Version JavaScript de la stratégie SuperTrend

Auteur:La bonté, Créé: 2020-04-29 12:09:15, Mis à jour: 2023-11-06 20:03:58

Version JavaScript de la stratégie SuperTrend

Il existe de nombreuses versions de l'indicateur SuperTrend sur la télévision. J'ai trouvé un algorithme relativement facile à comprendre et je l'ai transplanté. Par rapport à l'indicateur SuperTrend chargé sur le graphique TV du système de backtest de la plateforme de trading FMZ, j'ai trouvé une légère différence et je ne comprenais pas la raison des causes, j'attends avec impatience les conseils de nos lecteurs. Je vais d'abord montrer ma compréhension comme suit.

Indicateur de SuperTrend Algoritme de version JavaScript

// VIA: https://github.com/freqtrade/freqtrade-strategies/issues/30

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

// The main function for testing indicators is not a trading strategy

function main() {

while (1) {

var r = _C(exchange.GetRecords)

var st = SuperTrend(r, 10, 3)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

Sleep(2000)

}

}

Comparaison des tests antérieurs du code de test:

Une stratégie simple à l'aide de l'indicateur SuperTrend

La partie logique du trading est relativement simple, c'est-à-dire que lorsque la tendance courte se transforme en tendance longue, des positions longues sont ouvertes. Ouvrez une position courte lorsque la tendance longue devient une tendance courte.

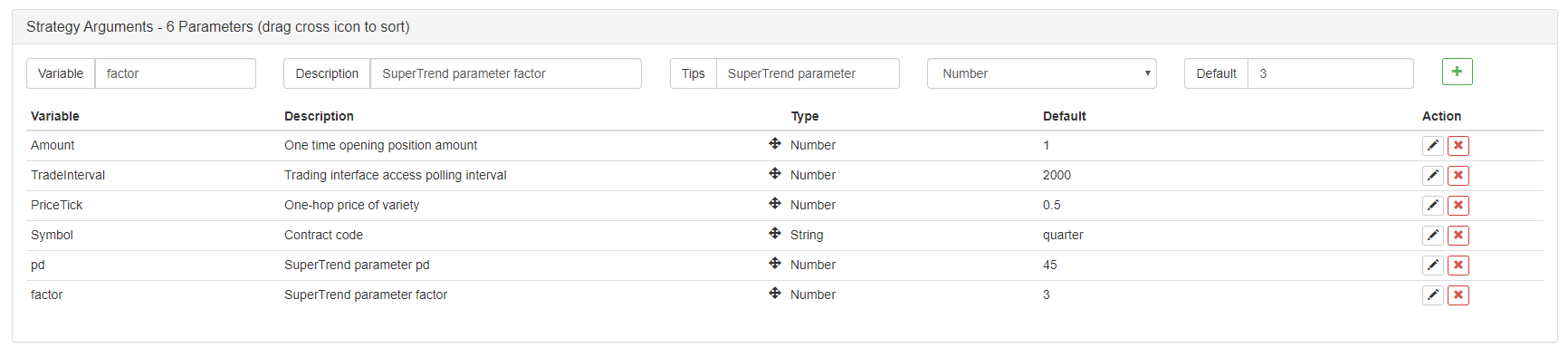

Paramètres de stratégie:

Stratégie de négociation SuperTrend

/*backtest

start: 2019-08-01 00:00:00

end: 2020-03-11 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

// Global variables

var OpenAmount = 0 // The number of open positions after opening

var KeepAmount = 0 // Reserved position

var IDLE = 0

var LONG = 1

var SHORT = 2

var COVERLONG = 3

var COVERSHORT = 4

var COVERLONG_PART = 5

var COVERSHORT_PART = 6

var OPENLONG = 7

var OPENSHORT = 8

var State = IDLE

// Trading logic part

function GetPosition(posType) {

var positions = _C(exchange.GetPosition)

/*

if(positions.length > 1){

throw "positions error:" + JSON.stringify(positions)

}

*/

var count = 0

for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw "positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0]

}

function CancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

function Trade(Type, Price, Amount, CurrPos, OnePriceTick){ // Processing transactions

if(Type == OPENLONG || Type == OPENSHORT){ // Handling open positions

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sell

var idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} else if(Type == COVERLONG || Type == COVERSHORT){ // Deal with closing positions

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buy

var idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw "Type error:" + Type

}

}

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

var preTime = 0

function main() {

exchange.SetContractType(Symbol)

while (1) {

var r = _C(exchange.GetRecords)

var currBar = r[r.length - 1]

if (r.length < pd) {

Sleep(5000)

continue

}

var st = SuperTrend(r, pd, factor)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

if(!isNaN(st[0][st[0].length - 2]) && isNaN(st[0][st[0].length - 3])){

if (State == SHORT) {

State = COVERSHORT

} else if(State == IDLE) {

State = OPENLONG

}

}

if(!isNaN(st[1][st[1].length - 2]) && isNaN(st[1][st[1].length - 3])){

if (State == LONG) {

State = COVERLONG

} else if (State == IDLE) {

State = OPENSHORT

}

}

// 执行信号

var pos = null

var price = null

if(State == OPENLONG){ // Open long positions

pos = GetPosition(PD_LONG) // Check positions

// Determine whether the status is satisfied, if it is satisfied, modify the status

if(pos[1] >= Amount){ // Open positions exceed or equal to the open positions set by the parameters

Sleep(1000)

$.PlotFlag(currBar.Time, "Open long positions", 'OL') // mark

OpenAmount = pos[1] // Record the number of open positions

State = LONG // Mark as long

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2 // Calculate the price

Trade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // Placing Order function (Type, Price, Amount, CurrPos, PriceTick)

}

if(State == OPENSHORT){ // Open short position

pos = GetPosition(PD_SHORT) // Check positions

if(pos[1] >= Amount){

Sleep(1000)

$.PlotFlag(currBar.Time, "Open short position", 'OS')

OpenAmount = pos[1]

State = SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(State == COVERLONG){ // Handling long positions

pos = GetPosition(PD_LONG) // Get position information

if(pos[1] == 0){ // Determine if the position is 0

$.PlotFlag(currBar.Time, "Close long position", '----CL') // mark

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(State == COVERSHORT){ // Deal with long positions

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

$.PlotFlag(currBar.Time, "Close short position", '----CS')

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

if(State == COVERLONG_PART) { // Partially close long positions

pos = GetPosition(PD_LONG) // Get positions

if(pos[1] <= KeepAmount){ // The position is less than or equal to the holding amount, this time the closing action is completed

$.PlotFlag(currBar.Time, "Close long positions, keep:" + KeepAmount, '----CL') // mark

State = pos[1] == 0 ? IDLE : LONG // update status

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1] - KeepAmount, pos, PriceTick)

}

if(State == COVERSHORT_PART){

pos = GetPosition(PD_SHORT)

if(pos[1] <= KeepAmount){

$.PlotFlag(currBar.Time, "Close short positions, keep:" + KeepAmount, '----CS')

State = pos[1] == 0 ? IDLE : SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1] - KeepAmount, pos, PriceTick)

}

LogStatus(_D())

Sleep(1000)

}

}

Adresse stratégique:https://www.fmz.com/strategy/201837

Performances des essais antérieurs

Réglage des paramètres, période de la ligne K, référence: homélie SuperTrend V.1

La période de la ligne K est réglée sur 15 minutes et le paramètre SuperTrend est réglé sur 45, 3. Retestez le contrat trimestriel OKEX pour l'année la plus récente et définissez un contrat à négocier à la fois.

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (2)

- Introduction à la suite de Lead-Lag dans les monnaies numériques (2)

- Discussion sur la réception de signaux externes de la plateforme FMZ: une solution complète pour la réception de signaux avec un service Http intégré dans la stratégie

- Exploration de la réception de signaux externes sur la plateforme FMZ: stratégie intégrée pour la réception de signaux sur le service HTTP

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (1)

- Introduction à la suite de Lead-Lag dans les monnaies numériques (1)

- Discussion sur la réception de signaux externes de la plateforme FMZ: API étendue VS stratégie intégrée au service HTTP

- Débat sur la réception de signaux externes sur la plateforme FMZ: API étendue contre stratégie de service HTTP intégré

- Discussion sur la méthode de test de stratégie basée sur le générateur de tickers aléatoires

- Une méthode de test stratégique basée sur un générateur de marché aléatoire

- Nouvelle fonctionnalité de FMZ Quant: Utilisez la fonction _Serve pour créer facilement des services HTTP

- Les ouvriers vous apprennent à utiliser l'API de couplage JS pour étendre FMZ

- Basé sur l'utilisation d'un nouvel indice de résistance relative dans les stratégies intraday

- Recherche sur la stratégie de couverture multi-monnaie des contrats à terme de Binance Partie 4

- Larry Connors Larry Connors RSI2 stratégie de régression moyenne

- Recherche sur la stratégie de couverture multi-monnaie des contrats à terme de Binance Partie 3

- Recherche sur la stratégie de couverture multi-monnaie des contrats à terme de Binance Partie 2

- Recherche sur la stratégie de couverture multi-monnaie des contrats à terme de Binance Partie 1

- Le manuel vous apprend à mettre à niveau la fonctionnalité de récupération des sources de données personnalisées pour le collecteur de transactions

- Système de négociation de ligne de crocodile version Python

- L'API de l'extension de la plate-forme de négociation quantitative utilisée par les inventeurs pour réaliser des transactions de signaux d'alarme TradingView (recommandé)

- SuperTrend V.1 - Système de ligne de tendance supérieure

- La stratégie de SuperTrend de la version JavaScript

- [Guerre des millénaires] Résultats de la rétrospective récente et de la revue de la ligne K à l'échelle de la minute sur les stratégies de couverture multi-monnaies monétaires et monétaires (article 4)

- La main à la main vous apprend à réaliser un collecteur de transactions

- [Guerre des millénaires] Les contrats à terme monétaires à l'inflation sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes sur le marché des changes

- [Guerre des millénaires] Optimisation importante de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de l'optimisation de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la stratégie de la

- [Guerre des millénaires] Une étude sur les stratégies de couverture multi-monnaies pour les devises et les options monétaires (article 1)

- Une pièce de monnaie de l'étudiant de premier cycle de 98 et le chemin de la quantification

- Stratégie de délégation de l'iceberg Python

- Stratégie d'équilibrage dynamique basée sur la monnaie numérique