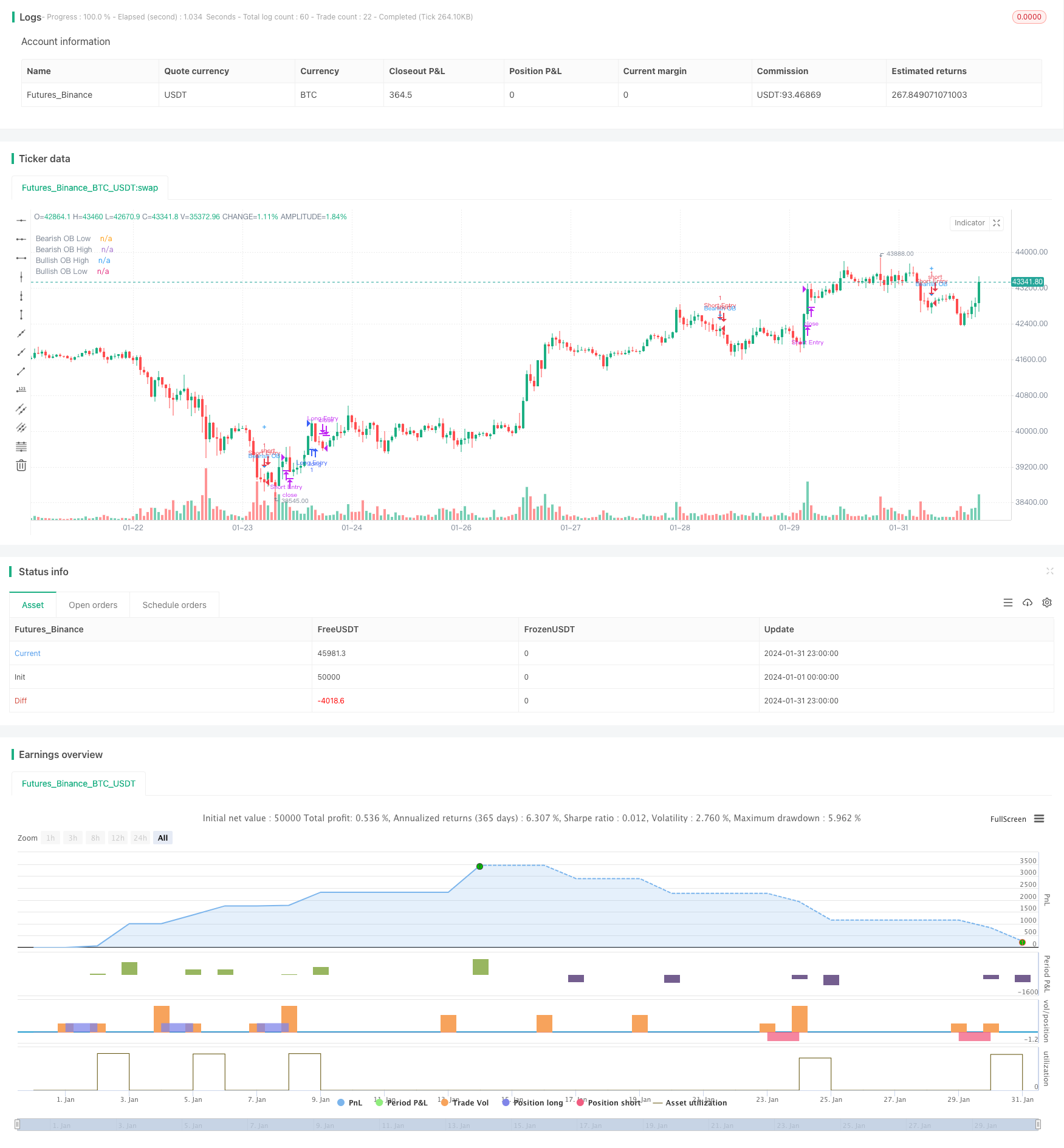

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingSecrets and wugamlo

// This experimental Indicator helps identifying instituational Order Blocks.

// Often these blocks signal the beginning of a strong move, but there is a significant probability that these price levels will be revisited at a later point in time again.

// Therefore these are interesting levels to place limit orders (Buy Orders for Bullish OB / Sell Orders for Bearish OB).

//

// A Bullish Order block is defined as the last down candle before a sequence of up candles. (Relevant price range "Open" to "Low" is marked) / Optionally full range "High" to "Low"

// A Bearish Order Block is defined as the last up candle before a sequence of down candles. (Relevant price range "Open" to "High" is marked) / Optionally full range "High" to "Low"

//

// In the settings the number of required sequential candles can be adjusted.

// Furthermore a %-threshold can be entered. It defines which %-change the sequential move needs to achieve in order to identify a relevant Order Block.

// Channels for the last Bullish/Bearish Block can be shown/hidden.

//

// In addition to the upper/lower limits of each Order Block, also the equlibrium (average value) is marked as this is an interesting area for price interaction.

//

// Alerts added: Alerts fire when an Order Block is detected. The delay is based on the "Relevant Periods" input. Means with the default setting "5" the alert will trigger after the

// number of consecutive candles is reached.

//@version=4

strategy("[Backtest] Order Block Finder", overlay = true)

colors = input(title = "Color Scheme", defval="DARK", options=["DARK", "BRIGHT"])

periods = input(5, "Relevant Periods to identify OB") // Required number of subsequent candles in the same direction to identify Order Block

threshold = input(0.0, "Min. Percent move to identify OB", step = 0.1) // Required minimum % move (from potential OB close to last subsequent candle to identify Order Block)

usewicks = input(false, "Use whole range [High/Low] for OB marking?" ) // Display High/Low range for each OB instead of Open/Low for Bullish / Open/High for Bearish

showbull = input(false, "Show latest Bullish Channel?") // Show Channel for latest Bullish OB?

showbear = input(false, "Show latest Bearish Channel?") // Show Channel for latest Bearish OB?

showdocu = input(false, "Show Label for documentation tooltip?") // Show Label which shows documentation as tooltip?

info_pan = input(false, "Show Latest OB Panel?") // Show Info Panel with latest OB Stats

//strategy inputs

plot_offset = input( type=input.bool,defval = false, title = 'Plot Offset?')

stoploss_percent = input(type=input.float, defval = 1, title = 'Stop Loss [%]')

takeprofit_percent = input(type=input.float, defval = 2, title = 'Take Profit [%]')

pyramiding = input( type=input.bool,defval = true, title = 'Pyramiding')

ob_period = periods + 1 // Identify location of relevant Order Block candle

absmove = ((abs(close[ob_period] - close[1]))/close[ob_period]) * 100 // Calculate absolute percent move from potential OB to last candle of subsequent candles

relmove = absmove >= threshold // Identify "Relevant move" by comparing the absolute move to the threshold

// Color Scheme

bullcolor = colors == "DARK"? color.white : color.green

bearcolor = colors == "DARK"? color.blue : color.red

// Bullish Order Block Identification

bullishOB = close[ob_period] < open[ob_period] // Determine potential Bullish OB candle (red candle)

int upcandles = 0

for i = 1 to periods

upcandles := upcandles + (close[i] > open[i]? 1 : 0) // Determine color of subsequent candles (must all be green to identify a valid Bearish OB)

OB_bull = bullishOB and (upcandles == (periods)) and relmove // Identification logic (red OB candle & subsequent green candles)

OB_bull_high = OB_bull? usewicks? high[ob_period] : open[ob_period] : na // Determine OB upper limit (Open or High depending on input)

OB_bull_low = OB_bull? low[ob_period] : na // Determine OB lower limit (Low)

OB_bull_avg = (OB_bull_high + OB_bull_low)/2 // Determine OB middle line

// Bearish Order Block Identification

bearishOB = close[ob_period] > open[ob_period] // Determine potential Bearish OB candle (green candle)

int downcandles = 0

for i = 1 to periods

downcandles := downcandles + (close[i] < open[i]? 1 : 0) // Determine color of subsequent candles (must all be red to identify a valid Bearish OB)

OB_bear = bearishOB and (downcandles == (periods)) and relmove // Identification logic (green OB candle & subsequent green candles)

OB_bear_high = OB_bear? high[ob_period] : na // Determine OB upper limit (High)

OB_bear_low = OB_bear? usewicks? low[ob_period] : open[ob_period] : na // Determine OB lower limit (Open or Low depending on input)

OB_bear_avg = (OB_bear_low + OB_bear_high)/2 // Determine OB middle line

//@TradingSecrets: Option to disable the offset in order to allign signals with Backtest

if not plot_offset

ob_period := 0

// Plotting

plotshape(OB_bull, title="Bullish OB", style = shape.triangleup, color = bullcolor, textcolor = bullcolor, size = size.tiny, location = location.belowbar, offset = -ob_period, text = "Bullish OB") // Bullish OB Indicator

bull1 = plot(OB_bull_high, title="Bullish OB High", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 3) // Bullish OB Upper Limit

bull2 = plot(OB_bull_low, title="Bullish OB Low", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 3) // Bullish OB Lower Limit

fill(bull1, bull2, color=bullcolor, transp = 0, title = "Bullish OB fill") // Fill Bullish OB

plotshape(OB_bull_avg, title="Bullish OB Average", style = shape.cross, color = bullcolor, size = size.normal, location = location.absolute, offset = -ob_period) // Bullish OB Average

plotshape(OB_bear, title="Bearish OB", style = shape.triangledown, color = bearcolor, textcolor = bearcolor, size = size.tiny, location = location.abovebar, offset = -ob_period, text = "Bearish OB") // Bearish OB Indicator

bear1 = plot(OB_bear_low, title="Bearish OB Low", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 3) // Bearish OB Lower Limit

bear2 = plot(OB_bear_high, title="Bearish OB High", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 3) // Bearish OB Upper Limit

fill(bear1, bear2, color=bearcolor, transp = 0, title = "Bearish OB fill") // Fill Bearish OB

plotshape(OB_bear_avg, title="Bearish OB Average", style = shape.cross, color = bearcolor, size = size.normal, location = location.absolute, offset = -ob_period) // Bullish OB Average

var line linebull1 = na // Bullish OB average

var line linebull2 = na // Bullish OB open

var line linebull3 = na // Bullish OB low

var line linebear1 = na // Bearish OB average

var line linebear2 = na // Bearish OB high

var line linebear3 = na // Bearish OB open

if OB_bull and showbull

line.delete(linebull1)

linebull1 := line.new(x1 = bar_index, y1 = OB_bull_avg, x2 = bar_index - 1, y2 = OB_bull_avg, extend = extend.left, color = bullcolor, style = line.style_solid, width = 1)

line.delete(linebull2)

linebull2 := line.new(x1 = bar_index, y1 = OB_bull_high, x2 = bar_index - 1, y2 = OB_bull_high, extend = extend.left, color = bullcolor, style = line.style_dashed, width = 1)

line.delete(linebull3)

linebull3 := line.new(x1 = bar_index, y1 = OB_bull_low, x2 = bar_index - 1, y2 = OB_bull_low, extend = extend.left, color = bullcolor, style = line.style_dashed, width = 1)

if OB_bear and showbear

line.delete(linebear1)

linebear1 := line.new(x1 = bar_index, y1 = OB_bear_avg, x2 = bar_index - 1, y2 = OB_bear_avg, extend = extend.left, color = bearcolor, style = line.style_solid, width = 1)

line.delete(linebear2)

linebear2 := line.new(x1 = bar_index, y1 = OB_bear_high, x2 = bar_index - 1, y2 = OB_bear_high, extend = extend.left, color = bearcolor, style = line.style_dashed, width = 1)

line.delete(linebear3)

linebear3 := line.new(x1 = bar_index, y1 = OB_bear_low, x2 = bar_index - 1, y2 = OB_bear_low, extend = extend.left, color = bearcolor, style = line.style_dashed, width = 1)

// Alerts for Order Blocks Detection

alertcondition(OB_bull, title='New Bullish OB detected', message='New Bullish OB detected - This is NOT a BUY signal!')

alertcondition(OB_bear, title='New Bearish OB detected', message='New Bearish OB detected - This is NOT a SELL signal!')

// Print latest Order Blocks in Data Window

var latest_bull_high = 0.0 // Variable to keep latest Bull OB high

var latest_bull_avg = 0.0 // Variable to keep latest Bull OB average

var latest_bull_low = 0.0 // Variable to keep latest Bull OB low

var latest_bear_high = 0.0 // Variable to keep latest Bear OB high

var latest_bear_avg = 0.0 // Variable to keep latest Bear OB average

var latest_bear_low = 0.0 // Variable to keep latest Bear OB low

// Assign latest values to variables

if OB_bull_high > 0

latest_bull_high := OB_bull_high

if OB_bull_avg > 0

latest_bull_avg := OB_bull_avg

if OB_bull_low > 0

latest_bull_low := OB_bull_low

if OB_bear_high > 0

latest_bear_high := OB_bear_high

if OB_bear_avg > 0

latest_bear_avg := OB_bear_avg

if OB_bear_low > 0

latest_bear_low := OB_bear_low

// Plot invisible characters to be able to show the values in the Data Window

plotchar(latest_bull_high, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bull High")

plotchar(latest_bull_avg, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bull Avg")

plotchar(latest_bull_low, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bull Low")

plotchar(latest_bear_high, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bear High")

plotchar(latest_bear_avg, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bear Avg")

plotchar(latest_bear_low, char = ' ', location = location.abovebar, color = #777777, transp = 100, size = size.tiny, title = "Latest Bear Low")

//InfoPanel for latest Order Blocks

draw_InfoPanel(_text, _x, _y, font_size)=>

var label la_panel = na

label.delete(la_panel)

la_panel := label.new(

x=_x, y=_y,

text=_text, xloc=xloc.bar_time, yloc=yloc.price,

color=color.new(#383838, 5), style=label.style_label_left, textcolor=color.white, size=font_size)

info_panel_x = time_close + round(change(time) * 100)

info_panel_y = close

title = "LATEST ORDER BLOCKS"

row0 = "-----------------------------------------------------"

row1 = ' Bullish - High: ' + tostring(latest_bull_high, '#.##')

row2 = ' Bullish - Avg: ' + tostring(latest_bull_avg, '#.##')

row3 = ' Bullish - Low: ' + tostring(latest_bull_low, '#.##')

row4 = "-----------------------------------------------------"

row5 = ' Bearish - High: ' + tostring(latest_bear_high, '#.##')

row6 = ' Bearish - Avg: ' + tostring(latest_bear_avg, '#.##')

row7 = ' Bearish - Low: ' + tostring(latest_bear_low, '#.##')

panel_text = '\n' + title + '\n' + row0 + '\n' + row1 + '\n' + row2 + '\n' + row3 + '\n' + row4 + '\n\n' + row5 + '\n' + row6 + '\n' + row7 + '\n'

if info_pan

draw_InfoPanel(panel_text, info_panel_x, info_panel_y, size.normal)

// === Label for Documentation/Tooltip ===

chper = time - time[1]

chper := change(chper) > 0 ? chper[1] : chper

// === Tooltip text ===

var vartooltip = "Indicator to help identifying instituational Order Blocks. Often these blocks signal the beginning of a strong move, but there is a high probability, that these prices will be revisited at a later point in time again and therefore are interesting levels to place limit orders. \nBullish Order block is the last down candle before a sequence of up candles. \nBearish Order Block is the last up candle before a sequence of down candles. \nIn the settings the number of required sequential candles can be adjusted. \nFurthermore a %-threshold can be entered which the sequential move needs to achieve in order to validate a relevant Order Block. \nChannels for the last Bullish/Bearish Block can be shown/hidden."

// === Print Label ===

var label l_docu = na

label.delete(l_docu)

if showdocu

l_docu := label.new(x = time + chper * 35, y = close, text = "DOCU OB", color=color.gray, textcolor=color.white, style=label.style_label_center, xloc = xloc.bar_time, yloc=yloc.price, size=size.tiny, textalign = text.align_left, tooltip = vartooltip)

// @TradingSecrets: Generate entry and exit orders based on the signals

entryLongSignal = OB_bull

entryShortSignal = OB_bear

if not pyramiding

entryLongSignal := entryLongSignal and not strategy.position_size

entryShortSignal := entryShortSignal and not strategy.position_size

if entryLongSignal

strategy.entry("Long Entry", strategy.long)

//strategy.exit("Long Exit Loss", "Long Entry", stop = close * (1 - stoploss_percent*0.01))

if entryShortSignal

strategy.entry("Short Entry", strategy.short)

//strategy.exit("Short Exit Loss", "Short Entry", stop = close * (1 + stoploss_percent*0.01))

strategy.initial_capital = 50000

//Close Position by market order

if strategy.position_size > 0 and strategy.openprofit/nz(strategy.initial_capital + strategy.netprofit) >= takeprofit_percent*0.01

//If I m in a long position and my take profit got hit close it by market order

strategy.close("Long Entry", comment = "Long Exit Profit")

if strategy.position_size < 0 and strategy.openprofit/nz(strategy.initial_capital + strategy.netprofit) >= takeprofit_percent*0.01

strategy.close("Short Entry", comment = "Short Exit Profit")

if strategy.position_size > 0 and strategy.openprofit/nz(strategy.initial_capital + strategy.netprofit) <= -stoploss_percent*0.01

//If I m in a long position and my take profit got hit close it by market order

strategy.close("Long Entry", comment = "Long Exit Loss")

if strategy.position_size < 0 and strategy.openprofit/nz(strategy.initial_capital + strategy.netprofit) <= -stoploss_percent*0.01

strategy.close("Short Entry", comment = "Short Exit Loss")