Stratégie de moyenne mobile des contrats à terme sur matières premières

Auteur:La bonté, Créé: 2020-05-28 13:17:45, Mis à jour: 2023-11-02 19:57:32

Il est complètement transplanté du

En tant que stratégie la plus simple, la stratégie de moyenne mobile est très facile à apprendre, car la stratégie de moyenne mobile n'a pas d'algorithmes avancés et de logique complexe. Les idées sont claires et faciles, permettant aux débutants de se concentrer davantage sur l'étude de la conception de la stratégie, et même de supprimer la partie liée au codage, laissant un cadre de stratégie multi-variété qui peut être facilement étendu en ATR, MACD, BOLL et autres stratégies d'indicateurs.

Articles liés à la version JavaScript:https://www.fmz.com/bbs-topic/5235.

Code source de la stratégie

'''backtest

start: 2019-07-01 09:00:00

end: 2020-03-25 15:00:00

period: 1d

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

'''

import json

import re

import time

_bot = ext.NewPositionManager()

class Manager:

'Strategy logic control'

ACT_IDLE = 0

ACT_LONG = 1

ACT_SHORT = 2

ACT_COVER = 3

ERR_SUCCESS = 0

ERR_SET_SYMBOL = 1

ERR_GET_ORDERS = 2

ERR_GET_POS = 3

ERR_TRADE = 4

ERR_GET_DEPTH = 5

ERR_NOT_TRADING = 6

errMsg = ["Success", "Failed to switch contract", "Failed to get order info", "Failed to get position info", "Placing Order failed", "Failed to get order depth info", "Not in trading hours"]

def __init__(self, needRestore, symbol, keepBalance, fastPeriod, slowPeriod):

# Get symbolDetail

symbolDetail = _C(exchange.SetContractType, symbol)

if symbolDetail["VolumeMultiple"] == 0 or symbolDetail["MaxLimitOrderVolume"] == 0 or symbolDetail["MinLimitOrderVolume"] == 0 or symbolDetail["LongMarginRatio"] == 0 or symbolDetail["ShortMarginRatio"] == 0:

Log(symbolDetail)

raise Exception("Abnormal contract information")

else :

Log("contract", symbolDetail["InstrumentName"], "1 lot", symbolDetail["VolumeMultiple"], "lot, Maximum placing order quantity", symbolDetail["MaxLimitOrderVolume"], "Margin rate: ", _N(symbolDetail["LongMarginRatio"]), _N(symbolDetail["ShortMarginRatio"]), "Delivery date", symbolDetail["StartDelivDate"])

# Initialization

self.symbol = symbol

self.keepBalance = keepBalance

self.fastPeriod = fastPeriod

self.slowPeriod = slowPeriod

self.marketPosition = None

self.holdPrice = None

self.holdAmount = None

self.holdProfit = None

self.task = {

"action" : Manager.ACT_IDLE,

"amount" : 0,

"dealAmount" : 0,

"avgPrice" : 0,

"preCost" : 0,

"preAmount" : 0,

"init" : False,

"retry" : 0,

"desc" : "idle",

"onFinish" : None

}

self.lastPrice = 0

self.symbolDetail = symbolDetail

# Position status information

self.status = {

"symbol" : symbol,

"recordsLen" : 0,

"vm" : [],

"open" : 0,

"cover" : 0,

"st" : 0,

"marketPosition" : 0,

"lastPrice" : 0,

"holdPrice" : 0,

"holdAmount" : 0,

"holdProfit" : 0,

"symbolDetail" : symbolDetail,

"lastErr" : "",

"lastErrTime" : "",

"isTrading" : False

}

# Other processing work during object construction

vm = None

if RMode == 0:

vm = _G(self.symbol)

else:

vm = json.loads(VMStatus)[self.symbol]

if vm:

Log("Ready to resume progress, current contract status is", vm)

self.reset(vm[0])

else:

if needRestore:

Log("could not find" + self.symbol + "progress recovery information")

self.reset()

def setLastError(self, err=None):

if err is None:

self.status["lastErr"] = ""

self.status["lastErrTime"] = ""

return

t = _D()

self.status["lastErr"] = err

self.status["lastErrTime"] = t

def reset(self, marketPosition=None):

if marketPosition is not None:

self.marketPosition = marketPosition

pos = _bot.GetPosition(self.symbol, PD_LONG if marketPosition > 0 else PD_SHORT)

if pos is not None:

self.holdPrice = pos["Price"]

self.holdAmount = pos["Amount"]

Log(self.symbol, "Position", pos)

else :

raise Exception("Restore" + self.symbol + "position status is wrong, no position information found")

Log("Restore", self.symbol, "average holding position price:", self.holdPrice, "Number of positions:", self.holdAmount)

self.status["vm"] = [self.marketPosition]

else :

self.marketPosition = 0

self.holdPrice = 0

self.holdAmount = 0

self.holdProfit = 0

self.holdProfit = 0

self.lastErr = ""

self.lastErrTime = ""

def Status(self):

self.status["marketPosition"] = self.marketPosition

self.status["holdPrice"] = self.holdPrice

self.status["holdAmount"] = self.holdAmount

self.status["lastPrice"] = self.lastPrice

if self.lastPrice > 0 and self.holdAmount > 0 and self.marketPosition != 0:

self.status["holdProfit"] = _N((self.lastPrice - self.holdPrice) * self.holdAmount * self.symbolDetail["VolumeMultiple"], 4) * (1 if self.marketPosition > 0 else -1)

else :

self.status["holdProfit"] = 0

return self.status

def setTask(self, action, amount = None, onFinish = None):

self.task["init"] = False

self.task["retry"] = 0

self.task["action"] = action

self.task["preAmount"] = 0

self.task["preCost"] = 0

self.task["amount"] = 0 if amount is None else amount

self.task["onFinish"] = onFinish

if action == Manager.ACT_IDLE:

self.task["desc"] = "idle"

self.task["onFinish"] = None

else:

if action != Manager.ACT_COVER:

self.task["desc"] = ("Adding long position" if action == Manager.ACT_LONG else "Adding short position") + "(" + str(amount) + ")"

else :

self.task["desc"] = "Closing Position"

Log("Task received", self.symbol, self.task["desc"])

self.Poll(True)

def processTask(self):

insDetail = exchange.SetContractType(self.symbol)

if not insDetail:

return Manager.ERR_SET_SYMBOL

SlideTick = 1

ret = False

if self.task["action"] == Manager.ACT_COVER:

hasPosition = False

while True:

if not ext.IsTrading(self.symbol):

return Manager.ERR_NOT_TRADING

hasPosition = False

positions = exchange.GetPosition()

if positions is None:

return Manager.ERR_GET_POS

depth = exchange.GetDepth()

if depth is None:

return Manager.ERR_GET_DEPTH

orderId = None

for i in range(len(positions)):

if positions[i]["ContractType"] != self.symbol:

continue

amount = min(insDetail["MaxLimitOrderVolume"], positions[i]["Amount"])

if positions[i]["Type"] == PD_LONG or positions[i]["Type"] == PD_LONG_YD:

exchange.SetDirection("closebuy_today" if positions[i].Type == PD_LONG else "closebuy")

orderId = exchange.Sell(_N(depth["Bids"][0]["Price"] - (insDetail["PriceTick"] * SlideTick), 2), min(amount, depth["Bids"][0]["Amount"]), self.symbol, "Close today's position" if positions[i]["Type"] == PD_LONG else "Close yesterday's position", "Bid", depth["Bids"][0])

hasPosition = True

elif positions[i]["Type"] == PD_SHORT or positions[i]["Type"] == PD_SHORT_YD:

exchange.SetDirection("closesell_today" if positions[i]["Type"] == PD_SHORT else "closesell")

orderId = exchange.Buy(_N(depth["Asks"][0]["Price"] + (insDetail["PriceTick"] * SlideTick), 2), min(amount, depth["Asks"][0]["Amount"]), self.symbol, "Close today's position" if positions[i]["Type"] == PD_SHORT else "Close yesterday's position", "Ask", depth["Asks"][0])

hasPosition = True

if hasPosition:

if not orderId:

return Manager.ERR_TRADE

Sleep(1000)

while True:

orders = exchange.GetOrders()

if orders is None:

return Manager.ERR_GET_ORDERS

if len(orders) == 0:

break

for i in range(len(orders)):

exchange.CancelOrder(orders[i]["Id"])

Sleep(500)

if not hasPosition:

break

ret = True

elif self.task["action"] == Manager.ACT_LONG or self.task["action"] == Manager.ACT_SHORT:

while True:

if not ext.IsTrading(self.symbol):

return Manager.ERR_NOT_TRADING

Sleep(1000)

while True:

orders = exchange.GetOrders()

if orders is None:

return Manager.ERR_GET_ORDERS

if len(orders) == 0:

break

for i in range(len(orders)):

exchange.CancelOrder(orders[i]["Id"])

Sleep(500)

positions = exchange.GetPosition()

if positions is None:

return Manager.ERR_GET_POS

pos = None

for i in range(len(positions)):

if positions[i]["ContractType"] == self.symbol and (((positions[i]["Type"] == PD_LONG or positions[i]["Type"] == PD_LONG_YD) and self.task["action"] == Manager.ACT_LONG) or ((positions[i]["Type"] == PD_SHORT) or positions[i]["Type"] == PD_SHORT_YD) and self.task["action"] == Manager.ACT_SHORT):

if not pos:

pos = positions[i]

pos["Cost"] = positions[i]["Price"] * positions[i]["Amount"]

else :

pos["Amount"] += positions[i]["Amount"]

pos["Profit"] += positions[i]["Profit"]

pos["Cost"] += positions[i]["Price"] * positions[i]["Amount"]

# records pre position

if not self.task["init"]:

self.task["init"] = True

if pos:

self.task["preAmount"] = pos["Amount"]

self.task["preCost"] = pos["Cost"]

else:

self.task["preAmount"] = 0

self.task["preCost"] = 0

remain = self.task["amount"]

if pos:

self.task["dealAmount"] = pos["Amount"] - self.task["preAmount"]

remain = int(self.task["amount"] - self.task["dealAmount"])

if remain <= 0 or self.task["retry"] >= MaxTaskRetry:

ret = {

"price" : (pos["Cost"] - self.task["preCost"]) / (pos["Amount"] - self.task["preAmount"]),

"amount" : (pos["Amount"] - self.task["preAmount"]),

"position" : pos

}

break

elif self.task["retry"] >= MaxTaskRetry:

ret = None

break

depth = exchange.GetDepth()

if depth is None:

return Manager.ERR_GET_DEPTH

orderId = None

if self.task["action"] == Manager.ACT_LONG:

exchange.SetDirection("buy")

orderId = exchange.Buy(_N(depth["Asks"][0]["Price"] + (insDetail["PriceTick"] * SlideTick), 2), min(remain, depth["Asks"][0]["Amount"]), self.symbol, "Ask", depth["Asks"][0])

else:

exchange.SetDirection("sell")

orderId = exchange.Sell(_N(depth["Bids"][0]["Price"] - (insDetail["PriceTick"] * SlideTick), 2), min(remain, depth["Bids"][0]["Amount"]), self.symbol, "Bid", depth["Bids"][0])

if orderId is None:

self.task["retry"] += 1

return Manager.ERR_TRADE

if self.task["onFinish"]:

self.task["onFinish"](ret)

self.setTask(Manager.ACT_IDLE)

return Manager.ERR_SUCCESS

def Poll(self, subroutine = False):

# Judge the trading hours

self.status["isTrading"] = ext.IsTrading(self.symbol)

if not self.status["isTrading"]:

return

# Perform order trading tasks

if self.task["action"] != Manager.ACT_IDLE:

retCode = self.processTask()

if self.task["action"] != Manager.ACT_IDLE:

self.setLastError("The task was not successfully processed:" + Manager.errMsg[retCode] + ", " + self.task["desc"] + ", Retry:" + str(self.task["retry"]))

else :

self.setLastError()

return

if subroutine:

return

suffix = "@" if WXPush else ""

# switch symbol

_C(exchange.SetContractType, self.symbol)

# Get K-line data

records = exchange.GetRecords()

if records is None:

self.setLastError("Failed to get K line")

return

self.status["recordsLen"] = len(records)

if len(records) < self.fastPeriod + 2 or len(records) < self.slowPeriod + 2:

self.setLastError("The length of the K line is less than the moving average period:" + str(self.fastPeriod) + "or" + str(self.slowPeriod))

return

opCode = 0 # 0 : IDLE , 1 : LONG , 2 : SHORT , 3 : CoverALL

lastPrice = records[-1]["Close"]

self.lastPrice = lastPrice

fastMA = TA.EMA(records, self.fastPeriod)

slowMA = TA.EMA(records, self.slowPeriod)

# Strategy logic

if self.marketPosition == 0:

if fastMA[-3] < slowMA[-3] and fastMA[-2] > slowMA[-2]:

opCode = 1

elif fastMA[-3] > slowMA[-3] and fastMA[-2] < slowMA[-2]:

opCode = 2

else:

if self.marketPosition < 0 and fastMA[-3] < slowMA[-3] and fastMA[-2] > slowMA[-2]:

opCode = 3

elif self.marketPosition > 0 and fastMA[-3] > slowMA[-3] and fastMA[-2] < slowMA[-2]:

opCode = 3

# If no condition is triggered, the opcode is 0 and return

if opCode == 0:

return

# Preforming closing position action

if opCode == 3:

def coverCallBack(ret):

self.reset()

_G(self.symbol, None)

self.setTask(Manager.ACT_COVER, 0, coverCallBack)

return

account = _bot.GetAccount()

canOpen = int((account["Balance"] - self.keepBalance) / (self.symbolDetail["LongMarginRatio"] if opCode == 1 else self.symbolDetail["ShortMarginRatio"]) / (lastPrice * 1.2) / self.symbolDetail["VolumeMultiple"])

unit = min(1, canOpen)

# Set up trading tasks

def setTaskCallBack(ret):

if not ret:

self.setLastError("Placing Order failed")

return

self.holdPrice = ret["position"]["Price"]

self.holdAmount = ret["position"]["Amount"]

self.marketPosition += 1 if opCode == 1 else -1

self.status["vm"] = [self.marketPosition]

_G(self.symbol, self.status["vm"])

self.setTask(Manager.ACT_LONG if opCode == 1 else Manager.ACT_SHORT, unit, setTaskCallBack)

def onexit():

Log("Exited strategy...")

def main():

if exchange.GetName().find("CTP") == -1:

raise Exception("Only support commodity futures CTP")

SetErrorFilter("login|ready|flow control|connection failed|initial|Timeout")

mode = exchange.IO("mode", 0)

if mode is None:

raise Exception("Failed to switch modes, please update to the latest docker!")

while not exchange.IO("status"):

Sleep(3000)

LogStatus("Waiting for connection with the trading server," + _D())

positions = _C(exchange.GetPosition)

if len(positions) > 0:

Log("Detecting the current holding position, the system will start to try to resume the progress...")

Log("Position information:", positions)

initAccount = _bot.GetAccount()

initMargin = json.loads(exchange.GetRawJSON())["CurrMargin"]

keepBalance = _N((initAccount["Balance"] + initMargin) * (KeepRatio / 100), 3)

Log("Asset information", initAccount, "Retain funds:", keepBalance)

tts = []

symbolFilter = {}

arr = Instruments.split(",")

arrFastPeriod = FastPeriodArr.split(",")

arrSlowPeriod = SlowPeriodArr.split(",")

if len(arr) != len(arrFastPeriod) or len(arr) != len(arrSlowPeriod):

raise Exception("The moving average period parameter does not match the number of added contracts, please check the parameters!")

for i in range(len(arr)):

symbol = re.sub(r'/\s+$/g', "", re.sub(r'/^\s+/g', "", arr[i]))

if symbol in symbolFilter.keys():

raise Exception(symbol + "Already exists, please check the parameters!")

symbolFilter[symbol] = True

hasPosition = False

for j in range(len(positions)):

if positions[j]["ContractType"] == symbol:

hasPosition = True

break

fastPeriod = int(arrFastPeriod[i])

slowPeriod = int(arrSlowPeriod[i])

obj = Manager(hasPosition, symbol, keepBalance, fastPeriod, slowPeriod)

tts.append(obj)

preTotalHold = -1

lastStatus = ""

while True:

if GetCommand() == "Pause/Resume":

Log("Suspending trading ...")

while GetCommand() != "Pause/Resume":

Sleep(1000)

Log("Continue trading...")

while not exchange.IO("status"):

Sleep(3000)

LogStatus("Waiting for connection with the trading server," + _D() + "\n" + lastStatus)

tblStatus = {

"type" : "table",

"title" : "Position information",

"cols" : ["Contract Name", "Direction of Position", "Average Position Price", "Number of Positions", "Position profits and Losses", "Number of Positions Added", "Current Price"],

"rows" : []

}

tblMarket = {

"type" : "table",

"title" : "Operating status",

"cols" : ["Contract name", "Contract multiplier", "Margin rate", "Trading time", "Bar length", "Exception description", "Time of occurrence"],

"rows" : []

}

totalHold = 0

vmStatus = {}

ts = time.time()

holdSymbol = 0

for i in range(len(tts)):

tts[i].Poll()

d = tts[i].Status()

if d["holdAmount"] > 0:

vmStatus[d["symbol"]] = d["vm"]

holdSymbol += 1

tblStatus["rows"].append([d["symbolDetail"]["InstrumentName"], "--" if d["holdAmount"] == 0 else ("long" if d["marketPosition"] > 0 else "short"), d["holdPrice"], d["holdAmount"], d["holdProfit"], abs(d["marketPosition"]), d["lastPrice"]])

tblMarket["rows"].append([d["symbolDetail"]["InstrumentName"], d["symbolDetail"]["VolumeMultiple"], str(_N(d["symbolDetail"]["LongMarginRatio"], 4)) + "/" + str(_N(d["symbolDetail"]["ShortMarginRatio"], 4)), "is #0000ff" if d["isTrading"] else "not #ff0000", d["recordsLen"], d["lastErr"], d["lastErrTime"]])

totalHold += abs(d["holdAmount"])

now = time.time()

elapsed = now - ts

tblAssets = _bot.GetAccount(True)

nowAccount = _bot.Account()

if len(tblAssets["rows"]) > 10:

tblAssets["rows"][0] = ["InitAccount", "Initial asset", initAccount]

else:

tblAssets["rows"].insert(0, ["NowAccount", "Currently available", nowAccount])

tblAssets["rows"].insert(0, ["InitAccount", "Initial asset", initAccount])

lastStatus = "`" + json.dumps([tblStatus, tblMarket, tblAssets]) + "`\nPolling time:" + str(elapsed) + " Seconds, current time:" + _D() + ", Number of varieties held:" + str(holdSymbol)

if totalHold > 0:

lastStatus += "\nManually restore the string:" + json.dumps(vmStatus)

LogStatus(lastStatus)

if preTotalHold > 0 and totalHold == 0:

LogProfit(nowAccount.Balance - initAccount.Balance - initMargin)

preTotalHold = totalHold

Sleep(LoopInterval * 1000)

Adresse stratégique:https://www.fmz.com/strategy/208512

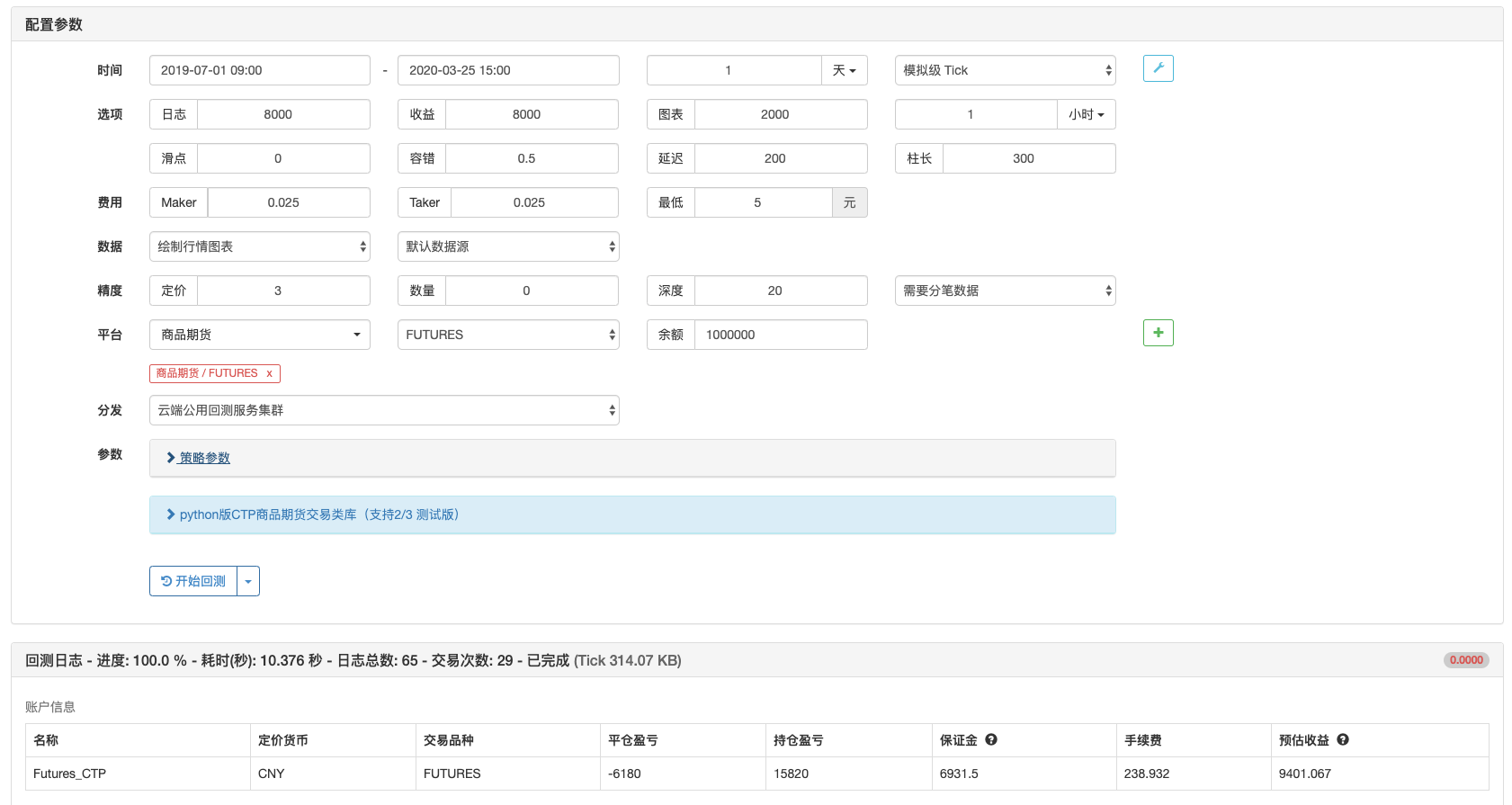

Comparaison avec les tests antérieurs

Nous avons comparé la version JavaScript et la version Python de la stratégie avec backtest.

- Backtest de la version Python

Nous utilisons un serveur public pour le backtest, et nous pouvons voir que le backtest de la version Python est légèrement plus rapide.

- Test de retour de la version JavaScript

On peut voir que les résultats des backtests sont exactement les mêmes.

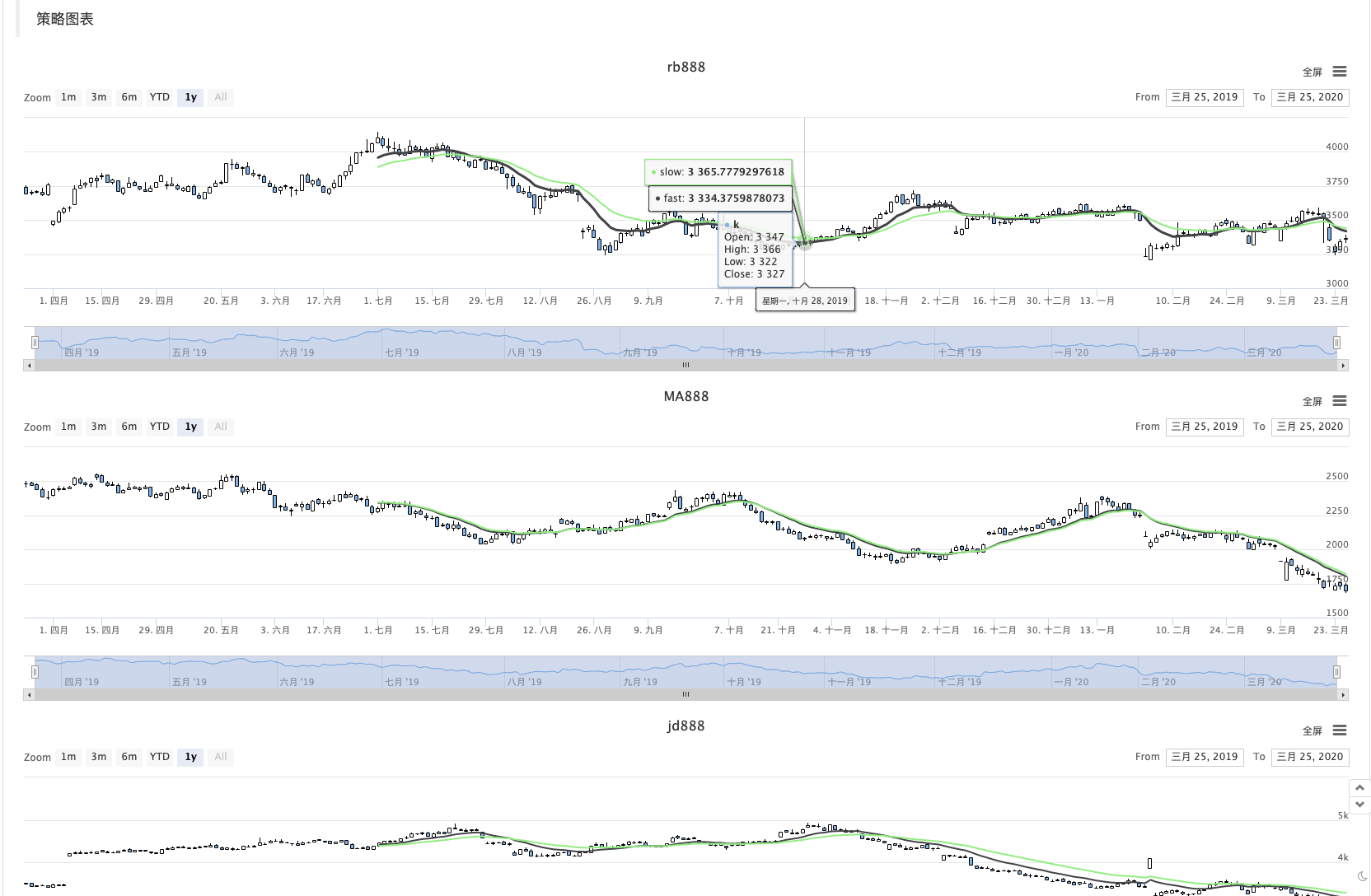

Élargir

Faisons une démonstration d'extension et étendons la fonction graphique à la stratégie, comme indiqué sur la figure:

Principalement augmenter la partie de codage:

- Ajouter un membre à la classe Manager:

objChart - Ajouter une méthode à la classe Manager:

PlotRecords

Vous pouvez comparer les différences entre les deux versions et apprendre les idées des fonctions étendues.

- Introduction à la suite de Lead-Lag dans les monnaies numériques (3)

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (2)

- Introduction à la suite de Lead-Lag dans les monnaies numériques (2)

- Discussion sur la réception de signaux externes de la plateforme FMZ: une solution complète pour la réception de signaux avec un service Http intégré dans la stratégie

- Exploration de la réception de signaux externes sur la plateforme FMZ: stratégie intégrée pour la réception de signaux sur le service HTTP

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (1)

- Introduction à la suite de Lead-Lag dans les monnaies numériques (1)

- Discussion sur la réception de signaux externes de la plateforme FMZ: API étendue VS stratégie intégrée au service HTTP

- Débat sur la réception de signaux externes sur la plateforme FMZ: API étendue contre stratégie de service HTTP intégré

- Discussion sur la méthode de test de stratégie basée sur le générateur de tickers aléatoires

- Une méthode de test stratégique basée sur un générateur de marché aléatoire

- Version Python de la stratégie de couverture intertemporelle des contrats à terme sur matières premières

- Quelques réflexions sur la logique du trading à terme de crypto-monnaie

- Outil d'analyse amélioré basé sur le développement de la grammaire Alpha101

- Apprendre à mettre à niveau le collecteur de marché backtest la source de données personnalisée

- Les défauts du système de retouche haute fréquence basé sur les transactions à la lettre et de la retouche K-line

- Explication du mécanisme de backtest au niveau de simulation FMZ

- La meilleure façon d'installer et de mettre à niveau FMZ docker sur Linux VPS

- Stratégie R-Breaker des contrats à terme sur matières premières

- Un peu de réflexion sur la logique des échanges de devises numériques

- Vous apprendre à mettre en œuvre un collecteur de cotations de marché

- Le collecteur de cotations de marché est à nouveau mis à niveau.

- Réaménagement du collecteur de données - support des importations de fichiers au format CSV pour fournir des sources de données personnalisées

- Stratégie de négociation à haute fréquence sur les contrats à terme sur matières premières écrite en C++

- Larry Connors RSI2 Stratégie d'inversion moyenne

- Les ouvriers vous apprennent à utiliser l'API de couplage JS pour étendre FMZ

- Basé sur l'utilisation d'un nouvel indice de résistance relative dans les stratégies intraday

- Recherche sur la stratégie de couverture multi-monnaie des contrats à terme de Binance Partie 4

- Larry Connors Larry Connors RSI2 stratégie de régression moyenne

- Recherche sur la stratégie de couverture multi-monnaie des contrats à terme de Binance Partie 3

- Recherche sur la stratégie de couverture multi-monnaie des contrats à terme de Binance Partie 2