Fukuiz Octa-EMA + Ichimoku est une marque américaine.

Auteur:ChaoZhang est là., Date: le 16 mai 2022 à 17h43:51Les étiquettes:Le taux d'intérêt

Cette stratégie est basée sur EMA de 8 périodes différentes et Ichimoku Cloud qui fonctionne mieux en 1h 4h et en temps quotidien.

Une brève introduction à Ichimoku Le Ichimoku Cloud est une collection d'indicateurs techniques qui montrent les niveaux de support et de résistance, ainsi que l'élan et la direction de la tendance. Il le fait en prenant plusieurs moyennes et en les traçant sur un graphique.

Une brève introduction à l'EMA Une moyenne mobile exponentielle (EMA) est un type de moyenne mobile (MA) qui place un poids et une signification plus importants sur les points de données les plus récents.

Comment utiliser La stratégie donnera des points d'entrée elle-même, vous pouvez surveiller et prendre des bénéfices manuellement (recommandé), ou vous pouvez utiliser la configuration de sortie.

EMA (couleur) = tendance haussière EMA (Gray) = tendance à la baisse

# Condition # Acheter = Tout Ema (couleur) au-dessus du nuage. Toutes les Ema deviennent grises.

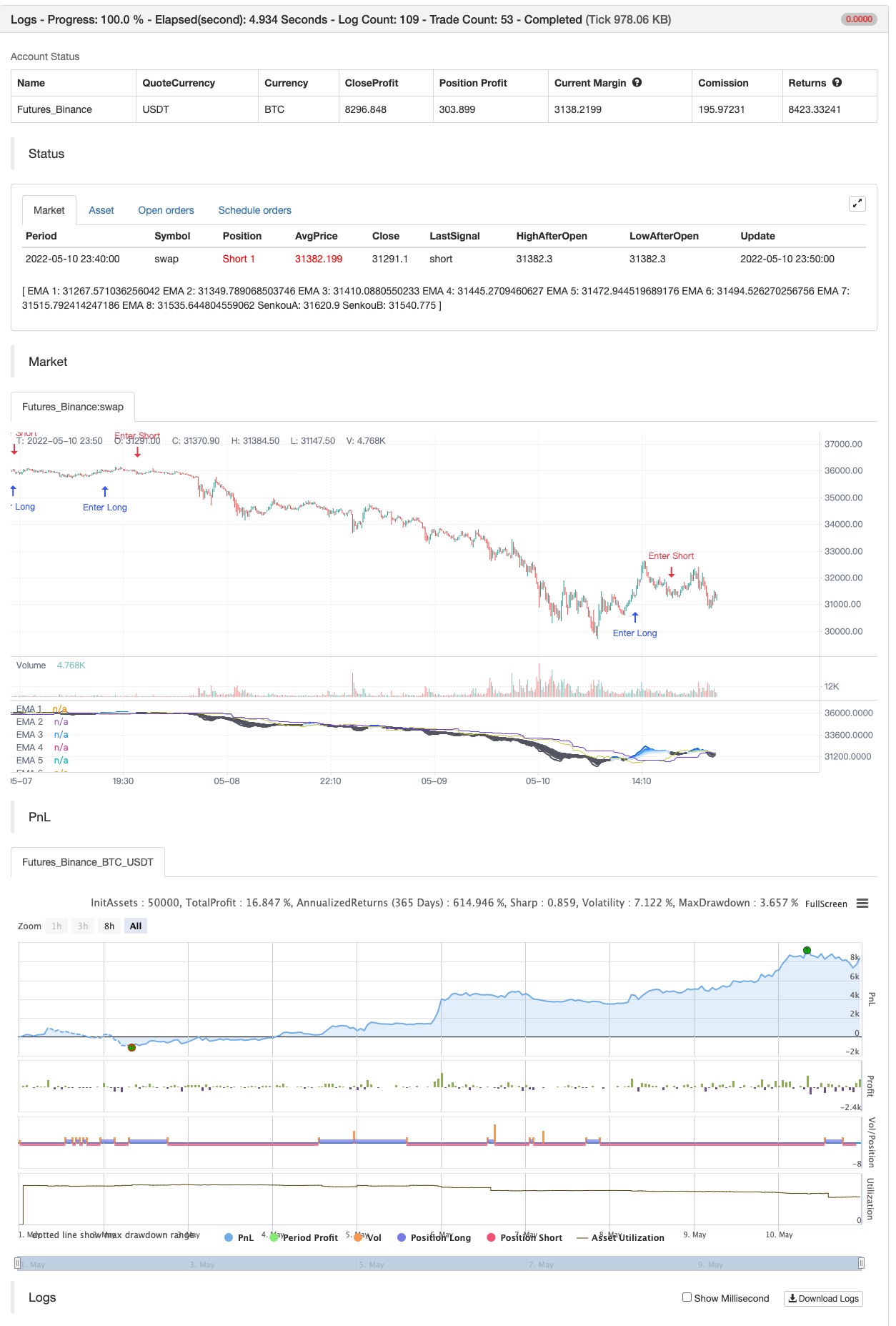

test de retour

/*backtest

start: 2022-05-01 00:00:00

end: 2022-05-10 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Fukuiz

//strategy(title='Fukuiz Octa-EMA + Ichimoku', shorttitle='Fuku octa strategy', overlay=true, process_orders_on_close=true,

// default_qty_type= strategy.cash , default_qty_value=1000, currency=currency.USD, initial_capital=10000 ,commission_type = strategy.commission.percent,commission_value=0.25)

//OCTA EMA ##################################################

// Functions

f_emaRibbon(_src, _e1, _e2, _e3, _e4, _e5, _e6, _e7, _e8) =>

_ema1 = ta.ema(_src, _e1)

_ema2 = ta.ema(_src, _e2)

_ema3 = ta.ema(_src, _e3)

_ema4 = ta.ema(_src, _e4)

_ema5 = ta.ema(_src, _e5)

_ema6 = ta.ema(_src, _e6)

_ema7 = ta.ema(_src, _e7)

_ema8 = ta.ema(_src, _e8)

[_ema1, _ema2, _ema3, _ema4, _ema5, _ema6, _ema7, _ema8]

showRibbon = input(true, 'Show Ribbon (EMA)')

ema1Len = input(5, title='EMA 1 Length')

ema2Len = input(11, title='EMA 2 Length')

ema3Len = input(15, title='EMA 3 Length')

ema4Len = input(18, title='EMA 4 Length')

ema5Len = input(21, title='EMA 5 Length')

ema6Len = input(24, title='EMA 6 Length')

ema7Len = input(28, title='EMA 7 Length')

ema8Len = input(34, title='EMA 8 Length')

[ema1, ema2, ema3, ema4, ema5, ema6, ema7, ema8] = f_emaRibbon(close, ema1Len, ema2Len, ema3Len, ema4Len, ema5Len, ema6Len, ema7Len, ema8Len)

//Plot

ribbonDir = ema8 < ema2

p1 = plot(ema1, color=showRibbon ? ribbonDir ? #1573d4 : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 1')

p2 = plot(ema2, color=showRibbon ? ribbonDir ? #3096ff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 2')

plot(ema3, color=showRibbon ? ribbonDir ? #57abff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 3')

plot(ema4, color=showRibbon ? ribbonDir ? #85c2ff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 4')

plot(ema5, color=showRibbon ? ribbonDir ? #9bcdff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 5')

plot(ema6, color=showRibbon ? ribbonDir ? #b3d9ff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 6')

plot(ema7, color=showRibbon ? ribbonDir ? #c9e5ff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 7')

p8 = plot(ema8, color=showRibbon ? ribbonDir ? #dfecfb : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 8')

fill(p1, p2, color.new(#1573d4, 85))

fill(p2, p8, color.new(#1573d4, 85))

//ichimoku##################################################

//color

colorblue = #3300CC

colorred = #993300

colorwhite = #FFFFFF

colorgreen = #CCCC33

colorpink = #CC6699

colorpurple = #6633FF

//switch

switch1 = input(false, title='Chikou')

switch2 = input(false, title='Tenkan')

switch3 = input(false, title='Kijun')

middleDonchian(Length) =>

lower = ta.lowest(Length)

upper = ta.highest(Length)

math.avg(upper, lower)

//Functions

conversionPeriods = input.int(9, minval=1)

basePeriods = input.int(26, minval=1)

laggingSpan2Periods = input.int(52, minval=1)

displacement = input.int(26, minval=1)

Tenkan = middleDonchian(conversionPeriods)

Kijun = middleDonchian(basePeriods)

xChikou = close

SenkouA = middleDonchian(laggingSpan2Periods)

SenkouB = (Tenkan[basePeriods] + Kijun[basePeriods]) / 2

//Plot

A = plot(SenkouA[displacement], color=color.new(colorpurple, 0), title='SenkouA')

B = plot(SenkouB, color=color.new(colorgreen, 0), title='SenkouB')

plot(switch1 ? xChikou : na, color=color.new(colorpink, 0), title='Chikou', offset=-displacement)

plot(switch2 ? Tenkan : na, color=color.new(colorred, 0), title='Tenkan')

plot(switch3 ? Kijun : na, color=color.new(colorblue, 0), title='Kijun')

fill(A, B, color=color.new(colorgreen, 90), title='Ichimoku Cloud')

//Buy and Sell signals

fukuiz = math.avg(ema2, ema8)

white = ema2 > ema8

gray = ema2 < ema8

buycond = white and white[1] == 0

sellcond = gray and gray[1] == 0

bullish = ta.barssince(buycond) < ta.barssince(sellcond)

bearish = ta.barssince(sellcond) < ta.barssince(buycond)

buy = bearish[1] and buycond and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

sell = bullish[1] and sellcond and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

sell2=ema2 < ema8

buy2 = white and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

//$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

//Back test

startYear = input.int(defval=2017, title='Start Year', minval=2000, maxval=3000)

startMonth = input.int(defval=1, title='Start Month', minval=1, maxval=12)

startDay = input.int(defval=1, title='Start Day', minval=1, maxval=31)

endYear = input.int(defval=2023, title='End Year', minval=2000 ,maxval=3000)

endMonth = input.int(defval=12, title='End Month', minval=1, maxval=12)

endDay = input.int(defval=31, title='End Day', minval=1, maxval=31)

start = timestamp(startYear, startMonth, startDay, 00, 00)

end = timestamp(endYear, endMonth, endDay, 23, 59)

period() => time >= start and time <= end ? true : false

if buy2

strategy.entry("Enter Long", strategy.long)

else if sell2

strategy.entry("Enter Short", strategy.short)

- Détermination des tendances multidimensionnelles et stratégie d'arrêt-perte dynamique ATR

- La tendance à l'augmentation des indicateurs confirme la stratégie de négociation

- Stratégie de suivi des tendances d'adaptation et de confirmation de plusieurs transactions

- Stratégie d'optimisation des transactions journalières combinée à l'indicateur de dynamique RSI

- Stratégie de suivi des tendances de la dynamique à travers plusieurs indicateurs technologiques

- La tendance de l'EMA est associée à une reprise de la stratégie de négociation

- Stratégie de négociation quantifiée par paramètres dynamiques RSI à travers plusieurs lignes uniformes

- Les tendances dynamiques déterminent la stratégie de croisement des indicateurs RSI

- Stratégie de suivi des doubles tendances croisées: l'index homogène et le système de négociation synchrone MACD

- Des stratégies de quantification avancées croisent des tendances multidimensionnelles et de multiples indicateurs

- Stratégie de négociation quantitative de suivi des tendances dynamiques croisées et des confirmations multiples

- ZigZag basé sur l'élan

- VuManChu chiffrement B + stratégie de divergence

- Concept du double SuperTrend

- Super scalper

- Tests de retour - indicateur

- Des tendances

- Le tueur de Sma BTC

- Modèle d'alerte ML

- La progression de Fibonacci avec des pauses

- RSI MTF Ob+Os

- Le montant de l'impôt sur les sociétés est calculé à partir de l'impôt sur les sociétés.

- Le MACD est plus intelligent

- Stratégie R5.1 du CCO

- Bienvenue sur le marché aux ours.

- Le chef de file

- Points de pivotement haut bas multi-temps

- Une base de données de stratégies de suivi de la tendance fantôme

- Les phantômes suivent les stratégies de l'entreprise

- Les stratégies de suivi de la tendance fantôme

- Oscillateur arc-en-ciel