Model Pembalikan Breakout Berdasarkan Strategi Perdagangan Penyu

Penulis:ChaoZhang, Tanggal: 2024-01-29 16:48:00Tag:

Gambaran umum

Strategi ini didasarkan pada

Perlu dicatat bahwa strategi ini menggabungkan dua sistem yang bekerja sama (S1 dan S2).

Logika Strategi

Posisi ukuran sangat penting bagi para pedagang penyu untuk mengelola risiko dengan benar. Strategi ukuran posisi ini beradaptasi dengan volatilitas pasar dan akun (keuntungan dan kerugian).

Jumlah unit yang akan dibeli adalah:

unit = (percentage_to_risk/100)*account/atr*syminfo.pointvalue

Tergantung pada nafsu risiko Anda, Anda dapat meningkatkan persentase akun Anda, tetapi pedagang penyu default ke 1%.

Ada juga aturan tambahan untuk mengurangi risiko jika nilai akun jatuh di bawah modal awal: dalam hal ini dan hanya dalam hal ini, dalam rumus satuan harus diganti dengan:

account := (strategy.equity-strategy.openprofit)*(strategy.equity-strategy.openprofit)/strategy.initial_capital

2 sistem bekerja sama:

Breakout adalah titik tinggi atau titik rendah baru. jika ini adalah titik tinggi baru, kita membuka posisi panjang dan sebaliknya jika ini adalah titik rendah baru kita masuk ke posisi pendek.

Kami menambahkan aturan tambahan:

Aturan tambahan ini memungkinkan trader untuk berada dalam tren utama jika sinyal sistem 1 telah dilewatkan. Jika sinyal untuk sistem 1 telah dilewatkan, dan lilin berikutnya juga adalah breakout 20 hari baru, S1 tidak memberikan sinyal.

Analisis Keuntungan

Strategi penyu memungkinkan kita untuk menambahkan unit tambahan ke posisi jika harga bergerak menguntungkan kita. saya telah mengkonfigurasi strategi untuk memungkinkan hingga 5 order ditambahkan ke arah yang sama. jadi jika harga bervariasi dari, kita menambahkan unit dengan rumus ukuran posisi.

Kami telah menetapkan SL maksimum 10% untuk order pertama, yang berarti Anda tidak akan kehilangan lebih dari 10% dari nilai order pertama Anda. Namun, mungkin untuk kehilangan lebih banyak pada order piramida Anda, karena SL meningkat/kurang sebesar 0.5*ATR(20), yang tidak menjamin kerugian lebih dari 10% pada order piramida Anda.

Analisis Risiko

Risiko terbesar dari strategi ini adalah posisi yang terlalu besar. Karena pesanan pasar digunakan untuk penempatan pesanan, menempatkan beberapa pesanan pasar besar pada saat yang sama akan berdampak besar pada kutipan, menyebabkan kemiringan besar. Ini akan menyebabkan kerugian modal yang sangat besar.

Risiko lain adalah konfigurasi manajemen modal yang tidak tepat. Misalnya, konfigurasi stop loss yang tidak benar atau proporsi yang terlalu besar dapat menyebabkan kerugian besar. Ini perlu dikonfigurasi dengan hati-hati sesuai dengan selera risiko seseorang.

Optimalisasi

Strategi dapat dioptimalkan dalam aspek berikut:

-

Uji dampak dari parameter yang berbeda seperti periode ATR, ATR multiplier untuk stop loss, dll pada pengembalian dan rasio tajam.

-

Uji aturan masuk dan keluar yang berbeda. Misalnya, gunakan pola lilin sebagai filter tambahan.

-

Cobalah jenis stop loss lainnya, seperti stop loss bergerak, stop loss dinamis.

-

Uji jumlah pesanan piramida yang berbeda. semakin banyak pesanan, semakin besar leverage dan risiko. temukan titik keseimbangan terbaik.

-

Cobalah untuk menghentikan perdagangan selama periode waktu tertentu (seperti sebelum rilis data US Non-Farm Payrolls) untuk menghindari dampak peristiwa besar.

Ringkasan

Secara keseluruhan, strategi ini mencapai keseimbangan yang baik antara risiko dan imbalan, cocok untuk perdagangan tren jangka menengah dan panjang.

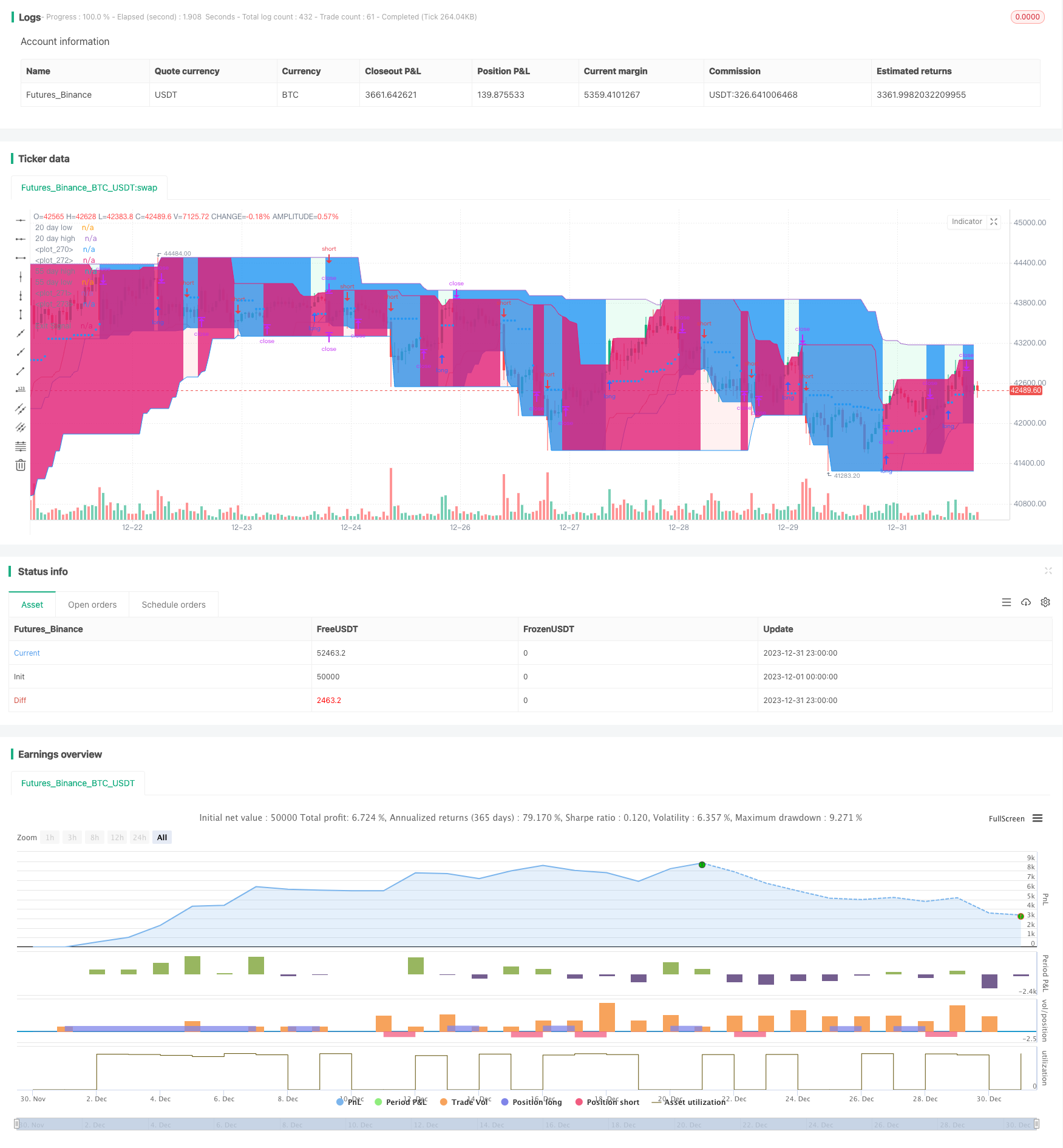

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gsanson66

//This strategy is based on the famous "Turtle Strategy"

//A well-known strategy which proved its performance during past years

//@version=5

strategy("TURTLE STRATEGY", overlay=true)

//------------------------------TOOL TIPS--------------------------------//

t1 = "Percentage of the account the trader is willing to lose. This percentage is used to define the position size based on previous gains or losses. Turtle traders default to 1%."

t2 = "ATR Length"

t3 = "ATR Multiplier to fix the Stop Loss"

t4 = "Pyramiding : ATR Multiplier to set a profit target to increase position size"

t5 = "System 1 enter long if there is a new high after this selected period of time"

t6 = "System 2 enter long if there is a new high after this selected period of time"

t7 = "Exit Long from system 1 if there is a new low after this selected period of time"

t8 = "Exit Long from system 2 if there is a new low after this selected period of time"

t9 = "System 1 enter short if there is a new low after this selected period of time"

t10 = "System 2 enter short if there is a new low after this selected period of time"

t11 = "Exit short from system 1 if there is a new high after this selected period of time"

t12 = "Exit short from system 2 if there is a new high after this selected period of time"

//----------------------------------------FUNCTIONS---------------------------------------//

//@function Displays text passed to `txt` when called.

debugLabel(txt, color) =>

label.new(bar_index, high, text=txt, color=color, style=label.style_label_lower_right, textcolor=color.black, size=size.small)

//@function which looks if the close date of the current bar falls inside the date range

inBacktestPeriod(start, end) => true

//---------------------------------------USER INPUTS--------------------------------------//

//Risk Management and turtle system input

percentage_to_risk = input.float(1, "Risk % of capital", maxval=100, minval=0, group="Turtle Parameters", tooltip=t1)

atr_period = input.int(20, "ATR period", minval=1, group="Turtle Parameters", tooltip=t2)

stop_N_multiplier = input.float(1.5, "Stop ATR", minval=0.1, group="Turtle Parameters", tooltip=t3)

pyramid_profit = input.float(0.5, "Pyramid Profit", minval=0.01, group="Turtle Parameters", tooltip=t4)

S1_long = input.int(20, "S1 Long", minval=1, group="Turtle Parameters", tooltip=t5)

S2_long = input.int(55, "S2 Long", minval=1, group="Turtle Parameters", tooltip=t6)

S1_long_exit = input.int(10, "S1 Long Exit", minval=1, group="Turtle Parameters", tooltip=t7)

S2_long_exit = input.int(20, "S2 Long Exit", minval=1, group="Turtle Parameters", tooltip=t8)

S1_short = input.int(15, "S1 Short", minval=1, group="Turtle Parameters", tooltip=t9)

S2_short = input.int(55, "S2 Short", minval=1, group="Turtle Parameters", tooltip=t10)

S1_short_exit = input.int(7, "S1 Short Exit", minval=1, group="Turtle Parameters", tooltip=t11)

S2_short_exit = input.int(20, "S2 Short Exit", minval=1, group="Turtle Parameters", tooltip=t12)

//Backtesting period

startDate = input(title="Start Date", defval=timestamp("1 Jan 2020 00:00:00"), group="Backtesting Period")

endDate = input(title="End Date", defval=timestamp("1 July 2034 00:00:00"), group="Backtesting Period")

//----------------------------------VARIABLES INITIALISATION-----------------------------//

//Turtle variables

atr = ta.atr(atr_period)

var float buy_price_long = na

var float buy_price_short = na

var float stop_loss_long = na

var float stop_loss_short = na

float account = na

//Entry variables

day_high_syst1 = ta.highest(high, S1_long)

day_low_syst1 = ta.lowest(low, S1_short)

day_high_syst2 = ta.highest(high, S2_long)

day_low_syst2 = ta.lowest(low, S2_short)

var bool skip = false

var bool unskip_buffer_long = false

var bool unskip_buffer_short = false

//Exit variables

exit_long_syst1 = ta.lowest(low, S1_long_exit)

exit_short_syst1 = ta.highest(high, S1_short_exit)

exit_long_syst2 = ta.lowest(low, S2_long_exit)

exit_short_syst2 = ta.highest(high, S2_short_exit)

float exit_signal = na

//Backtesting period

bool inRange = na

//------------------------------CHECKING SOME CONDITIONS ON EACH SCRIPT EXECUTION-------------------------------//

strategy.initial_capital = 50000

//Checking if the date belong to the range

inRange := inBacktestPeriod(startDate, endDate)

//Checking if the current equity is higher or lower than the initial capital to adjusted position size

if strategy.equity - strategy.openprofit < strategy.initial_capital

account := (strategy.equity-strategy.openprofit)*(strategy.equity-strategy.openprofit)/strategy.initial_capital

else

account := strategy.equity - strategy.openprofit

//Checking if we close all trades in case where we exit the backtesting period

if strategy.position_size!=0 and not inRange

strategy.close_all()

debugLabel("END OF BACKTESTING PERIOD : we close the trade", color=color.rgb(116, 116, 116))

//--------------------------------------SKIP MANAGEMENT------------------------------------//

//Checking if a long signal has been skiped and system2 is not triggered

if skip and high>day_high_syst1[1] and high<day_high_syst2[1]

unskip_buffer_long := true

//Checking if a short signal has been skiped and system2 is not triggered

if skip and low<day_low_syst1[1] and low>day_low_syst2[1]

unskip_buffer_short := true

//Checking if current high is lower than previous 20_day_high after a skiped long signal to set skip to false

if unskip_buffer_long

if high<day_high_syst1[1]

skip := false

unskip_buffer_long := false

//Checking if current low is higher than previous 20_day_low after a skiped short signal to set skip to false

if unskip_buffer_short

if low>day_low_syst1[1]

skip := false

unskip_buffer_short := false

//Checking if we have an open position to reset skip and unskip buffers

if strategy.position_size!=0 and skip

skip := false

unskip_buffer_long := false

unskip_buffer_short := false

//--------------------------------------------ENTRY CONDITIONS--------------------------------------------------//

//We calculate the position size based on turtle calculation

unit = (percentage_to_risk/100)*account/atr*syminfo.pointvalue

//Long order for system 1

if not skip and not (strategy.position_size>0) and inRange

strategy.cancel("Long Syst 2")

//We check that position size doesn't exceed available equity

if unit*day_high_syst1>account

unit := account/day_high_syst1

stop_loss_long := day_high_syst1 - stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_long < day_high_syst1*0.9

stop_loss_long := day_high_syst1*0.9

strategy.order("Long Syst 1", strategy.long, unit, stop=day_high_syst1)

buy_price_long := day_high_syst1

//Long order for system 2

if skip and not (strategy.position_size>0) and inRange

//We check that position size doesn't exceed available equity

if unit*day_high_syst2>account

unit := account/day_high_syst2

stop_loss_long := day_high_syst2 - stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_long < day_high_syst2*0.9

stop_loss_long := day_high_syst2*0.9

strategy.order("Long Syst 2", strategy.long, unit, stop=day_high_syst2)

buy_price_long := day_high_syst2

//Short order for system 1

if not skip and not (strategy.position_size<0) and inRange

strategy.cancel("Short Syst 2")

//We check that position size doesn't exceed available equity

if unit*day_low_syst1>account

unit := account/day_low_syst1

stop_loss_short := day_low_syst1 + stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_short > day_low_syst1*1.1

stop_loss_short := day_low_syst1*1.1

strategy.order("Short Syst 1", strategy.short, unit, stop=day_low_syst1)

buy_price_short := day_low_syst1

//Short order for system 2

if skip and not (strategy.position_size<0) and inRange

//We check that position size doesn't exceed available equity

if unit*day_low_syst2>account

unit := account/day_low_syst2

stop_loss_short := day_low_syst2 + stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_short > day_low_syst2*1.1

stop_loss_short := day_low_syst2*1.1

strategy.order("Short Syst 2", strategy.short, unit, stop=day_low_syst2)

buy_price_short := day_low_syst2

//-------------------------------PYRAMIDAL------------------------------------//

//Pyramid for long orders

if close > buy_price_long + (pyramid_profit*atr) and strategy.position_size>0

//We calculate the remaining capital

remaining_capital = account - strategy.position_size*strategy.position_avg_price*(1-0.0018)

//We calculate units to add to the long position

units_to_add = (percentage_to_risk/100)*remaining_capital/atr*syminfo.pointvalue

if remaining_capital > units_to_add

//We set the new Stop loss

stop_loss_long := stop_loss_long + pyramid_profit*atr

strategy.entry("Pyramid Long", strategy.long, units_to_add)

buy_price_long := close

//Pyramid for short orders

if close < buy_price_short - (pyramid_profit*atr) and strategy.position_size<0

//We calculate the remaining capital

remaining_capital = account + strategy.position_size*strategy.position_avg_price*(1-0.0018)

//We calculate units to add to the short position

units_to_add = (percentage_to_risk/100)*remaining_capital/atr*syminfo.pointvalue

if remaining_capital > units_to_add

//We set the new Stop loss

stop_loss_short := stop_loss_short - pyramid_profit*atr

strategy.entry("Pyramid Short", strategy.short, units_to_add)

buy_price_short := close

//----------------------------EXIT ORDERS-------------------------------//

//Checking if exit_long_syst1 is higher than stop_loss_long

if strategy.opentrades.entry_id(0)=="Long Syst 1"

if exit_long_syst1[1] > stop_loss_long

exit_signal := exit_long_syst1[1]

else

exit_signal := stop_loss_long

//Checking if exit_long_syst2 is higher than stop_loss_long

if strategy.opentrades.entry_id(0)=="Long Syst 2"

if exit_long_syst2[1] > stop_loss_long

exit_signal := exit_long_syst2[1]

else

exit_signal := stop_loss_long

//Checking if exit_short_syst1 is lower than stop_loss_short

if strategy.opentrades.entry_id(0)=="Short Syst 1"

if exit_short_syst1[1] < stop_loss_short

exit_signal := exit_short_syst1[1]

else

exit_signal := stop_loss_short

//Checking if exit_short_syst2 is lower than stop_loss_short

if strategy.opentrades.entry_id(0)=="Short Syst 2"

if exit_short_syst2[1] < stop_loss_short

exit_signal := exit_short_syst2[1]

else

exit_signal := stop_loss_short

//If the exit order is configured to close the position at a profit, we set 'skip' to true (we substract commission)

if strategy.position_size*exit_signal>strategy.position_size*strategy.position_avg_price*(1-0.0018)

strategy.cancel("Long Syst 1")

strategy.cancel("Short Syst 1")

skip := true

if strategy.position_size*exit_signal<=strategy.position_size*strategy.position_avg_price*(1-0.0018)

skip := false

//We place stop exit orders

if strategy.position_size > 0

strategy.exit("Exit Long", stop=exit_signal)

if strategy.position_size < 0

strategy.exit("Exit Short", stop=exit_signal)

//------------------------------PLOTTING ELEMENTS-------------------------------//

plotchar(atr, "ATR", "", location.top, color.rgb(131, 5, 83))

//Plotting enter threshold

plot(day_high_syst1[1], "20 day high", color.rgb(118, 217, 159))

plot(day_high_syst2[1], "55 day high", color.rgb(4, 92, 53))

plot(day_low_syst1[1], "20 day low", color.rgb(234, 108, 108))

plot(day_low_syst2[1], "55 day low", color.rgb(149, 17, 17))

//Plotting Exit Signal

plot(exit_signal, "Exit Signal", color.blue, style=plot.style_circles)

//Plotting our position

exit_long_syst2_plot = plot(exit_long_syst2[1], color=na)

day_high_syst2_plot = plot(day_high_syst2[1], color=na)

exit_short_syst2_plot = plot(exit_short_syst2[1], color=na)

day_low_syst2_plot = plot(day_low_syst2[1], color=na)

fill(exit_long_syst2_plot, day_high_syst2_plot, color=strategy.position_size>0 ? color.new(color.lime, 90) : na)

fill(exit_short_syst2_plot, day_low_syst2_plot, color=strategy.position_size<0 ? color.new(color.red, 90) : na)

- Strategi Scalping Berdasarkan Likuiditas dan Tren Pasar

- Strategi Pembalikan Terobosan Jangka Pendek 5EMA

- Strategi Perdagangan Saham Piramida Berbasis Indikator RSI

- Semua tentang Strategi Perdagangan Saluran EMA

- Strategi Trading RSI Double Decker

- Bollinger Bands dan Strategi Kombinasi RSI

- Strategi Double Inside Bar & Trend

- Strategi Penembusan Harga Luar Biasa

- Strategi Lanjutan Tren yang Kuat

- Tren Pelacakan Rata-rata Gerak Strategi Crossover

- Strategi Tren Momentum

- Peanut 123 Reversal dan Breakout Range Strategi Perdagangan Jangka Pendek

- Strategi Perdagangan Saham Berbasis RSI yang Diatasi

- Strategi Band Volatilitas Ringan

- Strategi perdagangan reversal indeks saluran komoditas

- Strategi berbasis waktu dengan ATR Take Profit

- Strategi Pelacak Tren Momentum

- Strategi Penutupan Lilin EMA

- EMA Crossover Quantitative Trading Strategy Strategi perdagangan kuantitatif

- Strategi Stop-Loss Moving Average yang Dinamis