Kombo 2/20 EMA & Filter Bandpass

Penulis:ChaoZhang, Tanggal: 2022-05-12 15:27:19Tag:EMA

Ini adalah strategi kombinasi untuk mendapatkan sinyal kumulatif.

Strategi pertama Indikator ini memperlihatkan2⁄20rata-rata bergerak eksponensial. Rata-rata X2⁄20Indikator, EMA bar akan dicat ketika Alert kriteria terpenuhi.

Strategi Kedua Artikel terkait adalah bahan hak cipta dari Saham & Komoditas Maret 2010

Peringatan: - Untuk tujuan mendidik saja - Skripsi ini untuk mengubah warna bar.

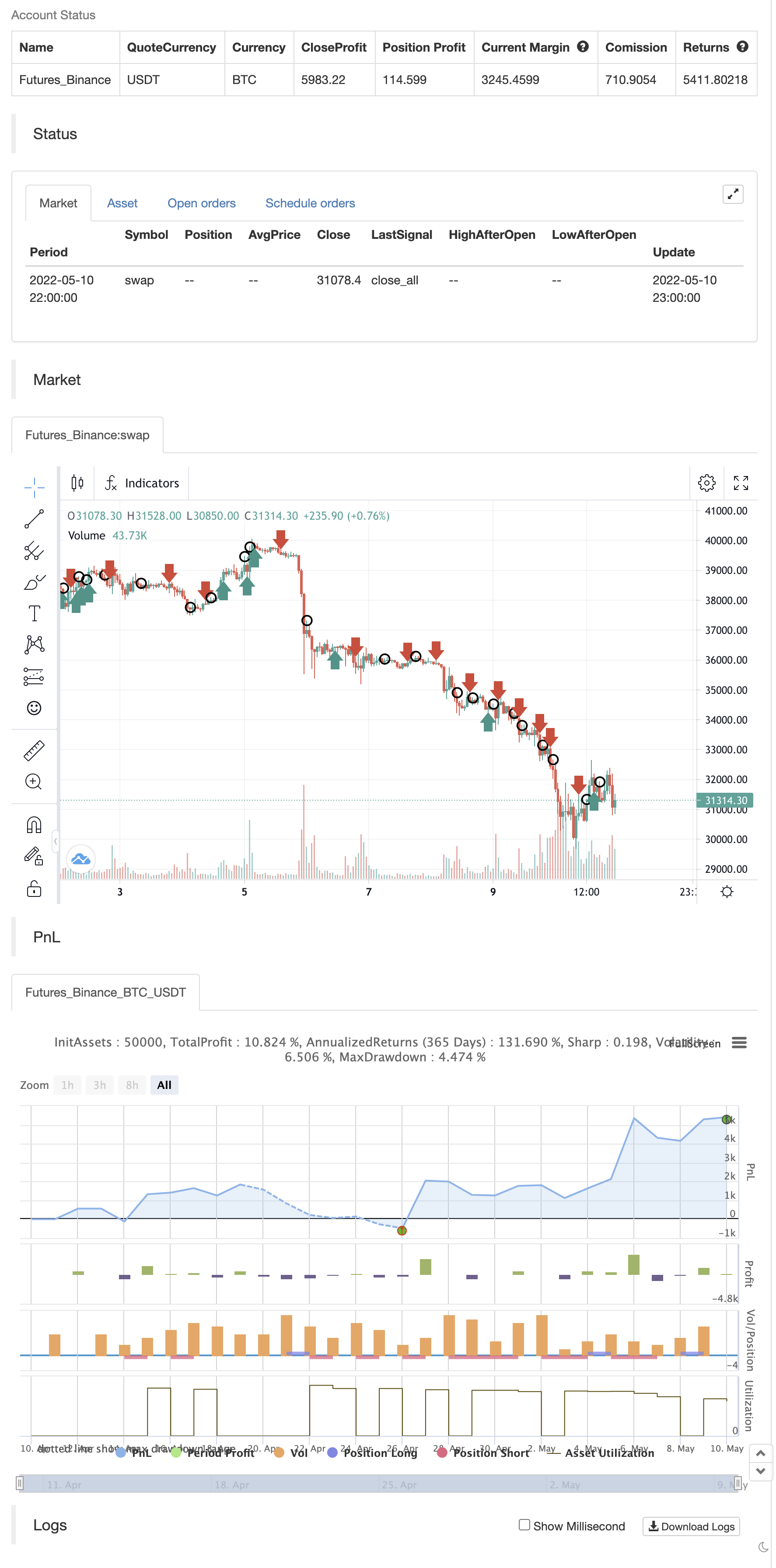

backtest

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 05/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// The related article is copyrighted material from

// Stocks & Commodities Mar 2010

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

BPF(Length,Delta,SellZone,BuyZone) =>

pos = 0.0

xPrice = hl2

beta = math.cos(3.14 * (360 / Length) / 180)

gamma = 1 / math.cos(3.14 * (720 * Delta / Length) / 180)

alpha = gamma - math.sqrt(gamma * gamma - 1)

BP = 0.0

BP := 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(BP[1]) - alpha * nz(BP[2])

pos:= BP > SellZone ? 1 :

BP <= BuyZone? -1 : nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & Bandpass Filter', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ Bandpass Filter ═════●'

LengthBPF = input.int(20, minval=1, group=I2)

Delta = input(0.5, group=I2)

SellZone = input.float(5, step = 0.01, group=I2)

BuyZone = input.float(-5, step = 0.01, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosBPF = BPF(LengthBPF,Delta,SellZone,BuyZone)

iff_1 = posEMA20 == -1 and prePosBPF == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosBPF == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

//barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)

Artikel terkait

- Pengertian Tren Multidimensional dan Strategi Stop Loss Dinamis ATR

- Tren multi-indikator tinggi mengkonfirmasi strategi perdagangan

- Strategi pelacakan tren adaptif dan konfirmasi transaksi ganda

- Strategi optimasi perdagangan intraday yang dikombinasikan dengan RSI

- Strategi pelacakan tren lintas indikator teknologi

- Tren EMA dikombinasikan dengan pergantian posisi untuk merobek strategi perdagangan

- Strategi perdagangan kuantitatif dengan RSI dinamis yang dibantu dengan cross-linear multi-uniform

- Tren Dinamis Menentukan Strategi RSI

- Strategi pelacakan tren silang ganda: indeks linear dengan sistem perdagangan simultan MACD

- Tren multi-indikator multi-dimensi lintas strategi kuantifikasi tingkat lanjut

- Strategi perdagangan kuantitatif dengan tracking tren lintas dinamis dan multi-konfirmasi

Informasi lebih lanjut

- FTL - Range Filter X2 + EMA + UO

- Brahmastra

- Band Mobo

- SAR + 3SMMA dengan SL & TP

- SSS

- Templat Peringatan Peluncuran Bulan [Indikator]

- HALFTREND + HEMA + SMA (Strategi Sinyal Palsu)

- RSI Divergensi dengan Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- RSI dan BBand oversold secara bersamaan

- Gulung Lilin Heikin Ashi

- ESSMA

- 3EMA

- Blok Perintah Pivot

- NMVOB-S

- Moving Average Colored EMA/SMA

- Band MAHL

- 3 Supertrend Tambahkan Dalam Script Tunggal Ini

- Indikator Swing High/Low dengan Konfirmasi MACD dan EMA

- Triple EMA + MACD

- Bermain salib