Stratégie de synchronisation des indicateurs doubles de l' élan quadratique

Auteur:ChaoZhang est là., Date: 2024-02-04 15:53:48 Je suis désoléLes étiquettes:

Résumé

Cette stratégie fusionne l'indicateur SuperTrend avec la théorie de Elliott Wave pour construire un outil de trading technique robuste.

Principe de stratégie

L'idée de base réside dans son approche à plusieurs niveaux:

- Utiliser 4 indicateurs de SuperTrend, chacun avec des longueurs et des multiplicateurs ATR différents, pour juger de la tendance à court et à long terme

- Identifier des signaux longs et courts solides grâce à la convergence des indicateurs

- Se référer à la méthode de reconnaissance des modèles Elliott Wave

pour identifier des comportements de marché similaires afin de confirmer les signaux commerciaux

Ainsi, il utilise plusieurs indicateurs et ajoute la reconnaissance de modèles pour rendre la stratégie plus robuste.

Analyse des avantages

- La conception multi-indicateur fournit un jugement complet

- L'inspiration de la théorie des ondes augmente la stabilité grâce à la reconnaissance de motifs

- L'ajustement de la direction en temps réel s'adapte aux changements du marché

- Paramètres configurables adaptés à différents produits et délais

Analyse des risques

- Le réglage des paramètres repose sur l'expérience, nécessitant un réglage pour déterminer les combinaisons optimales de paramètres

- La conception multi-indicateurs est complexe, ce qui augmente la charge de calcul

- Ne peut pas éviter complètement une génération de signal incorrecte

Les paramètres peuvent être optimisés pour déterminer progressivement l'optimum; le cloud computing peut améliorer les performances de calcul; les arrêts de perte peuvent contrôler le risque.

Directions d'optimisation

Des optimisations peuvent être effectuées sous plusieurs aspects:

- Ajouter un module d'ajustement de paramètres adaptatif pour ajuster dynamiquement les paramètres en fonction des conditions du marché

- Incorporer des modèles d'apprentissage automatique pour aider à juger de la fiabilité du signal

- Combiner des indicateurs de sentiment, des événements d'actualité, etc. pour déterminer les régimes du marché

- Prise en charge des modèles de paramètres multi-produits pour réduire la charge de travail de test

Cela rendra les paramètres stratégiques plus intelligents, les jugements plus précis et l'application pratique plus pratique.

Résumé

La stratégie prend en compte de manière exhaustive les dimensions de tendance et de modèle, assurant la robustesse du jugement tout en augmentant la flexibilité. Les paramètres multi-indicateurs et les paramètres assurent une pleine applicabilité au marché.

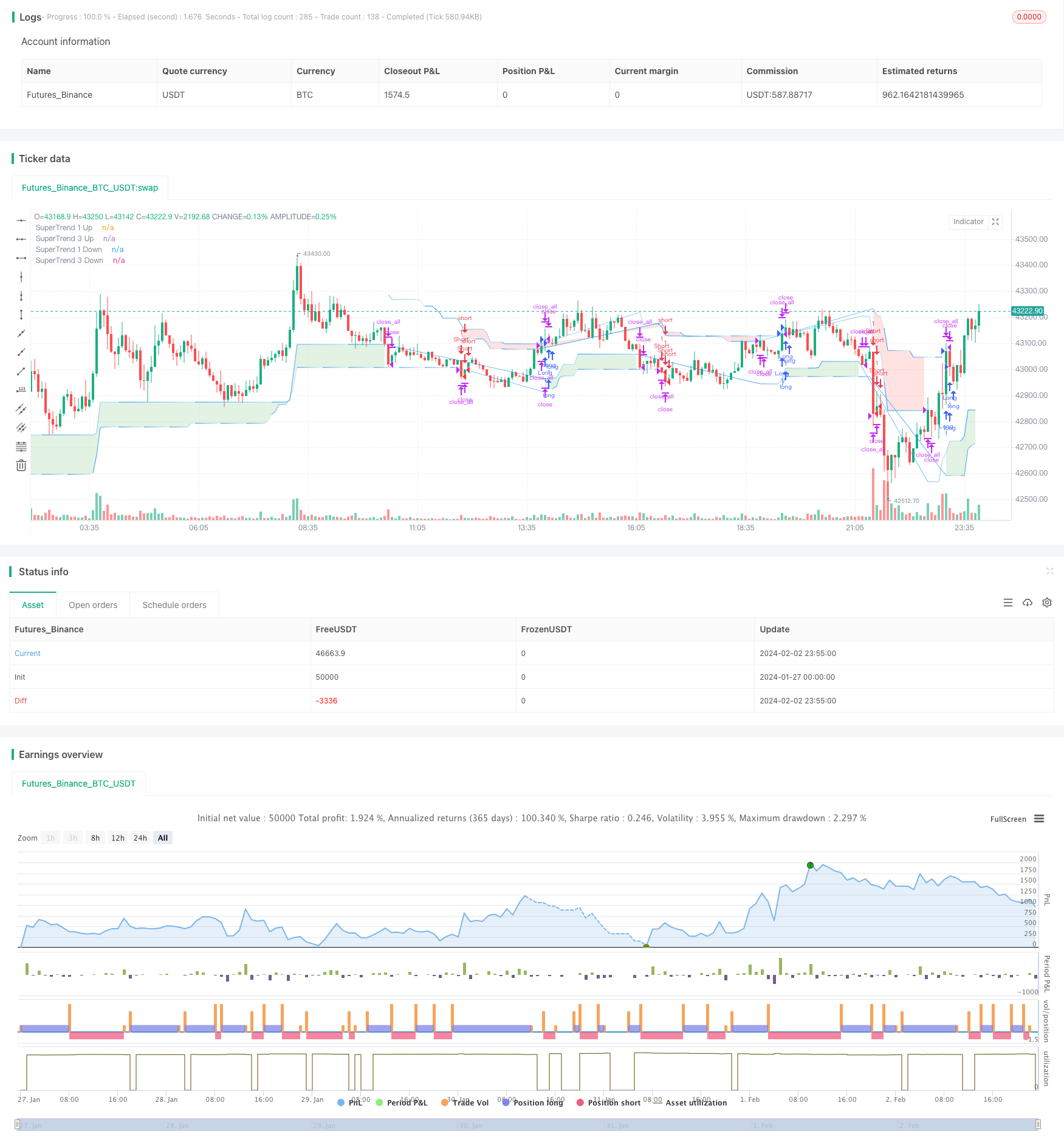

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-03 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Elliott's Quadratic Momentum - Strategy [presentTrading]",shorttitle = "EQM Strategy [presentTrading]", overlay=true )

// Inputs for selecting trading direction

tradingDirection = input.string("Both", "Select Trading Direction", options=["Long", "Short", "Both"])

// SuperTrend Function

supertrend(src, atrLength, multiplier) =>

atr = ta.atr(atrLength)

up = hl2 - (multiplier * atr)

dn = hl2 + (multiplier * atr)

trend = 1

trend := nz(trend[1], 1)

up := src > nz(up[1], 0) and src[1] > nz(up[1], 0) ? math.max(up, nz(up[1], 0)) : up

dn := src < nz(dn[1], 0) and src[1] < nz(dn[1], 0) ? math.min(dn, nz(dn[1], 0)) : dn

trend := src > nz(dn[1], 0) ? 1 : src < nz(up[1], 0)? -1 : nz(trend[1], 1)

[up, dn, trend]

// Inputs for SuperTrend settings

atrLength1 = input(7, title="ATR Length for SuperTrend 1")

multiplier1 = input(4.0, title="Multiplier for SuperTrend 1")

atrLength2 = input(14, title="ATR Length for SuperTrend 2")

multiplier2 = input(3.618, title="Multiplier for SuperTrend 2")

atrLength3 = input(21, title="ATR Length for SuperTrend 3")

multiplier3 = input(3.5, title="Multiplier for SuperTrend 3")

atrLength4 = input(28, title="ATR Length for SuperTrend 3")

multiplier4 = input(3.382, title="Multiplier for SuperTrend 3")

// Calculate SuperTrend

[up1, dn1, trend1] = supertrend(close, atrLength1, multiplier1)

[up2, dn2, trend2] = supertrend(close, atrLength2, multiplier2)

[up3, dn3, trend3] = supertrend(close, atrLength3, multiplier3)

[up4, dn4, trend4] = supertrend(close, atrLength4, multiplier4)

// Entry Conditions based on SuperTrend and Elliott Wave-like patterns

longCondition = trend1 == 1 and trend2 == 1 and trend3 == 1 and trend4 == 1

shortCondition = trend1 == -1 and trend2 == -1 and trend3 == -1 and trend4 == - 1

// Strategy Entry logic based on selected trading direction

if tradingDirection == "Long" or tradingDirection == "Both"

if longCondition

strategy.entry("Long", strategy.long)

// [Any additional logic for long entry]

if tradingDirection == "Short" or tradingDirection == "Both"

if shortCondition

strategy.entry("Short", strategy.short)

// [Any additional logic for short entry]

// Exit conditions - Define your own exit strategy

// Example: Exit when any SuperTrend flips

if trend1 != trend1[1] or trend2 != trend2[1] or trend3 != trend3[1] or trend4 != trend4[1]

strategy.close_all()

// Function to apply gradient effect

gradientColor(baseColor, length, currentBar) =>

var color res = color.new(baseColor, 100)

if currentBar <= length

res := color.new(baseColor, int(100 * currentBar / length))

res

// Apply gradient effect

color1 = gradientColor(color.blue, atrLength1, bar_index % atrLength1)

color4 = gradientColor(color.blue, atrLength4, bar_index % atrLength3)

// Plot SuperTrend with gradient for upward trend

plot1Up = plot(trend1 == 1 ? up1 : na, color=color1, linewidth=1, title="SuperTrend 1 Up")

plot4Up = plot(trend4 == 1 ? up4 : na, color=color4, linewidth=1, title="SuperTrend 3 Up")

// Plot SuperTrend with gradient for downward trend

plot1Down = plot(trend1 == -1 ? dn1 : na, color=color1, linewidth=1, title="SuperTrend 1 Down")

plot4Down = plot(trend4 == -1 ? dn4 : na, color=color4, linewidth=1, title="SuperTrend 3 Down")

// Filling the area between the first and third SuperTrend lines for upward trend

fill(plot1Up, plot4Up, color=color.new(color.green, 80), title="SuperTrend Upward Band")

// Filling the area between the first and third SuperTrend lines for downward trend

fill(plot1Down, plot4Down, color=color.new(color.red, 80), title="SuperTrend Downward Band")

- La stratégie de Willy Wonka

- Tendance combinée de moyenne mobile exponentielle et d'indice de résistance relative suivant la stratégie

- Stratégie combinée de capture de tendance d'inversion et de stop loss dynamique

- Stratégie de rupture de la parabole dorée

- Stratégie de suivi de l'inversion de l'élan SAR

- Stratégie de négociation dynamique RSI

- Stratégie de croisement entre plusieurs moyennes mobiles

- Stratégie de rupture de la moyenne mobile double

- Stratégie de croisement des moyennes mobiles

- Stratégie de suivi de la tendance des moyennes mobiles doubles

- Renko et l'indice de vigueur relative Suivre la stratégie

- Stratégie de tendance à bascule moyenne mobile

- Bollinger Band, moyenne mobile et stratégie de négociation combinée MACD

- Stratégie de monnaies cryptographiques à la hausse des prix

- Stratégie de négociation dynamique basée sur un modèle à facteurs multiples

- Stratégie de suivi des tendances des bandes de Bollinger adaptatives

- Stratégie de rupture RSI améliorée avec stop loss et take profit

- Stratégie de négociation quantitative basée sur l'indicateur de risque et les bandes de Bollinger

- Stratégie de négociation quantitative basée sur la SMA et la ligne de tendance en rotation

- Stratégie hebdomadaire de négociation d'options stochastiques