Double stratégie de tendance et d'oscillation

Auteur:ChaoZhang est là., Date: 2024-01-04 17h32: 26Les étiquettes:

Résumé

La double stratégie de tendance et d'oscillation est une stratégie de trading quantitative qui combine tendance et oscillation.

Principaux

La stratégie utilise principalement deux indicateurs ouverts: les Trend Surfers et l'oscillateur de tendance de Mawreez.

Trend Surfers est un indicateur de suivi de tendance de stop loss. En calculant les prix les plus élevés et les plus bas sur une certaine période, il juge le mouvement des prix et donne des positions de stop loss suggérées. Par exemple, lorsque le prix dépasse le prix le plus élevé des 168 K-lines les plus récentes, c'est un signal haussier; lorsque le prix dépasse le prix le plus bas des 168 K-lines les plus récentes, c'est un signal baissier.

L'oscillateur de tendance de Mawreez

Les règles de négociation de cette stratégie sont les suivantes:

Entrée longue: Acheter lorsque les surfeurs de tendance franchissent la ligne la plus élevée et que l'oscillateur de tendance de Mawreez montre un signal haussier

Entrée courte: vendre lorsque les surfeurs de tendance franchissent la ligne inférieure et que l'oscillateur de tendance de Mawreez montre un signal baissier

La méthode de stop loss est une combinaison de stop loss de suivi de tendance et de stop loss fixe.

Analyse des avantages

Cette stratégie combine des indicateurs de tendance et d'oscillation, qui peuvent capturer les tendances et trouver de meilleurs prix d'entrée pendant les oscillations.

- Le double filtre d'indicateur peut éviter efficacement les fausses éruptions

- La combinaison de tendance et d'oscillation facilite la saisie du prix bas dans les fourchettes de prix pour la chasse aux bonnes affaires ou la sortie au prix élevé pour le profit.

- Les méthodes de stop loss multiples peuvent très bien contrôler les risques

Analyse des risques

Cette stratégie comporte également certains risques:

- La combinaison de deux indicateurs peut entraîner des signaux de négociation manquants

- Des signaux contradictoires peuvent apparaître entre l'indicateur de tendance et l'indicateur d'oscillation

- L'arrêt-perte fixe peut être arrêté trop tôt

Pour atténuer ces risques, les mesures suivantes peuvent être prises:

- Rétrécir correctement les paramètres des indicateurs pour réduire le taux de filtration

- Ajouter des règles de jugement de tendance pour éviter les conflits d'indicateurs

- Réglage dynamique des positions de stop loss

Directions d'optimisation

Cette stratégie peut être encore optimisée:

- Testez différentes combinaisons de paramètres et paramètres de cycle pour trouver les paramètres optimaux

- Augmenter les règles auxiliaires basées sur la volatilité, le volume des transactions, etc.

- Adopter des techniques d'apprentissage automatique pour optimiser dynamiquement les indicateurs et les paramètres

Résumé

La double stratégie de tendance et d'oscillation intègre les avantages du suivi de tendance et des indicateurs d'oscillation. Elle peut identifier les directions de tendance et saisir les opportunités d'oscillation. Avec l'optimisation des paramètres et des règles, la rentabilité de cette stratégie peut être encore améliorée.

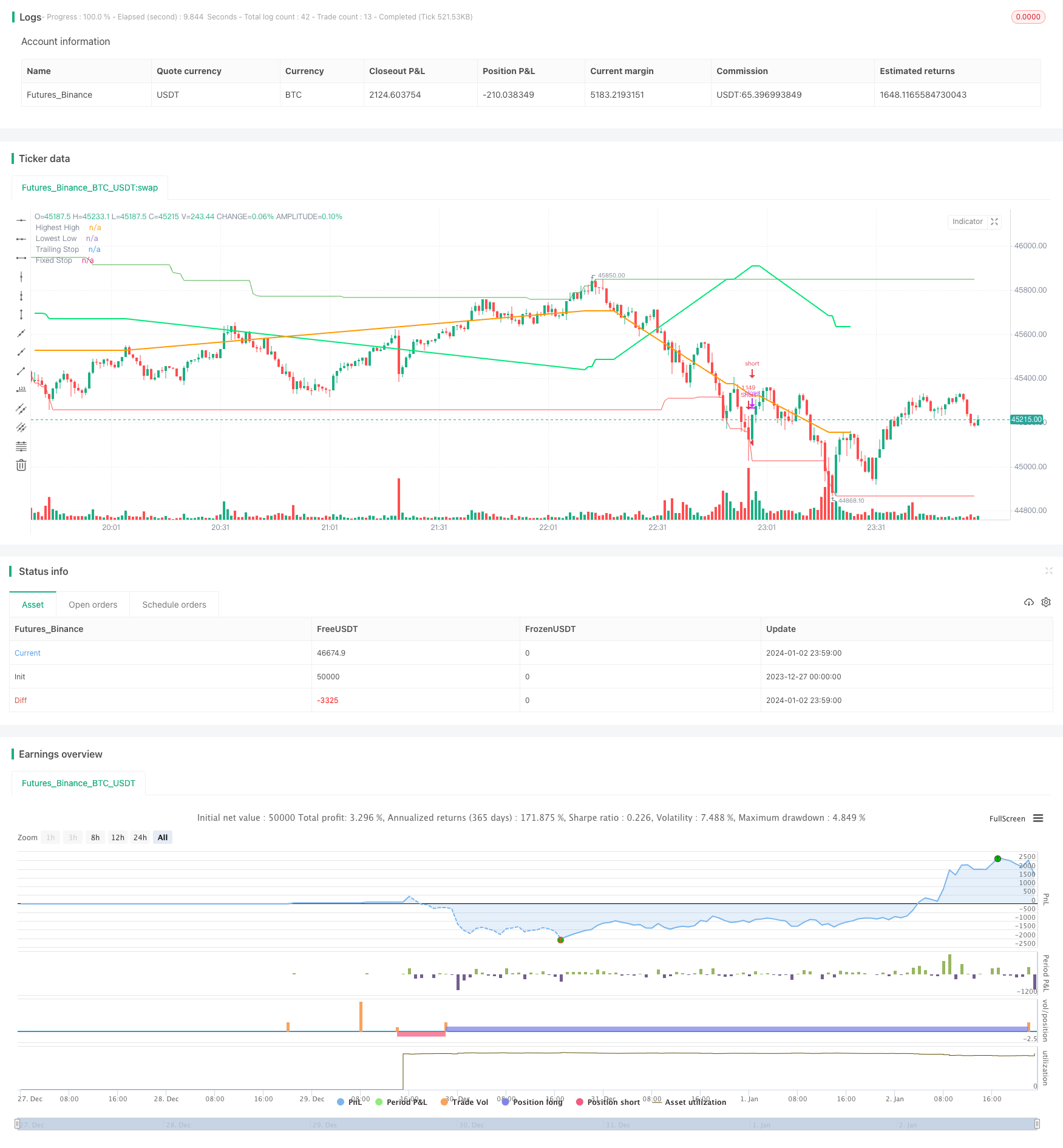

/*backtest

start: 2023-12-27 00:00:00

end: 2024-01-03 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © myn

//@version=5

strategy('Strategy Myth-Busting #8 - TrendSurfers+TrendOsc - [MYN]', max_bars_back=5000, overlay=true, pyramiding=0, initial_capital=20000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=100.0, commission_value=0.075, use_bar_magnifier = false)

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

//cAe9It4ynO4

// Strategies

// Trend Surfers - Premium Indicator

// Mawreez' Trend Oscillator Indicator

// Trading Setup / Rules

// Long Condition

// Trend Surfers Trailing stop line goes below (Crosses) lowest low

// Bullish Candle (red)

// Mawreeze Trend Oscilator Indicator is green

// Short Condition

// Trend Surfers Trailing stop line goes above (Crosses) highest high

// Bearish Candle (red)

// Mawreeze Trend Oscilator Indicator is red

// Stop loss middle between high and low Risk 1:2

//@version=5

//strategy(shorttitle='Trend Surfers - Breakout', title='Trend Surfers - Premium Breakout', overlay=true, calc_on_every_tick=false, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type='percent', commission_value=0.04)

// Risk for position and pyramid

maxriskval = input.float(2, 'Max % risk', tooltip='Risk % over total equity / Position', group='Risk Management')

pairnumber = input.int(title='How many pairs', defval=1, tooltip='How many pairs are you trading with the strategy?', group='Risk Management')

// Emtry Exit

highPeriod = input.int(title='Highest High Period', defval=168, tooltip='Highest High of X bars - This will trigger a Long Entry when close is above. (Thin Green Line)', group='Entry Condition')

lowPeriod = input.int(title='Lowest Low Period', defval=168, tooltip='Lowest low of X bars - This will trigger a Short Entry when close is under. (Thin Red Line)', group='Entry Condition')

// Stoploss

trailingAtrPeriod = input.int(title='Trailing ATR Pediod', defval=10, tooltip='Average True Range for the Trailing Stop. (Thick Green Line) ', group='Exit Condition')

trailingAtrMultiplier = input.float(title='Trailing ATR Multiplier', defval=8, group='Exit Condition')

fixAtrPeriod = input.int(title='Fix ATR Pediod', defval=10, tooltip='Average True Range for the Fix Stoloss. (Thick Yellow Line)', group='Exit Condition')

fixAtrMultiplier = input.float(title='Fix ATR Multiplier', defval=2, group='Exit Condition')

// Pair info

pair = syminfo.basecurrency + syminfo.currency

// High Low Variable

highestHigh = ta.highest(high, highPeriod)[1]

lowestLow = ta.lowest(low, lowPeriod)[1]

trailingAtr = ta.atr(trailingAtrPeriod) * trailingAtrMultiplier

// Trade Condition

longConditionTrendSurfers = ta.crossover(close, highestHigh)

shortConditionTrendSurfers = ta.crossunder(close, lowestLow)

// Risk Variable

fixAtr = ta.atr(fixAtrPeriod) * fixAtrMultiplier

stopvaluelong = close[1] - fixAtr[1]

stopvalueshort = close[1] + fixAtr[1]

// Position size Long

maxpossize = strategy.equity / close

positionsizelong = maxriskval / 100 * strategy.equity / (close - stopvaluelong)

stopperclong = (close - stopvaluelong) / close * 100

leveragelong = math.max(1, math.ceil(positionsizelong / maxpossize)) * 2

posperclong = positionsizelong * close / strategy.equity * 100 / leveragelong / pairnumber

realposlong = posperclong / 100 * strategy.equity * leveragelong / close

// Position size Short

positionsizeshort = maxriskval / 100 * strategy.equity / (stopvalueshort - close)

stoppercshort = (close - stopvalueshort) / close * 100

leverageshort = math.max(1, math.ceil(positionsizeshort / maxpossize)) * 2

pospercshort = positionsizeshort * close / strategy.equity * 100 / leverageshort / pairnumber

realposshort = pospercshort / 100 * strategy.equity * leverageshort / close

// Alert Message

entry_long_message = '\nGo Long for ' + pair + 'NOW!' + '\nPosition Size % =' + str.tostring(posperclong) + '\nLeverage' + str.tostring(leveragelong) + '\nStoploss Price =' + str.tostring(stopvaluelong) + '\nClose any Short position that are open for ' + pair + '!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

entry_short_message = '\nGo Short for ' + pair + 'NOW!' + '\nPosition Size % =' + str.tostring(pospercshort) + '\nLeverage' + str.tostring(leverageshort) + '\nStoploss Price =' + str.tostring(stopvalueshort) + '\nClose any Long position that are open for ' + pair + '!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

exit_short_message = '\nExit Short for ' + pair + 'NOW!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

exit_long_message = '\nExit Long for ' + pair + 'NOW!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

// Order

// if longCondition

// strategy.entry('Long', strategy.long, stop=highestHigh, comment='Long', qty=realposlong, alert_message=entry_long_message)

// if shortCondition

// strategy.entry('Short', strategy.short, stop=lowestLow, comment='Short', qty=realposshort, alert_message=entry_short_message)

// Stoploss Trailing

longTrailing = close - trailingAtr

shortTrailing = close + trailingAtr

var longTrailingStop = 0.0

var shortTrailingStop = 999999.9

trailingStopLine = 0.0

trailingStopLine := na

fixedStopLine = 0.0

fixedStopLine := na

var inTrade = 0

if longConditionTrendSurfers or shortConditionTrendSurfers

if 0 == inTrade

if longConditionTrendSurfers

inTrade := 1

inTrade

else

inTrade := -1

inTrade

if 1 == inTrade and (shortConditionTrendSurfers or low <= math.max(fixedStopLine[1], longTrailingStop))

inTrade := 0

inTrade

if -1 == inTrade and (longConditionTrendSurfers or high >= math.min(fixedStopLine[1], shortTrailingStop))

inTrade := 0

inTrade

longTrailingStop := if 1 == inTrade

stopValue = longTrailing

math.max(stopValue, longTrailingStop[1])

else

0

shortTrailingStop := if -1 == inTrade

stopValue = shortTrailing

math.min(stopValue, shortTrailingStop[1])

else

999999

// Fix Stoploss

firstPrice = 0.0

firstFixAtr = 0.0

firstPrice := na

firstFixAtr := na

if 0 != inTrade

firstPrice := ta.valuewhen(inTrade != inTrade[1] and 0 != inTrade, close, 0)

firstFixAtr := ta.valuewhen(inTrade != inTrade[1] and 0 != inTrade, fixAtr, 0)

if 1 == inTrade

fixedStopLine := firstPrice - firstFixAtr

trailingStopLine := longTrailingStop

trailingStopLine

else

fixedStopLine := firstPrice + firstFixAtr

trailingStopLine := shortTrailingStop

trailingStopLine

// if strategy.position_size > 0

// strategy.exit(id='L Stop', stop=math.max(fixedStopLine, longTrailingStop), alert_message=exit_long_message)

// if strategy.position_size < 0

// strategy.exit(id='S Stop', stop=math.min(fixedStopLine, shortTrailingStop), alert_message=exit_short_message)

// Plot

plot(highestHigh, color=color.new(color.green, 0), linewidth=1, title='Highest High')

plot(lowestLow, color=color.new(color.red, 0), linewidth=1, title='Lowest Low')

plot(trailingStopLine, color=color.new(color.lime, 0), linewidth=2, offset=1, title='Trailing Stop')

plot(fixedStopLine, color=color.new(color.orange, 0), linewidth=2, offset=1, title='Fixed Stop')

// Trend Surfers Trailing stop line goes above (Crossesover) highest high

// Bearish Candle (red)

// Mawreeze Trend Oscilator Indicator is red

trendSurfersShortEntry = trailingStopLine > highestHigh and close < close[1]

trendSurfersLongEntry = trailingStopLine < lowestLow and close > close[1]

//@version=5

// Taken from the TradingView house rules regarding scripts:

// "All open source scripts that do not mention a specific open source license

// in their comments are licensed under the Mozilla Public License 2.0.

// Following the Mozilla License, any script reusing open source code originally

// published by someone else must also be open source, unless specific

// permission is granted by the original author."

//indicator('Mawreez\' Trend Oscillator', precision=3)

len = input.int(title='DI Length', minval=1, defval=14)

sens = input.float(title='Sensitivity', defval=25)

// Lag-free smoothing of a given series

smooth(series, len) =>

f28 = ta.ema(series, len)

f30 = ta.ema(f28, len)

vC = f28 * 1.5 - f30 * 0.5

f38 = ta.ema(vC, len)

f40 = ta.ema(f38, len)

v10 = f38 * 1.5 - f40 * 0.5

f48 = ta.ema(v10, len)

f50 = ta.ema(f48, len)

f48 * 1.5 - f50 * 0.5

// Constructing the +DI and -DI

up = ta.change(high)

down = -ta.change(low)

plus_dm = up > 0 and up > down ? up : 0

minus_dm = down > 0 and down > up ? down : 0

range_1 = ta.rma(ta.tr, len)

plus_di = smooth(ta.rma(plus_dm, len) / range_1, 3)

minus_di = smooth(ta.rma(minus_dm, len) / range_1, 3)

// Constructing and plotting the modified ADX

adj_adx = 100 * math.abs(plus_di - minus_di) / (plus_di + minus_di) - sens

adj_adx := (minus_di > plus_di ? -1 : 1) * (adj_adx < 0 ? 0 : adj_adx)

//plot(smooth(adj_adx, 3), color=plus_di > minus_di ? color.green : color.red, style=plot.style_columns)

trendOscShortEntry = plus_di < minus_di

trendOscLongEntry = plus_di > minus_di

//////////////////////////////////////

//* Put your strategy rules below *//

/////////////////////////////////////

longCondition = trendSurfersLongEntry and trendOscLongEntry

shortCondition = trendSurfersShortEntry and trendOscShortEntry

//define as 0 if do not want to use

closeLongCondition = 0

closeShortCondition = 0

// ADX

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

adxEnabled = input.bool(defval = false , title = "Average Directional Index (ADX)", tooltip = "", group ="ADX" )

adxlen = input(14, title="ADX Smoothing", group="ADX")

adxdilen = input(14, title="DI Length", group="ADX")

adxabove = input(25, title="ADX Threshold", group="ADX")

adxdirmov(len) =>

adxup = ta.change(high)

adxdown = -ta.change(low)

adxplusDM = na(adxup) ? na : (adxup > adxdown and adxup > 0 ? adxup : 0)

adxminusDM = na(adxdown) ? na : (adxdown > adxup and adxdown > 0 ? adxdown : 0)

adxtruerange = ta.rma(ta.tr, len)

adxplus = fixnan(100 * ta.rma(adxplusDM, len) / adxtruerange)

adxminus = fixnan(100 * ta.rma(adxminusDM, len) / adxtruerange)

[adxplus, adxminus]

adx(adxdilen, adxlen) =>

[adxplus, adxminus] = adxdirmov(adxdilen)

adxsum = adxplus + adxminus

adx = 100 * ta.rma(math.abs(adxplus - adxminus) / (adxsum == 0 ? 1 : adxsum), adxlen)

adxsig = adxEnabled ? adx(adxdilen, adxlen) : na

isADXEnabledAndAboveThreshold = adxEnabled ? (adxsig > adxabove) : true

//Backtesting Time Period (Input.time not working as expected as of 03/30/2021. Giving odd start/end dates

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

useStartPeriodTime = input.bool(true, 'Start', group='Date Range', inline='Start Period')

startPeriodTime = input(timestamp('1 Jan 2019'), '', group='Date Range', inline='Start Period')

useEndPeriodTime = input.bool(true, 'End', group='Date Range', inline='End Period')

endPeriodTime = input(timestamp('31 Dec 2030'), '', group='Date Range', inline='End Period')

start = useStartPeriodTime ? startPeriodTime >= time : false

end = useEndPeriodTime ? endPeriodTime <= time : false

calcPeriod = true

// Trade Direction

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tradeDirection = input.string('Long and Short', title='Trade Direction', options=['Long and Short', 'Long Only', 'Short Only'], group='Trade Direction')

// Percent as Points

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// Take profit 1

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp1 = input.float(title='Take Profit 1 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 1')

q1 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 1')

// Take profit 2

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp2 = input.float(title='Take Profit 2 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 2')

q2 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 2')

// Take profit 3

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp3 = input.float(title='Take Profit 3 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 3')

q3 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 3')

// Take profit 4

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp4 = input.float(title='Take Profit 4 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit')

/// Stop Loss

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

stoplossPercent = input.float(title='Stop Loss (%)', defval=999, minval=0.01, group='Stop Loss') * 0.01

slLongClose = close < strategy.position_avg_price * (1 - stoplossPercent)

slShortClose = close > strategy.position_avg_price * (1 + stoplossPercent)

/// Leverage

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

leverage = input.float(1, 'Leverage', step=.5, group='Leverage')

contracts = math.min(math.max(.000001, strategy.equity / close * leverage), 1000000000)

/// Trade State Management

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

isInLongPosition = strategy.position_size > 0

isInShortPosition = strategy.position_size < 0

/// ProfitView Alert Syntax String Generation

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

alertSyntaxPrefix = input.string(defval='CRYPTANEX_99FTX_Strategy-Name-Here', title='Alert Syntax Prefix', group='ProfitView Alert Syntax')

alertSyntaxBase = alertSyntaxPrefix + '\n#' + str.tostring(open) + ',' + str.tostring(high) + ',' + str.tostring(low) + ',' + str.tostring(close) + ',' + str.tostring(volume) + ','

/// Trade Execution

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

longConditionCalc = (longCondition and isADXEnabledAndAboveThreshold)

shortConditionCalc = (shortCondition and isADXEnabledAndAboveThreshold)

if calcPeriod

if longConditionCalc and tradeDirection != 'Short Only' and isInLongPosition == false

strategy.entry('Long', strategy.long, qty=contracts)

alert(message=alertSyntaxBase + 'side:long', freq=alert.freq_once_per_bar_close)

if shortConditionCalc and tradeDirection != 'Long Only' and isInShortPosition == false

strategy.entry('Short', strategy.short, qty=contracts)

alert(message=alertSyntaxBase + 'side:short', freq=alert.freq_once_per_bar_close)

//Inspired from Multiple %% profit exits example by adolgo https://www.tradingview.com/script/kHhCik9f-Multiple-profit-exits-example/

strategy.exit('TP1', qty_percent=q1, profit=per(tp1))

strategy.exit('TP2', qty_percent=q2, profit=per(tp2))

strategy.exit('TP3', qty_percent=q3, profit=per(tp3))

strategy.exit('TP4', profit=per(tp4))

strategy.close('Long', qty_percent=100, comment='SL Long', when=slLongClose)

strategy.close('Short', qty_percent=100, comment='SL Short', when=slShortClose)

strategy.close_all(when=closeLongCondition or closeShortCondition, comment='Close Postion')

/// Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Inspired by https://www.tradingview.com/script/uWqKX6A2/ - Thanks VertMT

showDashboard = input.bool(group="Dashboard", title="Show Dashboard", defval=false)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + "\n" + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// Draw dashboard table

if showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)

- Suivre la tendance en suivant une stratégie basée sur l' EMA et le MACD à travers les périodes

- Stratégie d'inversion de collision à plusieurs indicateurs

- Stratégie d'inversion de tendance basée sur le croisement des EMA et des SMA

- Stratégie de garde du DPO du DMI

- Suivi des tendances Stratégie de négociation à court terme

- Tendance de l'indice RSI à la suite de la stratégie haussière

- Stratégie de combinaison de l'indice RS et de la moyenne mobile

- Tendance à l'AM sur plusieurs périodes suivant la stratégie

- Stratégie d'achat à deux indicateurs

- Stratégie d'inversion de l' engloutissement baissier

- TrendSurfing - Stratégie de tendance croisée de la moyenne mobile double

- Stratégie de combinaison entre l'IMD et l'AMH

- Stratégie améliorée de scalping RSI basée sur l'indice de force relative

- Stratégie d'alarme HistoAlert à double inversion de l'indicateur RSI

- Stratégie de rupture de momentum avec le filtre ADX

- Stratégie composée de coût moyen dynamique en dollars

- Tendance croisée multi-EMA à la suite de la stratégie

- Stratégie de rupture du pivot de Camarilla

- Indicateur Botvenko adaptatif Stratégie courte longue

- Les bandelettes de Bollinger et la stratégie quantitative de négociation basée sur le VWAP