SUPERTREND ATR DENGAN TRAILING Hentikan Hilang

Penulis:ChaoZhang, Tanggal: 2022-05-23 14:54:31Tag:ATR

SuperTrend adalah stop bergerak dan garis pembalikan berdasarkan volatilitas (ATR).

Strategi ini akan naik stop loss Anda ketika harga bergerak 1%.

Strategi ini akan menutup operasi Anda ketika harga pasar melintasi stop loss.

Strategi akan menutup operasi ketika garis berdasarkan volatilitas akan melintasi

Strategi ini memiliki parameter berikut:

- Periode ATR- Untuk memilih jumlah bar kembali untuk menjalankan perhitungan

- ATR MULTPLIER- Untuk menambahkan faktor multiplier pada volatilitas

- PEMUKAH PEMUKAH- Di mana bisa isert nilai untuk berhenti pertama.

- TIP Posisi- Di mana bisa memilih posisi perdagangan.

- Periode Uji Kembali- Untuk memilih jangkauan.

DISCLAIMER

- Saya bukan penasihat keuangan berlisensi atau dealer pialang. Saya tidak memberitahu Anda kapan atau apa yang harus dibeli atau dijual. Saya mengembangkan perangkat lunak ini yang memungkinkan Anda untuk melakukan perdagangan manual atau otomatis beberapa perdagangan menggunakan TradingView. Perangkat lunak ini memungkinkan Anda untuk mengatur kriteria yang Anda inginkan untuk memasuki dan keluar perdagangan.

- Jangan berdagang dengan uang yang tidak mampu Anda hilangkan.

- Aku tidak menjamin keuntungan yang konsisten atau siapa pun bisa menghasilkan uang tanpa usaha.

- Setiap sistem bisa memiliki kemenangan dan kekalahan beruntun.

- Manajemen uang memainkan peran besar dalam hasil perdagangan Anda. Misalnya: ukuran lot, ukuran akun, leverage broker, dan aturan panggilan margin broker semuanya memiliki efek pada hasil. Juga, pengaturan Take Profit dan Stop Loss Anda untuk perdagangan pasangan individu dan untuk ekuitas akun secara keseluruhan memiliki dampak besar pada hasil. Jika Anda baru dalam perdagangan dan tidak memahami item ini, maka saya sarankan Anda mencari bahan pendidikan untuk memperluas pengetahuan Anda.

Anda perlu menemukan dan menggunakan sistem perdagangan yang bekerja terbaik untuk Anda dan toleransi perdagangan Anda.

Aku tidak memberikan apa-apa selain alat dengan opsi untuk Anda untuk berdagang dengan program ini di TradingView.

Catatan

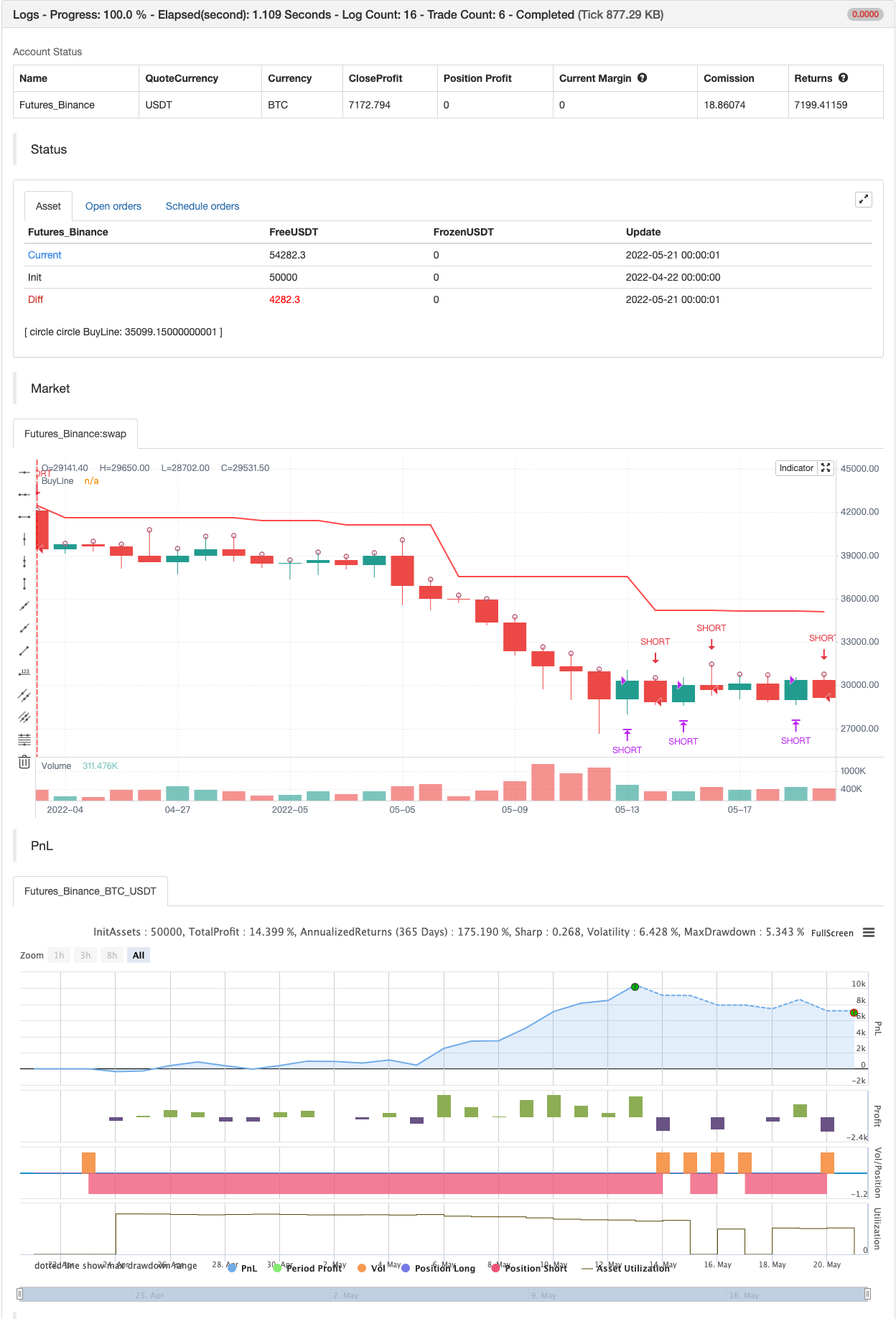

backtest

/*backtest

start: 2022-02-22 00:00:00

end: 2022-05-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// SuperTrend with Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 5-Aug-2019

//

// Description

// ===========

// SuperTrend is a moving stop and reversal line based on the volatility (ATR).

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

// The strategy has the following parameters:

//

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// ATR PERIOD - To select number of bars back to execute calculation

// ATR MULTPLIER - To add a multplier factor on volatility

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy(title = "SUPERTREND ATR WITH TRAILING STOP LOSS",

shorttitle = "SUPERTREND ATR WITH TSL",

overlay = true,

precision = 8,

calc_on_order_fills = true,

calc_on_every_tick = true,

backtest_fill_limits_assumption = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 1000,

currency = currency.USD,

linktoseries = true)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title = "═══════════════ FROM ═══════════════", defval = true, type = input.bool)

FromMonth = input(defval = 1, title = "Month", minval = 1)

FromDay = input(defval = 1, title = "Day", minval = 1)

FromYear = input(defval = 2019, title = "Year", minval = 2014)

backTestSectionTo = input(title = "════════════════ TO ════════════════", defval = true, type = input.bool)

ToMonth = input(defval = 31, title = "Month", minval = 1)

ToDay = input(defval = 12, title = "Day", minval = 1)

ToYear = input(defval = 9999, title = "Year", minval = 2014)

backTestPeriod() => (time > timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time < timestamp(ToYear, ToMonth, ToDay, 23, 59))

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title = "═════════════ STRATEGY ═════════════", defval = true, type = input.bool)

// === INPUT TO SELECT POSITION ===

positionType = input(defval="SHORT", title="Position Type", options=["LONG", "SHORT"])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input(defval = 3.0, minval = 0.0, title="Initial Stop Loss")

// === INPUT TO SELECT BARS BACK

barsBack = input(title="ATR Period", defval=1)

// === INPUT TO SELECT MULTPLIER FACTOR

multplierFactor = input(title="ATR multplierFactoriplier", step=0.1, defval=3.0)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// LOGIC TO FIND DIRECTION WHEN THERE IS TREND CHANGE ACCORDING VOLATILITY

atr = multplierFactor * atr(barsBack)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

direction = 1

direction := nz(direction[1], direction)

direction := direction == -1 and close > shortStopPrev ? 1 : direction == 1 and close < longStopPrev ? -1 : direction

longColor = color.blue

shortColor = color.blue

var valueToPlot = 0.0

var colorToPlot = color.white

if (direction == 1)

valueToPlot := longStop

colorToPlot := color.green

else

valueToPlot := shortStop

colorToPlot := color.red

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === GLOBAL VARIABLES AND FUNCTIONS TO STORE IMPORTANT CONDITIONALS TO TRAILING STOP

hasEntryLongConditional() => direction == 1

hasCloseLongConditional() => direction == -1

hasEntryShortConditional() => direction == -1

hasCloseShortConditional() => direction == 1

stopLossPercent = positionType == "LONG" ? initialStopLossPercent * -1 : initialStopLossPercent

var entryPrice = 0.0

var updatedEntryPrice = 0.0

var stopLossPrice = 0.0

hasOpenTrade() => strategy.opentrades != 0

notHasOpenTrade() => strategy.opentrades == 0

strategyClose() =>

if positionType == "LONG"

strategy.close("LONG", when=true)

else

strategy.close("SHORT", when=true)

strategyOpen() =>

if positionType == "LONG"

strategy.entry("LONG", strategy.long, when=true)

else

strategy.entry("SHORT", strategy.short, when=true)

isLong() => positionType == "LONG" ? true : false

isShort() => positionType == "SHORT" ? true : false

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === LOGIC TO TRAILING STOP IN LONG POSITION

if (isLong())

crossedStopLoss = close <= stopLossPrice

terminateOperation = hasOpenTrade() and (crossedStopLoss or hasCloseLongConditional())

if (terminateOperation)

entryPrice := 0.0

updatedEntryPrice := entryPrice

stopLossPrice := 0.0

strategyClose()

startOperation = notHasOpenTrade() and hasEntryLongConditional()

if(startOperation)

entryPrice := close

updatedEntryPrice := entryPrice

stopLossPrice := entryPrice + (entryPrice * stopLossPercent) / 100

strategyOpen()

strategyPercentege = (close - updatedEntryPrice) / updatedEntryPrice * 100.00

rideUpStopLoss = hasOpenTrade() and strategyPercentege > 1

if (isLong() and rideUpStopLoss)

stopLossPercent := stopLossPercent + strategyPercentege - 1.0

newStopLossPrice = updatedEntryPrice + (updatedEntryPrice * stopLossPercent) / 100

stopLossPrice := max(stopLossPrice, newStopLossPrice)

updatedEntryPrice := stopLossPrice

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === LOGIC TO TRAILING STOP IN SHORT POSITION

if (isShort())

crossedStopLoss = close >= stopLossPrice

terminateOperation = hasOpenTrade() and (crossedStopLoss or hasCloseShortConditional())

if (terminateOperation)

entryPrice := 0.0

updatedEntryPrice := entryPrice

stopLossPrice := 0.0

strategyClose()

startOperation = notHasOpenTrade() and hasEntryShortConditional()

if(startOperation)

entryPrice := close

updatedEntryPrice := entryPrice

stopLossPrice := entryPrice + (entryPrice * stopLossPercent) / 100

strategyOpen()

strategyPercentege = (close - updatedEntryPrice) / updatedEntryPrice * 100.00

rideDownStopLoss = hasOpenTrade() and strategyPercentege < -1

if (rideDownStopLoss)

stopLossPercent := stopLossPercent + strategyPercentege + 1.0

newStopLossPrice = updatedEntryPrice + (updatedEntryPrice * stopLossPercent) / 100

stopLossPrice := min(stopLossPrice, newStopLossPrice)

updatedEntryPrice := stopLossPrice

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//

// === DRAWING SHAPES

entryPricePlotConditinal = entryPrice == 0.0 ? na : entryPrice

trailingStopLossPlotConditional = stopLossPrice == 0.0 ? na : stopLossPrice

plotshape(entryPricePlotConditinal, title= "Entry Price", color=color.blue, style=shape.circle, location=location.absolute, size=size.tiny)

plotshape(trailingStopLossPlotConditional, title= "Stop Loss", color=color.red, style=shape.circle, location=location.absolute, size=size.tiny)

plot(valueToPlot == 0.0 ? na : valueToPlot, title="BuyLine", linewidth=2, color=colorToPlot)

plotshape(direction == 1 and direction[1] == -1 ? longStop : na, title="Buy", style=shape.labelup, location=location.absolute, size=size.normal, text="Buy", transp=0, textcolor = color.white, color=color.green, transp=0)

plotshape(direction == -1 and direction[1] == 1 ? shortStop : na, title="Sell", style=shape.labeldown, location=location.absolute, size=size.normal, text="Sell", transp=0, textcolor = color.white, color=color.red, transp=0)

alertcondition(direction == 1 and direction[1] == -1 ? longStop : na, title="Buy", message="Buy!")

alertcondition(direction == -1 and direction[1] == 1 ? shortStop : na, title="Sell", message="Sell!")

Artikel terkait

- Sistem strategi pengukuran tren momentum dua indikator

- Pengertian Tren Multidimensional dan Strategi Stop Loss Dinamis ATR

- Tren multi-indikator tinggi mengkonfirmasi strategi perdagangan

- Strategi stop loss pelacakan cerdas berdasarkan rata-rata bergerak dan pola harian

- Sistem perdagangan kuantitatif dengan regresi multifaktor dan strategi sabuk harga dinamis

- Strategi perdagangan kuantitatif dengan tracking tren lintas dinamis dan multi-konfirmasi

- Strategi pelacakan stop loss dinamis lanjutan berdasarkan margin tingkat besar yang menyimpang dari RSI

- Strategi perdagangan kuantitatif untuk membalikkan tren sinkronisasi multi-indikator

- Multi-channel, dukungan dinamis untuk melawan strategi Kenny

- Pembelajaran mesin beradaptasi dengan strategi perdagangan kuantitatif supertrend

- Strategi perdagangan untuk melacak tren rata-rata berdasarkan stop loss volatilitas

Informasi lebih lanjut

- Regresi linier ++

- RedK Dual VADER dengan Energy Bar

- Zona Konsolidasi - Hidup

- Perkiraan Kuantitatif Kualitatif

- Peringatan lintas rata-rata bergerak, multi-frame time (MTF)

- MACD Reloaded STRATEGY

- Rata-rata Bergerak SuperTrended

- Perdagangan ABC

- 15MIN BTCUSDTPERP BOT

- Entropi Shannon V2

- Aliran Volume v3

- Scalping berjam-jam dengan ma & rsi - ogcheckers

- ATR dihaluskan

- Order Block Finder

- TrendScalp-FractalBox-3EMA

- sinyal QQE

- Filter amplitudo kisi U

- CM MACD Custom Indicator - Multiple Time Frame - V2

- HODL LINE

- 2 Deteksi Arah Rata-rata Bergerak