Stratégie adaptative de prise de profit et d'arrêt de perte basée sur des délais doubles et des indicateurs de dynamique

Auteur:ChaoZhang est là., Date: 2023-11-23 17:57:52 Je vous en prie.Les étiquettes:

Résumé

Cette stratégie combine des délais doubles et des indicateurs de dynamique pour réaliser un profit adaptatif et un stop-loss. Le délai principal surveille la direction de la tendance, tandis que le délai secondaire est utilisé pour confirmer les signaux. Les signaux de trading sont générés lorsque les directions des deux s'alignent.

La logique de la stratégie

-

Le calendrier principal utilise l'indicateur de régression linéaire Squeeze Momentum (SQM) pour déterminer la tendance. Le calendrier secondaire utilise une combinaison EMA sur l'indicateur SQM pour filtrer les faux signaux.

-

Lorsque le graphique principal SQM s'écrase vers le haut et que le graphique secondaire SQM monte également, une position longue est prise.

-

Après être entré sur le marché, les niveaux de prise de profit et de stop loss initiaux sont définis en fonction des paramètres d'entrée. Lorsque le prix atteint le niveau de prise de profit, les niveaux de prise de profit et de stop loss sont mis à jour. Plus précisément, le niveau de prise de profit est augmenté progressivement et le niveau de stop loss est resserré, ce qui permet une prise de profit progressive.

Les avantages

-

Les doubles délais filtrent les faux signaux et assurent la précision.

-

L'indicateur SQM détermine la direction de la tendance, en évitant le bruit du marché.

-

Le mécanisme adaptatif de prise de bénéfices et de stop-loss bloque les bénéfices dans la mesure du possible et contrôle efficacement les risques.

Analyse des risques

-

Les paramètres SQM incorrects peuvent manquer les points de basculement de la tendance, entraînant des pertes.

-

Un délai secondaire inapproprié peut ne pas filtrer efficacement le bruit, ce qui entraîne des transactions erronées.

-

Si l'amplitude de stop loss est trop large, la perte par transaction peut être substantielle.

Des possibilités d'amélioration

-

Les paramètres du MQS doivent être ajustés pour différents marchés afin d'assurer la sensibilité.

-

Différentes périodes de temps secondaires doivent être testées pour trouver le meilleur effet de filtrage du bruit.

-

Au lieu d'une valeur fixe, l'amplitude de stop loss peut avoir une plage définie dynamiquement en fonction de la volatilité du marché.

Résumé

Dans l'ensemble, il s'agit d'une stratégie très pratique. La combinaison de deux délais avec un indicateur de dynamique pour déterminer les tendances, ainsi que la méthode adaptative de prise de profit et de stop-loss peuvent générer des profits stables. En optimisant les paramètres SQM, la période de délai secondaire et l'amplitude de stop-loss, les résultats de la stratégie peuvent être encore améliorés pour une application et une amélioration productives en direct.

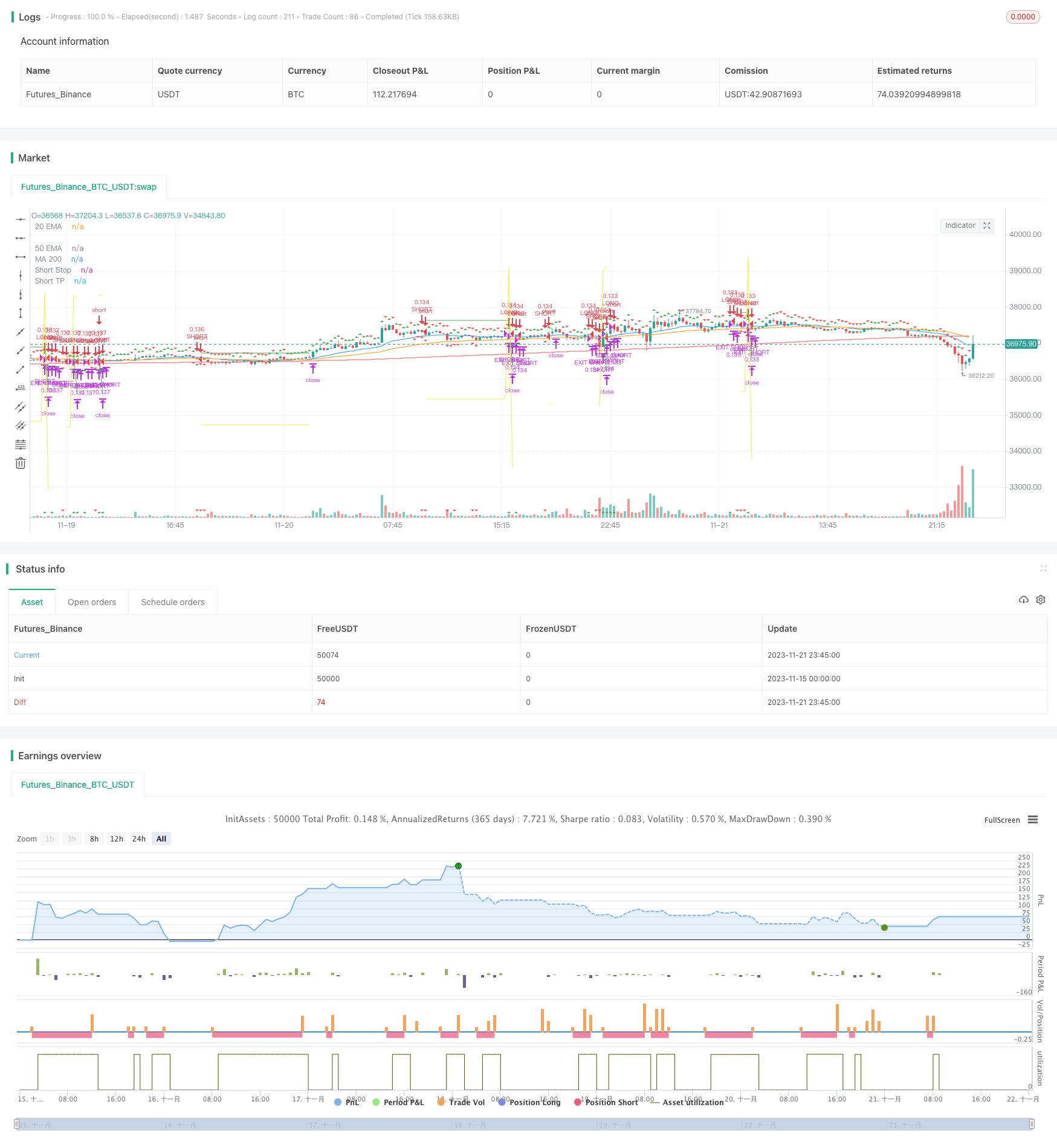

/*backtest

start: 2023-11-15 00:00:00

end: 2023-11-22 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SQZ Multiframe Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

fast_ema_len = input(11, minval=5, title="Fast EMA")

slow_ema_len = input(34, minval=20, title="Slow EMA")

sqm_lengthKC = input(20, title="SQM KC Length")

kauf_period = input(20, title="Kauf Period")

kauf_mult = input(2,title="Kauf Mult factor")

min_profit_sl = input(5.0, minval=1, maxval=100, title="Min profit to start moving SL [%]")

longest_sl = input(10, minval=1, maxval=100, title="Maximum possible of SL [%]")

sl_step = input(0.5, minval=0.0, maxval=1.0, title="Take profit factor")

// ADMF

CMF_length = input(11, minval=1, title="CMF length") // EMA27 = SMMA/RMA14 ~ lunar month

show_plots = input(true, title="Show plots")

lower_resolution = timeframe.period=='1'?'5':timeframe.period=='5'?'15':timeframe.period=='15'?'30':timeframe.period=='30'?'60':timeframe.period=='60'?'240':timeframe.period=='240'?'D':timeframe.period=='D'?'W':'M'

higher_resolution = timeframe.period=='5'?'1':timeframe.period=='15'?'5':timeframe.period=='30'?'15':timeframe.period=='60'?'30':timeframe.period=='240'?'60':timeframe.period=='D'?'240':timeframe.period=='W'?'D':'W'

// Calculate Squeeze Momentum

sqm_val = linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0)

sqm_val_high = security(syminfo.tickerid, higher_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), lookahead=barmerge.lookahead_on)

sqm_val_low = security(syminfo.tickerid, lower_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_on)

// Emas

high_close = security(syminfo.tickerid, higher_resolution, close, lookahead=barmerge.lookahead_on)

high_fast_ema = security(syminfo.tickerid, higher_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

high_slow_ema = security(syminfo.tickerid, higher_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

//low_fast_ema = security(syminfo.tickerid, lower_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

//low_slow_ema = security(syminfo.tickerid, lower_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

// CMF

ad = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

money_flow = sum(ad, CMF_length) / sum(volume, CMF_length)

// Entry conditions

low_condition_long = (sqm_val_low > sqm_val_low[1])

low_condition_short = (sqm_val_low < sqm_val_low[1])

money_flow_min = (money_flow[4] > money_flow[3]) and (money_flow[3] > money_flow[2]) and (money_flow[2] < money_flow[1]) and (money_flow[1] < money_flow)

money_flow_max = (money_flow[4] < money_flow[3]) and (money_flow[3] < money_flow[2]) and (money_flow[2] > money_flow[1]) and (money_flow[1] > money_flow)

condition_long = ((sqm_val > sqm_val[1])) and (money_flow_min or money_flow_min[1] or money_flow_min[2] or money_flow_min[3]) and lowest(sqm_val, 5) < 0

condition_short = ((sqm_val < sqm_val[1])) and (money_flow_max or money_flow_max[1] or money_flow_max[2] or money_flow_max[3]) and highest(sqm_val, 5) > 0

high_condition_long = true//high_close > high_fast_ema and high_close > high_slow_ema //(high_fast_ema > high_slow_ema) //and (sqm_val_low > sqm_val_low[1])

high_condition_short = true//high_close < high_fast_ema and high_close < high_slow_ema//(high_fast_ema < high_slow_ema) //and (sqm_val_low < sqm_val_low[1])

enter_long = low_condition_long and condition_long and high_condition_long

enter_short = low_condition_short and condition_short and high_condition_short

// Stop conditions

var current_target_price = 0.0

var current_sl_price = 0.0 // Price limit to take profit

var current_target_per = 0.0

var current_profit_per = 0.0

set_targets(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

if isLong

target := close * (1.0 + current_target_per)

sl := close * (1.0 - (longest_sl/100.0)) // Longest SL

else

target := close * (1.0 - current_target_per)

sl := close * (1.0 + (longest_sl/100.0)) // Longest SL

[target, sl]

target_reached(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

profit_per = 0.0

target_per = 0.0

if current_profit_per == 0

profit_per := (min_profit*sl_step) / 100.0

else

profit_per := current_profit_per + ((min_profit*sl_step) / 100.0)

target_per := current_target_per + (min_profit / 100.0)

if isLong

target := strategy.position_avg_price * (1.0 + target_per)

sl := strategy.position_avg_price * (1.0 + profit_per)

else

target := strategy.position_avg_price * (1.0 - target_per)

sl := strategy.position_avg_price * (1.0 - profit_per)

[target, sl, profit_per, target_per]

hl_diff = sma(high - low, kauf_period)

stop_condition_long = 0.0

new_stop_condition_long = low - (hl_diff * kauf_mult)

if (strategy.position_size > 0)

if (close > current_target_price)

[target, sl, profit_per, target_per] = target_reached(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_long := max(stop_condition_long[1], current_sl_price)

else

stop_condition_long := new_stop_condition_long

stop_condition_short = 99999999.9

new_stop_condition_short = high + (hl_diff * kauf_mult)

if (strategy.position_size < 0)

if (close < current_target_price)

[target, sl, profit_per, target_per] = target_reached(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_short := min(stop_condition_short[1], current_sl_price)

else

stop_condition_short := new_stop_condition_short

// Submit entry orders

if (enter_long and (strategy.position_size <= 0))

if (strategy.position_size < 0)

strategy.close(id="SHORT")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="LONG", long=true)

// if show_plots

// label.new(bar_index, high, text=tostring("LONG\nSL: ") + tostring(stop_condition_long), style=label.style_labeldown, color=color.green)

if (enter_short and (strategy.position_size >= 0))

if (strategy.position_size > 0)

strategy.close(id="LONG")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="SHORT", long=false)

// if show_plots

// label.new(bar_index, high, text=tostring("SHORT\nSL: ") + tostring(stop_condition_short), style=label.style_labeldown, color=color.red)

if (strategy.position_size > 0)

strategy.exit(id="EXIT LONG", stop=stop_condition_long)

if (strategy.position_size < 0)

strategy.exit(id="EXIT SHORT", stop=stop_condition_short)

// Plot anchor trend

plotshape(low_condition_long, style=shape.triangleup,

location=location.abovebar, color=color.green)

plotshape(low_condition_short, style=shape.triangledown,

location=location.abovebar, color=color.red)

plotshape(condition_long, style=shape.triangleup,

location=location.belowbar, color=color.green)

plotshape(condition_short, style=shape.triangledown,

location=location.belowbar, color=color.red)

//plotshape((close < profit_target_short) ? profit_target_short : na, style=shape.triangledown,

// location=location.belowbar, color=color.yellow)

plotshape(enter_long, style=shape.triangleup,

location=location.bottom, color=color.green)

plotshape(enter_short, style=shape.triangledown,

location=location.bottom, color=color.red)

// Plot emas

plot(ema(close, 20), color=color.blue, title="20 EMA")

plot(ema(close, 50), color=color.orange, title="50 EMA")

plot(sma(close, 200), color=color.red, title="MA 200")

// Plot stop loss values for confirmation

plot(series=(strategy.position_size > 0) and show_plots ? stop_condition_long : na,

color=color.green, style=plot.style_linebr,

title="Long Stop")

plot(series=(strategy.position_size < 0) and show_plots ? stop_condition_short : na,

color=color.green, style=plot.style_linebr,

title="Short Stop")

plot(series=(strategy.position_size < 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Short TP")

plot(series=(strategy.position_size > 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Long TP")

//plot(series=(strategy.position_size < 0) ? profit_sl_short : na,

// color=color.gray, style=plot.style_linebr,

// title="Short Stop")

- Stratégie basée sur la décomposition des séries chronologiques et les bandes de Bollinger pondérées par volume

- Stratégie de négociation quantitative de l'oscillateur de prix décentralisé

- Tendance à la suite d'une stratégie multi-indicateurs

- La CCI suit une double tendance en termes de calendrier

- Stratégie de suivi des tendances du T3-CCI

- Stratégie de rupture de la supertendance à intervalles chronologiques

- Stratégie de combinaison des moyennes mobiles de renversement de l'élan

- Rétrécissement de la moyenne mobile dynamique Stratégie Martin

- Stratégie d'appariement à double voie de combo pour inversion de l'élan

- Stratégie quantique du nuage Ichimoku

- Stratégie de négociation de la grille RSI à plusieurs périodes

- Stratégie de croisement des moyennes mobiles à double exponentiel

- Stratégie de suivi des tendances de la moyenne mobile

- Stratégie de croisement des prix de clôture mensuels et des moyennes mobiles

- Tendance à court terme de rupture des bandes de Bollinger à la suite de la stratégie

- Achat de baisses avec prise de profit et stop loss

- RSI Stratégie de croisement des moyennes mobiles axiales

- Stratégie de croisement à double SMA

- Stratégie de combinaison double EMA et RSI

- Spéculation dans le Golfe : Suivre la tendance en suivant la stratégie basée sur SAR