Strategi Supertrend Advance

Penulis:ChaoZhang, Tanggal: 2024-01-08 10:03:31Tag:

Gambaran umum

Strategi Supertrend Advance adalah versi yang dioptimalkan dan ditingkatkan berdasarkan indikator Supertrend klasik. Ini menggabungkan aksi harga, volatilitas, dan beberapa indikator teknis untuk meningkatkan kualitas sinyal, mengurangi kebisingan, dan lebih akurat menangkap perubahan tren pasar.

Prinsip Strategi

Inti dari Strategi Supertrend Advance adalah garis Supertrend. Hal ini dihitung berdasarkan rentang rata-rata yang sebenarnya dan momentum harga untuk menentukan arah tren potensial dan titik infleksi. Ketika harga di atas garis Supertrend, itu menunjukkan tren naik. Sebaliknya, ketika di bawah garis, itu menandakan tren turun.

Tidak seperti indikator Supertrend tradisional yang terutama mempertimbangkan harga penutupan dan ATR, strategi Advance juga menggabungkan dimensi seperti volume perdagangan, osilator momentum, dan bahkan data fundamental untuk memvalidasi keandalan sinyal.

Analisis Keuntungan

Keuntungan utama dari Supertrend Advance Strategy meliputi:

-

Dengan menunggu konfirmasi dari beberapa indikator, strategi ini sangat meningkatkan akurasi.

-

Mengurangi gangguan kebisingan. Kombinasi filter menyaring data pasar yang tidak penting, membuat penilaian lebih jelas.

-

Manajemen risiko yang lebih baik. Sinyal perdagangan yang jelas memudahkan perencanaan stop loss dan mengambil keuntungan dengan lebih efektif.

-

Selain mengidentifikasi tren, strategi juga dapat dikombinasikan dengan alat teknis lainnya untuk menciptakan sistem perdagangan yang komprehensif.

Analisis Risiko

Strategi Supertrend Advance juga memiliki risiko utama berikut:

-

Kombinasi parameter yang salah dapat membuat strategi tidak efektif atau memicu terlalu banyak sinyal palsu.

-

Tidak ada strategi yang dapat sepenuhnya menghindari risiko kesalahan penilaian. Ketika tren berubah secara tak terduga, kerugian dapat terjadi.

-

Risiko optimasi yang berlebihan: Ketika parameter terlalu cocok dengan data historis, strategi mungkin tidak dapat beradaptasi dengan perubahan kondisi pasar.

-

Risiko biaya perdagangan. Karena frekuensi perdagangan meningkat, biaya seperti komisi dan slippage juga meningkat secara signifikan.

Solusi yang sesuai:

-

Mengoptimalkan pengaturan parameter dan secara teratur backtest ketahanan.

-

Atur stop loss dan ambil keuntungan untuk membatasi kerugian per perdagangan.

-

Hindari over-optimasi untuk mempertahankan kemampuan generalisasi.

-

Menghitung risiko / imbalan sinyal dan mengelola biaya perdagangan.

Arahan Optimasi

Strategi Supertrend Advance dapat dioptimalkan dalam aspek berikut:

-

Sesuaikan parameter berdasarkan pasar yang berbeda agar lebih sesuai dengan karakteristik mereka.

-

Tambahkan mekanisme penyaringan adaptif ke indikator penyesuaian otomatis atau matikan filter di kondisi pasar tertentu.

-

Jelajahi metode pembelajaran mesin untuk mengoptimalkan parameter secara dinamis menggunakan jaringan saraf.

-

Menggabungkan data sentimen dan analisis berita untuk meningkatkan kinerja menggunakan data yang tidak terstruktur.

-

Tambahkan kemampuan ukuran posisi untuk meningkatkan pengembalian ketika tingkat kemenangan sangat tinggi.

Kesimpulan

Dengan memperkenalkan beberapa filter dan indikator konfirmasi, Supertrend Advance Strategy mengoptimalkan indikator Supertrend klasik untuk menilai tren dengan lebih tepat dan meningkatkan kualitas sinyal. Dibandingkan dengan indikator tunggal, strategi multidimensional ini memberikan solusi perdagangan yang lebih kuat, komprehensif dan efisien. Namun, risiko seperti penyesuaian parameter yang tidak tepat dan kesalahan penilaian juga harus dijaga dengan mengadopsi langkah-langkah pengendalian risiko yang tepat. Dengan optimasi lebih lanjut dan integrasi dengan alat lain, Supertrend Advance Strategy memiliki potensi aplikasi yang sangat besar.

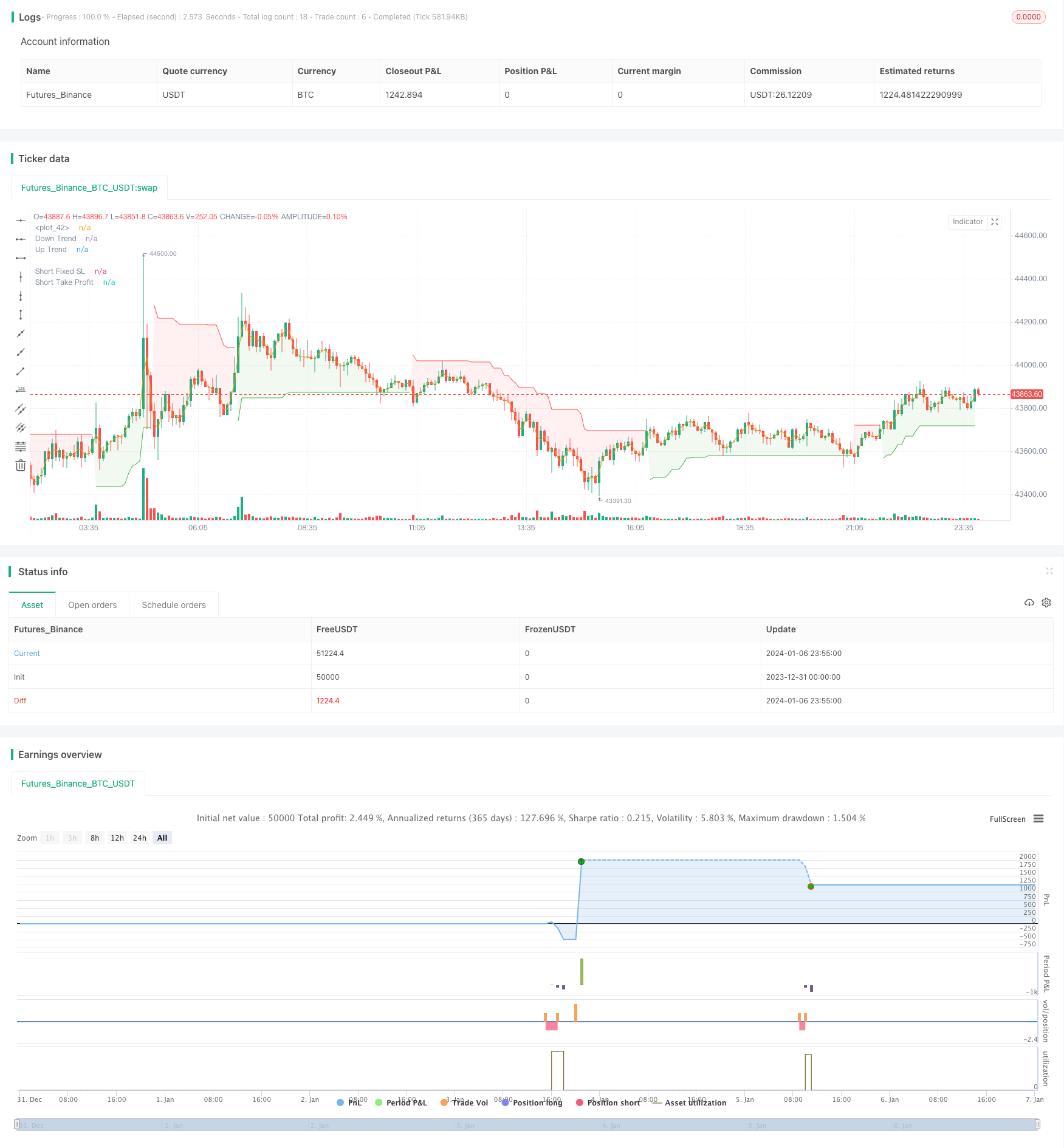

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-07 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © JS_TechTrading

//@version=5

strategy("Supertrend advance", overlay=true,default_qty_type =strategy.percent_of_equity,default_qty_value = 1,process_orders_on_close = false)

// group string////

var string group_text000="Choose Strategy"

var string group_text0="Supertrend Settings"

var string group_text0000="Ema Settings"

var string group_text00="Rsi Settings"

var string group_text1="Backtest Period"

var string group_text2="Trade Direction"

var string group_text3="Quantity Settings"

var string group_text4="Sl/Tp Settings"

var string group_text5="Enable/Disable Condition Filter"

var string group_macd="Macd Set"

var group_cci="Cci Set"

var string group_text6="Choose Sl/Tp"

var string group_text7="Percentage Sl/Tp"

var string group_text9="Atr SL/Tp"

var string group_text8='Swing Hl & Supertrend Sl/Tp'

// filter enable and disbale

on_ma =input.bool(true,"Ema Condition On/Off",group=group_text5,inline = "CL")

en_rsi = input.bool(true,"Rsi Condition On/Off",group = group_text5,inline = "CL")

en_macd=input.bool(true,title ="Enable Macd Condition",group =group_text5,inline = "CS")

en_cci=input.bool(true,title ="Enable/Disable CCi Filter",group =group_text5,inline = "CS")

////////////////////

option_ch=input.string('Pullback',title = "Type Of Stratgey",options =['Pullback','Simple'],group = "Choose Strategy Type")

// option for stop loss and take profit

option_ts=input.string("Percentage","Chosse Type Of Sl/tp",["Percentage","Supertrend","Swinghl","Atr"],group=group_text6)

//atr period input supertrend

atrPeriod = input(10, "ATR Length",group = group_text0)

factor = input.float(3.0, "Factor", step = 0.01,group=group_text0)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

long=direction < 0 ? supertrend : na

short=direction < 0? na : supertrend

longpos=false

shortpos=false

longpos :=long?true :short?false:longpos[1]

shortpos:=short?true:long?false:shortpos[1]

fin_pullbuy= (ta.crossunder(low[1],long) and long and high>high[1])

fin_pullsell=(ta.crossover(high[1],short) and short and low<low[1])

//Ema 1

ma_len= input.int(200, minval=1, title="Ema Length",group = group_text0000)

ma_src = input.source(close, title="Ema Source",group = group_text0000)

ma_out = ta.ema(ma_src, ma_len)

ma_buy=on_ma?close>ma_out?true:false:true

ma_sell=on_ma?close<ma_out?true:false:true

// rsi indicator and condition

// Get user input

rsiSource = input(title='RSI Source', defval=close,group = group_text00)

rsiLength = input(title='RSI Length', defval=14,group = group_text00)

rsiOverbought = input(title='RSI BUY Level', defval=50,group = group_text00)

rsiOversold = input(title='RSI SELL Level', defval=50,group = group_text00)

// Get RSI value

rsiValue = ta.rsi(rsiSource, rsiLength)

rsi_buy=en_rsi?rsiValue>=rsiOverbought ?true:false:true

rsi_sell=en_rsi?rsiValue<=rsiOversold?true:false:true

// Getting inputs macd

fast_length = input(title="Fast Length", defval=12,group =group_macd)

slow_length = input(title="Slow Length", defval=26,group =group_macd)

macd_src = input(title="Source", defval=close,group =group_macd)

signal_length = input.int(title="Signal Smoothing", minval = 1, maxval = 50, defval = 9,group =group_macd)

[macdLine, signalLine, histLine] = ta.macd(macd_src, fast_length ,slow_length,signal_length)

buy_macd=en_macd?macdLine>0?true:false:true

sell_macd=en_macd?macdLine<0?true:false:true

// CCI indicator

length_cci = input.int(20, minval=1,group = group_cci)

src_cci = input(hlc3, title="Source",group = group_cci)

cci_gr=input.int(200,title = "CCi > Input",group = group_cci,tooltip ="CCi iS Greater thn 100 buy")

cci_ls=input.int(-200,title = "CCi < -Input",group = group_cci,tooltip ="CCi iS Less thn -100 Sell")

ma = ta.sma(src_cci, length_cci)

cci = (src_cci - ma) / (0.015 * ta.dev(src_cci, length_cci))

//cci buy and sell

buy_cci=en_cci?cci>cci_gr?true:false:true

sell_cci=en_cci?cci<cci_ls?true:false:true

// final condition

buy_cond=option_ch=='Simple'?long and not(longpos[1]) and rsi_buy and ma_buy and buy_macd and buy_cci:option_ch=='Pullback'?fin_pullbuy and rsi_buy and ma_buy and buy_macd and buy_cci:na

sell_cond=option_ch=='Simple'?short and not(shortpos[1]) and rsi_sell and ma_sell and sell_macd and sell_cci:option_ch=='Pullback'?fin_pullsell and rsi_sell and ma_sell and sell_macd and sell_cci:na

//backtest engine

start = input(timestamp('2005-01-01'), title='Start calculations from',group=group_text1)

end=input(timestamp('2045-03-01'), title='End calculations',group=group_text1)

time_cond = true

// Make input option to configure trade direction

tradeDirection = input.string(title='Trade Direction', options=['Long', 'Short', 'Both'], defval='Both',group = group_text2)

// Translate input into trading conditions

longOK = (tradeDirection == "Long") or (tradeDirection == "Both")

shortOK = (tradeDirection == "Short") or (tradeDirection == "Both")

// quantity

qty_new=input.float(1.0,step =0.10,title ="Quantity",group =group_text3)

// supertrend and swing high and low

tpnewf = input.float(title="take profit swinghl||supertrend ", step=0.1, defval=1.5, group=group_text8)

hiLen = input.int(title='Highest High Lookback', defval=6, minval=2, group=group_text8)

loLen = input.int(title='Lowest Low Lookback', defval=6, minval=2, group=group_text8)

globl = option_ts=="Swinghl"? nz(ta.lowest(low, loLen),low[1]):option_ts=="Supertrend"?nz(supertrend,low[1]):na

globl2=option_ts=="Swinghl"? nz(ta.highest(high, hiLen),high[1]) :option_ts=="Supertrend"?nz(supertrend,high[1]):na

var store = float(na)

var store2=float(na)

// strategy start

if buy_cond and longOK and time_cond and strategy.position_size==0

strategy.entry("enter long",direction = strategy.long,qty =qty_new)

store:=globl

if sell_cond and shortOK and time_cond and strategy.position_size==0

strategy.entry("enter short",direction =strategy.short,qty =qty_new)

store2:=globl2

//stop loss and take profit

enable_trail=input.bool(false,"Enable Trail",group =group_text7)

stopPer = input.float(1.0,step=0.10,title='Stop Loss %',group=group_text7)* 0.01

takePer = input.float(2.0,step=0.10, title='Take Profit %',group=group_text7)* 0.01

//TRAILING STOP CODE

trailStop = input.float(title='Trailing Stop (%)', minval=0.0, step=0.1, defval=1,group=group_text7) * 0.01

longStopPrice = 0.0

shortStopPrice = 0.0

longStopPrice := if strategy.position_size > 0

stopValue = close * (1 - trailStop)

math.max(stopValue, longStopPrice[1])

else

0

shortStopPrice := if strategy.position_size < 0

stopValue = close * (1 + trailStop)

math.min(stopValue, shortStopPrice[1])

else

999999

// Determine where you've entered and in what direction

longStop = 0.0

shortStop =0.0

shortTake =0.0

longTake = 0.0

if (option_ts=="Percentage" )

// Determine where you've entered and in what direction

longStop := strategy.position_avg_price * (1 - stopPer)

shortStop := strategy.position_avg_price * (1 + stopPer)

shortTake := strategy.position_avg_price * (1 - takePer)

longTake := strategy.position_avg_price * (1 + takePer)

if enable_trail and (option_ts=="Percentage" )

longStop := longStopPrice

shortStop := shortStopPrice

//single take profit exit position

if strategy.position_size > 0 and option_ts=="Percentage"

strategy.exit(id='Close Long',from_entry = "enter long", stop=longStop, limit=longTake)

if strategy.position_size < 0 and option_ts=="Percentage"

strategy.exit(id='Close Short',from_entry = "enter short", stop=shortStop, limit=shortTake)

//PLOT FIXED SLTP LINE

plot(strategy.position_size > 0 and option_ts=="Percentage" ? longStop : na, style=plot.style_linebr, color=enable_trail?na:color.new(#c0ff52, 0), linewidth=1, title='Long Fixed SL')

plot(strategy.position_size < 0 and option_ts=="Percentage"? shortStop : na, style=plot.style_linebr, color=enable_trail?na:color.new(#5269ff, 0), linewidth=1, title='Short Fixed SL')

plot(strategy.position_size > 0 and option_ts=="Percentage"? longTake : na, style=plot.style_linebr, color=color.new(#5e6192, 0), linewidth=1, title='Long Take Profit')

plot(strategy.position_size < 0 and option_ts=="Percentage"? shortTake : na, style=plot.style_linebr, color=color.new(#dcb53d, 0), linewidth=1, title='Short Take Profit')

//PLOT TSL LINES

plot(series=strategy.position_size > 0 and option_ts=="Percentage" and enable_trail ? longStopPrice : na, color=color.new(color.red, 0), style=plot.style_linebr, linewidth=1, title='Long Trail Stop', offset=1)

plot(series=strategy.position_size < 0 and option_ts=="Percentage" and enable_trail ? shortStopPrice : na, color=color.new(color.red, 0), style=plot.style_linebr, linewidth=1, title='Short Trail Stop', offset=1)

// swing high and low

//take profit

takeProfit_buy = strategy.position_avg_price - ((store - strategy.position_avg_price) * tpnewf)

takeProfit_sell = strategy.position_avg_price - ((store2 - strategy.position_avg_price) * tpnewf)

// Submit stops based on highest high and lowest low

if strategy.position_size >= 0 and (option_ts=="Swinghl" or option_ts=="Supertrend")

strategy.exit(id='XL HH',from_entry = "enter long", stop=store,limit=takeProfit_buy,comment ="Long Exit")

if strategy.position_size <= 0 and (option_ts=="Swinghl" or option_ts=="Supertrend")

strategy.exit(id='XS LL',from_entry = "enter short", stop=store2,limit=takeProfit_sell,comment = "Short Exit")

// plot take profit

plot(series=strategy.position_size < 0 and (option_ts=="Swinghl" or option_ts=="Supertrend")? takeProfit_sell : na, style=plot.style_circles, color=color.orange, linewidth=1, title="take profit sell")

plot(series=strategy.position_size > 0 and (option_ts=="Swinghl" or option_ts=="Supertrend")? takeProfit_buy: na, style=plot.style_circles, color=color.blue, linewidth=1, title="take profit buy")

// Plot stop Loss for visual confirmation

plot(series=strategy.position_size > 0 and (option_ts=="Swinghl" or option_ts=="Supertrend")? store : na, style=plot.style_circles, color=color.new(color.green, 0), linewidth=1, title='Lowest Low Stop')

plot(series=strategy.position_size < 0 and (option_ts=="Swinghl" or option_ts=="Supertrend")? store2 : na, style=plot.style_circles, color=color.new(color.red, 0), linewidth=1, title='Highest High Stop')

// atr

enable_atrtrail=input.bool(false,"Enable Atr Trail",group = group_text9)

atrLength = input(title='ATR Length', defval=14,group =group_text9)

slATRMult = input.float(title='Stop loss ATR multiplier',step=0.1, defval=2.0,group =group_text9)

tpATRMult = input.float(title='Take profit multiplier',step=0.1, defval=1.5,group =group_text9)

lookback = input.int(title='How Far To Look Back For High/Lows', defval=7, minval=1,group =group_text9)

atr = ta.atr(atrLength)

lowestLow = ta.lowest(low, lookback)

highestHigh = ta.highest(high, lookback)

longStopa = (enable_atrtrail ? lowestLow : close) - atr * slATRMult

shortStopa = (enable_atrtrail ? highestHigh : close) + atr * slATRMult

atr_l=0.0

atr_s=0.0

atr_l:=nz(strategy.position_avg_price-(atr[1] * slATRMult),strategy.position_avg_price-(1 * slATRMult))

atr_s:=nz(strategy.position_avg_price+ (atr[1] * slATRMult),strategy.position_avg_price-(1 * slATRMult))

stoploss_l = ta.valuewhen(strategy.position_size != 0 and strategy.position_size[1] == 0,atr_l, 0)

stoploss_s = ta.valuewhen(strategy.position_size != 0 and strategy.position_size[1] == 0,atr_s, 0)

takeprofit_l = strategy.position_avg_price - ((stoploss_l - strategy.position_avg_price) * tpATRMult)

takeprofit_s = strategy.position_avg_price - ((stoploss_s - strategy.position_avg_price) * tpATRMult)

// Submit stops based on highest high and lowest low

if strategy.position_size > 0 and (option_ts=="Atr")

strategy.exit(id='Xl', stop= enable_atrtrail?longStopa:stoploss_l,limit=takeprofit_l ,comment ="Long Exit")

if strategy.position_size < 0 and (option_ts=="Atr")

strategy.exit(id='XH', stop=enable_atrtrail?shortStopa:stoploss_s,limit=takeprofit_s,comment = "Short Exit")

// // plot take profit

plot(series=strategy.position_size > 0 and (option_ts=="Atr")? takeprofit_l : na, style=plot.style_circles, color=color.orange, linewidth=1, title="take profit sell")

plot(series=strategy.position_size < 0 and (option_ts=="Atr")? takeprofit_s: na, style=plot.style_circles, color=color.blue, linewidth=1, title="take profit buy")

// Plot stop Loss for visual confirmation

plot(series=strategy.position_size >0 and (option_ts=="Atr") and not enable_atrtrail? stoploss_l : na, style=plot.style_circles, color=color.new(color.green, 0), linewidth=1, title='Lowest Low Stop')

plot(series=strategy.position_size < 0 and (option_ts=="Atr") and not enable_atrtrail? stoploss_s : na, style=plot.style_circles, color=color.new(color.red, 0), linewidth=1, title='Highest High Stop')

//PLOT TSL LINES

plot(series=strategy.position_size >0 and option_ts=="Atr" and enable_atrtrail ? longStopa : na, color=color.new(color.green, 0), style=plot.style_linebr, linewidth=1, title='Long Trail Stop', offset=1)

plot(series=strategy.position_size < 0 and (option_ts=="Atr") and enable_atrtrail? shortStopa : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='short Trail Stop', offset=1)

- Membeli/Menjual pada Strategi Penutupan Lilin

- Supertrend mengambil keuntungan strategi

- Tren Saluran Harga Mengikuti Strategi

- Strategi Countertrend Rata-rata Bergerak Ganda

- Positif Bars Strategi Penembusan Persentase

- RSI Dual-track Strategy Terobosan

- Strategi Crossover Moving Average Minyak Besi

- Strategi Backtest Filter Horizontal Vertikal

- RSI dan Bollinger Bands Strategi Perdagangan Kuantitatif

- Tren ZigZag Mengikuti Strategi

- Strategi Warna Lilin Tengah Malam dengan Stop Loss dan Take Profit

- Tren ATR Mengikuti Strategi Berdasarkan Saluran Penyimpangan Standar

- Strategi Pelacakan Tren Berbasis ATR

- Strategi Trading Kuantitatif Menggabungkan RSI, MACD dan Support/Resistance

- RSI Trend Tracking Strategi Hanya Panjang

- Strategi Penembusan Saluran Ganda Penyu

- Strategi RSI MACD Moving Average yang Ditingkatkan

- Strategi Keputusan EMA jangka pendek dan jangka panjang

- Strategi Keluar Chandelier

- Tren Pengesahan Tiga Kali Bergerak Mengikuti Strategi