Stratégie dynamique d'achat et de vente

Auteur:ChaoZhang est là., Date: 2023-12-26 à 11h15Les étiquettes:

Résumé

Cette stratégie détermine le volume d'achat et de vente long et court à travers un calendrier personnalisé, combiné à des VWAP hebdomadaires et des bandes de Bollinger pour le filtrage, pour réaliser un suivi de tendance à haute probabilité.

Principe de stratégie

- Calculer les indicateurs de volume d'achat et de vente dans un délai personnalisé

- BV: Volume d'achat, causé par les achats à bas prix

- SV: Volume des ventes, causé par les ventes à un point élevé

- Volume des achats et des ventes de procédés

- Légère par EMA à 20 périodes

- Volume d'achat et de vente transformés séparés en volume positif et négatif

- Direction de l'indicateur de jugement

- Plus de 0 est haussier, moins de 0 est baissier

- Déterminer la divergence combinée avec les bandes de Bollinger et le VWAP hebdomadaires

- Le prix au-dessus du VWAP et l'indicateur haussier est un signal long

- Le prix inférieur à VWAP et l'indicateur baissier est un signal court

- Prise de bénéfices et stop loss dynamiques

- Pourcentage fixe de prise de bénéfices et de stop-loss basé sur l'ATR quotidien

Les avantages

- Le volume d'achat et de vente reflète la dynamique réelle du marché, capte l'énergie potentielle des tendances

- VWAP hebdomadaire juge la direction de la tendance sur une période plus longue, les bandes de Bollinger déterminent les signaux de rupture

- Les ensembles ATR dynamiques prennent des bénéfices et arrêtent les pertes, maximisent le verrouillage des bénéfices et évitent le sur-ajustement

Les risques

- Les données sur les volumes d'achat et de vente présentent certaines erreurs et peuvent entraîner des erreurs de jugement.

- Le jugement combiné d'un seul indicateur tend à générer de faux signaux

- Les paramètres des bandes de Bollinger incorrects réduisent les écarts valides

Directions d'optimisation

- Optimiser avec des indicateurs de volume d'achat et de vente sur plusieurs délais

- Ajouter le volume des transactions et d'autres indicateurs auxiliaires pour le filtrage

- Ajustez dynamiquement les paramètres des bandes de Bollinger pour améliorer l'efficacité de la rupture

Conclusion

Cette stratégie tire pleinement parti de la prévisibilité du volume d'achat et de vente, générant des signaux à forte probabilité complétés par des VWAP et des bandes de Bollinger, tout en contrôlant efficacement le risque grâce à des prises de profit et des arrêts de perte dynamiques.

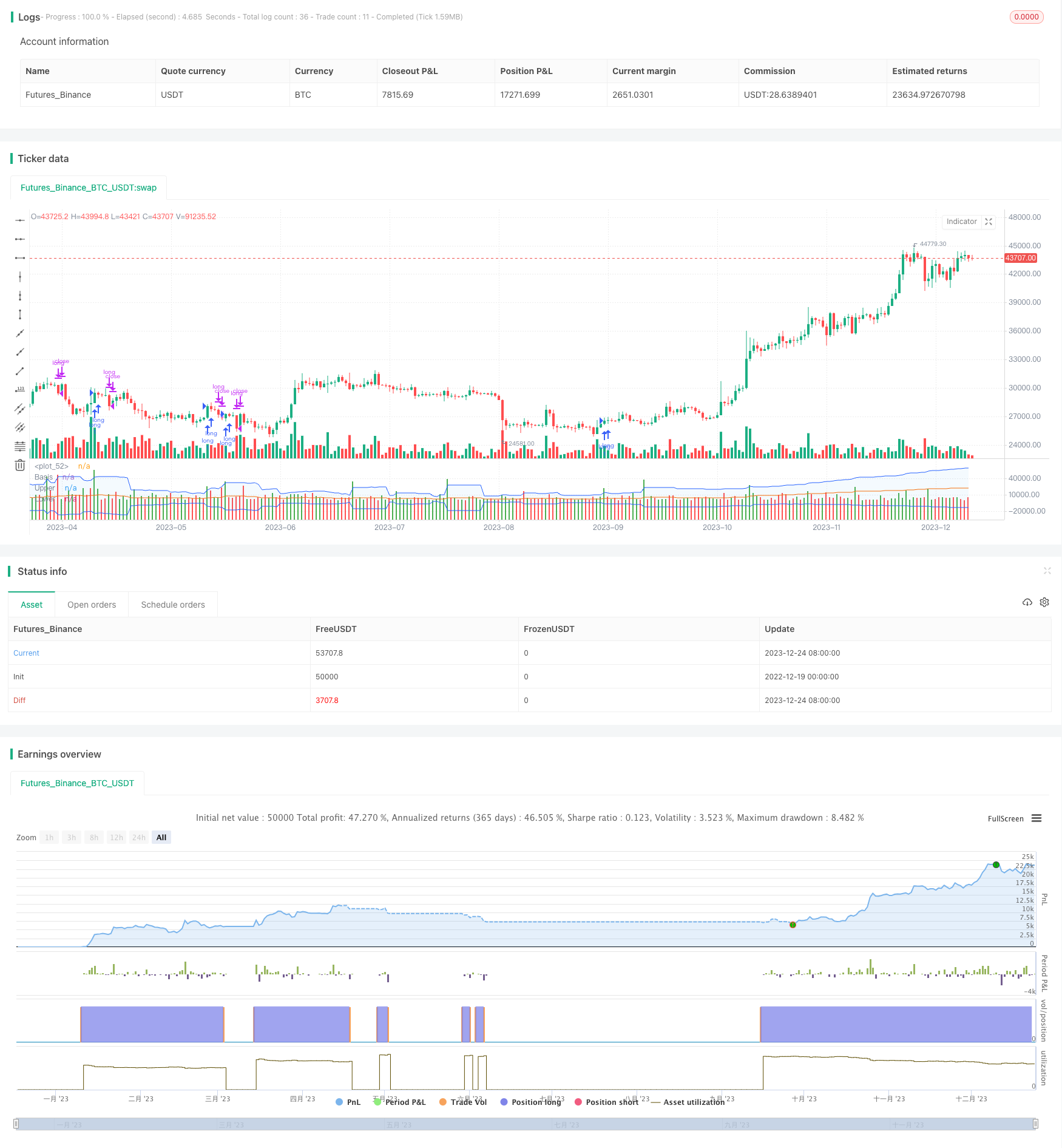

/*backtest

start: 2022-12-19 00:00:00

end: 2023-12-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © original author ceyhun

//@ exlux99 update

//@version=5

strategy('Buying Selling Volume Strategy', format=format.volume, precision=0, overlay=false)

weekly_vwap = request.security(syminfo.tickerid, "W", ta.vwap(hlc3))

vi = false

customTimeframe = input.timeframe("60", group="Entry Settings")

allow_long = input.bool(true, group="Entry Settings")

allow_short = input.bool(false, group="Entry Settings")

xVolume = request.security(syminfo.tickerid, customTimeframe, volume)

xHigh = request.security(syminfo.tickerid, customTimeframe, high)

xLow = request.security(syminfo.tickerid, customTimeframe, low)

xClose = request.security(syminfo.tickerid, customTimeframe, close)

BV = xHigh == xLow ? 0 : xVolume * (xClose - xLow) / (xHigh - xLow)

SV = xHigh == xLow ? 0 : xVolume * (xHigh - xClose) / (xHigh - xLow)

vol = xVolume > 0 ? xVolume : 1

TP = BV + SV

BPV = BV / TP * vol

SPV = SV / TP * vol

TPV = BPV + SPV

tavol20 = request.security(syminfo.tickerid, customTimeframe, ta.ema(vol, 20))

tabv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(BV, 20))

tasv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(SV, 20))

VN = vol / tavol20

BPN = BV / tabv20 * VN * 100

SPN = SV / tasv20 * VN * 100

TPN = BPN + SPN

xbvp = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPV))

xbpn = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPN))

xspv = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPV))

xspn = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPN))

BPc1 = BPV > SPV ? BPV : xbvp

BPc2 = BPN > SPN ? BPN : xbpn

SPc1 = SPV > BPV ? SPV : xspv

SPc2 = SPN > BPN ? SPN : xspn

BPcon = vi ? BPc2 : BPc1

SPcon = vi ? SPc2 : SPc1

minus = BPcon + SPcon

plot(minus, color = BPcon > SPcon ? color.green : color.red , style=plot.style_columns)

length = input.int(20, minval=1, group="Volatility Settings")

src = minus//input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev", group="Volatility Settings")

xtasma = request.security(syminfo.tickerid, customTimeframe, ta.sma(src, length))

xstdev = request.security(syminfo.tickerid, customTimeframe, ta.stdev(src, length))

basis = xtasma

dev = mult * xstdev

upper = basis + dev

lower = basis - dev

plot(basis, "Basis", color=#FF6D00, offset = 0)

p1 = plot(upper, "Upper", color=#2962FF, offset = 0)

p2 = plot(lower, "Lower", color=#2962FF, offset = 0)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// Original a

longOriginal = minus > upper and BPcon > SPcon and close > weekly_vwap

shortOriginal = minus > upper and BPcon < SPcon and close< weekly_vwap

high_daily = request.security(syminfo.tickerid, "D", high)

low_daily = request.security(syminfo.tickerid, "D", low)

close_daily = request.security(syminfo.tickerid, "D", close)

true_range = math.max(high_daily - low_daily, math.abs(high_daily - close_daily[1]), math.abs(low_daily - close_daily[1]))

atr_range = ta.sma(true_range*100/request.security(syminfo.tickerid, "D", close), 14)

ProfitTarget_Percent_long = input.float(100.0, title='TP Multiplier for Long entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_long = close + (close * (atr_range * ProfitTarget_Percent_long))/100

LossTarget_Percent_long = input.float(1.0, title='SL Multiplier for Long entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_long = close - (close * (atr_range * LossTarget_Percent_long ))/100

ProfitTarget_Percent_short = input.float(100.0, title='TP Multiplier for Short entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_short = close - (close * (atr_range*ProfitTarget_Percent_short))/100

LossTarget_Percent_short = input.float(5.0, title='SL Multiplier for Short entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_short = close + (close * (atr_range*LossTarget_Percent_short))/100

var longOpened_original = false

var int timeOfBuyLong = na

var float tpLong_long_original = na

var float slLong_long_original = na

long_entryx = longOriginal

longEntry_original = long_entryx and not longOpened_original

if longEntry_original

longOpened_original := true

tpLong_long_original := Profit_Ticks_long

slLong_long_original := Loss_Ticks_long

timeOfBuyLong := time

//lowest_low_var_sl := lowest_low

tpLong_trigger = longOpened_original[1] and ((close > tpLong_long_original) or (high > tpLong_long_original)) //or high > lowest_low_var_tp

slLong_Trigger = longOpened_original[1] and ((close < slLong_long_original) or (low < slLong_long_original)) //or low < lowest_low_var_sl

longExitSignal_original = shortOriginal or tpLong_trigger or slLong_Trigger

if(longExitSignal_original)

longOpened_original := false

tpLong_long_original := na

slLong_long_original := na

if(allow_long)

strategy.entry("long", strategy.long, when=longOriginal)

strategy.close("long", when= longExitSignal_original) //or shortNew

if(allow_short)

strategy.entry("short", strategy.short, when=shortOriginal )

strategy.close("short", when= longOriginal) //or shortNew

Plus de

- Stratégie de croisement de moyenne mobile de Larry Williams

- Stratégie de synchronisation de la moyenne mobile différentielle de l'oscillateur

- Une stratégie de négociation DMI et stochastique avec stop-loss dynamique

- Stratégie d'inversion et d'indice de masse combinée à deux facteurs

- Stratégie de négociation quantitative basée sur le double filtre de tendance

- Stratégie de négociation de l'oscillation de l'impulsion du RSI stochastique

- Stratégie de négociation de vente à découvert lorsque la bande de Bollinger franchit le seuil inférieur au prix avec appel de retour du RSI

- Stratégie de croisement des moyennes mobiles

- Stratégie de suivi des tendances basée sur des bandes pivot dynamiques

- Tendance de dynamisme des bandes de Bollinger à la suite de la stratégie

- Stratégie quantitative MACD de la tendance supérieure

- 4 Stratégie de tendance de l' EMA

- Stratégie de trading Bitcoin basée sur des indicateurs quantitatifs

- La dernière N bougie stratégie de logique inverse

- Stratégie de suivi des tendances

- Stratégie simple d'achat à bas prix

- N Bar Close au-dessous de la stratégie courte ouverte

- Stratégie de contre-test de volatilité statistique basée sur la méthode des valeurs extrêmes

- Stratégie d'arrêt des pertes pour l'indice de force relative

- Stratégie de rupture à double canal