Pivot Point dan Fibonacci Retracement Berbasis Tren Otomatis Mengikuti Strategi

Penulis:ChaoZhang, Tanggal: 2024-01-05 11:34:17Tag:

Gambaran umum

Strategi ini secara otomatis mengidentifikasi pola ABC dalam harga saham berdasarkan titik pivot dan rasio retracement Fibonacci, dan menghasilkan sinyal panjang/pendek.

Logika Strategi

- Menghitung titik tinggi dan rendah pivot saham

- Menghakimi apakah harga telah turun dari titik tinggi sebelumnya atau naik dari titik rendah sebelumnya

- Hitung rasio retracement Fibonacci antara gelombang saat ini dan gelombang sebelumnya

- Jika rasio retracement dari kedua gelombang ke atas dan ke bawah berada dalam kisaran yang tepat, menentukan pola ABC potensial

- Setelah konfirmasi pola ABC, atur stop loss di Point C untuk panjang, dan Point A untuk pendek.

Analisis Keuntungan

- Titik pivot mengidentifikasi tingkat pendukung/resistensi utama untuk meningkatkan akurasi sinyal

- Retracement Fibonacci menangkap titik balik tren dengan mengidentifikasi pola ABC

- Aturan laba rugi yang jelas menghindari kerugian besar

Analisis Risiko

- Titik pivot dan retracement Fibonacci tidak dapat memastikan identifikasi sempurna dari setiap titik balik tren.

- Titik C dan Titik A berhenti dapat dipecahkan, menyebabkan kerugian yang lebih besar

- Parameter seperti rentang rasio retracement Fibonacci membutuhkan optimasi lebih lanjut

Arahan Optimasi

- Masukkan lebih banyak indikator teknis untuk membantu konfirmasi pola ABC, meningkatkan akurasi sinyal

- Mengoptimalkan rentang rasio retracement Fibonacci agar sesuai dengan kondisi pasar

- Menggunakan metode pembelajaran mesin untuk melatih model pengenalan pola ABC

Kesimpulan

Strategi ini mengidentifikasi pola ABC untuk menghasilkan sinyal panjang/pendek pada titik balik tren, berdasarkan konfirmasi titik pivot dari level support/resistance utama, dan perhitungan rasio retracement Fibonacci. Logika sederhana dan bersih, dengan aturan profit/loss yang masuk akal yang secara efektif mengendalikan risiko. Namun, beberapa risiko penilaian yang salah tetap ada, yang membutuhkan optimasi dan perbaikan lebih lanjut untuk memenuhi kondisi pasar yang lebih banyak.

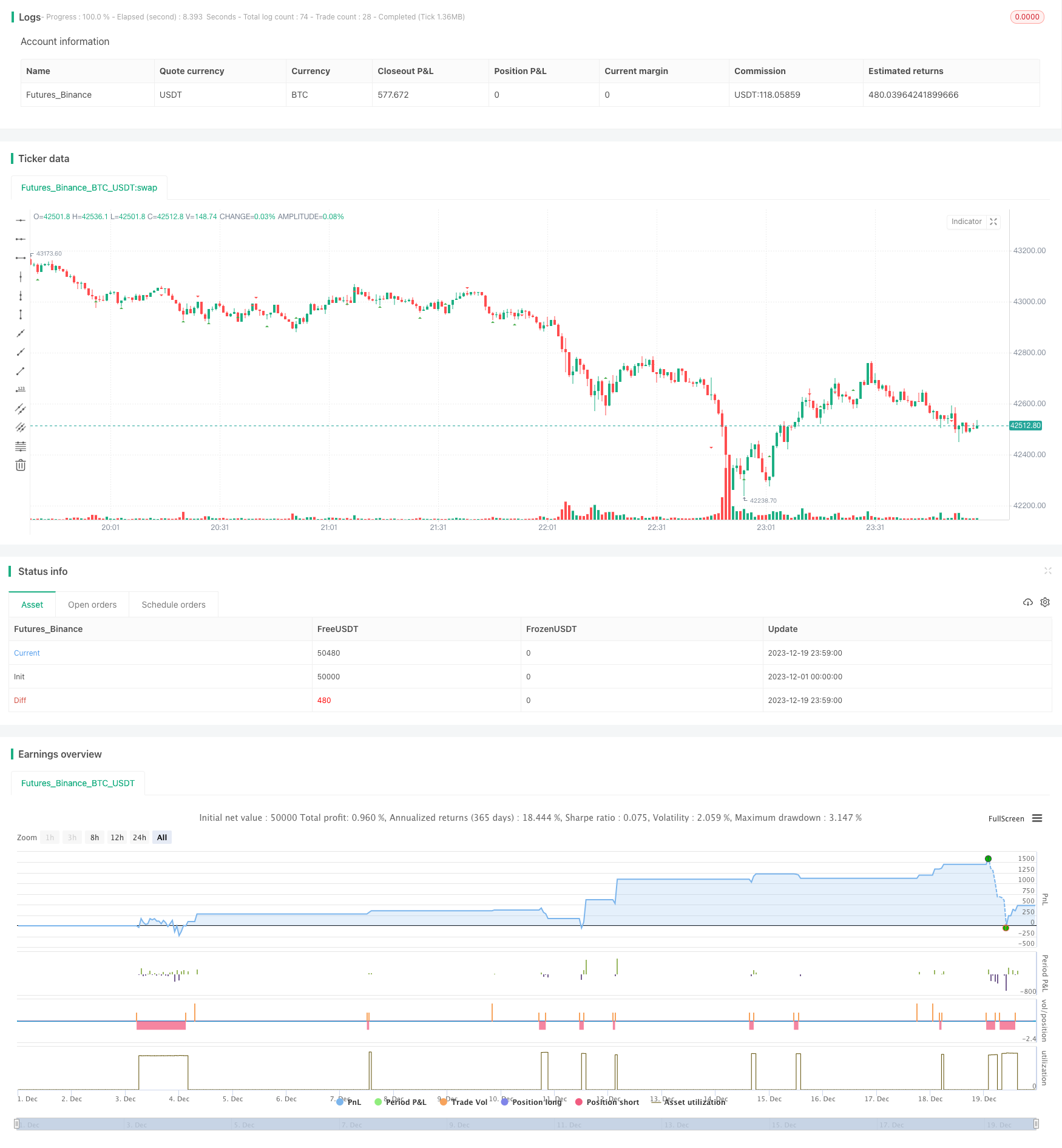

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-19 23:59:59

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kerok3g

//@version=5

strategy("ABCD Strategy", shorttitle="ABCDS", overlay=true, commission_value=0.04)

calcdev(fprice, lprice, fbars, lbars) =>

rise = lprice - fprice

run = lbars - fbars

avg = rise/run

((bar_index - lbars) * avg) + lprice

len = input(5)

ph = ta.pivothigh(len, len)

pl = ta.pivotlow(len, len)

var bool ishigh = false

ishigh := ishigh[1]

var float currph = 0.0

var int currphb = 0

currph := nz(currph)

currphb := nz(currphb)

var float oldph = 0.0

var int oldphb = 0

oldph := nz(oldph)

oldphb := nz(oldphb)

var float currpl = 0.0

var int currplb = 0

currpl := nz(currpl)

currplb := nz(currplb)

var float oldpl = 0.0

var int oldplb = 0

oldpl := nz(oldpl)

oldplb := nz(oldplb)

if (not na(ph))

ishigh := true

oldph := currph

oldphb := currphb

currph := ph

currphb := bar_index[len]

else

if (not na(pl))

ishigh := false

oldpl := currpl

oldplb := currplb

currpl := pl

currplb := bar_index[len]

endHighPoint = calcdev(oldph, currph, oldphb, currphb)

endLowPoint = calcdev(oldpl, currpl, oldplb, currplb)

plotshape(ph, style=shape.triangledown, color=color.red, location=location.abovebar, offset=-len)

plotshape(pl, style=shape.triangleup, color=color.green, location=location.belowbar, offset=-len)

// var line lnhigher = na

// var line lnlower = na

// lnhigher := line.new(oldphb, oldph, bar_index, endHighPoint)

// lnlower := line.new(oldplb, oldpl, bar_index, endLowPoint)

// line.delete(lnhigher[1])

// line.delete(lnlower[1])

formlong = oldphb < oldplb and oldpl < currphb and currphb < currplb

longratio1 = (currph - oldpl) / (oldph - oldpl)

longratio2 = (currph - currpl) / (currph - oldpl)

formshort = oldplb < oldphb and oldphb < currplb and currplb < currphb

shortratio1 = (oldph - currpl) / (oldph - oldpl)

shortratio2 = (currph - currpl) / (oldph - currpl)

// prevent multiple entry for one pattern

var int signalid = 0

signalid := nz(signalid[1])

longCond = formlong and

longratio1 < 0.7 and

longratio1 > 0.5 and

longratio2 > 1.1 and

longratio2 < 1.35 and

close < oldph and

close > currpl and

signalid != oldplb

if (longCond)

signalid := oldplb

longsl = currpl - ta.tr

longtp = ((close - longsl) * 1.5) + close

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", limit=math.min(longtp, oldph), stop=longsl)

shortCond = formshort and

shortratio1 < 0.7 and

shortratio1 > 0.5 and

shortratio2 > 1.1 and

shortratio2 < 1.35 and

close > oldpl and

close < currph and

signalid != oldphb

if (shortCond)

signalid := oldphb

shortsl = currph + ta.tr

shorttp = close - ((shortsl - close) * 1.5)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", limit=math.max(shorttp, oldpl), stop=shortsl)

Lebih banyak

- Tren Mengikuti Strategi Perdagangan Rata-rata Bergerak

- Tren Mengikuti Strategi Momentum Breakout

- Breakout dan Intelligent Bollinger Bands Strategi Saluran Harga

- Tren Sederhana Mengikuti Strategi

- Strategi Terobosan Panjang Berdasarkan Konstruksi K-Line

- Momentum Oscillating Moving Average Trading Strategy Berdasarkan Bollinger Band Buffered

- Adaptive Backtest Strategi Pilihan Jangkauan Tanggal Berdasarkan Double MA

- Strategi Optimasi Crossover Rata-rata Bergerak Berbagai Jangka Waktu

- Strategi Pelacakan Terobosan

- Strategi perdagangan adaptif berdasarkan indikator momentum

- Tren Mengikuti Strategi Berdasarkan EMA dan MACD di Seluruh Jangka Waktu

- Strategi pembalikan tabrakan multi-indikator

- Strategi Pembalikan Tren Berdasarkan EMA dan SMA Crossover

- Strategi Penjaga DPO DMI

- Pelacakan Tren Strategi Perdagangan Jangka Pendek

- Tren RSI Mengikuti Strategi Bull

- Strategi kombinasi RSIndex dan moving average

- Trend MA multi-frame Timeframe Mengikuti Strategi

- Dual Indikator Bottom Strategi Beli

- Strategi Pembalikan Perampokan Buruh