Adaptive Take Profit dan Stop Loss Strategy Berdasarkan Dual Time Frame dan Momentum Indicator

Penulis:ChaoZhang, Tanggal: 2023-11-23 17:57:52Tag:

Gambaran umum

Strategi ini menggabungkan dua time frame dan indikator momentum untuk mencapai adaptif take profit dan stop loss. time frame utama memantau arah tren, sementara time frame sekunder digunakan untuk mengkonfirmasi sinyal. sinyal perdagangan dihasilkan ketika arah keduanya sejajar. setelah memasuki pasar, take profit dan stop loss tingkat diperbarui secara progresif.

Logika Strategi

-

Kerangka waktu utama menggunakan indikator regresi linier Squeeze Momentum (SQM) untuk menentukan tren. Kerangka waktu sekunder menggunakan kombinasi EMA pada indikator SQM untuk menyaring sinyal palsu.

-

Ketika grafik utama SQM pecah ke atas dan grafik sekunder SQM juga naik, posisi panjang diambil.

-

Setelah memasuki pasar, tingkat awal take profit dan stop loss ditetapkan berdasarkan parameter input. Ketika harga mencapai level take profit, tingkat take profit dan stop loss diperbarui. Secara khusus, tingkat take profit meningkat secara progresif dan level stop loss diperketat, mencapai profit taking secara bertahap.

Keuntungan

-

Kerangka waktu ganda menyaring sinyal palsu dan memastikan akurasi.

-

Indikator SQM menentukan arah tren, menghindari kebisingan pasar.

-

Mekanisme adaptif mengambil keuntungan dan menghentikan kerugian mengunci keuntungan sejauh mungkin dan secara efektif mengendalikan risiko.

Analisis Risiko

-

Pengaturan parameter SQM yang tidak benar dapat melewatkan titik perubahan tren, yang menyebabkan kerugian.

-

Kerangka waktu sekunder yang tidak tepat mungkin gagal menyaring kebisingan secara efektif, menyebabkan perdagangan yang salah.

-

Jika amplitudo stop loss diatur terlalu luas, kerugian per perdagangan bisa sangat besar.

Peluang Peningkatan

-

Parameter SQM perlu disesuaikan untuk pasar yang berbeda untuk memastikan sensitivitas.

-

Periode waktu sekunder yang berbeda harus diuji untuk menemukan efek penyaringan kebisingan terbaik.

-

Alih-alih nilai tetap, amplitudo stop loss dapat memiliki rentang yang ditetapkan secara dinamis berdasarkan volatilitas pasar.

Ringkasan

Secara keseluruhan ini adalah strategi yang sangat praktis. Kombinasi dari dua kerangka waktu dengan indikator momentum untuk menentukan tren, bersama dengan metode adaptif mengambil keuntungan dan stop loss dapat menghasilkan keuntungan yang stabil. Dengan mengoptimalkan parameter SQM, periode kerangka waktu sekunder, dan amplitudo stop loss, hasil strategi dapat ditingkatkan lebih lanjut untuk aplikasi dan peningkatan langsung yang produktif.

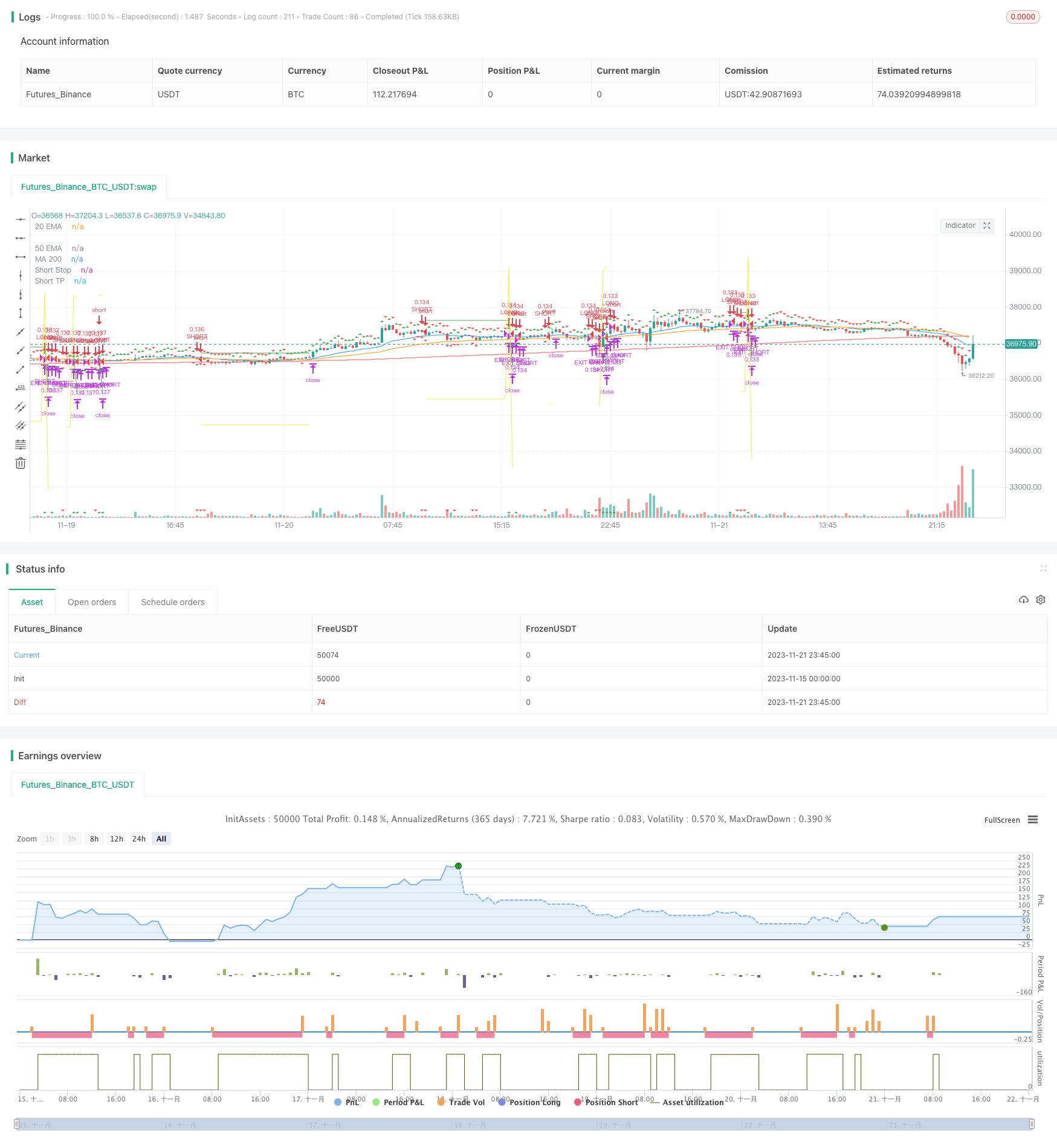

/*backtest

start: 2023-11-15 00:00:00

end: 2023-11-22 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SQZ Multiframe Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

fast_ema_len = input(11, minval=5, title="Fast EMA")

slow_ema_len = input(34, minval=20, title="Slow EMA")

sqm_lengthKC = input(20, title="SQM KC Length")

kauf_period = input(20, title="Kauf Period")

kauf_mult = input(2,title="Kauf Mult factor")

min_profit_sl = input(5.0, minval=1, maxval=100, title="Min profit to start moving SL [%]")

longest_sl = input(10, minval=1, maxval=100, title="Maximum possible of SL [%]")

sl_step = input(0.5, minval=0.0, maxval=1.0, title="Take profit factor")

// ADMF

CMF_length = input(11, minval=1, title="CMF length") // EMA27 = SMMA/RMA14 ~ lunar month

show_plots = input(true, title="Show plots")

lower_resolution = timeframe.period=='1'?'5':timeframe.period=='5'?'15':timeframe.period=='15'?'30':timeframe.period=='30'?'60':timeframe.period=='60'?'240':timeframe.period=='240'?'D':timeframe.period=='D'?'W':'M'

higher_resolution = timeframe.period=='5'?'1':timeframe.period=='15'?'5':timeframe.period=='30'?'15':timeframe.period=='60'?'30':timeframe.period=='240'?'60':timeframe.period=='D'?'240':timeframe.period=='W'?'D':'W'

// Calculate Squeeze Momentum

sqm_val = linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0)

sqm_val_high = security(syminfo.tickerid, higher_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), lookahead=barmerge.lookahead_on)

sqm_val_low = security(syminfo.tickerid, lower_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_on)

// Emas

high_close = security(syminfo.tickerid, higher_resolution, close, lookahead=barmerge.lookahead_on)

high_fast_ema = security(syminfo.tickerid, higher_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

high_slow_ema = security(syminfo.tickerid, higher_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

//low_fast_ema = security(syminfo.tickerid, lower_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

//low_slow_ema = security(syminfo.tickerid, lower_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

// CMF

ad = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

money_flow = sum(ad, CMF_length) / sum(volume, CMF_length)

// Entry conditions

low_condition_long = (sqm_val_low > sqm_val_low[1])

low_condition_short = (sqm_val_low < sqm_val_low[1])

money_flow_min = (money_flow[4] > money_flow[3]) and (money_flow[3] > money_flow[2]) and (money_flow[2] < money_flow[1]) and (money_flow[1] < money_flow)

money_flow_max = (money_flow[4] < money_flow[3]) and (money_flow[3] < money_flow[2]) and (money_flow[2] > money_flow[1]) and (money_flow[1] > money_flow)

condition_long = ((sqm_val > sqm_val[1])) and (money_flow_min or money_flow_min[1] or money_flow_min[2] or money_flow_min[3]) and lowest(sqm_val, 5) < 0

condition_short = ((sqm_val < sqm_val[1])) and (money_flow_max or money_flow_max[1] or money_flow_max[2] or money_flow_max[3]) and highest(sqm_val, 5) > 0

high_condition_long = true//high_close > high_fast_ema and high_close > high_slow_ema //(high_fast_ema > high_slow_ema) //and (sqm_val_low > sqm_val_low[1])

high_condition_short = true//high_close < high_fast_ema and high_close < high_slow_ema//(high_fast_ema < high_slow_ema) //and (sqm_val_low < sqm_val_low[1])

enter_long = low_condition_long and condition_long and high_condition_long

enter_short = low_condition_short and condition_short and high_condition_short

// Stop conditions

var current_target_price = 0.0

var current_sl_price = 0.0 // Price limit to take profit

var current_target_per = 0.0

var current_profit_per = 0.0

set_targets(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

if isLong

target := close * (1.0 + current_target_per)

sl := close * (1.0 - (longest_sl/100.0)) // Longest SL

else

target := close * (1.0 - current_target_per)

sl := close * (1.0 + (longest_sl/100.0)) // Longest SL

[target, sl]

target_reached(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

profit_per = 0.0

target_per = 0.0

if current_profit_per == 0

profit_per := (min_profit*sl_step) / 100.0

else

profit_per := current_profit_per + ((min_profit*sl_step) / 100.0)

target_per := current_target_per + (min_profit / 100.0)

if isLong

target := strategy.position_avg_price * (1.0 + target_per)

sl := strategy.position_avg_price * (1.0 + profit_per)

else

target := strategy.position_avg_price * (1.0 - target_per)

sl := strategy.position_avg_price * (1.0 - profit_per)

[target, sl, profit_per, target_per]

hl_diff = sma(high - low, kauf_period)

stop_condition_long = 0.0

new_stop_condition_long = low - (hl_diff * kauf_mult)

if (strategy.position_size > 0)

if (close > current_target_price)

[target, sl, profit_per, target_per] = target_reached(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_long := max(stop_condition_long[1], current_sl_price)

else

stop_condition_long := new_stop_condition_long

stop_condition_short = 99999999.9

new_stop_condition_short = high + (hl_diff * kauf_mult)

if (strategy.position_size < 0)

if (close < current_target_price)

[target, sl, profit_per, target_per] = target_reached(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_short := min(stop_condition_short[1], current_sl_price)

else

stop_condition_short := new_stop_condition_short

// Submit entry orders

if (enter_long and (strategy.position_size <= 0))

if (strategy.position_size < 0)

strategy.close(id="SHORT")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="LONG", long=true)

// if show_plots

// label.new(bar_index, high, text=tostring("LONG\nSL: ") + tostring(stop_condition_long), style=label.style_labeldown, color=color.green)

if (enter_short and (strategy.position_size >= 0))

if (strategy.position_size > 0)

strategy.close(id="LONG")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="SHORT", long=false)

// if show_plots

// label.new(bar_index, high, text=tostring("SHORT\nSL: ") + tostring(stop_condition_short), style=label.style_labeldown, color=color.red)

if (strategy.position_size > 0)

strategy.exit(id="EXIT LONG", stop=stop_condition_long)

if (strategy.position_size < 0)

strategy.exit(id="EXIT SHORT", stop=stop_condition_short)

// Plot anchor trend

plotshape(low_condition_long, style=shape.triangleup,

location=location.abovebar, color=color.green)

plotshape(low_condition_short, style=shape.triangledown,

location=location.abovebar, color=color.red)

plotshape(condition_long, style=shape.triangleup,

location=location.belowbar, color=color.green)

plotshape(condition_short, style=shape.triangledown,

location=location.belowbar, color=color.red)

//plotshape((close < profit_target_short) ? profit_target_short : na, style=shape.triangledown,

// location=location.belowbar, color=color.yellow)

plotshape(enter_long, style=shape.triangleup,

location=location.bottom, color=color.green)

plotshape(enter_short, style=shape.triangledown,

location=location.bottom, color=color.red)

// Plot emas

plot(ema(close, 20), color=color.blue, title="20 EMA")

plot(ema(close, 50), color=color.orange, title="50 EMA")

plot(sma(close, 200), color=color.red, title="MA 200")

// Plot stop loss values for confirmation

plot(series=(strategy.position_size > 0) and show_plots ? stop_condition_long : na,

color=color.green, style=plot.style_linebr,

title="Long Stop")

plot(series=(strategy.position_size < 0) and show_plots ? stop_condition_short : na,

color=color.green, style=plot.style_linebr,

title="Short Stop")

plot(series=(strategy.position_size < 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Short TP")

plot(series=(strategy.position_size > 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Long TP")

//plot(series=(strategy.position_size < 0) ? profit_sl_short : na,

// color=color.gray, style=plot.style_linebr,

// title="Short Stop")

- Tren Mengikuti Strategi Berdasarkan Dekomposisi Seri Waktu dan Volume Bollinger Bands Tertimbang

- Strategi perdagangan kuantitatif dari osilator harga terdetensi

- Tren Multi-Indikator Mengikuti Strategi

- CCI Dual Timeframe Trend Mengikuti Strategi

- Strategi Pelacakan Tren T3-CCI

- Strategi Penembusan SuperTrend Cross Timeframe

- Strategi kombinasi rata-rata bergerak pembalikan momentum

- Rata-rata Gerak Dinamis Retracement Strategi Martin

- Kombo Momentum Reversal Dual-Rail Matching Strategy

- Ichimoku Cloud Quant Strategi

- Strategi Perdagangan Grid RSI Multi-Periode

- Strategi Crossover Rata-rata Bergerak Eksponensial Ganda

- Tren Pelacakan Rata-rata Gerak Strategi RSI

- Strategi Crossover Harga Penutupan Bulanan dan Rata-rata Gerak

- Bollinger Bands Breakout tren jangka pendek setelah Strategi

- Membeli penurunan dengan mengambil keuntungan dan stop loss

- RSI Axial Moving Average Crossover Strategi

- Dual SMA Crossover Strategi

- Strategi kombinasi dua EMA dan RSI

- Spekulasi Teluk: Trend Follow Strategi Berdasarkan SAR