Indice de force relative - Différences - Libertus

Auteur:ChaoZhang est là., Date: le 24 mai 2022 à 15h24Les étiquettes:Indice de résistance

Bonjour à tous,

Pour faciliter l'expérience de trading de tout le monde j'ai fait ce script qui colore les conditions de surachat et de survente du RSI et comme bonus affiche les divergences haussières ou baissières dans les 50 dernières bougies (par défaut, vous pouvez le changer). Si vous avez des suggestions ou si vous avez déjà apporté des améliorations, veuillez le signaler dans les commentaires.

Bon commerce et bonne chance!

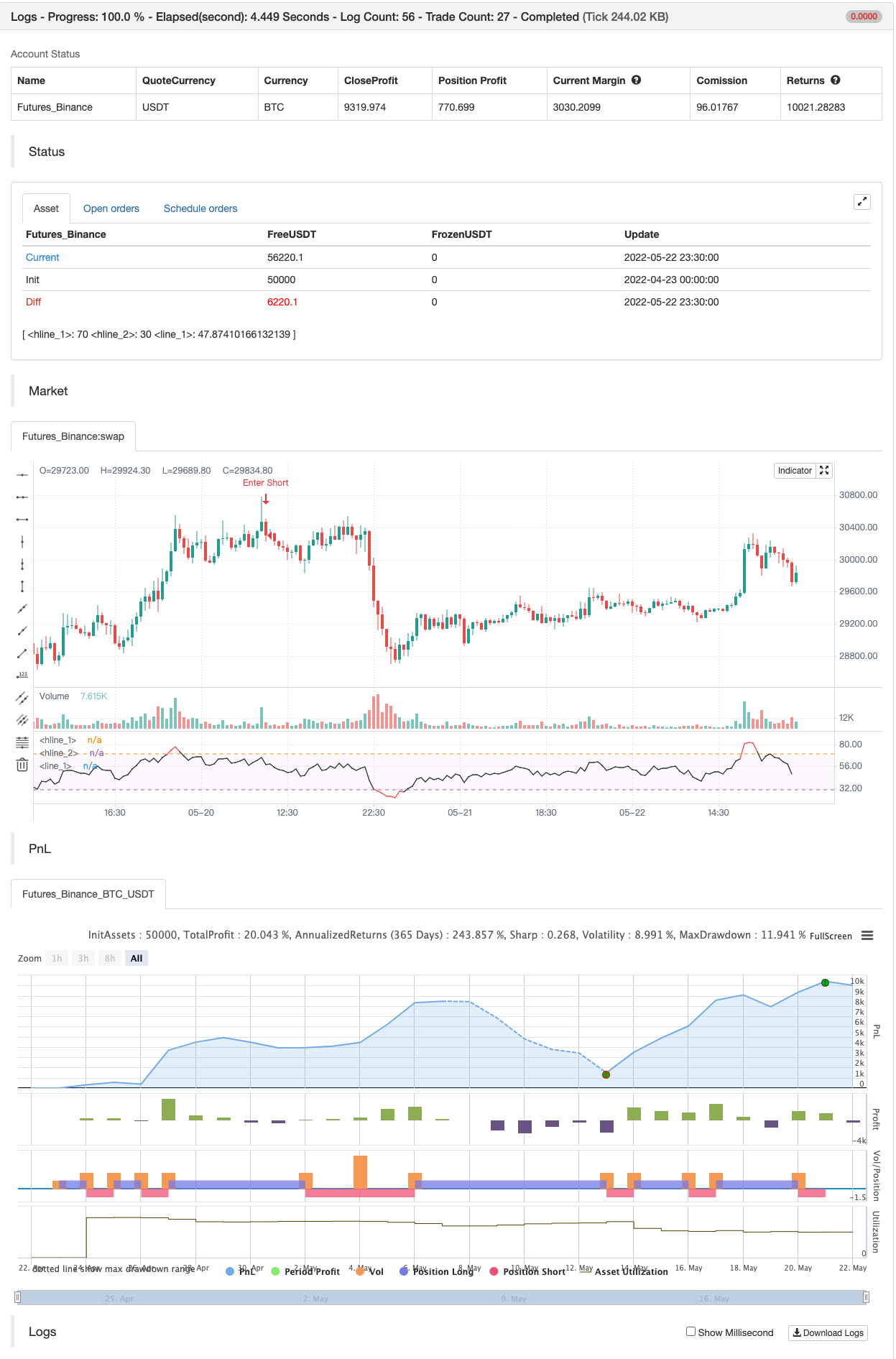

test de retour

//@version=4

// Copyright by Libertus - 2021

// RSI Divergences v3.2

// Free for private use

study(title="Relative Strength Index - Divergences - Libertus", shorttitle="RSI Div - Lib")

len = input(14, minval=1, title="RSI Length")

ob = input(defval=70, title="Overbought", type=input.integer, minval=0, maxval=100)

os = input(defval=30, title="Oversold", type=input.integer, minval=0, maxval=100)

// RSI code

rsi = rsi(close, len)

band1 = hline(ob)

band0 = hline(os)

plot(rsi, color=(rsi > ob or rsi < os ? color.new(color.red, 0) : color.new(color.black, 0)))

fill(band1, band0, color=color.new(color.purple, 97))

// DIVS code

piv = input(false,"Hide pivots?")

shrt = input(false,"Shorter labels?")

hidel = input(false, "Hide labels and color background")

xbars = input(defval=90, title="Div lookback period (bars)?", type=input.integer, minval=1)

hb = abs(highestbars(rsi, xbars)) // Finds bar with highest value in last X bars

lb = abs(lowestbars(rsi, xbars)) // Finds bar with lowest value in last X bars

// Defining variable values, mandatory in Pine 3

max = float(na)

max_rsi = float(na)

min = float(na)

min_rsi = float(na)

pivoth = bool(na)

pivotl = bool(na)

divbear = bool(na)

divbull = bool(na)

// If bar with lowest / highest is current bar, use it's value

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare high of current bar being examined with previous bar's high

// If curr bar high is higher than the max bar high in the lookback window range

if close > max // we have a new high

max := close // change variable "max" to use current bar's high value

if rsi > max_rsi // we have a new high

max_rsi := rsi // change variable "max_rsi" to use current bar's RSI value

if close < min // we have a new low

min := close // change variable "min" to use current bar's low value

if rsi < min_rsi // we have a new low

min_rsi := rsi // change variable "min_rsi" to use current bar's RSI value

// Finds pivot point with at least 2 right candles with lower value

pivoth := (max_rsi == max_rsi[2]) and (max_rsi[2] != max_rsi[3]) ? true : na

pivotl := (min_rsi == min_rsi[2]) and (min_rsi[2] != min_rsi[3]) ? true : na

// Detects divergences between price and indicator with 1 candle delay so it filters out repeating divergences

if (max[1] > max[2]) and (rsi[1] < max_rsi) and (rsi <= rsi[1])

divbear := true

if (min[1] < min[2]) and (rsi[1] > min_rsi) and (rsi >= rsi[1])

divbull := true

// Alerts

alertcondition(divbear, title='Bear div', message='Bear div')

alertcondition(divbull, title='Bull div', message='Bull div')

alertcondition(pivoth, title='Pivot high', message='Pivot high')

alertcondition(pivotl, title='Pivot low', message='Pivot low')

if divbull

strategy.entry("Enter Long", strategy.long)

else if divbear

strategy.entry("Enter Short", strategy.short)

// // Plots divergences and pivots with offest

// l = divbear ?

// label.new (bar_index-1, rsi[1]+1, "BEAR", color=color.red, textcolor=color.white, style=label.style_labeldown, yloc=yloc.price, size=size.small) :

// divbull ?

// label.new (bar_index-1, rsi[1]-1, "BULL", color=color.green, textcolor=color.white, style=label.style_labelup, yloc=yloc.price, size=size.small) :

// pivoth ?

// label.new (bar_index-2, max_rsi+1, "PIVOT", color=color.blue, textcolor=color.white, style=label.style_labeldown, yloc=yloc.price, size=size.small) :

// pivotl ?

// label.new (bar_index-2, min_rsi-1, "PIVOT", color=color.blue, textcolor=color.white, style=label.style_labelup, yloc=yloc.price, size=size.small) :

// na

// // Shorter labels

// if shrt

// label.set_text (l, na)

// // Hides pivots or labels

// if (piv and (pivoth or pivotl)) or hidel

// label.delete (l)

// // Colors indicator background

// bgcolor (hidel ? (divbear ? color.new(color.red, 50) : divbull ? color.new(color.green, 50) : na) : na, offset=-1)

// bgcolor (hidel ? (piv ? na : (pivoth or pivotl ? color.new(color.blue, 50) : na)) : na, offset=-2)

// Debug tools

// plot(max, color=blue, linewidth=2)

// plot(max_rsi, color=red, linewidth=2)

// plot(hb, color=orange, linewidth=2)

// plot(lb, color=purple, linewidth=1)

// plot(min_rsi, color=lime, linewidth=1)

// plot(min, color=black, linewidth=1)

Contenu lié

- Système stratégique de quantification des tendances de la mobilité à deux indicateurs

- Stratégie de négociation de tendance à signaux multiples à double équilibre RSI

- Stratégie d'optimisation des transactions journalières combinée à l'indicateur de dynamique RSI

- Stratégie de suivi des tendances de la dynamique à travers plusieurs indicateurs technologiques

- Stratégie de suivi de la tendance de la forme de la colonne d'éléphant pour une correction dynamique des pertes

- Stratégie de dynamique de tendance RSI bicyclique combinée à un système de gestion de position pyramidale

- Stratégie de négociation quantifiée par paramètres dynamiques RSI à travers plusieurs lignes uniformes

- Les tendances dynamiques déterminent la stratégie de croisement des indicateurs RSI

- Algorithmes de négociation de l'analyse quantitative des prix à proximité K multidimensionnelle et de la forme de la chute

- Système de commutation dynamique multi-stratégique adaptatif: stratégie de négociation quantitative pour suivre les tendances de convergence et les perturbations de la plage

- Des stratégies de quantification avancées croisent des tendances multidimensionnelles et de multiples indicateurs

En savoir plus

- Stratégie Swing Hull/rsi/EMA

- Outil de négociation Swing de scalping R1-4

- Meilleure stratégie d' engloutissement + de rupture

- Bollinger Awesome Alerte R1 Pour les produits de base

- Plugin de partage multi-échanges

- Le triangle de l'intérêt (l'écart entre les prix de vente des petites devises)

- Grille dynamique par contrat inverse bybit (grille spécifique)

- Alertes de tradingView à MT4 MT5 + variables dynamiques NON-REPAINTING

- Série de matrice

- Super scalper - 5 minutes 15 minutes

- Régression linéaire ++

- RedK double VADER avec barres d'énergie

- Zones de consolidation - en direct

- Évaluation quantitative et qualitative

- Alerte croisée moyenne mobile (MTF) sur plusieurs délais

- La stratégie de recharge du MACD

- Les moyennes mobiles à tendance supérieure

- Échange ABC

- 15 minutes BTCUSDTPERP BOT

- L'entropie de Shannon V2