Triple Overlapping Stochastic Momentum Strategi

Penulis:ChaoZhang, Tanggal: 2024-01-26 12:15:20Tag:

Gambaran umum

Triple Overlapping Stochastic Momentum adalah strategi perdagangan jangka pendek yang khas. Strategi ini menghitung tiga indikator Stochastic Momentum Index (SMI) dengan pengaturan parameter yang berbeda dan menghasilkan sinyal perdagangan ketika ketiga indikator menunjukkan kondisi overbought atau oversold secara bersamaan. Dengan menggabungkan analisis multi-timeframe, strategi ini dapat secara efektif menyaring kebisingan pasar dan meningkatkan kualitas sinyal.

Logika Strategi

Indikator inti dari strategi ini adalah Stochastic Momentum Index (SMI).

SMI = 100 * EMA(EMA(Close - Midpoint of High-Low Range, N1), N2) / 0.5 * EMA(EMA(High - Low, N1), N2)

Di mana N1 dan N2 adalah panjang parameter. SMI berosilasi antara -100 dan 100. Nilai di atas 0 menunjukkan penutupan berada di setengah atas kisaran harian, sementara nilai di bawah 0 menunjukkan penutupan berada di setengah bawah.

Sama seperti osilator stokastik tradisional, tingkat overbought (misalnya 40) / oversold (misalnya -40) menunjukkan sinyal pembalikan potensial.

Strategi ini menggunakan tiga indikator SMI dengan set parameter yang berbeda, khususnya:

- SMI1: %K Periode 10, %K Perlambatan Periode 3

- SMI2: %K Periode 20, %K Perlambatan Periode 3

- SMI3: %K Periode 5, %K Perlambatan Periode 3

Sinyal perdagangan dihasilkan ketika ketiga SMI secara bersamaan menunjukkan kondisi overbought atau oversold.

Keuntungan

- Analisis multi-frame waktu untuk sinyal kuat

- SMI meningkatkan kegunaan atas Stochastic tradisional

- Terdiri tiga kali meningkatkan keandalan dibandingkan indikator tunggal

- Parameter yang fleksibel untuk optimasi

- Sangat cocok untuk perdagangan jangka pendek/frekuensi tinggi

Risiko

- Beberapa indikator mungkin sinyal lag

- Frekuensi perdagangan yang tinggi meningkatkan biaya

- Uji kembali overfiting

- Parameter mungkin gagal dengan perubahan rezim pasar

Pengurangan Risiko:

- Mengoptimalkan parameter untuk mengurangi lag

- Sesuaikan periode penahanan untuk mengurangi biaya perdagangan

- Melakukan pengujian statistik untuk memvalidasi ketahanan

- Mengadaptasi parameter secara dinamis

Peningkatan

- Uji kombinasi parameter SMI yang berbeda

- Tambahkan metrik statistik untuk mengevaluasi stabilitas parameter

- Sertakan indikator pendukung seperti volume, Bollinger Bands dll.

- Pergantian parameter dinamis berdasarkan lingkungan

- Mengoptimalkan strategi stop loss

Kesimpulan

Triple Overlapping Stochastic Momentum strategi menggabungkan generasi sinyal yang kuat di beberapa kerangka waktu dengan overlaying tiga indikator SMI dengan parameter yang unik. Dibandingkan dengan osilator tunggal, pendekatan multi-indikator ini menyaring lebih banyak kebisingan dan meningkatkan konsistensi. penyempurnaan lebih lanjut dapat dilakukan ke depan melalui optimasi parameter, validasi statistik, indikator tambahan dll untuk meningkatkan kekuatan strategi.

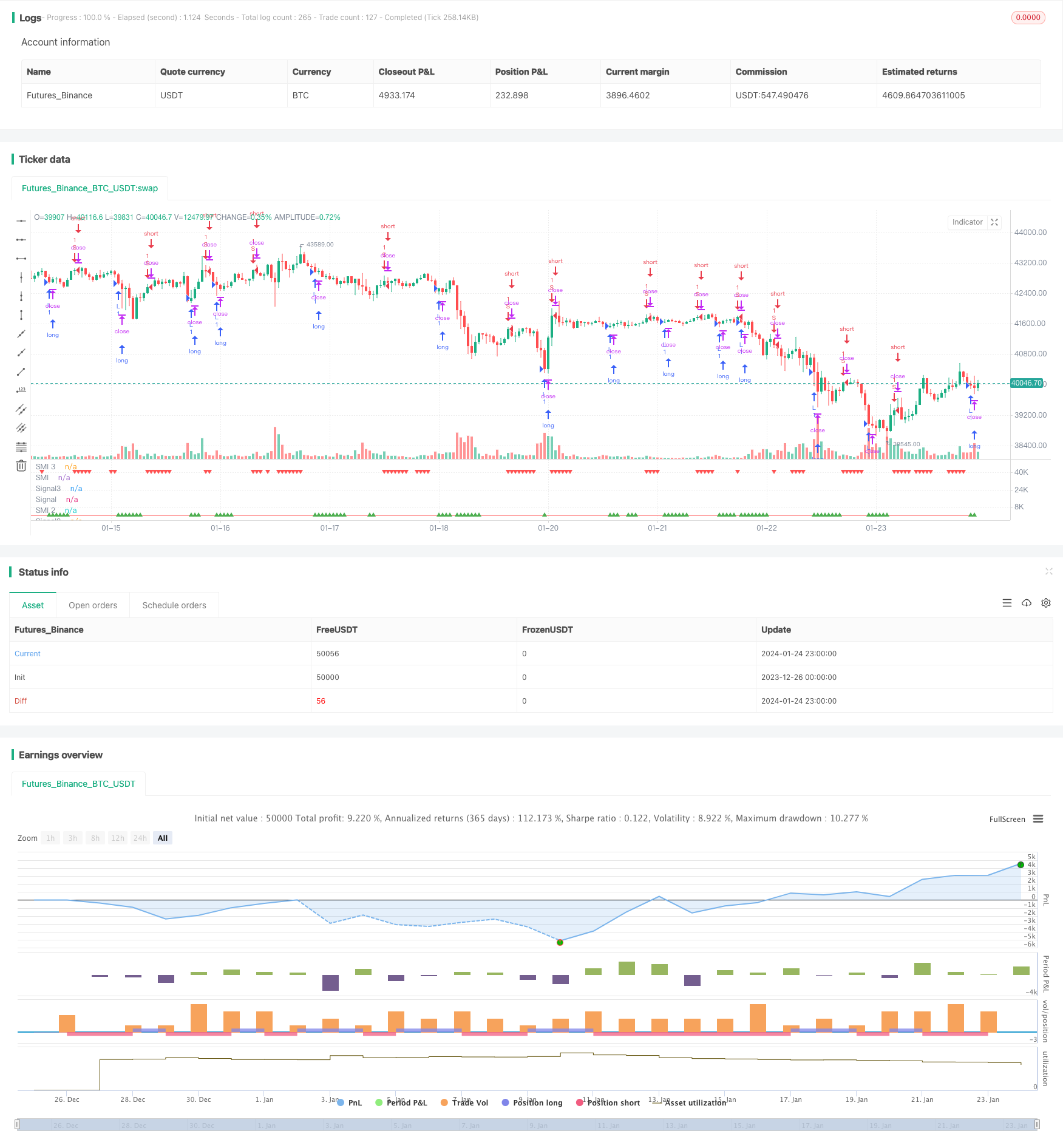

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Stochastic Momentum multi strategy", "Stochastic Momentum Index multi strategy", overlay=false)

q = input(10, title="%K Length")

r = input(3, title="%K Smoothing Length")

s = input(3, title="%K Double Smoothing Length")

nsig = input(10, title="Signal Length")

matype = input("ema", title="Signal MA Type") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought = input(40, title="Overbought Level", type=float)

oversold = input(-40, title="Oversold Level", type=float)

trima(src, length) => sma(sma(src,length),length)

hma(src, length) => wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

dema(src, length) => 2*ema(src,length) - ema(ema(src,length),length)

tema(src, length) => (3*ema(src,length) - 3*ema(ema(src,length),length)) + ema(ema(ema(src,length),length),length)

zlema(src, length) => ema(src,length) + (ema(src,length) - ema(ema(src,length),length))

smi = 100 * ema(ema(close-0.5*(highest(q)+lowest(q)),r),s) / (0.5 * ema(ema(highest(q)-lowest(q),r),s))

sig = matype=="ema" ? ema(smi,nsig) : matype=="sma" ? sma(smi,nsig) : matype=="wma" ? wma(smi,nsig) : matype=="trima" ? trima(smi,nsig) : matype=="hma" ? hma(smi,nsig) : matype=="dema" ? dema(smi,nsig) : matype=="tema" ? tema(smi,nsig) : matype=="zlema" ? zlema(smi,nsig) : ema(smi,nsig)

p_smi = plot(smi, title="SMI", color=aqua)

p_sig = plot(sig, title="Signal", color=red)

// plotchar(crossover(smi, sig), title= "low", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi, sig), title= "high", location=location.top, color=red, char="▼", size= size.tiny)

/////////////////////////////2

q2 = input(20, title="%K Length 2")

r2 = input(3, title="%K Smoothing Length 2")

s2 = input(3, title="%K Double Smoothing Length 2")

nsig2 = input(10, title="Signal Length 2")

matype2 = input("ema", title="Signal MA Type 2") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought2 = input(40, title="Overbought Level 2", type=float)

oversold2 = input(-40, title="Oversold Level 2", type=float)

trima2(src2, length2) => sma(sma(src2,length2),length2)

hma2(src2, length2) => wma(2*wma(src2, length2/2)-wma(src2, length2), round(sqrt(length2)))

dema2(src2, length2) => 2*ema(src2,length2) - ema(ema(src2,length2),length2)

tema2(src2, length2) => (3*ema(src2,length2) - 3*ema(ema(src2,length2),length2)) + ema(ema(ema(src2,length2),length2),length2)

zlema2(src2, length2) => ema(src2,length2) + (ema(src2,length2) - ema(ema(src2,length2),length2))

smi2 = 100 * ema(ema(close-0.5*(highest(q2)+lowest(q2)),r2),s2) / (0.5 * ema(ema(highest(q2)-lowest(q2),r2),s2))

sig2 = matype2=="ema" ? ema(smi2,nsig2) : matype2=="sma 2" ? sma(smi2,nsig2) : matype2=="wma 2" ? wma(smi2,nsig2) : matype2=="trima 2" ? trima2(smi2,nsig2) : matype2=="hma 2" ? hma2(smi2,nsig2) : matype=="dema 2" ? dema2(smi2,nsig2) : matype2=="tema 2" ? tema2(smi2,nsig2) : matype2=="zlema 2" ? zlema2(smi2,nsig2) : ema(smi2,nsig2)

p_smi2 = plot(smi2, title="SMI 2", color=aqua)

p_sig2 = plot(sig2, title="Signal2", color=red)

// plotchar(crossover(smi2, sig2), title= "low2", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi2, sig2), title= "high2", location=location.top, color=red, char="▼", size= size.tiny)

/////////////////////////////3

q3 = input(5, title="%K Length 3")

r3 = input(3, title="%K Smoothing Length 3")

s3 = input(3, title="%K Double Smoothing Length 3")

nsig3 = input(10, title="Signal Length 3")

matype3 = input("ema", title="Signal MA Type 3") // possible: ema, sma, wma, trima, hma, dema, tema, zlema

overbought3 = input(40, title="Overbought Level 3", type=float)

oversold3 = input(-40, title="Oversold Level 3", type=float)

trima3(src3, length3) => sma(sma(src3,length3),length3)

hma3(src3, length3) => wma(2*wma(src3, length3/2)-wma(src3, length3), round(sqrt(length3)))

dema3(src3, length3) => 2*ema(src3,length3) - ema(ema(src3,length3),length3)

tema3(src3, length3) => (3*ema(src3,length3) - 3*ema(ema(src3,length3),length3)) + ema(ema(ema(src3,length3),length3),length3)

zlema3(src3, length3) => ema(src3,length3) + (ema(src3,length3) - ema(ema(src3,length3),length3))

smi3 = 100 * ema(ema(close-0.5*(highest(q3)+lowest(q3)),r3),s3) / (0.5 * ema(ema(highest(q3)-lowest(q3),r3),s3))

sig3 = matype3=="ema" ? ema(smi3,nsig3) : matype3=="sma 3" ? sma(smi3,nsig3) : matype3=="wma 3" ? wma(smi3,nsig3) : matype3=="trima 3" ? trima3(smi3,nsig3) : matype3=="hma 3" ? hma3(smi3,nsig3) : matype=="dema 3" ? dema3(smi3,nsig3) : matype3=="tema 3" ? tema3(smi3,nsig3) : matype3=="zlema 3" ? zlema3(smi3,nsig3) : ema(smi3,nsig3)

p_smi3 = plot(smi3, title="SMI 3", color=aqua)

p_sig3 = plot(sig3, title="Signal3", color=red)

// plotchar(crossover(smi3, sig3) and crossover(smi2, sig2) and crossover(smi, sig), title= "low3", location=location.bottom, color=green, char="▲", size= size.tiny)

// plotchar(crossunder(smi3, sig3) and crossunder(smi2, sig2) and crossunder(smi, sig), title= "high3", location=location.top, color=red, char="▼", size= size.tiny)

plotchar (((smi3 < sig3) and (smi2 < sig2) and (smi < sig)), title= "low3", location=location.bottom, color=green, char="▲", size= size.tiny)

plotchar (((smi3 > sig3) and (smi2 > sig2) and (smi > sig)), title= "high3", location=location.top, color=red, char="▼", size= size.tiny)

// === BACKTEST RANGE ===

FromMonth = input(defval = 8, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2014)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2018, title = "To Year", minval = 2014)

longCondition = ((smi3 < sig3) and (smi2 < sig2) and (smi < sig))

shortCondition = ((smi3 > sig3) and (smi2 > sig2) and (smi > sig))

// buy = longCondition == 1 and longCondition[1] == 1 ? longCondition : na

buy = longCondition == 1 ? longCondition : na

sell = shortCondition == 1? shortCondition : na

// === ALERTS ===

strategy.entry("L", strategy.long, when=buy)

strategy.entry("S", strategy.short, when=sell)

alertcondition(((smi3 < sig3) and (smi2 < sig2) and (smi < sig)), title='Low Fib.', message='Low Fib. Buy')

alertcondition(((smi3 > sig3) and (smi2 > sig2) and (smi > sig)), title='High Fib.', message='High Fib. Low')

- EMA harga dengan optimasi stokastik berdasarkan pembelajaran mesin

- Strategi Bollinger Dynamic Breakout

- Dua Tahun Baru Tinggi Retracement Moving Average Strategi

- Strategi Perdagangan Rata-rata Bergerak Ganda

- Sistem Pelacakan Tren Posisi Dinamis

- Strategi pembalikan terbuka harian

- Golden Cross SMA Strategi Perdagangan

- Strategi Rata-rata Bergerak Golden Cross

- Strategi Trading Crypto MACD

- Strategi jangka pendek regresi linier dan rata-rata bergerak ganda

- Strategi Tren Momentum

- Momentum Moving Average Crossover Quant Strategi

- Strategi kombinasi pembalikan rata-rata bergerak ganda dan ATR Trailing Stop

- Strategi perdagangan berjangka Martingale leveraged

- Strategi Pullback Momentum

- Dual Candlestick Prediksi Strategi Tutup