Stratégie de trading à court terme Momentum Breakout

Aperçu

Cette stratégie permet de déterminer avec précision les tendances à court terme et de prendre des décisions d’achat et de vente en suivant les données de transactions SPY, combinées à des signaux d’indicateurs techniques tels que les moyennes mobiles, le MACD et le RSI, afin de réaliser des bénéfices sur les transactions à court terme.

Principe de stratégie

La logique de base de la stratégie est basée sur les indicateurs techniques suivants pour juger des tendances à court terme et des opportunités d’entrée:

- Les fourches dorées et les fourches mortes des moyennes mobiles des indices (EMA) des 5e et 13e jours sont utilisées pour déterminer le renversement de la tendance à la hausse.

- L’indicateur MACD détermine s’il y a une tendance à la hausse.

- L’indicateur ADX détermine si une tendance est en cours.

- L’indicateur RSI détermine la force d’une tendance.

En optimisant les paramètres de l’indicateur ci-dessus, déterminez le point de basculement de la polygone critique. Lorsque 5⁄6 des conditions sont remplies, affichez le signal blanc indiquant L ou S, et lorsque les six conditions sont remplies, affichez le signal en forme de diagonale dorée à la fermeture du tableau.

Les conditions qui forment un signal d’achat:

EMA de 5 jours supérieure à l’EMA de 13 jours et ligne MACD inférieure à 0,5 et ADX supérieure à 20 et pente MACD supérieure à 0 et ligne de signal supérieure à -0,1 et RSI supérieure à 40

Les conditions de la vente sont les suivantes:

EMA de 5 jours inférieure à EMA de 13 jours et ligne MACD supérieure à -0.5 et ADX supérieure à 20 et ligne de signal inférieure à 0 et courbe MACD inférieure à 0 et RSI inférieure à 60

Analyse des avantages

Cette stratégie présente les avantages suivants:

- La combinaison de plusieurs signaux d’indicateurs permet une meilleure précision.

- La sensibilité et l’exactitude du jugement sont équilibrées par l’optimisation des paramètres.

- Les signaux sont clairs et précis, le seuil de fonctionnement est bas.

- Il s’applique aux transactions à court terme et répond aux préférences de risque de la plupart des investisseurs.

- Il faut tenir compte des besoins de l’exploitation du disque dur et éviter les fluctuations importantes du temps de clôture.

Analyse des risques

La stratégie présente également les risques suivants:

- Une mauvaise configuration des paramètres peut entraîner un risque d’erreur de jugement. Des tests et des optimisations continus sont nécessaires.

- Une seule variété, sans diversification des risques sectoriels et de répartition des actifs.

- Les frais de transaction et les risques de glissement liés aux transactions fréquentes.

- Le temps de la fin de la période de clôture ne permet pas de constituer une réserve, ce qui pourrait nous faire manquer certaines opportunités.

Direction d’optimisation

Cette stratégie peut être optimisée à partir des dimensions suivantes:

- Modifier les paramètres du test pour améliorer l’exactitude des jugements.

- Augmenter le seuil de stop-loss pour contrôler les pertes individuelles.

- Optimiser les heures d’ouverture, filtrer les périodes de forte volatilité de la clôture.

- Ajouter d’autres variétés à la stratégie.

- L’auto-adaptation des paramètres est améliorée en combinaison avec des algorithmes d’apprentissage automatique.

Résumer

Cette stratégie, qui suit les données SPY, combinant plusieurs indicateurs techniques tels que les moyennes mobiles, le MACD et le RSI, pour déterminer les tendances à court terme, est très adaptée aux opérations à haute fréquence et aux retraits à faible fréquence.

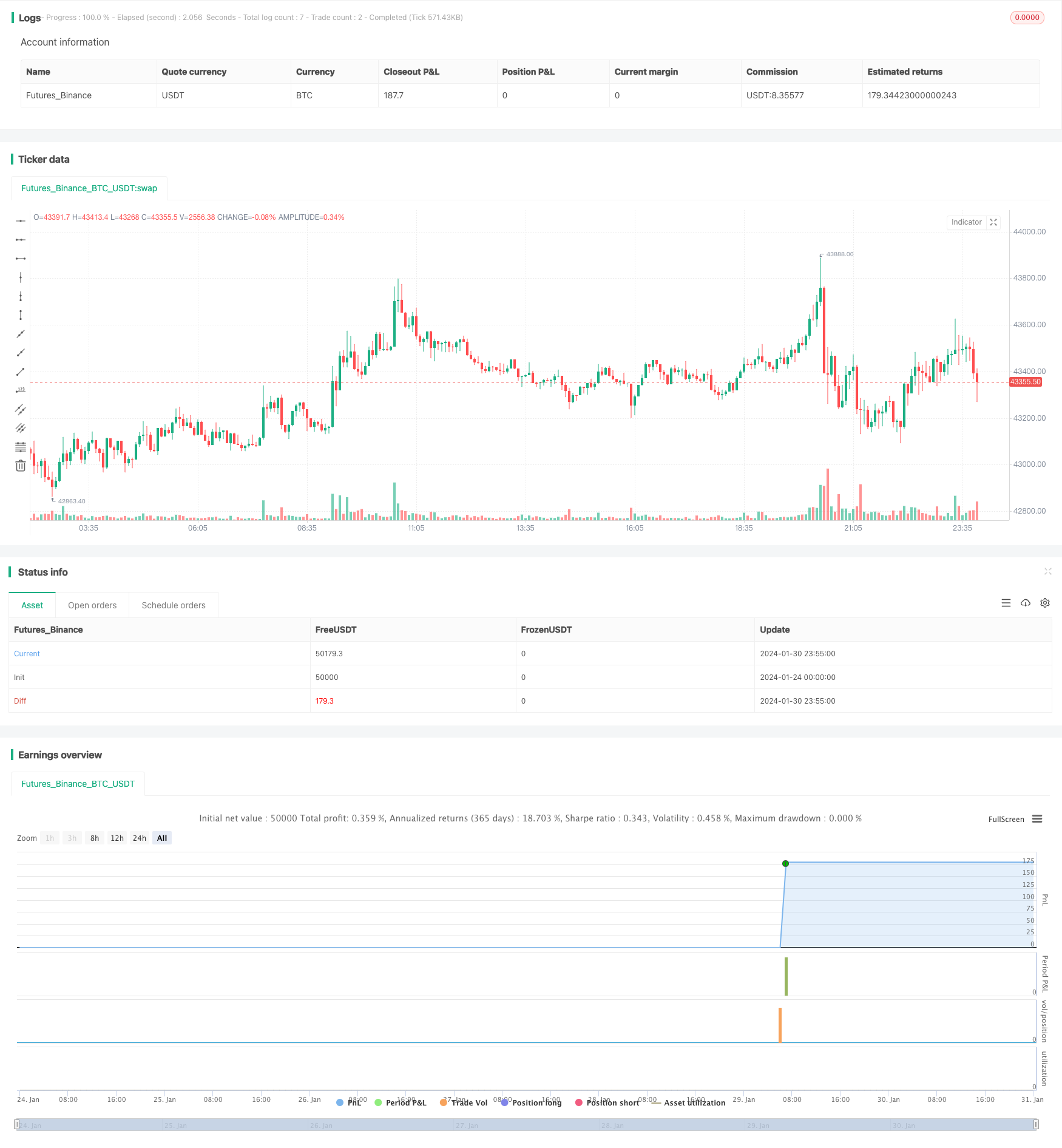

/*backtest

start: 2024-01-24 00:00:00

end: 2024-01-31 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="SPY 1 Minute Day Trader", overlay=true)

//This script has been created to take into account how the following variables impact trend for SPY 1 Minute

//The SPY stop losses/take profit have been set at 30 cents which equates to 15 cents on SPY 1 DTE ATM contracts

//5 ema vs 13 ema : A cross establishes start of trend

//MACD (Line, Signal & Slope) : If you have momentum

//ADX : if you are trending

//RSI : If the trend has strength

//The above has been optimized to determine pivot points in the trend using key values for these 6 indicators

//bounce up = ema5 > ema13 and macdLine < .5 and adx > 20 and macdSlope > 0 and signalLine > -.1 and rsiSignal > 40

//bounce down = ema5 < ema13 and macdLine > -.5 and adx > 20 and signalLine < 0 and macdSlope < 0 and rsiSignal < 60

//White L's indicate that 5 of 6 conditions are met due to impending uptrend w/ missing one in green below it

//Yellow L's indicate that 6 of 6 conditions still are met

//White S's indicate that 5 of 6 conditions are met due to impending downtrend w/ missing condition in red above it

//Yellow S's indicate that 6 of 6 conditions still are met

//After a downtrend or uptrend is established, once it closes it can't repeat for 10 minutes

//Won't open any trades on last two minutes of any hours to avoid volatility

//Will close any open trades going into last minute of hour

// Initialize variables

var float long_entry_price = na

var float short_entry_price = na

var float stop_loss = na

var float take_profit = na

var float short_stop_loss = na

var float short_take_profit = na

var float option_SL = 0.3 //approx 15 cents on SPY 1 DTE

var float option_TP = 0.3 //approx 15 cents on SPY 1 DTE

var long_entry_time = 0

var short_entry_time = 0

var allow_long_entry = true

var allow_short_entry = true

var allow_trades = true

var hourlyclose = 0

var notify = 0

var shortnotify = 0

// Calculate the EMAs & SMAs

ema5 = ta.ema(close, 5)

ema13 = ta.ema(close, 13)

sma20 = ta.sma(close, 20)

// Input parameters

fastLength = input.int(12, minval=1, title="Fast Length")

slowLength = input.int(26, minval=1, title="Slow Length")

signalLength = input.int(9, minval=1, title="Signal Smoothing")

// Inputs

length = input.int(14, "Length")

smoothK = input.int(3, "SmoothK")

src = input(close, "Source")

overbought = input.float(80, "Overbought")

oversold = input.float(20, "Oversold")

//Stochastic Calculation

highestHigh = ta.highest(src, length)

lowestLow = ta.lowest(src, length)

k = 100 * ((src - lowestLow) / (highestHigh - lowestLow))

d = ta.sma(k, smoothK)

// Calculate MACD

[macdLines, signalLines, _] = ta.macd(close, fastLength, slowLength, signalLength)

// Calculate slope of MACD line

macdSlope = (macdLines - macdLines[1]) / (bar_index - bar_index[1])

// Calculate the RSI

rsiValue = ta.rsi(close, 5)

// Calculate the signal line as the SMA of the RSI for 5 minute over 9 periods

rsiSignal = ta.sma(rsiValue, 9)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Length of the ATR

atr_length = input.int(14, title="ATR Length", minval=1)

// Calculate the True Range

tr = ta.tr(true)

// Calculate the ATR

atr = ta.atr(atr_length)

// Length of the ADX

len = input.int(14, minval=1)

// Set minimum number of bars between trades

min_bars_between_trades = 10

// Calculate the Directional Movement

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

// Calculate the Smoothed Directional Movement

plusDI = 100 * ta.ema(plusDM, len) / ta.ema(tr, len)

minusDI = 100 * ta.ema(minusDM, len) / ta.ema(tr, len)

// Calculate the Directional Index (DX)

DX = 100 * math.abs(plusDI - minusDI) / (plusDI + minusDI)

// Calculate the ADX

adx = ta.ema(DX, len)

// Get high, low, and close prices

highPrice = high

lowPrice = low

closePrice = close

// Determine buy and sell signals - Tried to optimize as much as possible - changing these do impact results

buy_signal = ema5 > ema13 and macdLine < .5 and adx > 20 and macdSlope > 0 and signalLine > -.1 and rsiSignal > 40

short_buy_signal = ema5 < ema13 and macdLine > -.5 and adx > 20 and signalLine < 0 and macdSlope < 0 and rsiSignal < 60

// Define long entry conditions

C1 = ema5 > ema13 ? 1 : 0 //E below bar when only one missing

C2 = d < 70 ? 1 : 0 //no longer part of signal - but was Smoothed Stoicastic

C3 = macdLine < .5 ? 1 : 0 //M below bar when only one missing

C4 = adx > 20 ? 1 : 0 //A below bar when only one missing

C5 = macdSlope > 0 ? 1 : 0 //% below bar when only one missing

C6 = signalLine > -.01 ? 1 : 0 //S (MACD Signal) below bar when only one missing

C7 = rsiSignal > 50 ? 1 : 0 //R below bar when only one missing

// Define short entry conditions

C8 = ema5 < ema13 ? 1 : 0 //E above bar when only one missing

C9 = d > 40 ? 1 : 0 //no longer part of signal - but was Smoothed Stoicastic

C10 = macdLine > -0.5 ? 1 : 0 //M above bar when only one missing

C11 = adx > 20 ? 1 : 0 //A above bar when only one missing

C12 = macdSlope < 0 ? 1 : 0 //% above bar when only one missing

C13 = signalLine < 0 ? 1 : 0 //S (MACD Signal) above bar when only one missing

C14 = rsiSignal < 50 ? 1 : 0 //R above bar when only one missing

// Long or Short Incoming denoted by white color and gold means all conditions met

plotchar((C1 + C3 + C4 + C5 + C6 + C7) == 5 ? 1 : na, title="Pivot Up White", char="L", location=location.belowbar, color=color.white, size = size.tiny)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) == 5 ? 1 : na, title="Pivot Down White", char="S", location=location.abovebar, color=color.white, size = size.tiny)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) > 5 ? 1 : na, title="Pivot Up Gold", char="L", location=location.belowbar, color=color.yellow, size = size.tiny)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) > 5 ? 1 : na, title="Pivot Down Gold", char="S", location=location.abovebar, color=color.yellow, size = size.tiny)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C1) != 1 ? 1 : na, title="Missing", char = "", text="E", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C3) != 1 ? 1 : na, title="Missing", char = "", text="M", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C4) != 1 ? 1 : na, title="Missing", char = "", text="A", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C5) != 1 ? 1 : na, title="Missing", char = "", text="%", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C6) != 1 ? 1 : na, title="Missing", char = "", text="S", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C7) != 1 ? 1 : na, title="Missing", char = "", text="R", location=location.belowbar, color=color.green, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C8) != 1 ? 1 : na, title="Missing", char = "", text="E", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C10) != 1 ? 1 : na, title="Missing", char = "", text="M", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C11) != 1 ? 1 : na, title="Missing", char = "", text="A", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C12) != 1 ? 1 : na, title="Missing", char = "", text="%", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C13) != 1 ? 1 : na, title="Missing", char = "", text="S", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C14) != 1 ? 1 : na, title="Missing", char = "", text="R", location=location.abovebar, color=color.red, size = size.small)

// Execute buy and sell orders

if buy_signal and allow_trades and allow_long_entry //Don't buy on last 2 minutes of hour

long_entry_price := open

strategy.entry("Pivot Up", strategy.long)

stop_loss := long_entry_price - option_SL

take_profit := long_entry_price + option_TP

long_entry_time := time

allow_long_entry := false

allow_trades := false

notify := 1

plotshape(notify == 1 ? 1 : na, "Pivot Up", style=shape.triangleup, offset = 1, location=location.belowbar, size=size.normal, textcolor = color.orange, color=color.orange)

if notify == 1

notify := notify - 1

if short_buy_signal and allow_trades and allow_short_entry //Don't buy on last 2 minutes of hour

short_entry_price := open

strategy.entry("Pivot Down", strategy.short)

short_stop_loss := short_entry_price + option_SL

short_take_profit := short_entry_price - option_TP

short_entry_time := time

allow_short_entry := false

allow_trades := false

shortnotify := 1

plotshape(shortnotify == 1 ? 1 : na, "Pivot Down", style=shape.triangledown, offset = 1, location=location.abovebar, size=size.normal, textcolor = color.orange, color=color.orange)

if shortnotify == 1

shortnotify := shortnotify - 1

// Take scalp when in a position and 5 or more parameters are met!

if strategy.position_size != 0 and (C1 + C3 + C4 + C5 + C6 + C7) >5

strategy.exit("Exit Longs", "Pivot Up", stop=stop_loss, limit = take_profit)

else if strategy.position_size != 0 and (C8 + C10 + C11 + C12 + C13 + C14) >5

strategy.exit("Exit Shorts", "Pivot Down", stop=short_stop_loss, limit = short_take_profit)

// Reset allow_trades after cool-down period of min_bars_between_trades bars set above

if time > long_entry_time + (time - time[1]) * min_bars_between_trades

allow_long_entry := true

allow_trades := true

if time > short_entry_time + (time - time[1]) * min_bars_between_trades

allow_short_entry := true

allow_trades := true

// Close all positions at the end of the trading day and when volatile hours approach!

if strategy.position_size != 0

strategy.close("Pivot Up")

strategy.close("Pivot Down")

hourlyclose := 1

plotshape(hourlyclose == 1 ? 1 : na, "Suggested Volatile Hour Close", text="Suggested Volatile Hour Close", offset = 1, style=shape.triangledown, location=location.abovebar, size=size.tiny, textcolor = color.orange, color=color.orange)

if hourlyclose == 1

hourlyclose := hourlyclose - 1