概述

该策略是一个结合了珊瑚趋势指标(Coral Trend)和唐奇安通道(Donchian Channel)的趋势跟踪交易系统。通过对市场动量的精确捕捉和趋势突破的多重确认,有效地过滤掉了震荡市中的虚假信号,提高了交易的准确性。策略采用了自适应均线技术,能够根据市场状态动态调整参数,使其在不同的市场环境下都能保持稳定的表现。

策略原理

策略的核心逻辑建立在两个主要指标的协同作用上: 1. 珊瑚趋势指标(Coral Trend):通过计算(最高价+最低价+收盘价)/3的平滑值,并与当前收盘价比较,确定趋势方向。 2. 唐奇安通道(Donchian Channel):通过计算用户定义周期内的最高价和最低价,判断价格是否突破关键水平。

当两个指标同时确认上升趋势时(coralTrendVal == 1 且 donchianTrendVal == 1),系统产生做多信号;当两个指标同时确认下降趋势时(coralTrendVal == -1 且 donchianTrendVal == -1),系统产生做空信号。策略使用状态机(trendState)来追踪当前的趋势状态,避免重复信号。

策略优势

- 多重确认机制:通过结合两个独立的趋势指标,大大降低了虚假信号的概率。

- 自适应性强:珊瑚趋势指标的平滑计算方法使其能够适应不同的市场波动状态。

- 参数可调性:策略提供了灵活的参数设置选项,可以根据不同的交易品种和时间周期进行优化。

- 趋势持续性识别:系统能够有效识别强趋势行情,并在趋势期间保持仓位。

- 视觉反馈清晰:通过图表标记和趋势线的绘制,交易者可以直观地理解市场状态。

策略风险

- 趋势反转风险:在趋势转折点可能出现滞后,导致一定的回撤。解决方案:可以添加波动率过滤器,在市场波动加剧时及时减仓。

- 震荡市表现:在横盘整理行情中可能产生过多交易信号。解决方案:增加趋势强度确认指标,只在趋势明确时开仓。

- 参数敏感性:不同的参数设置可能导致策略表现差异较大。解决方案:建议通过历史数据回测,找到最优参数组合。

策略优化方向

- 动态参数调整:可以根据市场波动率自动调整唐奇安通道周期和珊瑚趋势平滑周期。

- 增加止损机制:建议添加基于ATR的动态止损,提高风险控制能力。

- 加入成交量确认:在信号生成时增加成交量过滤条件,提高趋势确认的可靠性。

- 优化仓位管理:实现基于趋势强度的动态仓位管理系统。

- 市场环境分类:增加市场环境识别模块,在不同市场状态下使用不同的参数组合。

总结

该策略通过多重趋势确认机制和灵活的参数设置,实现了一个稳健的趋势跟踪系统。其自适应特性和清晰的信号逻辑使其适合各种交易周期和市场环境。通过建议的优化方向,策略的表现还有进一步提升的空间。在实盘应用时,建议结合风险管理措施,并根据具体交易品种的特性进行参数优化。

策略源码

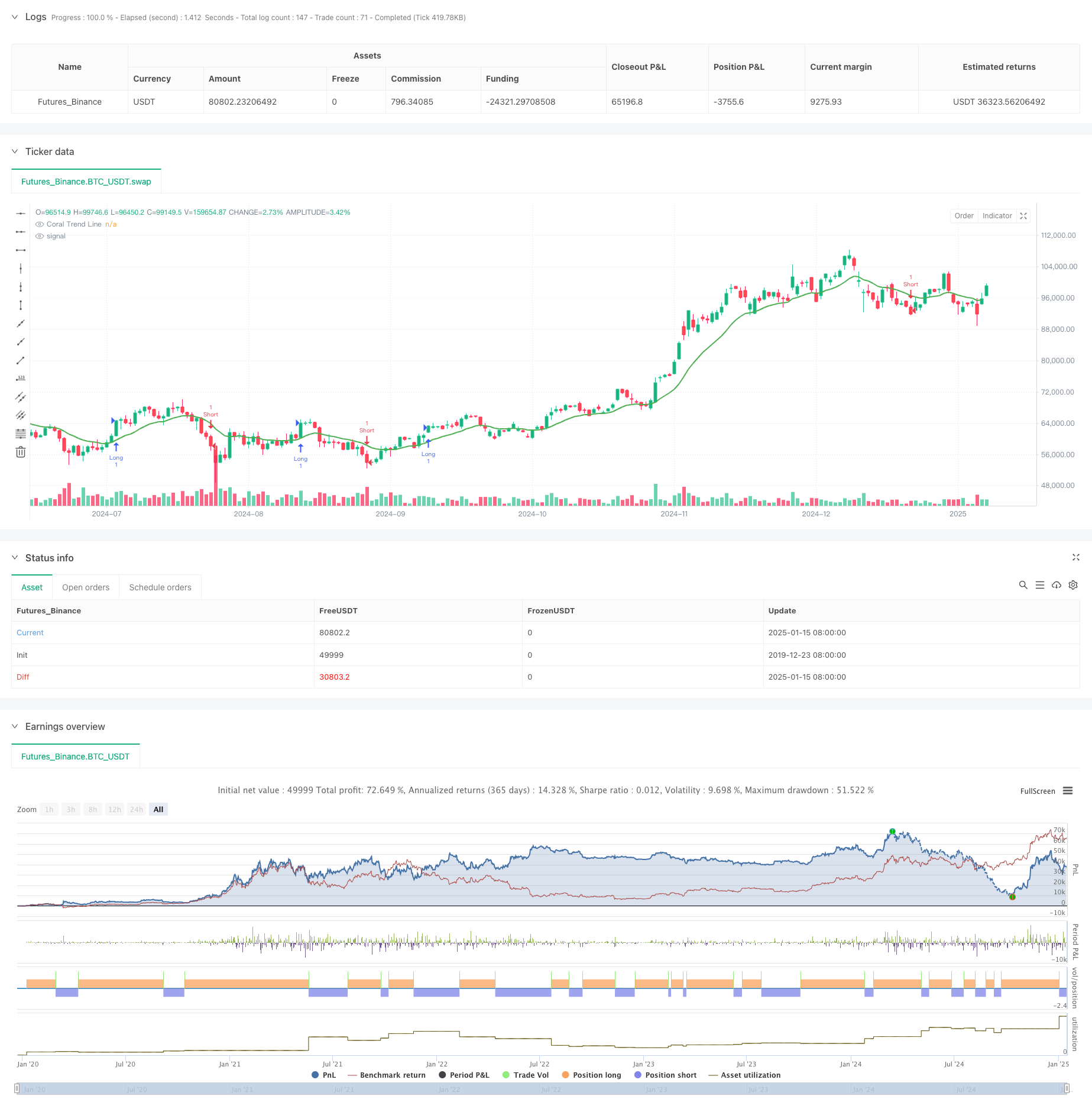

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-16 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Coral Tides Strategy", shorttitle="CoralTidesStrat", overlay=true)

// === Inputs ===

dlen = input.int(defval=20, title="Donchian Channel Period", minval=10)

coralPeriod = input.int(defval=14, title="Coral Trend Period")

// === Functions ===

// Coral Trend Calculation

coralTrend(period) =>

smooth = (high + low + close) / 3

coral = ta.ema(smooth, period)

trend = 0

trend := close > coral ? 1 : close < coral ? -1 : trend[1]

[trend, coral]

// Donchian Trend Calculation

donchianTrend(len) =>

hh = ta.highest(high, len)

ll = ta.lowest(low, len)

trend = 0

trend := close > hh[1] ? 1 : close < ll[1] ? -1 : trend[1]

trend

// === Trend Calculation ===

[coralTrendVal, coralLine] = coralTrend(coralPeriod)

donchianTrendVal = donchianTrend(dlen)

// === Signal Logic ===

var int trendState = 0

buySignal = false

sellSignal = false

if (coralTrendVal == 1 and donchianTrendVal == 1 and trendState != 1)

buySignal := true

sellSignal := false

trendState := 1

else if (coralTrendVal == -1 and donchianTrendVal == -1 and trendState != -1)

sellSignal := true

buySignal := false

trendState := -1

else

buySignal := false

sellSignal := false

// === Strategy Execution ===

// Entry Signals

if (buySignal)

strategy.entry("Long", strategy.long)

if (sellSignal)

strategy.entry("Short", strategy.short)

// === Plots ===

// Coral Trend Line

plot(coralLine, color=color.green, linewidth=2, title="Coral Trend Line")

// Buy/Sell Signal Labels

if buySignal

label.new(bar_index, low, "BUY", color=color.green, textcolor=color.white, style=label.style_label_down, size=size.normal)

if sellSignal

label.new(bar_index, high, "SELL", color=color.red, textcolor=color.white, style=label.style_label_up, size=size.normal)

相关推荐