Strategi Pullback Momentum

Penulis:ChaoZhang, Tanggal: 2024-01-26 11:07:47Tag:

Gambaran umum

Momentum Pullback Strategy adalah strategi perdagangan jangka menengah yang menggabungkan moving average dan pola candlestick untuk mengidentifikasi peluang trading dengan mendeteksi breakout dan pullback.

Logika Strategi

Logika inti dari strategi ini didasarkan pada rata-rata bergerak sederhana 5 hari. Ketika harga akan menembus garis rata-rata ini, itu akan membentuk candle gap tinggi atau rendah, yang menandakan peluang panjang atau pendek yang potensial. Sinyal masuk dipicu ketika lilin kedua menutup di luar rata-rata bergerak tidak melanggar candle gap sebelumnya rendah atau tinggi.

Ketika harga melanggar di atas MA 5 hari dan ditutup, gap candle

Sebuah filter opsional disediakan di mana penutupan lilin saat ini harus sedikit lebih rendah atau lebih tinggi daripada penutupan lilin celah untuk konfirmasi tambahan, menghindari sinyal palsu.

Analisis Keuntungan

- Logika strategi yang jelas dan sederhana, mudah dimengerti dan diterapkan

- Mengidentifikasi tren dan penurunan menggunakan rata-rata bergerak

- Waktu perdagangan yang lebih tepat menggabungkan pola candlestick

- Mencocokkan risiko dan imbalan, selaras dengan perdagangan yang bijaksana

- Parameter yang dapat disesuaikan untuk produk dan jangka waktu yang berbeda

- Filter opsional menghindari beberapa sinyal palsu

Analisis Risiko

- Risiko analisis teknis umum seperti terjebak dalam tren, berhenti berjalan melalui

- Sifat tertinggal dari rata-rata bergerak dapat melewatkan pembalikan cepat

- Lebih banyak sinyal palsu yang mungkin terjadi di pasar yang terikat rentang

- Perdagangan yang berlebihan karena pengaturan parameter yang buruk

Risiko dapat dikurangi melalui stop loss yang masuk akal, ukuran posisi, perdagangan yang kurang sering, dll. Menggabungkan indikator lain untuk menyaring sinyal juga merupakan pilihan.

Arahan Optimasi

- Uji set parameter yang berbeda untuk kinerja terbaik

- Tambahkan indikator lain atau pola grafik ke sinyal filter

- Jelajahi peningkatan stop loss yang dinamis

- Menerapkan pembelajaran mesin untuk mengoptimalkan parameter secara otomatis

- Mengembangkan otomatis stop loss / mengambil keuntungan plugin

- Pemeriksaan ketahanan di seluruh produk dan kerangka waktu

Kesimpulan

Secara keseluruhan ini adalah strategi perdagangan jangka menengah yang mudah dipahami dan diimplementasikan. Ini memanfaatkan pembalikan tren yang diidentifikasi oleh moving average dan lilin celah, dengan kerangka pengendalian risiko yang rasional. Sementara perbaikan lebih lanjut mungkin, logika inti serbaguna untuk aplikasi yang lebih luas melalui penyesuaian parameter, penyaringan sinyal dll.

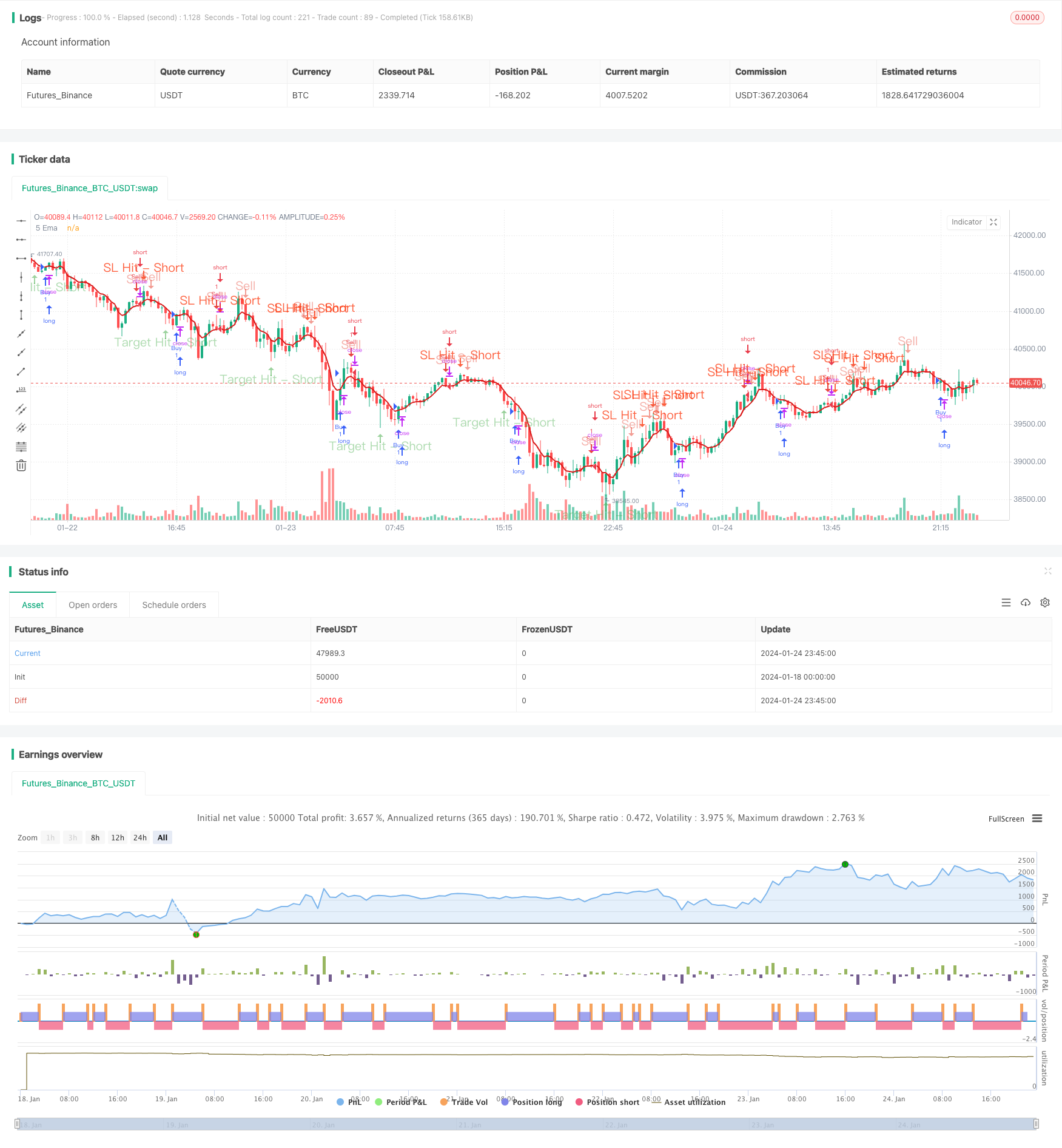

/*backtest

start: 2024-01-18 00:00:00

end: 2024-01-25 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingInsights2

//@version=5

strategy("Ultimate 5EMA Strategy By PowerOfStocks", overlay=true)

Eusl = input.bool(false, title="Enable the Extra SL shown below")

usl = input.int(defval=5, title='Value to set SL number of points below-low or above-high', minval=1, maxval=100)

RiRe = input.int(defval=3, title='Risk to Reward Ratio', minval=1, maxval=25)

ShowSell = input.bool(true, 'Show Sell Signals')

ShowBuy = input.bool(false, 'Show Buy Signals')

BSWCon = input.bool(defval=false, title='Buy/Sell with Extra Condition - candle close')

// Moving Average

ema5 = ta.ema(close, 5)

pema5 = plot(ema5, '5 Ema', color=color.new(#da1a1a, 0), linewidth=2)

var bool Short = na

var bool Long = na

var shortC = 0

var sslhitC = 0

var starhitC = 0

var float ssl = na

var float starl = na

var float star = na

var float sellat = na

var float alert_shorthigh = na

var float alert_shortlow = na

var line lssl = na

var line lstar = na

var line lsell = na

var label lssllbl = na

var label lstarlbl = na

var label lselllbl = na

var longC = 0

var lslhitC = 0

var ltarhitC = 0

var float lsl = na

var float ltarl = na

var float ltar = na

var float buyat = na

var float alert_longhigh = na

var float alert_longlow = na

var line llsl = na

var line lltar = na

var line lbuy = na

var label llsllbl = na

var label lltarlbl = na

var label lbuylbl = na

ShortWC = low[1] > ema5[1] and low[1] > low and shortC == 0 and close < close[1]

ShortWOC = low[1] > ema5[1] and low[1] > low and shortC == 0

Short := BSWCon ? ShortWC : ShortWOC

sslhit = high > ssl and shortC > 0 and sslhitC == 0

starhit = low < star and shortC > 0 and starhitC == 0

LongWC = high[1] < ema5[1] and high[1] < high and longC == 0 and close > close[1]

LongWOC = high[1] < ema5[1] and high[1] < high and longC == 0

Long := BSWCon ? LongWC : LongWOC

lslhit = low < lsl and longC > 0 and lslhitC == 0

ltarhit = high > ltar and longC > 0 and ltarhitC == 0

if Short and ShowSell

shortC := shortC + 1

sslhitC := 0

starhitC := 0

alert_shorthigh := high[1]

if Eusl

ssl := high[1] + usl

starl := BSWCon ? ((high[1] - close) + usl) * RiRe : ((high[1] - low[1]) + usl) * RiRe

else

ssl := high[1]

starl := BSWCon ? (high[1] - close) * RiRe : (high[1] - low[1]) * RiRe

star := BSWCon ? close - starl : low[1] - starl

sellat := BSWCon ? close : low[1]

// lssl := line.new(bar_index, ssl, bar_index, ssl, color=color.new(#fc2d01, 45), style=line.style_dashed)

// lstar := line.new(bar_index, star, bar_index, star, color=color.new(color.green, 45), style=line.style_dashed)

// lsell := line.new(bar_index, sellat, bar_index, sellat, color=color.new(color.orange, 45), style=line.style_dashed)

// lssllbl := label.new(bar_index, ssl, style=label.style_none, text='Stop Loss - Short' + ' (' + str.tostring(ssl) + ')', textcolor=color.new(#fc2d01, 35), color=color.new(#fc2d01, 35))

// lstarlbl := label.new(bar_index, star, style=label.style_none, text='Target - Short' + ' (' + str.tostring(star) + ')', textcolor=color.new(color.green, 35), color=color.new(color.green, 35))

// lselllbl := label.new(bar_index, sellat, style=label.style_none, text='Sell at' + ' (' + str.tostring(sellat) + ')', textcolor=color.new(color.orange, 35), color=color.new(color.orange, 35))

if sslhit == false and starhit == false and shortC > 0

// line.set_x2(lssl, bar_index)

// line.set_x2(lstar, bar_index)

// line.set_x2(lsell, bar_index)

sslhitC := 0

starhitC := 0

else

if sslhit

shortC := 0

sslhitC := sslhitC + 1

else

if starhit

shortC := 0

starhitC := starhitC + 1

if Long and ShowBuy

longC := longC + 1

lslhitC := 0

ltarhitC := 0

alert_longlow := low[1]

if Eusl

lsl := low[1] - usl

ltarl := BSWCon ? ((close - low[1]) + usl) * RiRe : ((high[1] - low[1]) + usl) * RiRe

else

lsl := low[1]

ltarl := BSWCon ? (close - low[1]) * RiRe : (high[1] - low[1]) * RiRe

ltar := BSWCon ? close + ltarl : high[1] + ltarl

buyat := BSWCon ? close : high[1]

llsl := line.new(bar_index, lsl, bar_index, lsl, color=color.new(#fc2d01, 45), style=line.style_dotted)

lltar := line.new(bar_index, ltar, bar_index, ltar, color=color.new(color.green, 45), style=line.style_dotted)

lbuy := line.new(bar_index, buyat, bar_index, buyat, color=color.new(color.orange, 45), style=line.style_dotted)

llsllbl := label.new(bar_index, lsl, style=label.style_none, text='Stop Loss - Long' + ' (' + str.tostring(lsl) + ')', textcolor=color.new(#fc2d01, 35), color=color.new(#fc2d01, 35))

lltarlbl := label.new(bar_index, ltar, style=label.style_none, text='Target - Long' + ' (' + str.tostring(ltar) + ')', textcolor=color.new(color.green, 35), color=color.new(color.green, 35))

lbuylbl := label.new(bar_index, buyat, style=label.style_none, text='Buy at' + ' (' + str.tostring(buyat) + ')', textcolor=color.new(color.orange, 35), color=color.new(color.orange, 35))

if lslhit == false and ltarhit == false and longC > 0

// line.set_x2(llsl, bar_index)

// line.set_x2(lltar, bar_index)

// line.set_x2(lbuy, bar_index)

lslhitC := 0

ltarhitC := 0

else

if lslhit

longC := 0

lslhitC := lslhitC + 1

else

if ltarhit

longC := 0

ltarhitC := ltarhitC + 1

strategy.entry("Buy", strategy.long, when=Long)

strategy.entry("Sell", strategy.short, when=Short)

strategy.close("ExitBuy", when=sslhit or starhit)

strategy.close("ExitSell", when=lslhit or ltarhit)

plotshape(ShowSell and Short, title='Sell', location=location.abovebar, offset=0, color=color.new(#e74c3c, 45), style=shape.arrowdown, size=size.normal, text='Sell', textcolor=color.new(#e74c3c, 55))

plotshape(ShowSell and sslhit, title='SL Hit - Short', location=location.abovebar, offset=0, color=color.new(#fc2d01, 25), style=shape.arrowdown, size=size.normal, text='SL Hit - Short', textcolor=color.new(#fc2d01, 25))

plotshape(ShowSell and starhit, title='Target Hit - Short', location=location.belowbar, offset=0, color=color.new(color.green, 45), style=shape.arrowup, size=size.normal, text='Target Hit - Short', textcolor=color.new(color.green, 55))

plotshape(ShowBuy and Long, title='Buy', location=location.belowbar, offset=0, color=color.new(#2ecc71, 45), style=shape.arrowup, size=size.normal, text='Buy', textcolor=color.new(#2ecc71, 55))

plotshape(ShowBuy and lslhit, title='SL Hit - Long', location=location.belowbar, offset=0, color=color.new(#fc2d01, 25), style=shape.arrowdown, size=size.normal, text='SL Hit - Long', textcolor=color.new(#fc2d01, 25))

plotshape(ShowBuy and ltarhit, title='Target Hit - Long', location=location.abovebar, offset=0, color=color.new(color.green, 45), style=shape.arrowup, size=size.normal, text='Target Hit - Long', textcolor=color.new(color.green, 55))

if ShowSell and Short

alert("Go Short@ " + str.tostring(sellat) + " : SL@ " + str.tostring(ssl) + " : Target@ " + str.tostring(star) + " ", alert.freq_once_per_bar )

if ShowBuy and Long

alert("Go Long@ " + str.tostring(buyat) + " : SL@ " + str.tostring(lsl) + " : Target@ " + str.tostring(ltar) + " ", alert.freq_once_per_bar )

///// End of code

- Strategi pembalikan terbuka harian

- Golden Cross SMA Strategi Perdagangan

- Strategi Rata-rata Bergerak Golden Cross

- Strategi Trading Crypto MACD

- Strategi jangka pendek regresi linier dan rata-rata bergerak ganda

- Triple Overlapping Stochastic Momentum Strategi

- Strategi Tren Momentum

- Momentum Moving Average Crossover Quant Strategi

- Strategi kombinasi pembalikan rata-rata bergerak ganda dan ATR Trailing Stop

- Strategi perdagangan berjangka Martingale leveraged

- Dual Candlestick Prediksi Strategi Tutup

- Strategi osilasi dukungan dan resistensi kuantitatif

- Strategi Mengikuti Tren dengan 3 EMA, DMI dan MACD

- Strategi Terobosan Indikator Ganda

- Strategi Sistem Perdagangan Pete Wave

- Strategi Kuantitatif Berdasarkan Rata-rata Bergerak Eksponensial dan Berat Volume