टीएमए-लेगेसी

लेखक:चाओझांग, दिनांकः 2022-05-09 22:38:11टैगःआरएसआई

यह PhoenixBinary द्वारा मूल TMA- RSI विचलन संकेतक पर आधारित एक स्क्रिप्ट है.

फीनिक्स बाइनरी समुदाय और टीएमए समुदाय ने फीनिक्स बाइनरी के निधन की सूचना के बाद समुदाय के लिए आगे के उपयोग और संशोधन के लिए सार्वजनिक कोड के रूप में इस संस्करण का निर्माण किया (समुदाय फीनिक्स

नियत उपयोग मूल के समान हैं लेकिन कुछ गणनाएं भिन्न हैं और मूल के समान कार्य या संकेत नहीं दे सकती हैं।

सूचक का मूल पोस्टिंग से वर्णन। यह सूचक आर्टी और क्रिस्टी से प्रेरित था.

█ घटक

यहाँ मूल पोस्टिंग से संकेतक का एक संक्षिप्त अवलोकन दिया गया हैः

1

2

3

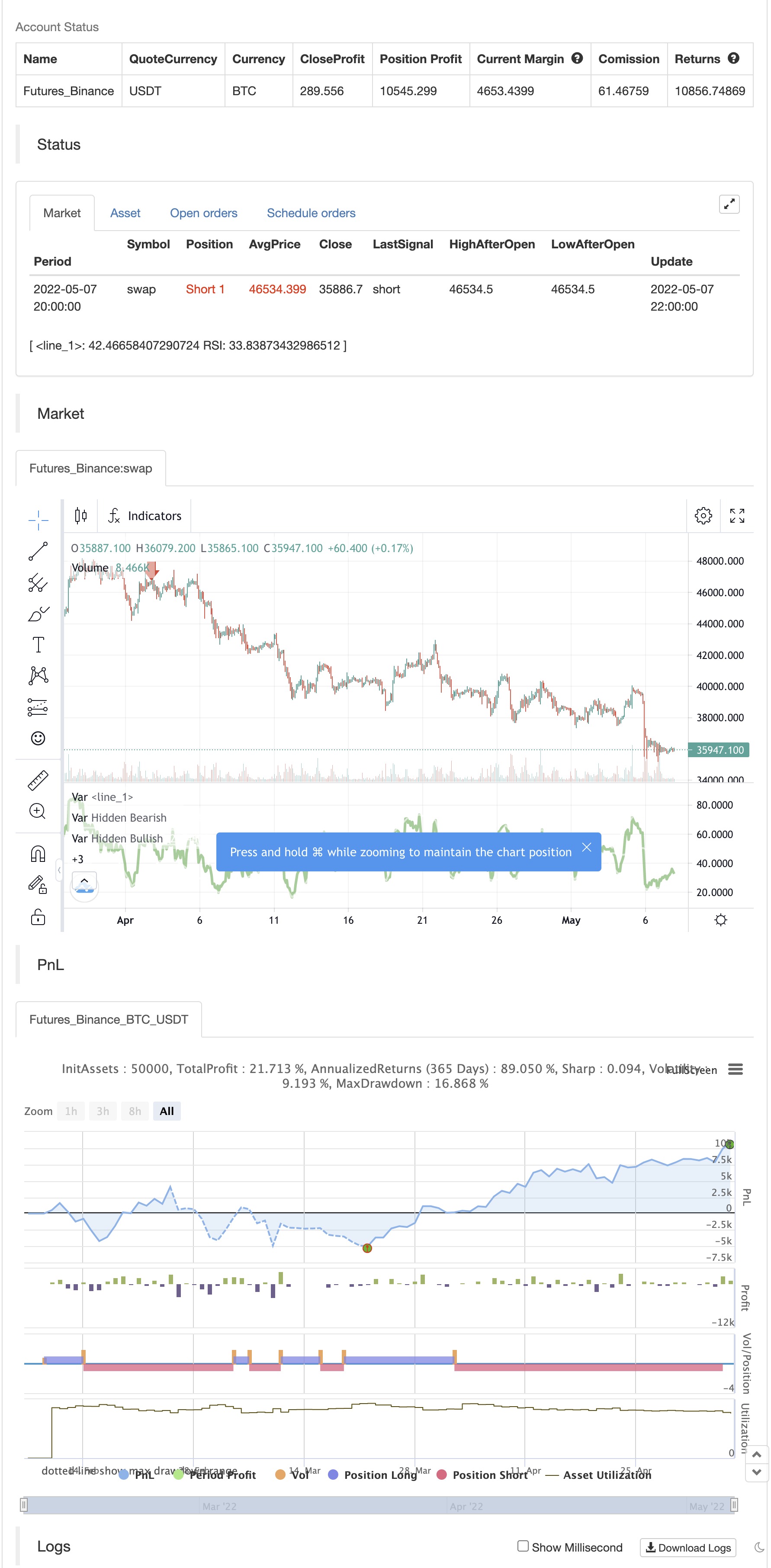

बैकटेस्ट

/*backtest

start: 2022-02-08 00:00:00

end: 2022-05-08 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ©Hotchachachaa, Rest in Peace Pheonix Algo(aka Doug) your community misses you and we extend our deepest sympathies to your family.

//@version=5

//

//This indicator is based on the TMA-Divergence indicator created by PhoenixBinary for the TMA discord Community. Since Phoenix is no longer part of the community

//we did our best to recreate the indicator for the community's continued use updates and revisions.

indicator("TMA-Legacy", overlay=false)

////////////////////////////////////inputs////////////////////////////////////////////////

displayRSI = input.string(title="RSI Type", defval="RSI Divergence", options=["RSI Divergence","RSI Smoothed","RSI Momentum"],group="Main Settings")

lenrsinordiv = input.int(title="RSI Normal Length", defval=14,minval=1, group= "RSI Normal")

lenrsismodiv = input.int(title="RSI Smoothed Length", defval=40, minval=1,group = "RSI Smoothed" )

lenrsissmoma = input.int(title="RSI Smoothed MA", defval=40,minval=1, group = "RSI Smoothed" )

lenrsimomdiv = input.int(title="RSI Normal Length", defval=5 ,minval=1, group = "RSI Momentum")

rsimommalen = input.int(34, minval=1, title="Smooth RSI MA Length",group="RSI Momentum")

srcrsidiv = input(title="RSI Source", defval=close, group="Main Settings")

lbR = input.int(title="Pivot Lookback Right", defval=5,minval=1,group="Divergence Spotter")

lbL = input.int(title="Pivot Lookback Left", defval=5,minval=1,group="Divergence Spotter")

rangeUpper = input.int(title="Max of Lookback Range", defval=60,minval=1,group="Divergence Spotter")

rangeLower = input.int(title="Min of Lookback Range", defval=5,minval=1,group="Divergence Spotter")

plotBull = input.bool(title="Plot Bullish", defval=true,group="Divergence Spotter")

plotHiddenBull = input.bool(title="Plot Hidden Bullish", defval=true,group="Divergence Spotter")

plotBear = input.bool(title="Plot Bearish", defval=true,group="Divergence Spotter")

plotHiddenBear = input.bool(title="Plot Hidden Bearish", defval=true,group="Divergence Spotter")

bearColorrsidiv = color.red

bullColorrsidiv = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

lenDisplay= displayRSI == "RSI Divergence" ? lenrsinordiv: displayRSI == "RSI Smoothed" ? lenrsismodiv: na

rsiValue1 = ta.rsi(srcrsidiv, lenrsinordiv)

// ### Smoothed MA

averageSource = rsiValue1

typeofMA1 = "SMMA"

length_ma1 = 50

f_smma(averageSource, averageLength) =>

smma = 0.0

smma := na(smma[1]) ? ta.sma(averageSource, averageLength) : (smma[1] * (averageLength - 1) + averageSource) / averageLength

smma

f_smwma(averageSource, averageLength) =>

smwma = 0.0

smwma := na(smwma[1]) ? ta.wma(averageSource, averageLength) : (smwma[1] * (averageLength - 1) + averageSource) / averageLength

smwma

f_tma(averageSource, averageLength) =>

ta.sma(ta.sma(averageSource, averageLength), averageLength)

f_dema(averageSource, averageLength) =>

emaValue = ta.ema(averageSource, averageLength)

2 * emaValue - ta.ema(emaValue, averageLength)

f_tema(averageSource, averageLength) =>

ema1 = ta.ema(averageSource, averageLength)

ema2 = ta.ema(ema1, averageLength)

ema3 = ta.ema(ema2, averageLength)

(3 * ema1) - (3 * ema2) + ema3

f_ma(smoothing, averageSource, averageLength) =>

switch str.upper(smoothing)

"SMA" => ta.sma(averageSource, averageLength)

"EMA" => ta.ema(averageSource, averageLength)

"WMA" => ta.wma(averageSource, averageLength)

"HMA" => ta.hma(averageSource, averageLength)

"RMA" => ta.rma(averageSource, averageLength)

"SWMA" => ta.swma(averageSource)

"ALMA" => ta.alma(averageSource, averageLength, 0.85, 6)

"VWMA" => ta.vwma(averageSource, averageLength)

"VWAP" => ta.vwap(averageSource)

"SMMA" => f_smma(averageSource, averageLength)

"SMWMA" => f_smwma(averageSource, averageLength)

"DEMA" => f_dema(averageSource, averageLength)

"TEMA"=> f_tema(averageSource, averageLength)

=> runtime.error("Moving average type '" + smoothing +

"' not found!"), na

MA1 = f_ma(typeofMA1, averageSource, length_ma1)

showNormal=displayRSI=="RSI Divergence"

showSmoothed=displayRSI=="RSI Smoothed"

showMomentum = displayRSI =="RSI Momentum"

showAll= displayRSI=="All Three"

///////OB/OS lines

hline(showNormal or showSmoothed ? 80 :na, title="OverBought", linestyle=hline.style_dotted, linewidth=2)

hline(showNormal or showSmoothed ? 20 :na, title="OverSold", linestyle=hline.style_dotted, linewidth=2)

////////////////show normal

plot(showNormal? MA1 : na , linewidth=2, color=color.white)

var int colortoken=1

color1= color.green

color2 = color.yellow

color3 = color.orange

color4 = color.red

if rsiValue1>rsiValue1[1] and colortoken!=1

colortoken:= colortoken[1] - 1

if rsiValue1<rsiValue1[1] and colortoken!=4

colortoken:= colortoken[1] + 1

lineColor= colortoken == 1 ? color1: colortoken ==2 ? color2 : colortoken == 3 ? color3 : colortoken == 4 ? color4 :na

plot(showNormal? rsiValue1 : na, title="RSI", linewidth=3, color=lineColor)

////////////show smoothed

lensig = input.int(14, title="ADX Smoothing", minval=1, maxval=50)

len = input.int(14, minval=1, title="DI Length")

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / trur)

minus = fixnan(100 * ta.rma(minusDM, len) / trur)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), lensig)

rsisrc = ta.rsi(close,lenrsismodiv)

adxthreshold=input.int(title="adx",defval=15)

smoothColor= adx>adxthreshold and plus>minus? color.green:adx>adxthreshold and plus<minus?color.red : adx<adxthreshold?color.gray:na

rsismma = 0.0

rsismma := na(rsismma[1]) ? ta.sma(rsisrc, lenrsissmoma) : (rsismma[1] * (lenrsissmoma - 1) + rsisrc) / lenrsissmoma

rsiwsmma= ta.wma(rsismma,lenrsissmoma)

plot(showSmoothed ? rsisrc:na, linewidth=2, color=smoothColor)

plot(showSmoothed ? rsiwsmma:na, linewidth=2, color=color.white)

////////////////RSI momentum

///////////////////// normal RSI

rsiValue2 = ta.rsi(ohlc4,lenrsimomdiv)

rsiema = ta.wma(rsiValue2,rsimommalen)

normalizedRSI= (rsiValue2-50)/100

/////////////////// Normal Momentum

lenmom = input.int(5, minval=1, title=" MOM Length",group= "RSI Momentum")

srcmom = ohlc4

mom = srcmom - srcmom[lenmom]

//////////stochRSI K line

smoothK = input.int(5, "K", minval=1)

lengthRSI = input.int(5, "RSI Length", minval=1, group="RSI Momentum")

lengthStoch = input.int(34, "Stochastic Length", minval=1,group= "RSI Momentum")

src = input(ohlc4, title="RSI Source",group= "RSI Momentum")

rsi1 = ta.rsi(src, lengthRSI)

k = ((ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK))-50)/100

WTF=math.avg(mom,normalizedRSI,k)

smmaLen = input.int(25, minval=1, title="SMMA Length", group = "RSI Momentum")

smmaLen1= 2

smmaSrc = WTF

WTFsmma = 0.0

WTFsmma := na(WTFsmma[1]) ? ta.sma(smmaSrc, smmaLen1) : (WTFsmma[1] * (smmaLen1 - 1) + smmaSrc) / smmaLen1

smma = 0.0

smma := na(smma[1]) ? ta.sma(smmaSrc, smmaLen) : (smma[1] * (smmaLen - 1) + smmaSrc) / smmaLen

color1a= #0E3F01

color2a = #31FA2A

color3a = #FA6B6B

color4a = #971643

momentumColor= WTF>WTF[1] and WTF>smma ? color1a : WTF<WTF[1] and WTF>smma ? color2a : WTF>WTF[1] and WTF<smma ? color3a : WTF<WTF[1] and WTF<smma ? color4a : na

plot(showMomentum ? WTF:na, color=momentumColor, linewidth=3)

plot(showMomentum ? smma:na , linewidth=2, color=color.white)

osc= displayRSI =="RSI Divergence" ? rsiValue1 : displayRSI =="RSI Smoothed" ? rsisrc:na

///////////divergence

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(

displayRSI !="RSI Momentum"and plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColorrsidiv : noneColor)

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

plot(

displayRSI !="RSI Momentum" and plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(

displayRSI !="RSI Momentum" and phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColorrsidiv : noneColor)

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

plot(

displayRSI !="RSI Momentum" and phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

// ### Alerts

if bearCond

alert("Bearish Divergence")

else if hiddenBearCond

alert("Hidden Bearish Divergence")

else if bullCond

alert("Bullish Divergence")

else if hiddenBullCond

alert("Hidden Bullish Divergence")

if hiddenBullCond

strategy.entry("Enter Long", strategy.long)

else if hiddenBearCond

strategy.entry("Enter Short", strategy.short)

// END ###

- द्वि-संकेतक गतिशीलता के रुझानों को मापने के लिए रणनीतिक प्रणाली

- द्वि-समान रेखा-आरएसआई मल्टी सिग्नल ट्रेंड ट्रेडिंग रणनीति

- गतिशील समोच्च प्रणाली के साथ आरएसआई गतिशीलता सूचकांक के साथ दिन के भीतर व्यापार अनुकूलन रणनीति

- बहु तकनीकी संकेतक क्रॉस गतिशीलता ट्रेंड ट्रैकिंग रणनीति

- डायनेमिक समायोजन स्टॉप लॉस हाथी के स्तंभ के आकार की ट्रेंड ट्रैकिंग रणनीति

- द्विचक्रीय आरएसआई ट्रेंड गतिशीलता की तीव्रता रणनीति पिरामिड स्थिति प्रबंधन प्रणाली के साथ संयुक्त

- बहु-समान रेखा पार सहायक आरएसआई गतिशील पैरामीटर परिमाणित व्यापार रणनीति

- गतिशील रुझान आरएसआई संकेतकों के क्रॉसिंग रणनीति को निर्धारित करते हैं

- बहु-आयामी K निकटवर्ती एल्गोरिदम और कैलिफोर्निया के आकार के साथ मात्रा मूल्य विश्लेषण व्यापार रणनीति

- अनुकूलन बहु-रणनीति गतिशील स्विचिंग प्रणालीः एकीकरण प्रवृत्ति ट्रैकिंग और सीमा में उतार-चढ़ाव के लिए परिमाणात्मक व्यापार रणनीति

- बहु-संकेतक बहु-आयामी रुझानों को पार करने के लिए उन्नत मात्रात्मक रणनीति

- राज द्वारा एमए हाइब्रिड

- हीरा प्रवृत्ति

- निक स्टोक

- स्टॉक सुपरटीआरडी एटीआर 200 एमए

- एमटीएफ आरएसआई और स्टोच रणनीति

- EMA + AROON + ASH

- गति 2.0

- ईएचएमए रेंज रणनीति

- चलती औसत खरीद-बेच

- मिडास एमके. II - अंतिम क्रिप्टो स्विंग

- टीवी उच्च और निम्न रणनीति

- सर्वश्रेष्ठ ट्रेडिंग व्यू रणनीति

- बड़े स्नैपर अलर्ट R3.0 + चाइकिंग अस्थिरता की स्थिति + TP RSI

- चंदे क्रॉल स्टॉप

- आरएसआई क्रॉस रणनीति के साथ सीसीआई + ईएमए

- ईएमए बैंड + लेलेडसी + बोलिंगर बैंड ट्रेंड कैचिंग रणनीति

- आरएसआई एमटीएफ ओबी+ओ

- एमएसीडी विली रणनीति

- आरएसआई - खरीदें बेचें संकेत

- हेकिन-अशी प्रवृत्ति