Stratégie de dynamique stochastique à triple chevauchement

Auteur:ChaoZhang est là., Date: 2024-01-26 12:15:20 Les résultats de l'enquêteLes étiquettes:

Résumé

La stratégie de triple chevauchement de l'élan stochastique est une stratégie de trading à court terme typique. Elle calcule trois indicateurs de l'indice de l'élan stochastique (SMI) avec des paramètres différents et génère des signaux de trading lorsque les trois montrent simultanément des conditions de surachat ou de survente.

La logique de la stratégie

L'indicateur de base de cette stratégie est l'indice de dynamique stochastique (SMI).

SMI = 100 * EMA(EMA(Close - Midpoint of High-Low Range, N1), N2) / 0.5 * EMA(EMA(High - Low, N1), N2)

Les valeurs supérieures à 0 indiquent que la clôture se situe dans la moitié supérieure de la fourchette quotidienne, tandis que les valeurs inférieures à 0 indiquent que la clôture se situe dans la moitié inférieure.

Comme pour l'oscillateur stochastique traditionnel, les niveaux de surachat (par exemple 40) / survente (par exemple -40) indiquent des signaux d'inversion potentiels.

La stratégie utilise trois indicateurs SMI avec différents ensembles de paramètres, notamment:

- SMI1: %K période 10, %K période de ralentissement 3

- SMI2: %K période 20, %K période de ralentissement 3

- SMI3: %K période 5, %K période de ralentissement 3

Les signaux de négociation sont générés lorsque les trois PME affichent simultanément des conditions de surachat ou de survente.

Les avantages

- Analyse de plusieurs délais pour des signaux robustes

- SMI améliore la facilité d'utilisation par rapport au Stochastique traditionnel

- La triple superposition améliore la fiabilité par rapport à un seul indicateur

- Paramètres flexibles pour l'optimisation

- Bien adapté au trading à court terme et à haute fréquence

Les risques

- Plusieurs indicateurs peuvent être des signaux de retard

- Une fréquence de négociation élevée augmente les coûts

- Retour à l'essai de suradaptation

- Les paramètres peuvent échouer avec des changements de régime du marché

Réduction des risques:

- Optimiser les paramètres pour réduire le retard

- Ajuster la période de détention pour réduire les coûts de négociation

- Effectuer des essais statistiques pour valider la robustesse

- Adaptation dynamique des paramètres

Améliorations

- Tester différentes combinaisons de paramètres SMI

- Ajouter des métriques statistiques pour évaluer la stabilité des paramètres

- Incorporer des indicateurs de soutien tels que le volume, les bandes de Bollinger, etc.

- Commutation dynamique des paramètres en fonction de l'environnement

- Optimiser les stratégies de stop loss

Conclusion

La stratégie du moment stochastique triple chevauchement combine une génération de signal robuste sur plusieurs délais en superposant trois indicateurs SMI avec des paramètres uniques.

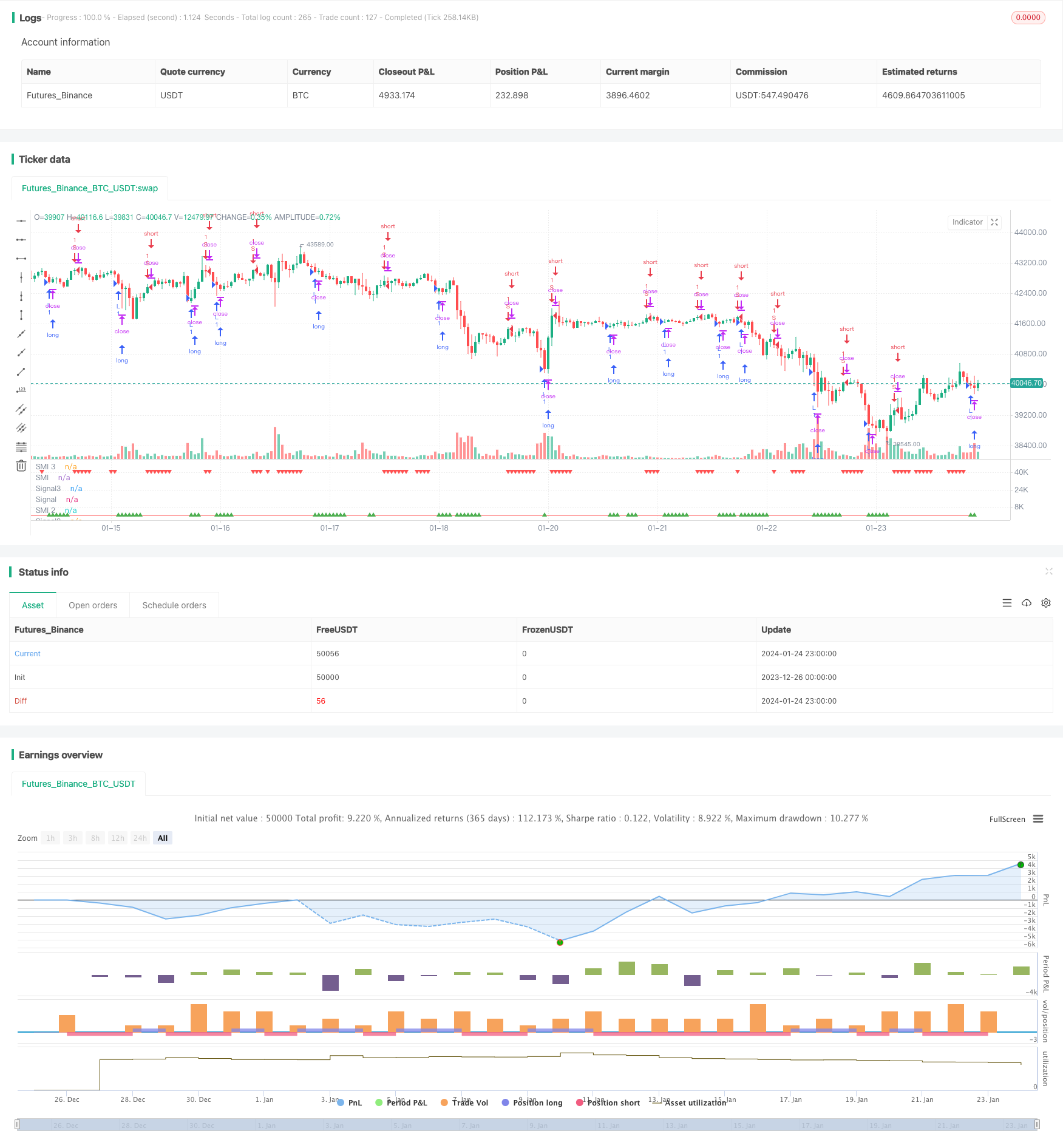

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Stochastic Momentum multi strategy", "Stochastic Momentum Index multi strategy", overlay=false)

q = input(10, title="%K Length")

r = input(3, title="%K Smoothing Length")

s = input(3, title="%K Double Smoothing Length")

nsig = input(10, title="Signal Length")

matype = input("ema", title="Signal MA Type") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought = input(40, title="Overbought Level", type=float)

oversold = input(-40, title="Oversold Level", type=float)

trima(src, length) => sma(sma(src,length),length)

hma(src, length) => wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

dema(src, length) => 2*ema(src,length) - ema(ema(src,length),length)

tema(src, length) => (3*ema(src,length) - 3*ema(ema(src,length),length)) + ema(ema(ema(src,length),length),length)

zlema(src, length) => ema(src,length) + (ema(src,length) - ema(ema(src,length),length))

smi = 100 * ema(ema(close-0.5*(highest(q)+lowest(q)),r),s) / (0.5 * ema(ema(highest(q)-lowest(q),r),s))

sig = matype=="ema" ? ema(smi,nsig) : matype=="sma" ? sma(smi,nsig) : matype=="wma" ? wma(smi,nsig) : matype=="trima" ? trima(smi,nsig) : matype=="hma" ? hma(smi,nsig) : matype=="dema" ? dema(smi,nsig) : matype=="tema" ? tema(smi,nsig) : matype=="zlema" ? zlema(smi,nsig) : ema(smi,nsig)

p_smi = plot(smi, title="SMI", color=aqua)

p_sig = plot(sig, title="Signal", color=red)

// plotchar(crossover(smi, sig), title= "low", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi, sig), title= "high", location=location.top, color=red, char="▼", size= size.tiny)

/////////////////////////////2

q2 = input(20, title="%K Length 2")

r2 = input(3, title="%K Smoothing Length 2")

s2 = input(3, title="%K Double Smoothing Length 2")

nsig2 = input(10, title="Signal Length 2")

matype2 = input("ema", title="Signal MA Type 2") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought2 = input(40, title="Overbought Level 2", type=float)

oversold2 = input(-40, title="Oversold Level 2", type=float)

trima2(src2, length2) => sma(sma(src2,length2),length2)

hma2(src2, length2) => wma(2*wma(src2, length2/2)-wma(src2, length2), round(sqrt(length2)))

dema2(src2, length2) => 2*ema(src2,length2) - ema(ema(src2,length2),length2)

tema2(src2, length2) => (3*ema(src2,length2) - 3*ema(ema(src2,length2),length2)) + ema(ema(ema(src2,length2),length2),length2)

zlema2(src2, length2) => ema(src2,length2) + (ema(src2,length2) - ema(ema(src2,length2),length2))

smi2 = 100 * ema(ema(close-0.5*(highest(q2)+lowest(q2)),r2),s2) / (0.5 * ema(ema(highest(q2)-lowest(q2),r2),s2))

sig2 = matype2=="ema" ? ema(smi2,nsig2) : matype2=="sma 2" ? sma(smi2,nsig2) : matype2=="wma 2" ? wma(smi2,nsig2) : matype2=="trima 2" ? trima2(smi2,nsig2) : matype2=="hma 2" ? hma2(smi2,nsig2) : matype=="dema 2" ? dema2(smi2,nsig2) : matype2=="tema 2" ? tema2(smi2,nsig2) : matype2=="zlema 2" ? zlema2(smi2,nsig2) : ema(smi2,nsig2)

p_smi2 = plot(smi2, title="SMI 2", color=aqua)

p_sig2 = plot(sig2, title="Signal2", color=red)

// plotchar(crossover(smi2, sig2), title= "low2", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi2, sig2), title= "high2", location=location.top, color=red, char="▼", size= size.tiny)

/////////////////////////////3

q3 = input(5, title="%K Length 3")

r3 = input(3, title="%K Smoothing Length 3")

s3 = input(3, title="%K Double Smoothing Length 3")

nsig3 = input(10, title="Signal Length 3")

matype3 = input("ema", title="Signal MA Type 3") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought3 = input(40, title="Overbought Level 3", type=float)

oversold3 = input(-40, title="Oversold Level 3", type=float)

trima3(src3, length3) => sma(sma(src3,length3),length3)

hma3(src3, length3) => wma(2*wma(src3, length3/2)-wma(src3, length3), round(sqrt(length3)))

dema3(src3, length3) => 2*ema(src3,length3) - ema(ema(src3,length3),length3)

tema3(src3, length3) => (3*ema(src3,length3) - 3*ema(ema(src3,length3),length3)) + ema(ema(ema(src3,length3),length3),length3)

zlema3(src3, length3) => ema(src3,length3) + (ema(src3,length3) - ema(ema(src3,length3),length3))

smi3 = 100 * ema(ema(close-0.5*(highest(q3)+lowest(q3)),r3),s3) / (0.5 * ema(ema(highest(q3)-lowest(q3),r3),s3))

sig3 = matype3=="ema" ? ema(smi3,nsig3) : matype3=="sma 3" ? sma(smi3,nsig3) : matype3=="wma 3" ? wma(smi3,nsig3) : matype3=="trima 3" ? trima3(smi3,nsig3) : matype3=="hma 3" ? hma3(smi3,nsig3) : matype=="dema 3" ? dema3(smi3,nsig3) : matype3=="tema 3" ? tema3(smi3,nsig3) : matype3=="zlema 3" ? zlema3(smi3,nsig3) : ema(smi3,nsig3)

p_smi3 = plot(smi3, title="SMI 3", color=aqua)

p_sig3 = plot(sig3, title="Signal3", color=red)

// plotchar(crossover(smi3, sig3) and crossover(smi2, sig2) and crossover(smi, sig), title= "low3", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi3, sig3) and crossunder(smi2, sig2) and crossunder(smi, sig), title= "high3", location=location.top, color=red, char="▼", size= size.tiny)

plotchar (((smi3 < sig3) and (smi2 < sig2) and (smi < sig)), title= "low3", location=location.bottom, color=green, char="▲", size= size.tiny)

plotchar (((smi3 > sig3) and (smi2 > sig2) and (smi > sig)), title= "high3", location=location.top, color=red, char="▼", size= size.tiny)

// === BACKTEST RANGE ===

FromMonth = input(defval = 8, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2014)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2018, title = "To Year", minval = 2014)

longCondition = ((smi3 < sig3) and (smi2 < sig2) and (smi < sig))

shortCondition = ((smi3 > sig3) and (smi2 > sig2) and (smi > sig))

// buy = longCondition == 1 and longCondition[1] == 1 ? longCondition : na

buy = longCondition == 1 ? longCondition : na

sell = shortCondition == 1? shortCondition : na

// === ALERTS ===

strategy.entry("L", strategy.long, when=buy)

strategy.entry("S", strategy.short, when=sell)

alertcondition(((smi3 < sig3) and (smi2 < sig2) and (smi < sig)), title='Low Fib.', message='Low Fib. Buy')

alertcondition(((smi3 > sig3) and (smi2 > sig2) and (smi > sig)), title='High Fib.', message='High Fib. Low')

- EMA des prix avec optimisation stochastique basée sur l'apprentissage automatique

- La stratégie de rupture dynamique de Bollinger

- Stratégie de moyenne mobile à retraite à deux ans

- Stratégie de négociation à moyenne mobile double

- Système de suivi des tendances de rééquilibrage dynamique de la position

- Stratégie de renversement ouvert quotidien

- Stratégie de négociation de la SMA Golden Cross

- Stratégie des moyennes mobiles de la Croix d'Or

- Stratégie de négociation des crypto-monnaies MACD

- Stratégie à court terme de régression linéaire et de moyenne mobile double

- Stratégie de tendance à la dynamique

- Stratégie quantitative de la moyenne mobile de l'élan

- Stratégie combinée de double inversion de la moyenne mobile et de l'arrêt de traînée ATR

- Stratégie de négociation des contrats à terme à effet de levier Martingale

- Stratégie de reprise de l' élan

- Prédiction à deux bougies stratégie de clôture

- Stratégie de négociation de suivi des supertendances stochastiques avec arrêt des pertes

- Tendance à la double inversion de la bande oscillante suivant la stratégie

- Suivre la tendance en suivant une stratégie basée sur l'IMD et l'ISR